Serving Tigard Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Tigard Reverse Mortgage Lenders

At All Reverse Mortgage, Inc. (ARLO™), we’re proud to be Oregon’s #1 Rated Reverse Mortgage Lender, celebrating 20 years of dedicated service. Our A+ rating from the Better Business Bureau and perfect 5-star reviews reflect our unwavering commitment to providing you with the best terms and exceptional customer care.

Since 2004, our mission has been simple: to help Oregon homeowners make the most of their home’s equity with peace of mind. As a HUD-approved lender, we offer a comprehensive range of HECM and jumbo reverse mortgages tailored to meet your specific needs.

With our competitive rates and lower costs, you can retain more of your home’s equity. We’re here to show you the difference our experience can make, and we look forward to guiding you every step of the way!

All Reverse Mortgage is licensed by the Division of Finance and Corporate Securities (DFCF) (License/Registration #ML-5006)

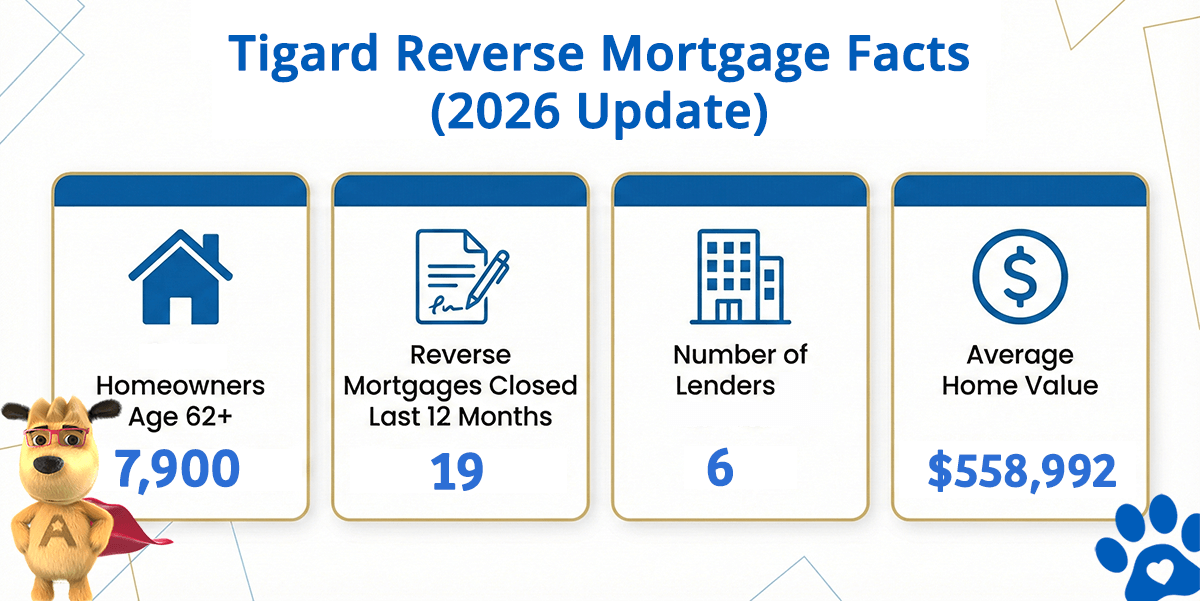

Tigard Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Tigard (est) | Avg. Home Value |

|---|---|---|---|---|

| Tigard | 7,900 | 19 | 6 | $558,992 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

HUD Approved Direct Lender

All Reverse Mortgage, Inc. (ARLO™) is approved by the Department of Housing and Urban Development (HUD) to originate, underwrite, and close HUD’s Home Equity Conversion Mortgage (HECM), commonly referred to as a reverse mortgage.

In Albany, All Reverse Mortgage, Inc. (ARLO™) assists homeowners with refinancing, whether they want to pay off an existing loan and eliminate monthly mortgage payments, access their home equity for other purposes, or pursue a combination of both.

About All Reverse Mortgage, Inc.

At All Reverse Mortgage, Inc. (ARLO™), we’re proud to be licensed by the state of Oregon, bringing decades of expertise and local knowledge to homeowners across the state. Our owners and management were part of the team that introduced and sold the first fixed-rate jumbo reverse mortgage in 2008. With extensive experience in jumbo and proprietary loan programs, we continually seek new products to better serve Oregon homeowners, especially those with high-value homes in markets where the HUD HECM may not fully meet their needs.

As a licensed Oregon lender, we understand the unique aspects of the local housing market. We’re dedicated to helping you navigate the complexities of reverse mortgage options, from the HUD HECM to niche jumbo programs. Our seasoned originators are well-equipped to guide you through the process, ensuring you understand the pros and cons of each option so you can make an informed decision.

For homeowners aged 62 and above, a reverse mortgage can be a powerful financial tool—not just a last resort. Whether it’s eliminating existing mortgage payments or establishing a growing line of credit, we’re here to help you use your home’s equity to live comfortably and plan for the future in your family home.

Tigard, Oregon: Community Overview

Though officially incorporated as a city in the latter half of the 20th century, Tigard, Oregon traces its origins back to the mid-1850s. The city’s name comes from the Tigard family, who were among the first settlers in the area, initially known as “East Butte.” By 1886, the town had become known as Tigardville before finally shortening the name to Tigard in 1907.

Tigard’s growth was fueled by the railroad’s arrival in the early 20th century, and the town became a hub for commercial and residential development. By the time Tigard officially became a city in 1961, it had established itself as an integral part of the Portland metropolitan area.

Today, Tigard’s population has grown to 54,000 people as of 2018, making it one of Oregon’s larger cities. Its convenient location near Interstate 5 connects it to the wider West Coast, providing easy access to Portland and beyond.

Outdoor Recreation and Economy

Tigard offers plenty of recreational opportunities, with 20 parks over nearly 500 acres. Residents enjoy outdoor activities while still benefiting from Portland’s close proximity. Key employers such as Capital One Services, Nordstrom, and Macy’s, along with the school district and city government, support the local economy.

One of Tigard’s standout features is Washington Square Mall, a major shopping destination with over 200 stores in 1.5 million square feet of retail space. It ranks among the highest-grossing malls in the U.S.

Tigard Lending Limits

Eleven percent of Tigard’s population is made up of seniors aged 65 or older, according to U.S. Census Bureau data. Of these seniors, 72 percent (accounting for 2,747 households) are homeowners, many of whom may be eligible for a reverse mortgage to support their retirement.

As of January 2023, Tigard’s median home value is $636,520, which is higher than the state average. This reflects the city’s desirable location and steady real estate market growth. For homeowners with properties exceeding the federal HUD lending limit of $1,249,125, a jumbo reverse mortgage could provide an opportunity to access additional home equity beyond what is available through an FHA-insured HECM loan.

Ready to Unlock Your Home’s Equity?

As Tigard’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

As a fully licensed lender by the Oregon Division of Financial Regulation (License #ML-4917), we’re committed to helping you secure the retirement you deserve.

Get Your Free Quote from Tigard’s #1 Rated Reverse Mortgage Lender, or call (503) 400-7121 to speak with a friendly expert today.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald