California's #1 Rated Reverse Mortgage

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Experience Excellence with California’s Top Reverse Mortgage Lender

For over 20 years, All Reverse Mortgage, Inc. (ARLO™) has helped California homeowners access their home equity through HUD-approved HECM and jumbo reverse mortgages. As California’s #1 Rated Reverse Mortgage Lender, we hold an A+ BBB rating with perfect 5-star reviews and zero complaints — a record that earned us recognition as a BBB Torch Award for Ethics Finalist three years running.

As a HUD-approved direct lender and proud member of the National Reverse Mortgage Lenders Association (NRMLA), we specialize exclusively in reverse mortgages — it’s all we’ve done since 2004. That singular focus is especially valuable in California, where high property values often require expertise across both FHA-insured HECM loans and proprietary jumbo programs. In fact, our team was part of the group that introduced the first fixed-rate jumbo reverse mortgage in 2008.

Whether your goal is to eliminate monthly mortgage payments, access equity for retirement planning, or evaluate a jumbo reverse mortgage for a higher-value home, we take the time to explain how each program works — including the advantages and limitations — so you can choose the option that aligns with your financial goals. For California homeowners age 62 and older, a reverse mortgage can be a strategic planning tool, and we’re here to help you make the most of it.

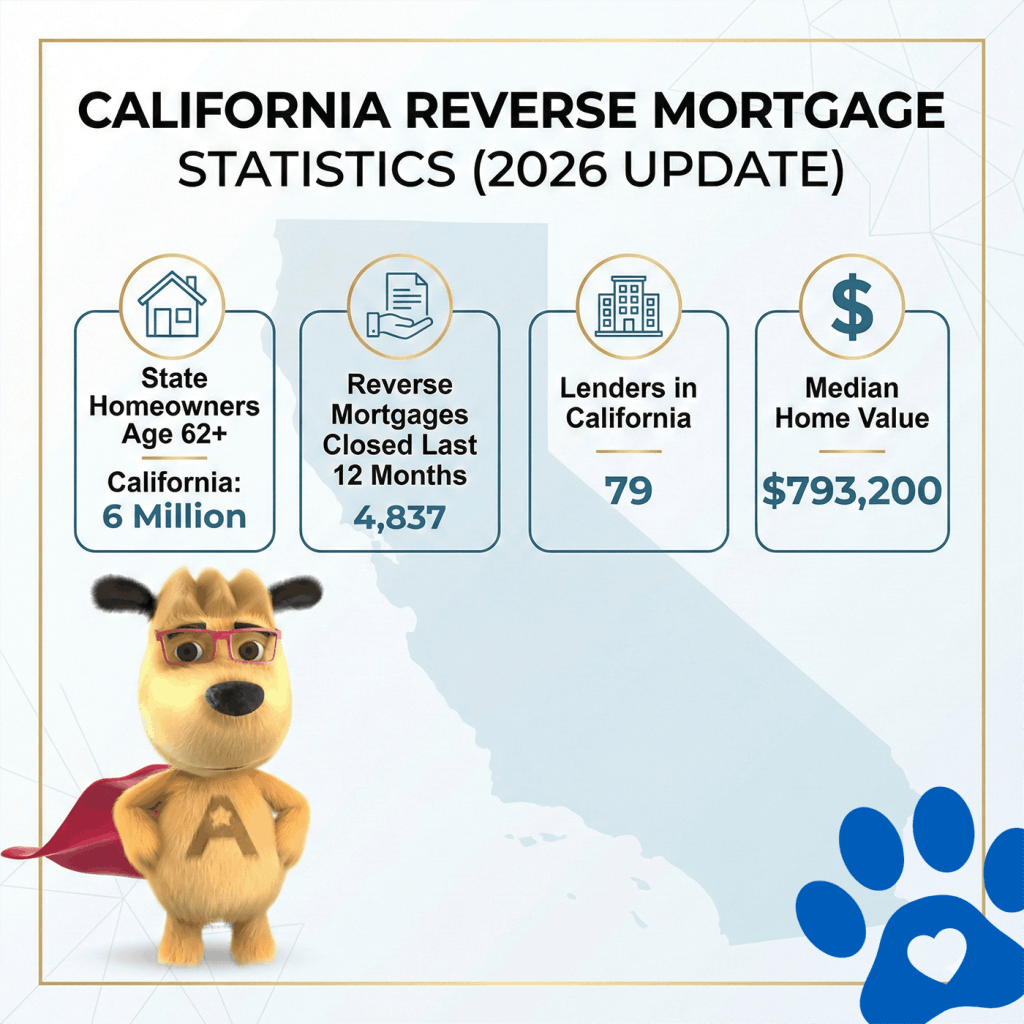

California Reverse Mortgage Statistics (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in California | Median Home Value |

|---|---|---|---|---|

| California | 6 Million | 4,837 | 79 | $793,200 |

Top Reverse Mortgage Cities in California

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Mo. | Active Lenders | Avg. Home Value |

|---|---|---|---|---|

| Los Angeles | 222,394 | 222 | 16 | $923,800 |

| San Diego | 92,614 | 189 | 14 | $972,713 |

| San Jose | 52,991 | 90 | 11 | $1,379,464 |

| Sacramento | 21,884 | 74 | 10 | $468,373 |

| Oceanside | 9,227 | 60 | 10 | $848,557 |

| Long Beach | 16,221 | 58 | 12 | $830,459 |

| Riverside | 10,921 | 49 | 13 | $635,073 |

| Fresno | 8,913 | 44 | 10 | $381,978 |

| Anaheim | 7,921 | 43 | 12 | $922,287 |

| Santa Rosa | 7,902 | 41 | 8 | $702,437 |

| Palm Desert | 7,984 | 40 | 10 | $542,636 |

| Corona | 4,343 | 40 | 11 | $748,672 |

| San Francisco | 33,418 | 38 | 7 | $1,268,418 |

| Escondido | 5,084 | 34 | 10 | $821,181 |

| Huntington Beach | 9,842 | 34 | 9 | $1,301,656 |

| Indio | 5,779 | 34 | 7 | $507,914 |

| Lincoln | 3,043 | 34 | 5 | $630,361 |

| Whittier | 7,428 | 33 | 12 | $799,577 |

| Moreno Valley | 5,964 | 32 | 10 | $541,184 |

| Mission Viejo | 6,742 | 29 | 9 | $1,175,304 |

| Hemet | 6,246 | 27 | 8 | $435,976 |

| Roseville | 6,307 | 26 | 7 | $633,597 |

| Fontana | 3,512 | 26 | 10 | $629,180 |

| Modesto | 7,118 | 25 | 6 | $436,258 |

| Murrieta | 5,431 | 25 | 7 | $678,045 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

California Reverse Mortgage Lending Limits

California, known as “The Golden State,” is the most populous state in the U.S., with nearly 40 million residents. Of these, almost two million are homeowners aged 62 and older, making them eligible for a reverse mortgage to help expand their financial options.

As of January 2026, the median home value in California is $793,200, which is below the HECM reverse mortgage lending limit of $1,249,125. This means many California homeowners can take advantage of a reverse mortgage to tap into their home’s equity.

If you’re a California homeowner aged 62 or older, All Reverse Mortgage, Inc. (ARLO™) is here to help you explore how a reverse mortgage can fit into your retirement plans. We’re ready to answer any questions you have and guide you through the process.

Top 20 Reverse Mortgage Lenders in California

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Frequently Asked Questions: California-Specific Answers

Will I lose my Prop 13 tax protection?

Do I need earthquake insurance?

Can I use a reverse mortgage to buy a home in California?

What happens if my home loses value?

Can my spouse stay in the home if I die?

Do I qualify if I have a trust?

What if I need to move to assisted living?

Can I pay off the loan early without penalty?

How does this affect my eligibility for Medi-Cal?

Can I rent out a room with a reverse mortgage?

What’s the difference between a reverse mortgage and a HELOC?

| Feature | Reverse Mortgage | HELOC |

|---|---|---|

| Monthly payments | None required | Required (interest + principal) |

| Age requirement | 62+ | Any age (18+) |

| Income verification | Yes (financial assessment) | Yes (strict debt-to-income) |

| Upfront costs | High ($20K-$30K) | Low ($0-$500) |

| Best for | Eliminating payments, long-term cash flow | Short-term needs, renovations |

Should I get a reverse mortgage to pay off credit card debt?

