Serving San Rafael Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

San Rafael Reverse Mortgages

At All Reverse Mortgage, Inc. (ARLO™), we take pride in being California’s #1 Rated Reverse Mortgage Lender. We have a perfect 5-star rating from the Better Business Bureau and an A+ Exemplary Rating. We’ve been serving communities across California and 15 additional states since 2004, all from our headquarters in Southern California.

We focus solely on reverse mortgages, so you can trust that we have the expertise you need. We’re dedicated to providing you with the best possible rates and the lowest costs, ensuring you get the most out of your home’s equity.

As a HUD-approved lender, we offer national HECM programs and provide non-FHA and Jumbo Reverse Mortgages for those with higher-value homes exceeding the national lending limit of $1,249,125.

We invite you to compare our reviews, rates, and closing costs with those of any other lender. We’re confident you’ll see the difference and are excited to help you make the most informed decision.

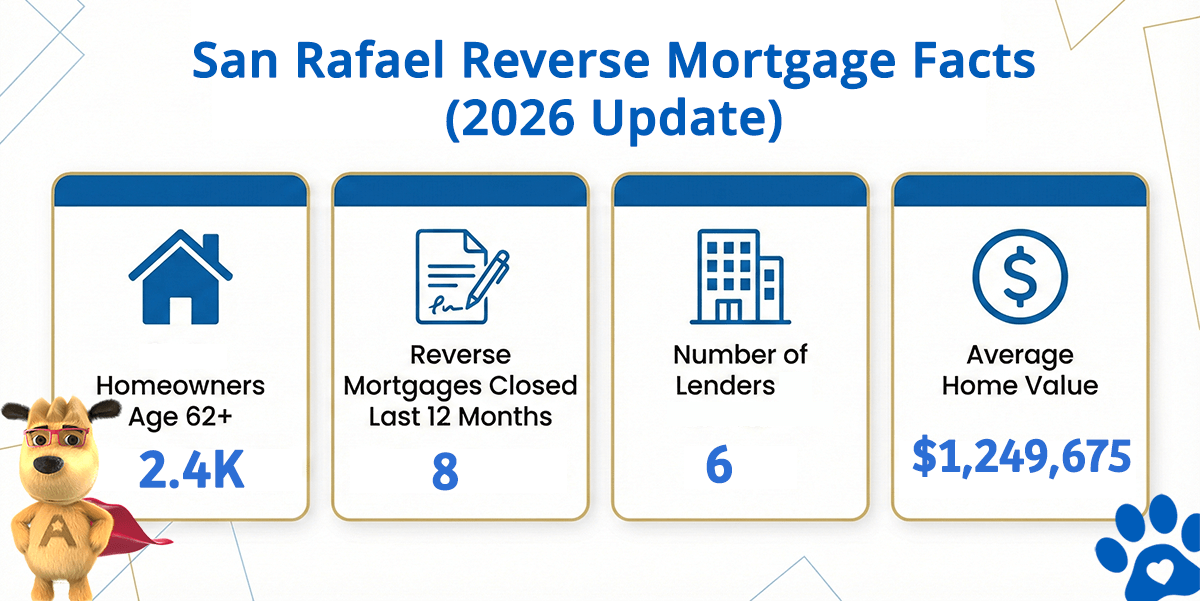

San Rafael Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in San Rafael (est) | Avg. Home Value |

|---|---|---|---|---|

| San Rafael | 2,400 | 8 | 6 | $1,249,675 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

HUD-Approved Direct Lender Serving San Rafael

All Reverse Mortgage, Inc. (ARLO™) is approved by the U.S. Department of Housing and Urban Development (HUD) to originate Home Equity Conversion Mortgages (HECMs), commonly known as reverse mortgages.

As a HUD-approved direct lender, we manage the entire process in-house, from application through closing. San Rafael homeowners work directly with licensed reverse mortgage specialists who focus exclusively on reverse mortgage lending.

We help San Rafael homeowners who want to:

-

Eliminate required monthly mortgage payments

-

Access home equity for retirement income or long-term planning

-

Establish a growing line of credit

-

Compare FHA-insured HECM options with jumbo reverse mortgage programs

Homeowners always retain title to their home and may sell or refinance at any time without a prepayment penalty.

About All Reverse Mortgage, Inc.

Reverse mortgages are all we do.

Our team has more than 20 years of experience dedicated solely to reverse mortgage lending. In 2008, we were involved in the introduction of the first fixed-rate jumbo reverse mortgage, giving us long-standing expertise in both FHA-insured HECM loans and proprietary jumbo programs.

That experience is especially important in high-value markets like San Rafael, where many homes sit at or above federal lending limits and loan structure can materially affect how much equity is available and how long it lasts. We explain every option clearly, including advantages and tradeoffs, so homeowners can make informed, pressure-free decisions.

San Rafael Lending Limits (2026)

San Rafael is the county seat of Marin County and one of the Bay Area’s most established residential communities. As of 2026, the city has an estimated population of 61,000, with roughly 21 percent of residents being homeowners aged 62 or older.

For 2026, the national FHA lending limit for Home Equity Conversion Mortgages (HECMs) is $1,249,125.

With an average home value of $1,249,675, San Rafael sits directly at the federal HECM lending limit. While FHA-insured HECM loans remain an option up to the national cap, many San Rafael homeowners with higher-valued properties explore jumbo reverse mortgage programs to access additional home equity beyond FHA limits.

Both HECM and jumbo reverse mortgages can be effective retirement planning tools, depending on age, goals, property value, and long-term plans.

Ready to Unlock Your Home’s Equity?

As San Rafael’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

As a fully licensed lender by the California Department of Financial Protection and Innovation (DFPI License #4131292), we’re committed to helping you secure the retirement you deserve.

Get Your Free Quote from San Rafael’s #1 Rated Reverse Mortgage Lender, or call (415) 874-7757 to speak with a friendly expert today.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald