ALL-NEW Jumbo Reverse Mortgage with Line of Credit Feature!

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

All Reverse Mortgage, Inc. is excited to unveil our innovative Jumbo Reverse Mortgage Line of Credit (RMLOC). Mirroring the non-recourse nature of the Home Equity Conversion Mortgage (HECM), our Jumbo RMLOC ensures that neither borrowers nor their heirs are personally liable for the loan. A standout feature of this product is the absence of mortgage insurance, both upfront and on an annual basis.

What sets our Jumbo RMLOC apart is its dynamic line of credit, which grows annually at a rate of 1.5% on the unused portion. This unique aspect provides borrowers with enhanced borrowing potential in future years, maximizing the benefits of their remaining credit line.

This option is especially appealing for owners of high-value homes seeking flexibility. The Jumbo LOC is an ideal solution for those who appreciate the benefits of a reverse mortgage but are hesitant about withdrawing the full loan amount immediately. It offers a strategic financial tool, combining the advantages of a reverse mortgage with the adaptability of a line of credit tailored to the needs of borrowers with substantial home equity.

Jumbo Line of Credit Features

- Loan amounts up to $4,000,000

- No upfront or monthly Mortgage Insurance Premium (MIP)

- Competitive adjustable rates. Interest rates change weekly with the publishing of the 3-month WSJ rates.

- Origination Fee: 2% of the first 200k; 1% of remaining value capped at $6,000.

- 5% cap over initial rate.

- Margin of 3.5% (or 3.75% if the borrower fails the Financial Assessment review).

- Borrowers can use loan proceeds to pay off debt at closing to income qualify.

- Non-recourse feature.

- Note: There are no term or tenure payment options allowed. The borrower may not bring additional funds to be added to the LOC.

- Unlike the HECM line of credit, borrowers can use loan proceeds to pay off debt at closing to income qualify.

Interest Rates & Margin

- A margin of 3.50% (or 3.75% if the borrower fails the Financial Assessment review)

- The rate is based on the three-month LIBOR index as published in the Wall Street Journal. Rates are updated weekly on Monday afternoons. ARM publishes the margins available to the borrower after the rates are updated.

- The initial interest rate is the three-month LIBOR index plus the borrower’s margin. Refer to All Reverse Mortgage® posted rates for the current margins available. Margins are subject to change.

- All Reverse Mortgage® does not offer rate locks currently, so margins are subject to change weekly.

- The floor (minimum) rate for the Proprietary Line of Credit is 4.99%.

- The rate caps are 1.00% per rate change period, and the rate ceiling (maximum) is 5.00% above the initial rate.

- Rates reset on the first day of each quarter after a full three months have passed since loan funding. (January 1, April 1, July 1, October 1)

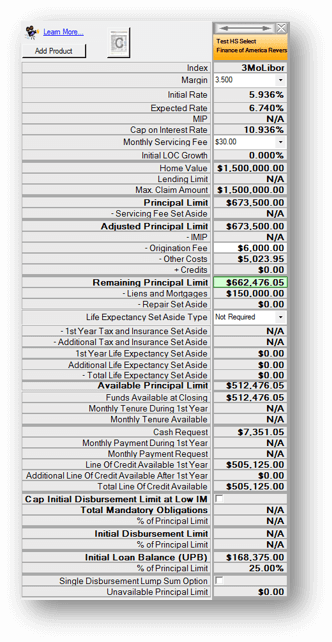

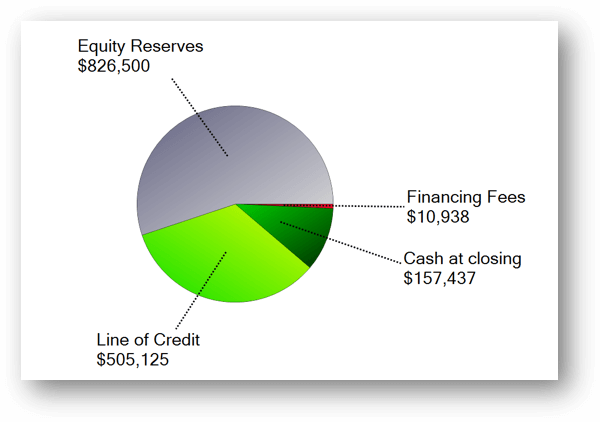

Line of Credit Quote Example

In this example, the borrower has an available principal limit of $673,500

The borrower is required to take 25% upfront as a closed-end loan = $168,375

- Mortgage payoff = $150,000

- Closing costs = $11,023.95

- Cash Requested = $7,351

The remaining 75% is available as an open-ended Line of Credit = $505,125

Line of Credit Loan-to-Values

| 3 Mo. Libor Rate | Current Rate 6% |

|---|---|

| Youngest Age | Loan-to-value % |

| 62 | 32% |

| 72 | 44% |

| 82 | 53% |

| 92 | 57% |

State Availability

The Private Reverse Mortgage Line of Credit is currently only available in California but is expanding rapidly.

| Line of Credit | Jumbo Lump Sum | Second Mortgage | Payment Plan |

|---|---|---|---|

| California | Arizona | California | California |

| California | Florida | Florida | |

| Colorado | South Carolina | South Carolina | |

| Connecticut | Texas | Texas | |

| District of Columbia | |||

| Florida | |||

| Georgia | |||

| Hawaii | |||

| Idaho | |||

| Illinois | |||

| Louisiana | |||

| Nevada | |||

| New Jersey | |||

| Oregon | |||

| Pennsylvania | |||

| Rhode Island | |||

| South Carolina | |||

| Texas | |||

| Utah | |||

| Virginia | |||

| Washington |

Summary

All Reverse Mortgage is proudly committed to helping people get the most out of their home equity. The release of our Private Reverse Mortgage Line of Credit will help many of our clients unlock housing wealth and leverage assets to meet their ongoing financial needs.

The Private Reverse Mortgage is specifically designed for borrowers who own property, allowing them to borrow more than the FHA maximum HECM lending limit of $1,249,125. It is also designed for those with other situations that would not qualify under the HECM program.

Please feel free to contact us at (800) 565-1722 with specific questions regarding the guidelines, exceptions, terms, documentation, underwriting, or calculations used to qualify.

Additional Tools

Download our NEW Jumbo Reverse Mortgage Line of Credit Amortization Calculator (Download Link)

(This amortization calculator is programmed specifically for the jumbo reverse mortgage line of credit program)

ARLO recommends these helpful resources:

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

December 3rd, 2018

December 3rd, 2018