HUD-Approved Reverse Mortgage Counseling Agencies in California

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| BALANCE - CONCORD | 90242 | 1655 Grant St, Concord, California, 94520-2600 | (800) 777-7526 | balancepro.org |

| BALANCE - SAN FRANCISCO | 80646 | 3543 18th St, San Francisco, California, 94110-1683 | (800) 777-7526 | balancepro.org |

| BALANCE - SANTA ROSA | 81721 | 3033 Cleveland Ave, Santa Rosa, California, 95403-2126 | (800) 777-7526 | balancepro.org |

| BALANCE-SF 3RD STREET | 90742 | 5172 3rd St, San Francisco, California, 94124-2302 | (888) 456-2227 | balancepro.org |

| CAROLYN E. WYLIE CENTER FOR CHILDREN, YOUTH | 90677 | 4164 Brockton Ave, Riverside, California, 92501-3400 | (951) 683-5193 | wyliecenter.org |

| CREDIT.ORG | 82722 | 1825 Chicago Ave, Riverside, California, 92507-2367 | (951) 414-2454 | credit.org |

| CREDIT.ORG - NATIONAL CITY | 90273 | 2140 Hoover Ave, National City, California, 91950-6514 | (619) 830-4802 | credit.org |

| CREDIT.ORG - RIVERSIDE | 84701 | 1450 Iowa Ave Ste 200, Riverside, California, 92507-0508 | (800) 947-3752 | credit.org |

| GREENPATH FINANCIAL WELLNESS | 90351 | 2525 Main St, Irvine, California, 92614-6682 | (888) 860-4167 | greenpath.org |

| INLAND FAIR HOUSING AND MEDIATION BOARD | 80034 | 3175 Sedona Ct Ste D, Ontario, California, 91764-6561 | (800) 321-0911 | ifhmb.com |

| MY WAY HOME | 84058 | 2231 Sturgis Rd Unit A, Oxnard, California, 93030-7813 | (805) 273-7800 | mywayhome.org |

| NATIONAL ASSOCIATION OF REAL ESTATE BROKERS-INVESTMENT | 80759 | 7677 OakPort Street, Suite 1030, 10th Fl, OAKLAND, California, 94621-1929 | (510) 268-9792 | nidhousing.com |

| NEIGHBORHOOD PARTNERSHIP HOUSING SERVICES, INC. | 81110 | 9551 Pittsburgh Ave, Rancho Cucamonga, California, 91730-6008 | (909) 988-5979 | nwoc.org |

| NHS OF ORANGE COUNTY dba NEIGHBORWORKS ORANGE | 81605 | 1748 W Katella Ave Ste 202, Orange, California, 92867-3430 | (714) 490-1250 | nwoc.org |

| COUNTY | 90449 | 23945 Sunnymead Blvd, MORENO VALLEY, California, 92553-3025 | (951) 399-4538 | nidhousing.com |

| PROJECT SENTINEL | 81800 | 1490 El Camino Real, Santa Clara, California, 95050-4609 | (408) 720-9888 | housing.org |

Did you know? California does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies, and you can conduct your required counseling from the comfort of your home.

Ready to Unlock Your Home’s Equity?

As California’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

All Reverse Mortgage, Inc. is fully licensed by California’s Department of Financial Protection & Innovation under Residential Mortgage Lending Act License #4131229 and the California Department of Real-Estate, License #01460013.

Get Your Reverse Mortgage Quote from California’s #1 Rated Reverse Mortgage Lender* or call (800) 565-1722 to speak with a licensed expert.

Other Areas of Interest in California

Alameda County Anaheim Brentwood Carlsbad Contra Costa County Corona Escondido Fontana Fresno Hemet Huntington Beach Indio Irvine Lincoln Long Beach Los Angeles Mission Viejo Modesto Moreno Valley Mount Shasta Murrieta Napa Novato Oakland Oceanside Orange County Palm Desert Palm Springs Riverside Roseville Sacramento San Bernardino County San Diego San Francisco San Jose San Rafael Santa Clara County Santa Clarita Santa Cruz Santa Rosa Sonoma Sun City Sylmar Ventura County West Hills Westminster Whittier

Additional Resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald