Reverse Mortgage Payoff at 95% Appraised Value — Can Heirs Buy the Home?

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Hello All Reverse,

I’ve read through your website and the Q&A section, and I’m confused by a few points. I’m hoping you can explain what really happens with my mother’s home and whether her grandchildren are allowed to buy it.

Your site says a reverse mortgage is non-recourse, so the estate doesn’t have to pay the difference if the home sells to a third party for less than the loan balance. But the same section says family members can buy the home for 95% of the appraised value. I also noticed in several of your replies that heirs, including grandchildren, can purchase the home at that same 95% amount.

Here’s my situation:

My mother passed away and her reverse mortgage balance was about $230,000 and could have grown to around $270,000. Since then, I’ve stayed in contact with the lender, rented out the property, paid the taxes, and taken care of maintenance. I’m not able to buy the home myself, but two of her heirs (the grandchildren) are trying to get financing to purchase it for 95% of the lender’s appraised value, which is $140,000.

Because of the conflicting information, I’m not sure whether the home can be sold to her grandchildren. Can you clarify this?

– Don H.

Hi Don,

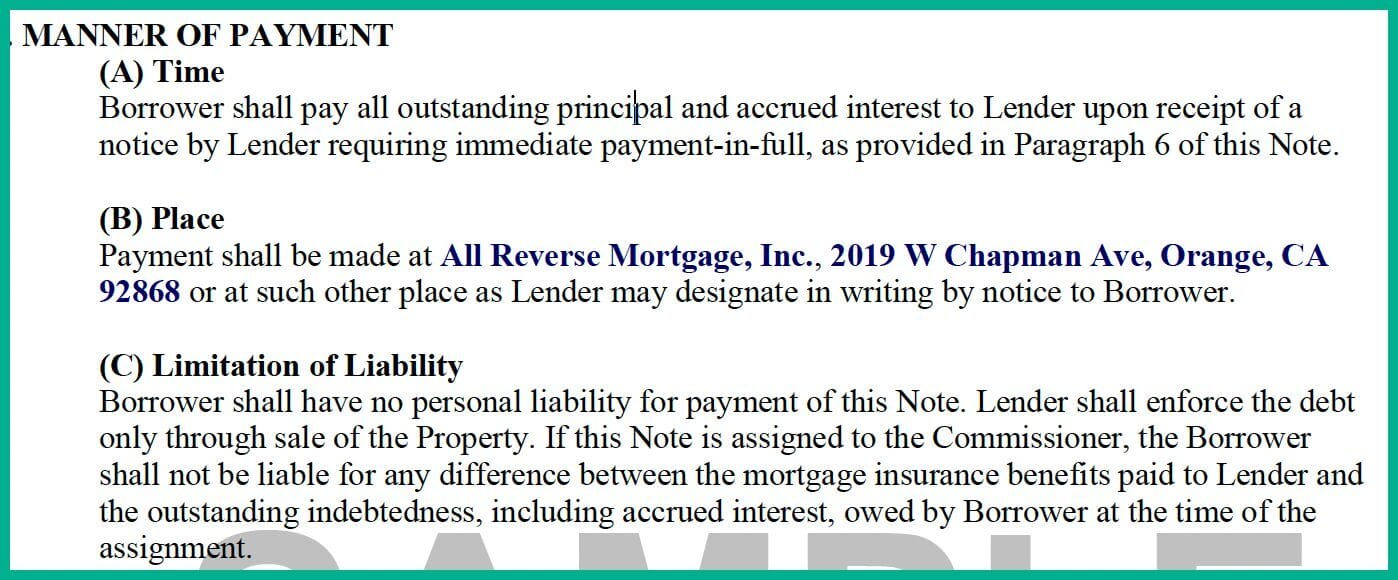

Here is the exact verbiage in the Note and Deed of Trust for the HECM reverse mortgage about no Deficiency Judgment:

Deficiency Judgment

2.10. Manner of Payment. Only a Borrower has a right to receive the Borrower’s Advance. Borrowers agree that payment from any subsequent Loan Advance should be made directly to the applicable third party for the benefit of the Borrowers.

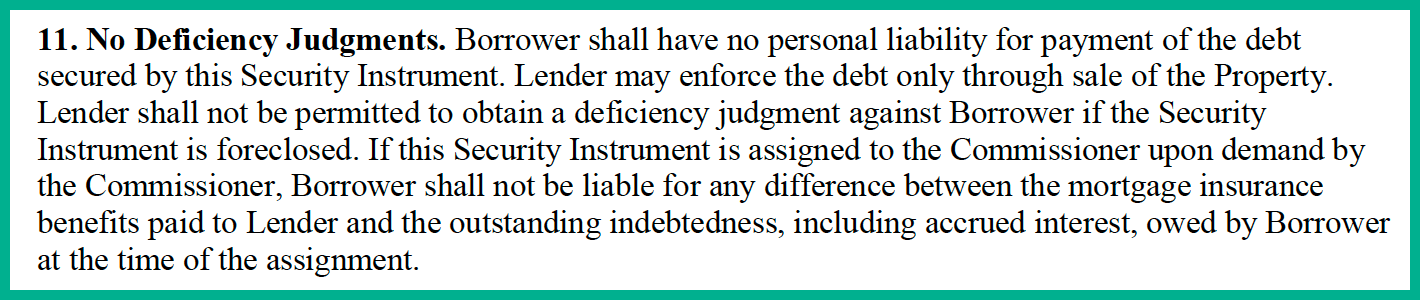

Deed of Trust

11. No Deficiency Judgments. Borrower shall have no personal liability for payment of the debt secured by this Security Instrument. Lender may enforce the debt only through sale of the Property. Lender shall not be permitted to obtain a deficiency judgment against Borrower if the Security Instrument is foreclosed. If this Security Instrument is assigned to the Commissioner upon demand by the Commissioner, Borrower shall not be liable for any difference between the mortgage insurance benefits paid to Lender and the outstanding indebtedness, including accrued interest, owed by Borrower at the time of the assignment.

