Oregon's #1 Rated Reverse Mortgage

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Experience Excellence with Oregon’s Top Reverse Mortgage Lender

For over 20 years, All Reverse Mortgage, Inc. (ARLO™) has helped Oregon homeowners access their home equity through HUD-approved HECM and jumbo reverse mortgages. As Oregon’s #1 Rated Reverse Mortgage Lender, we hold an A+ BBB rating with perfect 5-star reviews and zero complaints — a record that earned us recognition as a BBB Torch Award for Ethics Finalist three years running.

As a HUD-approved direct lender and proud member of the National Reverse Mortgage Lenders Association (NRMLA), we specialize exclusively in reverse mortgages — it’s all we’ve done since 2004. That singular focus is especially valuable in Oregon, where steady appreciation has pushed home values in the Portland metro — including Lake Oswego, West Linn, and the West Hills — well above the statewide average, and properties in Bend, Ashland, and along the coast in Cannon Beach and Newport often approach or exceed the $1,249,125 HECM lending limit. Our team introduced the first fixed-rate jumbo reverse mortgage in 2008, giving us the expertise to help Oregon homeowners evaluate both HECM and jumbo options and choose the program that fits their goals.

Whether your goal is to eliminate monthly mortgage payments, create a financial safety net with a growing line of credit, or access equity for retirement planning, we’re here to help you choose the right program with competitive rates and lower costs. Let us show you the difference two decades of dedicated experience can make.

Key Facts About Oregon Reverse Mortgages

| Top 10 Reverse Mortgage Cities in Oregon |

|---|

| 1 Portland |

| 2 Bend |

| 3 Redmond |

| 4 Grant’s Pass |

| 5 Gresham |

| 6 Terrebonne |

| 7 West Linn |

| 8 Central Point |

| 9 Newport |

| 10 Newberg |

| Data by MCA (January 2026) |

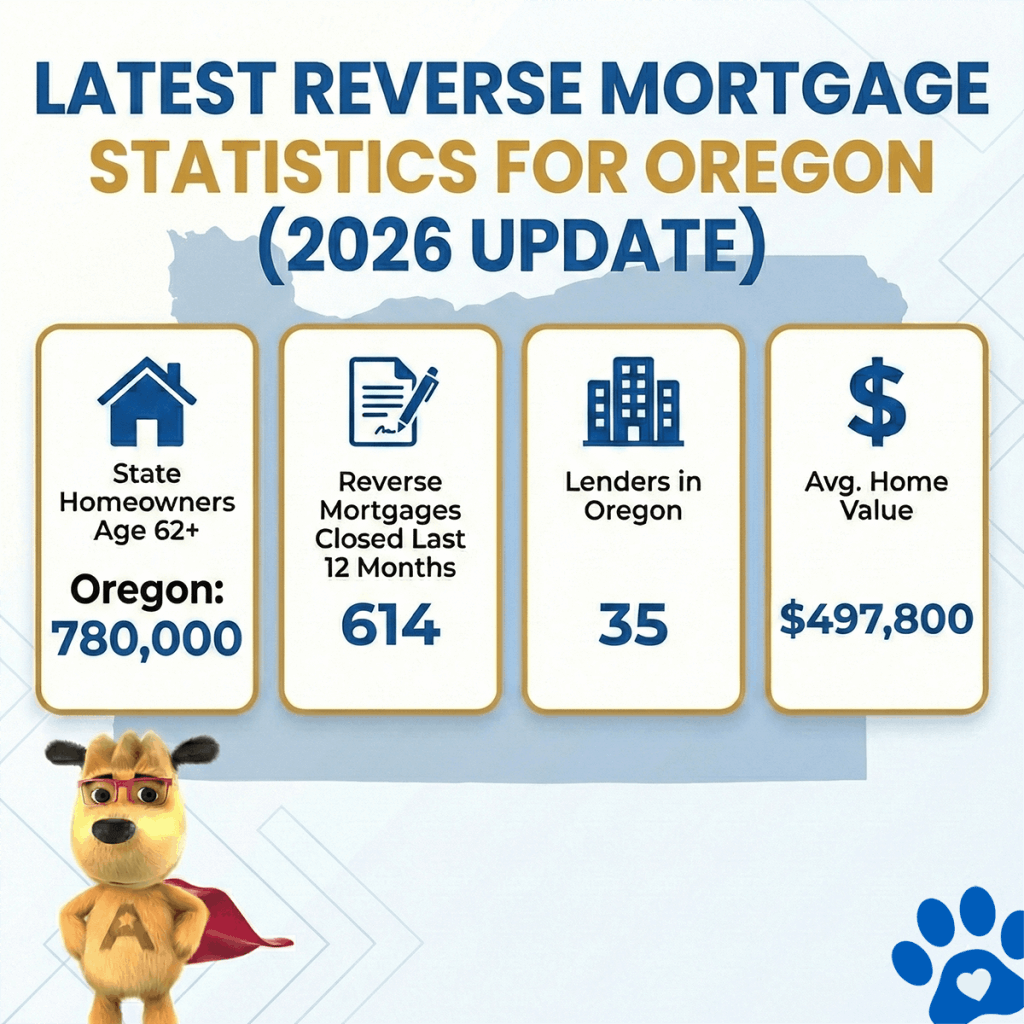

Latest Reverse Mortgage Statistics for Oregon (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Oregon | Avg. Home Value |

|---|---|---|---|---|

| Oregon | 780,000 | 614 | 35 | $497,800 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Top Reverse Mortgage Lenders in Oregon

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Oregon Reverse Mortgage Lending Limits for 2026

Oregon, known as “The Beaver State,” has a population of over 4.2 million, with more than 780,000 homeowners aged 62 and older. This means that over a quarter of a million Oregonians may qualify for a reverse mortgage, providing a way to access their home’s equity.

