Jumbo Reverse Mortgage — Loan Amounts Up to $4 Million

Jumbo Reverse Mortgage: 2026 Rates, Limits & Eligibility (Up to $4M)

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

As we move into 2026, many homeowners with higher-value properties are finding that the FHA-insured Home Equity Conversion Mortgage (HECM) program no longer unlocks the equity they expect. That’s where jumbo reverse mortgages may come into play. These privately funded programs offer higher lending limits, more flexibility, and solutions for property types that do not meet FHA standards.

This guide explains how jumbo reverse mortgages work, how they compare to HECMs, and why 2026 may be a particularly important year to evaluate your options.

Quick Summary: Jumbo Reverse Mortgages in 2026

- Designed for higher-value homes, often above FHA limits

- Privately funded, not FHA-insured

- Can offer higher loan amounts but fewer features and protections

- Best compared side-by-side with a HECM before choosing

What is a Jumbo Reverse Mortgage?

A jumbo reverse mortgage is a proprietary, non-FHA-insured reverse mortgage designed for higher-value homes. Unlike a HECM, which is capped at the national FHA lending limit of $1,249,125 for 2026, jumbo programs can lend up to $4 million.

Because these are private programs, lenders set their own guidelines. That flexibility allows features HECM does not offer:

- Eligibility starting at age 55 in certain states

- Financing for non-FHA-approved condos

- Full upfront access to proceeds

- No FHA mortgage insurance premiums

- Higher loan limits based on the home’s full value

Did You Know? If your home is worth more than the 2026 FHA limit of $1,249,125, a jumbo reverse mortgage may let you access far more of your equity, without FHA mortgage insurance costs.

Why 2026 Is a Key Year for Jumbos

The FHA HECM lending limit for 2026 increased to $1,249,125 — an uptick of only 3.25%, the slowest annual increase in more than a decade. This smaller rise reflects the cooling in national home-price appreciation.

For years, HECM limits climbed rapidly as home values surged. That cycle appears to have peaked. The modest 2026 adjustment signals a slowing market, and many economists expect values to flatten or soften in high-priced regions.

What that means for you:

- If your home is already above the HECM cap, waiting another year likely won’t increase HECM proceeds enough to make a difference.

- With slower appreciation, jumbo programs may offer more usable equity today than the HECM formula will in the near future.

- Homeowners who have been “just above” FHA limits now face the widest gap between HECM availability and jumbo availability in years.

This makes 2026 a particularly important year to review your options…

Did You Know? With the slowest HECM limit increase in more than ten years, many higher-value homes now sit well beyond what FHA can reach. Jumbo programs often fill that gap today.

When a Jumbo Can Make Sense Even Below the HECM Limit

In some cases, a jumbo reverse mortgage may still be helpful even if your home value is at or below the HECM limit.

Examples include:

- Non-FHA approved condos that are acceptable to the jumbo investor

- Certain properties with accessory units or other features that fit private guidelines more easily than HUD property requirements

- Borrowers who value full lump-sum access up front more than the HECM line of credit growth feature

The exact percentage of your home’s value you can borrow will depend on your age, current interest rates, and your property.

Did you know? While jumbo reverse mortgages can offer much higher loan limits than a HECM, they are designed primarily for higher-value homes. In practice, jumbo programs tend to make the most sense when a home’s value is above the FHA lending limit, or when the property does not meet FHA eligibility rules. If your home value is close to the FHA limit and otherwise qualifies for a HECM, the difference in available funds may be modest. This is why comparing the two options side by side is important before choosing a jumbo loan.

How Jumbo Reverse Mortgages Work in 2026

Several lenders offer jumbo reverse mortgages. Because these are proprietary loans, they are not required to comply with HUD HECM rules. That gives them flexibility, but also means you must pay close attention to the specific terms offered.

Typical features you may see on jumbo reverse mortgage programs in 2026:

- Minimum ages as low as 55 in some states

- Willingness to lend on non-FHA-approved condo units

- The option to take the full loan amount as a lump sum at closing

- Some programs that include open lines of credit instead of a lump sum only

- No FHA mortgage insurance premiums

At the same time, many jumbo programs mirror important HECM protections:

- Non-recourse protection, so neither you nor your heirs owes more than the value of the home when it is sold

- Counseling requirements prior to closing

- The same basic occupancy rules: the home must remain your primary residence, and you must stay current on taxes, insurance, and basic maintenance

Some jumbo programs allow borrowers as young as 55, which is seven years earlier than the minimum HECM age of 62, where state law permits.

Did you know? Because jumbo reverse mortgages involve larger loan amounts, lenders apply stricter valuation standards. Higher-value homes may require additional appraisal review, and in some cases, more than one appraisal. When multiple appraisals are ordered, lenders typically rely on the lower of the two values. These rules are not meant to reduce borrower benefits, but to ensure consistent, supportable valuations for higher-risk loans. These valuation standards are common on high-balance mortgages and are not unique to reverse mortgages.

