UNDERSTAND YOUR PROTECTIONS

Non-Recourse Reverse Mortgage Protections Explained

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

The non-recourse feature of reverse mortgages is a powerful safeguard, yet it’s often misunderstood. It’s even sparked debates — like the AARP lawsuit against HUD — over its scope.

Simply put, a non-recourse reverse mortgage ensures you’ll never owe more than your home’s value when the loan matures. But how does this protect you and your heirs? Let’s break it down.

How Non-Recourse Protection Works

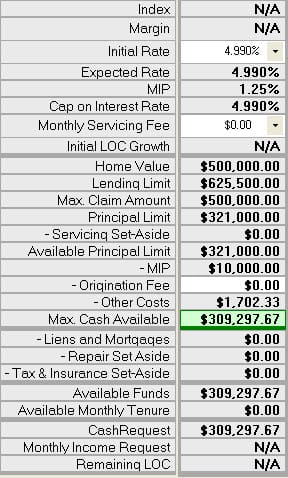

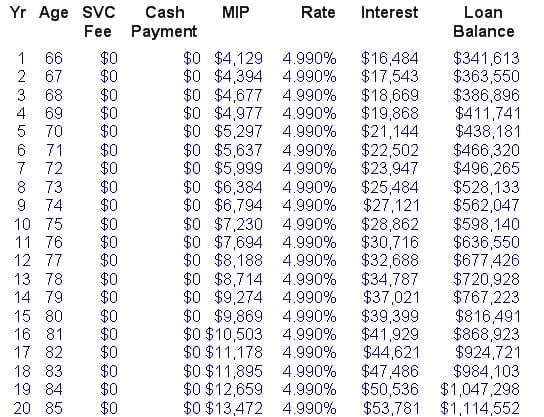

Picture this: A 66-year-old homeowner with a $500,000 home secures a $321,000 fixed-rate reverse mortgage. After 20 years of no payments, interest pushes the balance to $1,000,000. The home’s value could rise, fall, or stay flat — say it’s worth $500,000 when the loan matures. Here’s where non-recourse kicks in:

- If the home’s worth $1,000,000+: Heirs can sell, pay off the loan, and keep the excess — or refinance to retain it.

- If it’s worth $500,000: Heirs can sell, refinance, or walk away. The lender caps repayment at $500,000 — no chasing the estate for the rest. HUD’s insurance covers the lender’s loss.

This cap guarantees peace of mind, no matter the market.

The AARP Lawsuit and HUD Policy Shift

Before 2008, non-recourse applied universally — capping debt at the home’s value for sales or refinances. HUD’s Mortgagee Letter 2008-38 limited it to sales only, forcing heirs to pay full balances (e.g., $600,000 on a $500,000 home) to keep the property. AARP sued, arguing this gutted protections. HUD’s Mortgagee Letter 2011-16 reversed course, restoring the original intent. Now, your debt is capped at the home’s value, period.

Why Non-Recourse Matters

This feature is the backbone of HECM reverse mortgages, offering:

| Feature | Protection | What It Means for You |

|---|---|---|

| Debt Limit | Never owe more than home’s value | Loan capped at appraised value (e.g., $500K max) |

| Heirs’ Liability | No risk to heirs or estate | Pay only home’s value or walk away—no extra cost |

| Lifetime Use | Live in home as long as you want | Stay past 100 if taxes/insurance are paid |

| FHA Insurance | HUD covers lender losses | Your funds are secure, balance doesn’t matter |

| Notes: Applies to HECM loans. Updated for 2025 terms. |

Amortization Example of Interest Owed

Curious How Non-Recourse Fits Your Plan? Contact All Reverse Mortgage, Inc. (ARLO™) for a free, personalized consultation — America’s top-rated lender (4.99/5 stars). Call (800) 565-1722 or get a free quote online — no obligation.

Top FAQs

What Happens If the Reverse Mortgage Balance Exceeds the Property Value?

If your reverse mortgage balance surpasses the value of your property, it doesn’t impact your loan status. As long as you continue living in the home and meet your obligations, such as maintaining taxes, insurance, and property upkeep, your loan remains in good standing. Additionally, any available funds in your line of credit can still be accessed.

If the last surviving borrower leaves the home permanently and the loan balance exceeds the property value, the estate is not responsible for the shortfall. Thanks to the loan’s non-recourse feature, you or your heirs can never owe more than the property’s value at the time of sale.

For Home Equity Conversion Mortgages (HECMs), the Federal Housing Administration (FHA) Mortgage Insurance Fund covers any losses to the lender, ensuring no additional burden on the borrower or their heirs.

What Happens If I Live Beyond 100 Years Old?

If I Borrow Too Much, Can the Bank or Servicer Go After My Heirs or Other Assets?

No, this cannot happen. A reverse mortgage is a non-recourse loan, meaning you can never borrow “too much.” The lender’s only security for repayment is the home itself. They cannot pursue your heirs or your estate for additional funds, regardless of the loan balance.

This protection ensures peace of mind for borrowers and their families. The maximum repayment is capped at the value of the home when it is sold, with any shortfall covered by mortgage insurance in the case of federally insured reverse mortgages.

How Do You Get Out of a Reverse Mortgage That Is Upside Down?

If your reverse mortgage balance exceeds your home’s value, there’s no need to leave the home voluntarily. You can continue living there as long as you meet the loan’s requirements, such as maintaining it as your primary residence and keeping up with taxes and insurance.

When you eventually vacate the home — whether due to moving into assisted living or other reasons — you must notify the lender. At that point, if your heirs want to keep the property, they can pay off the loan at 95% of the home’s current appraised value, regardless of the loan balance. If your heirs don’t want the property, they can allow the lender to foreclose, or you can deed the home back to the bank if the title is clear.

In either scenario, the reverse mortgage’s non-recourse feature ensures that no additional repayment can be sought from your heirs or other assets. The home itself is the only collateral for the loan.

If I Do a Deed in Lieu of Foreclosure on a Reverse Mortgage, Will It Ruin My Credit?

In most cases, a Deed in Lieu of Foreclosure on a reverse mortgage does not impact your credit. Lenders typically do not report reverse mortgages to credit bureaus, and these transactions often occur at the end of the loan when borrowers transition to assisted living or other care, making credit less relevant.

However, if you choose a Deed in Lieu of Foreclosure early — simply because you no longer wish to stay in your current home — and later apply for financing on another property, the impact on your credit may vary. Future lenders might consider this decision differently, as there is no standardized way they evaluate such scenarios. It’s advisable to consult a financial advisor or lender for guidance if you’re concerned about potential future financing needs.

Recommended Reads:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

March 19th, 2024

March 21st, 2024

July 8th, 2023

July 8th, 2023

January 20th, 2023

January 22nd, 2023

March 2nd, 2022

March 2nd, 2022

November 26th, 2020

November 26th, 2020

September 20th, 2020

September 20th, 2020

March 9th, 2020

March 9th, 2020

February 7th, 2020

February 10th, 2020

September 18th, 2019

September 18th, 2019

August 8th, 2019

August 8th, 2019

June 10th, 2019

June 10th, 2019

June 10th, 2019

June 10th, 2019

November 26th, 2018

November 26th, 2018

November 26th, 2018

August 6th, 2017

August 11th, 2025

August 13th, 2025

April 18th, 2011