With an average home value of $497,800, Oregon sits higher than the national average and within comfortable reach of the HECM lending limit. However, the Portland metro area — where values in neighborhoods like the Pearl District, Dunthorpe, and Lake Oswego regularly exceed the statewide average — and popular retirement destinations in Central Oregon and along the coast mean that a meaningful number of Oregon homeowners may benefit from comparing HECM and jumbo options.

Oregon’s no-sales-tax policy, temperate climate in the Willamette Valley, and access to outdoor recreation from Mt. Hood to the Oregon Coast have made it a top destination for retirees relocating from higher-cost states like California and Washington. For homeowners who have built substantial equity over the years, a reverse mortgage can be a strategic way to access that equity without selling the home they love.

If you reside in Oregon, All Reverse Mortgage, Inc. (ARLO™) is here to answer your questions and provide the support you need to make the best decision for your financial future.

Essential Protections and Requirements for Oregon Reverse Mortgages

In Oregon, reverse mortgages are governed by federal guidelines and additional state-specific protections to ensure transparency and consumer confidence. For those considering a reverse mortgage, here are the key requirements and safeguards you should know:

- Mandatory HUD-Approved Counseling — Oregon requires all reverse mortgage applicants to complete a HUD-approved counseling session before proceeding with the loan. This ensures borrowers fully understand the loan’s structure, benefits, and potential alternatives. A signed certificate must be presented to the lender before the application is finalized.

- Protection Against Tied Financial Products — Oregon prohibits lenders from requiring borrowers to purchase additional financial products, such as annuities, as a condition of obtaining a reverse mortgage. This ensures a fair and unbiased process.

- Clear Disclosure of Tax and Insurance Responsibilities — Borrowers are required to maintain their property taxes, homeowners insurance, and home maintenance. Oregon lenders must clearly disclose these obligations to prevent misunderstandings that could lead to foreclosure.

- Cooling-Off Period — Oregon provides borrowers with a mandatory waiting period before finalizing a reverse mortgage. This allows time to review loan terms and consult with trusted advisors or family members, ensuring a well-informed decision.

- Licensed Loan Originators — All reverse mortgage lenders operating in Oregon must be properly licensed and adhere to strict state standards for professionalism and transparency, giving borrowers confidence in the lending process.

- Equity Safeguards Under Oregon Law — Oregon protects homeowners by enforcing strict rules on equity preservation, ensuring borrowers retain control of their home’s equity and that reverse mortgage terms are clear and beneficial.

HUD-Approved Reverse Mortgage Counseling Agencies in Oregon

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| CCCS OF SOUTHERN OREGON | 81735 | 820 Crater Lake Ave, Medford, Oregon, 97504-6581 | (541) 779-2273 | improvedcredit.org |

| HOUSING OPTIONS PROVIDED FOR THE ELDERLY | 90435 | 5200 Meadows Rd Ste 150, Lake Oswego, Oregon, 97035-0066 | (971) 207-7820 | hopeforseniorsstl.org |

| NEIGHBORIMPACT | 81156 | 2303 SW 1st St, Redmond, Oregon, 97756-7133 | (541) 323-6567 | neighborimpact.org |

| NEIGHBORIMPACT - MADRAS HOUSING CENTER | 84789 | 374 SW 5th St, MADRAS, Oregon, 97741-1344 | (541) 318-7506 | neighborimpact.org |

| NEIGHBORIMPACT - PRINEVILLE HOUSING CENTER | 84788 | 457 NE Ochoco Plaza Dr, Prineville, Oregon, 97754-8467 | (541) 323-6567 | neighborimpact.org |

| NEIGHBORIMPACT- BEND HOUSING CENTER | 90211 | 20310 Empire Ave., Suite A100, BEND, Oregon, 97703-5723 | (541) 323-6567 | neighborimpact.org |

Did you know? Oregon does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies, and you can conduct your required counseling from the comfort of your home.

Other Areas of Interest in Oregon

Albany Ashland Beaverton Bend Central Point Corvallis Eugene Grant's Pass Gresham Hillsboro Klamath Falls Medford Newberg Newport Oregon City Portland Redmond Roseburg Salem Terrebonne Tigard West Linn

Ready to Unlock Your Home’s Equity?

As Oregon’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

All Reverse Mortgage, Inc. is fully licensed by the Oregon Division of Financial Regulation (License #ML-4917), ensuring that you receive expert guidance every step of the way.

Get Your Reverse Mortgage Quote from Oregon’s #1 Rated Reverse Mortgage Lender* or call (800) 565-1722 to speak with a licensed expert.

Additional Resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald