Get the Facts on Your Reverse Mortgage Options

Reverse Mortgage Downsides Explained (2026) | 10 Common Claims Debunked

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Reverse mortgages have long been surrounded by misconceptions, leading many to believe they come with significant downsides. In reality, many of these concerns are based on myths. In this guide, we will debunk the top 10 common claims about the downsides of reverse mortgages, providing you with the clarity you need.

Whether you’re exploring reverse mortgage options for yourself or assisting a loved one, understanding the facts behind these so-called ‘downsides’ will help you make a confident and informed decision.

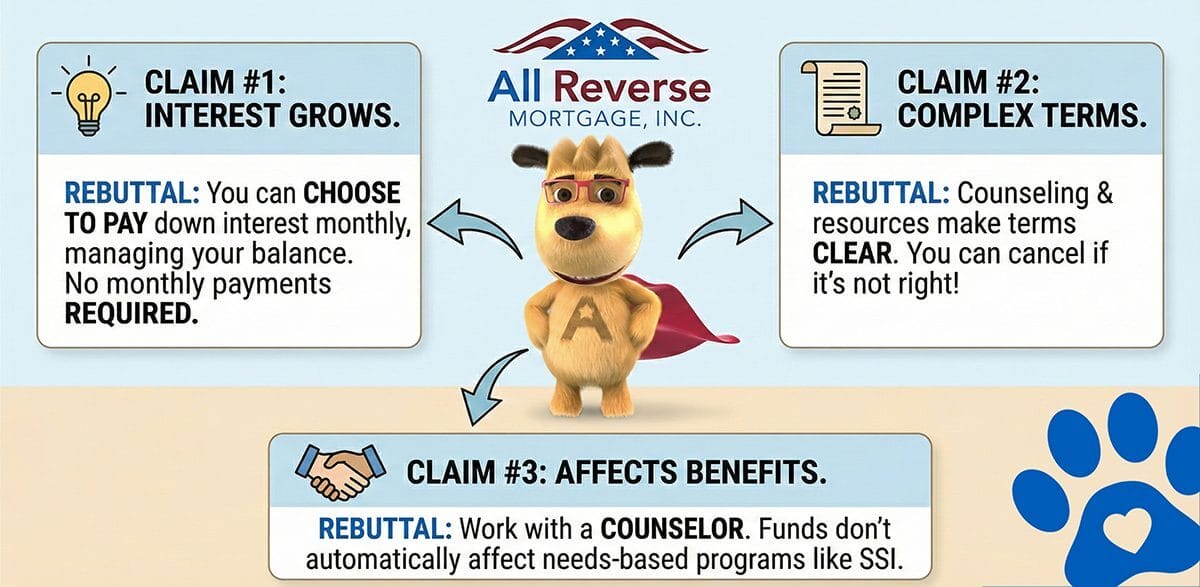

Claim #1: Reverse Mortgages Have Growing Interest and Fees

Concern: Skipping monthly payments may seem like an advantage, but the accumulating interest can significantly increase the total loan balance.

Truth: Like any loan, interest accrues on a reverse mortgage. However, one major benefit is flexibility. You are not required to make monthly payments, but you can choose to pay down the interest whenever you want without penalty. This allows you to manage the loan balance effectively and control how much interest accrues over time.

Claim #2: Reverse Mortgages Have Complex Loan Terms

Concern: Reverse mortgages have complicated terms that can lead to unexpected surprises regarding repayment or property use.

Truth: While reverse mortgages have specific terms, they are not inherently confusing. With required counseling, online tools, and supportive lenders, you’ll have the resources to thoroughly understand the details. Plus, you can cancel without penalty if you feel it’s not the right choice for you.

Claim #3: Reverse Mortgages Affect Needs-Based Programs

Concern: Receiving funds from a reverse mortgage could jeopardize eligibility for programs like Medicaid or Supplemental Security Income (SSI).

Truth: A reverse mortgage doesn’t automatically affect needs-based benefits. These programs don’t count reverse mortgage proceeds as income. The issue arises only if those funds accumulate in your bank account and push you over the program’s asset limit at the time they evaluate eligibility (SSI’s federal limit is $2,000 for individuals and $3,000 for couples; some Medicaid programs use similar limits). The solution is simple: work with a benefits counselor to understand your state’s rules and make sure any funds you draw don’t sit in your accounts long enough to raise your assets above the allowable threshold.

Claim #4: Reverse Mortgages Create Repayment Problems for Heirs

Concern: Heirs must sell the property or refinance the loan to keep it, which could cause financial strain.

Truth: Reverse mortgages are not designed to be passed down, but open communication with heirs can prevent complications. Heirs should be informed of their options, such as selling the property or refinancing the loan. Establishing a family trust or consulting an estate attorney can further simplify the process and ensure heirs are prepared.

Claim #5: Reverse Mortgages are Rising Debt and Falling Equity

Concern: Home equity decreases as payments are received and interest accumulates, leaving less for heirs.

Truth: While equity can decrease if home values stagnate or interest builds, this isn’t unique to reverse mortgages. Unlike traditional mortgages, reverse mortgages are non-recourse loans, meaning neither you nor your heirs are responsible for any shortfall if the home’s value doesn’t cover the loan balance.

Claim #6: Reverse Mortgages Have Occupancy Restrictions

Concern: Moving permanently, such as to a nursing home, makes the loan due, complicating living situations.

Truth: HUD’s occupancy rules aren’t as rigid as people think, but they’re important. HECM loans require the home to remain your principal residence, and you can leave temporarily as long as you stay within HUD’s limits. For non-medical absences, you can be away for up to 6 consecutive months; for medical absences such as rehab, hospitalization, or nursing care, you can be away for up to 12 consecutive months. If it becomes clear that a permanent move is needed, planning early gives you and your family time to sell the home or settle the loan without pressure.

Claim #7: Reverse Mortgages Can Be a Burden on Heirs

Concern: Heirs are left to manage repayment and avoid foreclosure under tight deadlines.

Truth: Proper preparation minimizes this burden. By educating heirs on loan terms, authorizing communication with lenders, and establishing clear plans, the process becomes manageable. Early planning ensures heirs know what to expect and how to proceed.

Claim #8: Borrowers Must Maintain Taxes & Insurance

Concern: Failing to keep up with home maintenance, taxes, or insurance could lead to default.

Truth: With any mortgage, you must keep your taxes and insurance current. If you fall behind, HUD requires the lender to declare the loan due and payable, which is why staying on top of these items is so important. If you qualify and have enough available proceeds, your lender can set up a LESA (Life Expectancy Set-Aside). This reserves part of your reverse mortgage funds specifically to pay your taxes and insurance for you, helping prevent future issues and keeping your loan in good standing. It’s a safeguard that many homeowners choose for peace of mind.

Claim #9: Reverse Mortgages Have a Risk of Negative Equity

Concern: Declining home values may result in the loan balance exceeding the property’s worth, leaving negative equity.

Truth: Reverse mortgages are non-recourse loans, meaning heirs or estates are not responsible for any shortfall. Heirs can repay the loan at 95% of the home’s current market value or choose to walk away without financial liability.

Claim #10: Potential for Scams

Concern: The complexity of reverse mortgages makes them a target for scams.

Truth: Scams typically involve misuse of proceeds rather than the loan itself. Choosing a reputable, HUD-approved lender is key. Open family communication ensures seniors make informed, secure decisions and avoid fraud.

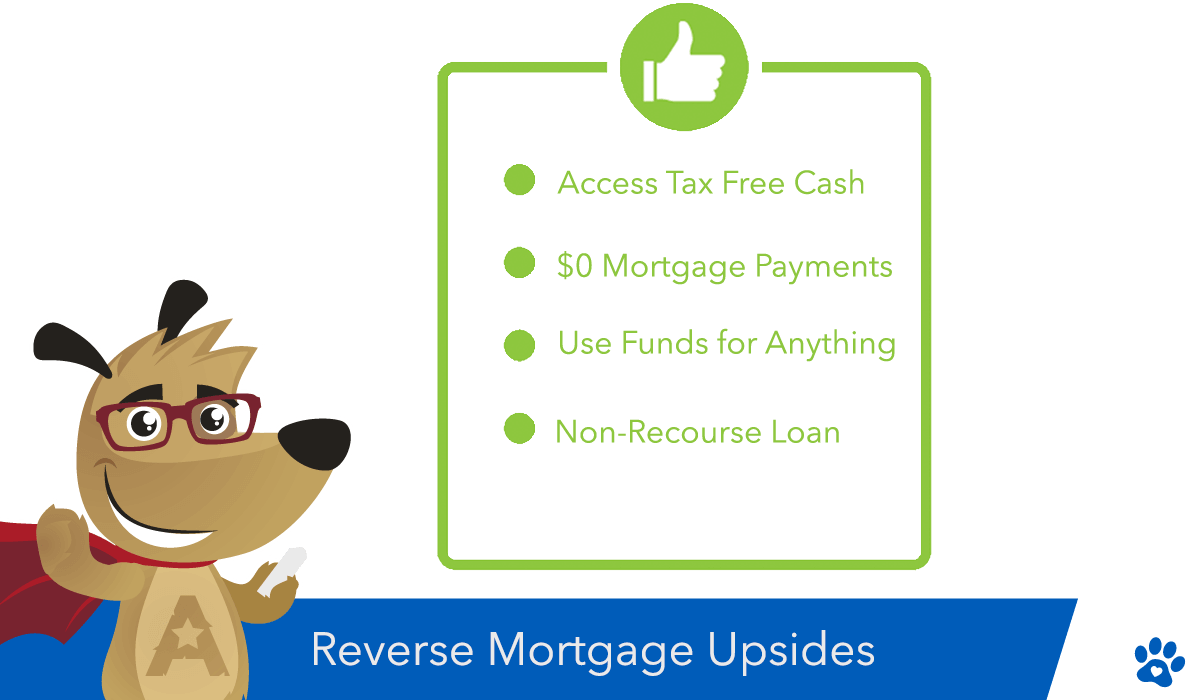

How a Reverse Mortgage Can Enhance Your Retirement

A reverse mortgage offers financial flexibility and security, enabling you to enjoy retirement on your terms:

- Make Your Home Age-Friendly: Fund upgrades like ramps or walk-in tubs to age in place comfortably.

- Spend How You Wish: Use funds for daily expenses, travel, or emergencies — the choice is yours.

- Buy a New Home: Relocate to a retirement-friendly property with reverse mortgage support.

- Pay for In-Home Care: Cover costs for care while remaining in the comfort of your home.

- Create an Emergency Fund: Establish a financial safety net for peace of mind.

Key FHA Protections

- Spousal Protections: Non-borrowing spouses may remain in the home under certain conditions.

- Non-Recourse: You or your heirs will never owe more than the home’s value.

- Guaranteed Payments: As long as you meet loan requirements, payments or credit lines remain accessible.

Below is a clear, side-by-side breakdown of the most common reverse mortgage concerns and what the facts say.

Reverse Mortgage Downsides Explained: Myths vs. Reality (2026)

| Common Concern | What the Facts Show |

|---|---|

| Interest and fees grow over time | Yes, interest accrues over time, like any mortgage. However, borrowers may make voluntary payments at any time to reduce their balance, and there is no prepayment penalty on a HECM. |

| Loan terms feel too complex | Reverse mortgages require independent HUD counseling before you can apply. Lenders must also provide clear disclosures, and you may stop the process at any point before closing. |

| A reverse mortgage could affect Medicaid or SSI | HECM proceeds are not considered income. Benefits may only be affected if unused funds remain in your bank account and push assets over program limits. Planning withdrawals with a benefits counselor helps most borrowers stay eligible. |

| Heirs will struggle with repayment | Your heirs have options. They may sell the home, refinance the loan, or Deed in Lieu of Foreclosure. The loan is typically repaid from the home’s value, not from heirs’ personal assets. |

| Equity will shrink over time | Home equity may decrease over time, but a HECM is a non-recourse loan. You and your heirs are never personally responsible for more than the home’s value at repayment at time of sale. |

| Leaving the home will trigger repayment | A HECM requires the home to remain your primary residence. HUD allows absences up to six months for non-medical reasons and up to twelve months for documented medical reasons. Longer absences may cause the loan to become due. |

| Loved ones will be burdened after death | With advance planning, settling a reverse mortgage is usually straightforward. Heirs receive written guidance from the servicer explaining timelines and available options. |

| You must pay taxes and insurance | Like any mortgage, borrowers must stay current on property taxes and insurance. If eligible, a Life Expectancy Set-Aside (LESA) can be established to pay these expenses automatically. |

| You might owe more than the home is worth | Because the HECM is FHA-insured and non-recourse, borrowers and heirs never owe more than the home’s market value. Heirs may repay at 95% of the appraised value or walk away without liability. |

| Reverse mortgages are tied to scams | Scams involve misuse of funds, not the HECM program itself. Working with a HUD-approved lender, completing counseling, and involving trusted family members reduces risk. |

Frequently Asked Questions

What is the downside of a reverse mortgage?

Is a reverse mortgage ever a good idea?

Can you lose your home with a reverse mortgage?

What happens to a reverse mortgage when you die?

Is a reverse mortgage a scam?

Summary: Making Informed Decisions About Reverse Mortgages

While reverse mortgages can provide financial relief and greater flexibility during retirement, they have drawbacks and complexities. It is essential for homeowners to fully understand these aspects and make an informed decision based on their circumstances, plans, and the needs of their heirs. Consulting with a financial advisor, an elder law attorney, or a HUD-approved counselor can provide valuable insights and guidance.

Concerned About the Downsides of a Reverse Mortgage? Let’s Talk Through It. At All Reverse Mortgage, Inc. (ARLO™), we walk you through every detail — honestly and without pressure. Call us Toll-Free at (800) 565-1722 to speak with an expert, or get an instant quote to see how much you may qualify for — no personal information required, just clarity.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

May 16th, 2024

May 22nd, 2024

March 16th, 2024

March 19th, 2024

December 30th, 2021

January 11th, 2022

June 10th, 2021

August 4th, 2020

August 14th, 2020

June 4th, 2020

June 8th, 2020

May 26th, 2020

June 2nd, 2020

April 24th, 2020

May 3rd, 2020

September 4th, 2019

September 4th, 2019