Refinancing Into a Jumbo Reverse Mortgage

Refinancing from a HECM or another reverse mortgage into a jumbo is not automatic. Most jumbo programs require a seasoning period between reverse mortgage transactions and a clear financial benefit to the borrower. This is designed to prevent unnecessary refinancing and protect borrowers from churning. A jumbo refinance should improve the borrower’s position in a meaningful way. This review helps ensure that refinancing improves long-term outcomes, not just short-term access to cash.

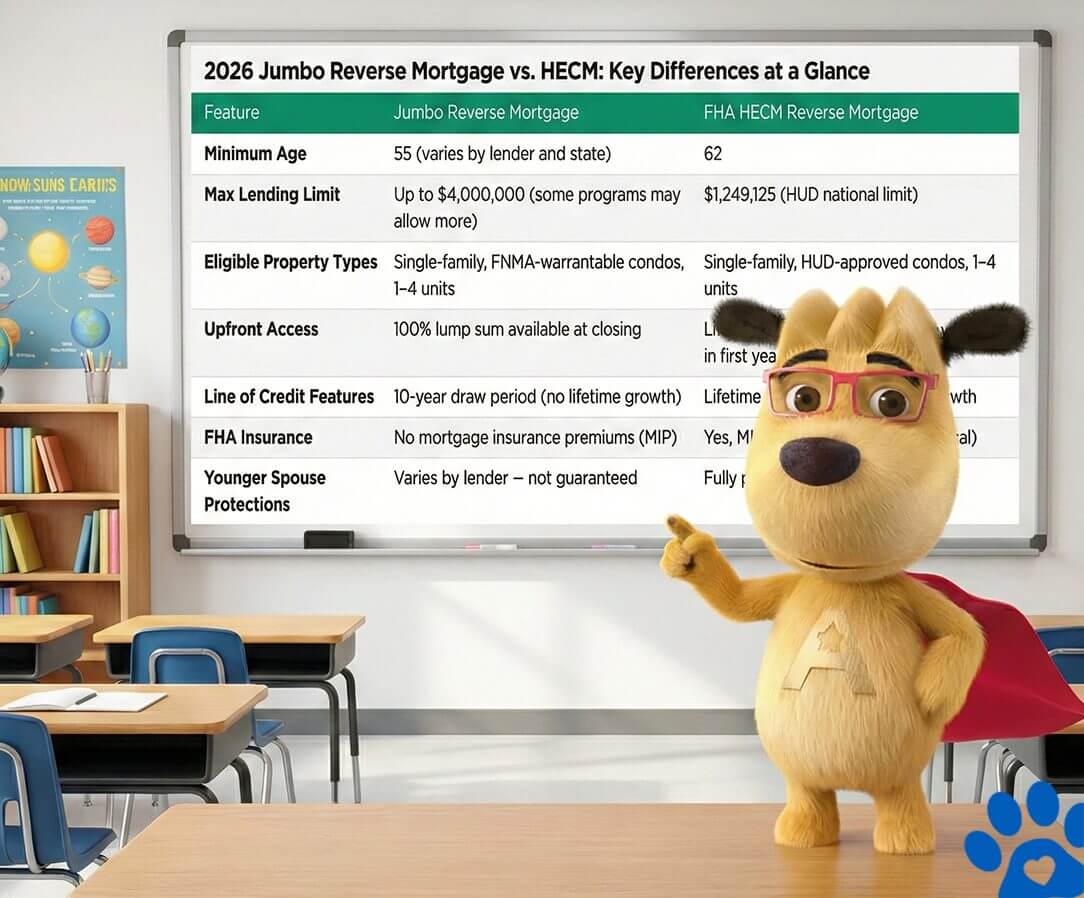

Jumbo Vs. HECM: Key Differences

| Feature | Jumbo Reverse Mortgage | FHA HECM Reverse Mortgage |

|---|---|---|

| Minimum Age | 55 (varies by lender and state) | 62 |

| Max Lending Limit | Up to $4,000,000 (some programs may allow more) | $1,249,125 (HUD national limit) |

| Eligible Property Types | Single-family, FNMA-warrantable condos, 1–4 units | Single-family, HUD-approved condos, 1–4 units |

| Upfront Access | 100% lump sum available at closing | Limited (typically 60% or obligations + 10% in first year) |

| Line of Credit Term | 10-year draw period | Lifetime draw period |

| Line of Credit Growth Rate | 1.5% for 7 Years | Note Rate + .50 MIP for Life |

| FHA Insurance | No mortgage insurance premiums (MIP) | Yes, MIP required (upfront and annual) |

| Younger Spouse Protections | Varies by lender – not guaranteed | Fully protected by HUD regulations |

| Use for Home Purchase | Yes | Yes |

| Note: *HECM lump sum capped at 60% of Principal Limit or obligations + 10% in first 12 months. | ||