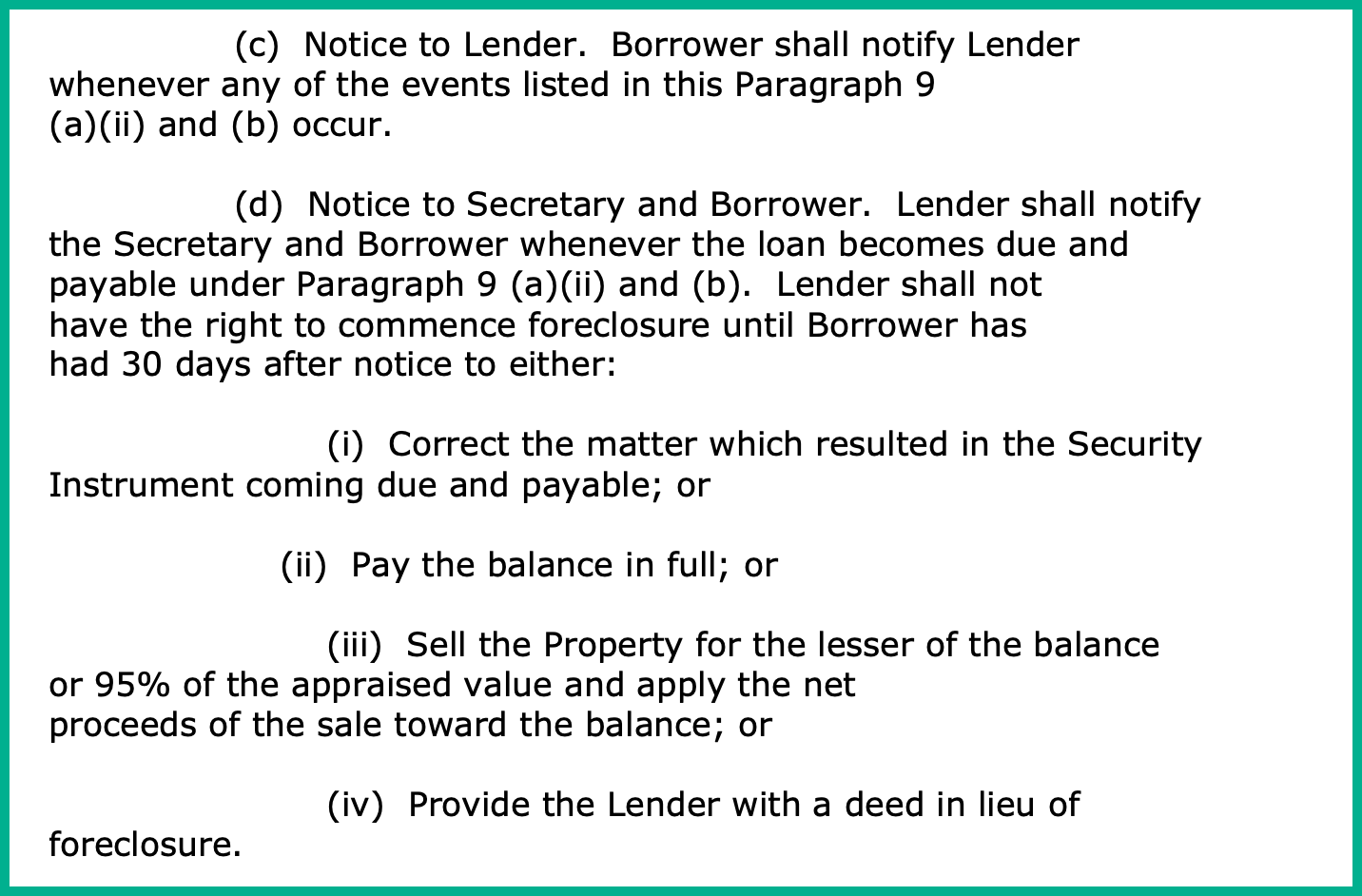

Verbiage in the HUD Manual 4235.1

(c) Notice to Lender. Borrower shall notify Lender whenever any of the events listed in this Paragraph 9 (a)(ii) and (b) occur. (d) Notice to Secretary and Borrower. Lender shall notify the Secretary and Borrower whenever the loan becomes due and payable under Paragraph 9 (a)(ii) and (b). Lender shall not have the right to commence foreclosure until Borrower has had 30 days after notice to either: (i) Correct the matter which resulted in the Security Instrument coming due and payable; or (ii) Pay the balance in full; or (iii) Sell the Property for the lesser of the balance or 95% of the appraised value and apply the net proceeds of the sale toward the balance; or (iv) Provide the Lender with a deed in lieu of foreclosure.

What it all boils down to is that the Note, Deed, and Security Agreement the borrower has signed, and the loan contracts, if you will, all guarantee that there is no personal liability for the loan. Since there is no personal liability, HUD and the lender can only look to the property to repay the debt.

Therefore, HUD has realized that a sale in the marketplace will cost them money. They will not be able to sell the property for above-market value, and the costs will be at least 5%. If the family sells the home, they can pay off the loan for 95% of the property’s current value or the balance owed, whichever is less.

HUD makes no differentiation in anything I can find; they only talk about the right to sell the home for at least 95% of its current appraised value, and there is no restriction on to whom the home is sold.

Having said that, you brought up another issue here that I would like to touch on. The Deed of Trust also contains provisions for the Assignment of Rent (and you mentioned that you rented the property).

Assignment of Rents

22. Assignment of Rents. Borrower unconditionally assigns and transfers to Lender all the rents and revenues of the Property. Borrower authorizes Lender or Lender’s agents to collect the rents and revenues and hereby directs each tenant of the Property to pay the rents to Lender or Lender’s agents. However, prior to Lender’s notice to Borrower of Borrower’s breach of any covenant or agreement in this Security Instrument, Borrower shall collect and receive all rents and revenues of the Property as trustee for the benefit of Lender and Borrower. This assignment of rents constitutes an absolute assignment and not an assignment for additional security only. If Lender gives notice of breach to Borrower: (a) all rents received by Borrower shall be held by Borrower as trustee for benefit of Lender only, to be applied to the sums secured by this Security Instrument; (b) Lender shall be entitled to collect and receive all of the rents of the Property; and (c) each tenant of the Property shall pay all rents due and unpaid to Lender or Lender’s agent on Lender’s written demand to the tenant. Borrower has not executed any prior assignment of the rents and has not and will not perform any act that would prevent Lender from exercising its rights under this Paragraph 22. Lender shall not be required to enter upon, take control of or maintain the Property before or after giving notice of breach to Borrower. However, Lender or a judicially appointed receiver may do so at any time there is a breach. Any application of rents shall not cure or waive any default or invalidate any other right or remedy of Lender. This assignment of rents of the Property shall terminate when the debt secured by this Security Instrument is paid in full.

The sooner you can complete the sale, the better, as all rent should go to the lender.

Are You an Heir Navigating a Reverse Mortgage Payoff? We help families understand their options every day — including the 95% appraised value rule and how heirs can purchase the home. Call All Reverse Mortgage, Inc. (ARLO™) at (800) 565-1722 or get a free consultation online.

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

January 2nd, 2026

January 2nd, 2026

September 29th, 2024

September 29th, 2024

May 23rd, 2023

May 23rd, 2023

May 20th, 2022

May 23rd, 2022

February 1st, 2022

February 2nd, 2022

July 11th, 2021

July 19th, 2021

March 30th, 2021

March 30th, 2021

October 22nd, 2020

October 22nd, 2020

October 8th, 2020

October 8th, 2020

September 23rd, 2020

September 23rd, 2020

September 4th, 2019

September 4th, 2019

August 20th, 2019

August 25th, 2019

April 4th, 2018

April 4th, 2018

September 13th, 2016

September 14th, 2016

September 7th, 2013