Jumbo Reverse Mortgage Loan-to-Value by Age Chart

Loan-to-value percentages in this table are based on an interest rate of 8.99% (9.602% APR). Loan amounts are illustrative estimates rounded to the nearest thousand and may vary based on final loan terms, closing costs, and borrower qualifications.Today's Jumbo Reverse Mortgage Rates

| Rate Type | Rate/APR | Lending Limit |

|---|---|---|

| Fixed | 7.990% (8.068% APR) | $4,000,000 |

| Fixed | 8.950% (8.955% APR) | $4,000,000 |

| Fixed | 8.980% (9.132% APR) | $4,000,000 |

| Fixed | 8.990% (9.600% APR) | $4,000,000 |

| Adjustable | 9.029% (5.499 Margin) | $4,000,000 |

| Adjustable | 9.155% (5.625 Margin) | $4,000,000 |

| Adjustable | 9.279% (5.749 Margin) | $4,000,000 |

| Adjustable | 9.280% (5.750 Margin) | $4,000,000 |

| Adjustable | 9.405% (5.875 Margin) | $4,000,000 |

| Adjustable | 9.520% (5.990 Margin) | $4,000,000 |

| Note: Fixed: Lump Sum only. Adjustable: Lump Sum or Line of Credit. APR for a 70-year-old, $1M loan in CA. | ||

Expert Insight from Michael Branson, CEO: “If your home is well above FHA limits, a jumbo loan can unlock far more equity while still protecting you with non-recourse features.”

Who Should Be Cautious About a Jumbo Reverse Mortgage

A jumbo reverse mortgage is not the right solution for everyone. Homeowners who expect to sell within a few years, prioritize FHA insurance protections such as the guaranteed line of credit growth rate, or whose home value is close to the FHA lending limit may find that a HECM is a better fit. The best choice depends on your goals, timeline, and how you plan to use the funds.

Jumbo vs HECM: Which May Be a Better Fit?

A jumbo reverse mortgage may be worth exploring if:

- Your home value is well above the HECM lending limit

- Your property does not meet FHA guidelines

- You want access based on your full home value, not a capped limit

- You are comfortable with private-lender terms and disclosures

A HECM reverse mortgage may be a better choice if:

- Your home value is near or below the HECM lending limit

- You want standardized HUD protections and insurance

- You value long-term line of credit growth

- Protecting a younger or non-borrowing spouse is a priority

Neither option is universally better. The right solution depends on your specific situation, not just the loan size.

Jumbo Reverse Mortgage Market History and 2026 Outlook

The jumbo reverse mortgage market has evolved and has been influenced by various factors. After the 2008 housing crash, many jumbo reverse mortgage products disappeared.

However, several new jumbo products have been introduced in recent years, offering different rates, terms, and features, thanks to low interest rates and changes to the FHA lending limit.

If you are considering a jumbo reverse mortgage, comparing lenders on the specific terms they offer is essential. Important details include the maximum amount you can borrow, how you will receive the loan proceeds, and the protections available for non-borrowing spouses, if applicable.

Understanding these factors will help you make an informed decision.

Expert Insight from Michael Branson, CEO: “Today’s jumbo market is healthier and more transparent than it was pre-2008, offering borrowers a greater variety of programs than ever before.”

In-Depth FAQ

What is a jumbo reverse mortgage?

What is the difference between a HECM and a jumbo reverse mortgage?

What is the difference between jumbo and proprietary loans?

How much can you get from a jumbo reverse mortgage?

What are the rates for jumbo reverse mortgages?

What is the maximum jumbo reverse mortgage?

Can you get a jumbo reverse mortgage line of credit?

What are the disadvantages of a jumbo reverse mortgage?

What lenders offer jumbo reverse mortgages?

How long does it take to process a jumbo reverse mortgage?

What about my property tax and insurance with a jumbo reverse mortgage?

Are jumbo reverse mortgages still non-recourse?

Can you have more than one jumbo reverse mortgage?

Can I rent rooms privately, with a rental company, or Airbnb if we have a jumbo reverse mortgage?

Ready to tap into more home equity with a jumbo reverse mortgage? The right choice isn’t about getting the biggest number. It’s about choosing the option that fits your home, your plans, and your comfort level with long-term protections. If you want to compare both options side-by-side using real-time rates and current 2026 limits, you can get an instant quote here or call us Toll-Free at (800) 565-1722. We’re here to help you make an informed decision you can feel good about.

Additional Resources:

- Read my article published at Forbes.com, “The Evolution Of Jumbo Reverse Mortgages.”

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

August 19th, 2025

August 28th, 2025

January 19th, 2023

January 31st, 2023

July 15th, 2022

July 19th, 2022

February 15th, 2022

February 15th, 2022

February 9th, 2022

February 15th, 2022

August 20th, 2021

August 24th, 2021

September 22nd, 2020

September 22nd, 2020

October 1st, 2019

October 6th, 2019