Florida's #1 Rated Reverse Mortgage

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Experience Excellence with Florida’s Top Reverse Mortgage Lender

For over 20 years, All Reverse Mortgage, Inc. (ARLO™) has helped Florida homeowners access their home equity through HUD-approved HECM and jumbo reverse mortgages. As Florida’s #1 Rated Reverse Mortgage Lender, we hold an A+ BBB rating with perfect 5-star reviews and zero complaints — a record that earned us recognition as a BBB Torch Award for Ethics Finalist three years running.

As a HUD-approved direct lender and proud member of the National Reverse Mortgage Lenders Association (NRMLA), we specialize exclusively in reverse mortgages — it’s all we’ve done since 2004. That singular focus is especially valuable in Florida, where the state’s large and diverse retirement community means homeowners come to us with a wide range of property values and financial goals — from active-adult communities in The Villages and Sun City Center to waterfront properties along Naples, Sarasota, and the Palm Beaches that often exceed the $1,249,125 HECM lending limit. For higher-value homes, our team introduced the first fixed-rate jumbo reverse mortgage in 2008, and our experienced originators can walk you through both programs so you can choose the one that best fits your needs.

Whether your goal is to eliminate monthly mortgage payments, access equity for retirement planning, or create more financial flexibility while staying in your home, we’re here to help you choose the right program with competitive rates and lower costs. Let us show you the difference two decades of dedicated experience can make.

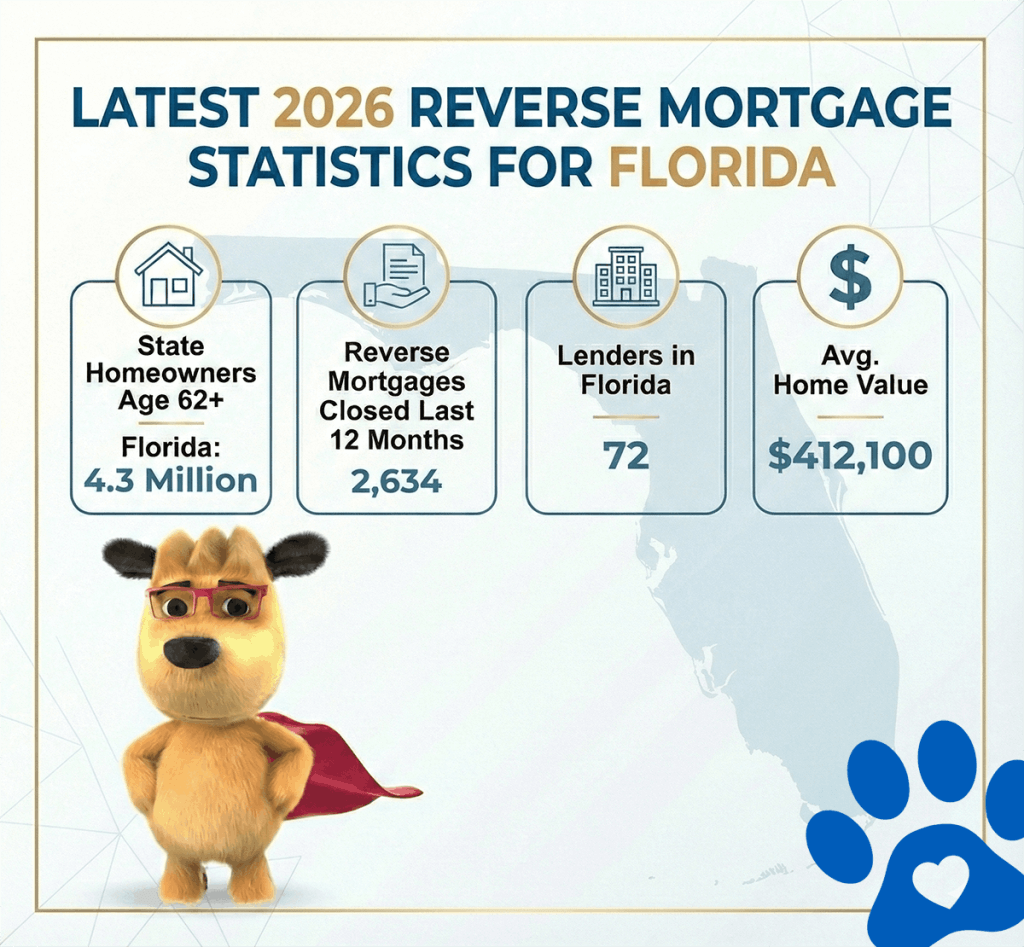

Latest 2026 Reverse Mortgage Statistics for Florida

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Florida | Avg. Home Value |

|---|---|---|---|---|

| Florida | 4.3 Million | 2,634 | 72 | $412,100 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Florida Reverse Mortgage Lending Limits

Florida, known as the Sunshine State, is home to 22 million people, with nearly 4.3 million homeowners aged 62 and older. This means over one-and-a-half million Florida residents may be eligible for a reverse mortgage, offering a valuable way to access their home’s equity.

As of January 2026, the average home value in Florida is $412,100, well below the HECM reverse mortgage lending limit of $1,249,125. This makes reverse mortgages a viable option for many homeowners throughout the state.

Florida’s rich history began with Spanish explorer Juan Ponce de León in 1513, and it has since grown into the most populous state in the American Southeast. Known for its warm climate, beautiful beaches, and vibrant tourist destinations, Florida has become a top choice for retirees. Communities such as The Villages, Boynton Beach, and Naples have attracted nearly 2 million senior homeowners aged 62 and older, all of whom enjoy the state’s pleasant weather and abundant activities.

Florida’s economy thrives on tourism, agriculture, and transportation, with world-famous attractions like Walt Disney World and Kennedy Space Center contributing to its robust growth.

If you’re a homeowner aged 62 or older living in Florida, All Reverse Mortgage, Inc. (ARLO™) is here to help you explore how a reverse mortgage can fit into your retirement plans. We’re ready to answer your questions and guide you through the process.

Top Reverse Mortgage Cities in Florida

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Active Lenders | Avg. Home Value |

|---|---|---|---|---|

| Bradenton | 9,218 | 20 | 7 | $403,118 |

| Boca Raton | 21,447 | 25 | 8 | $612,804 |

| Boynton Beach | 16,382 | 22 | 7 | $429,662 |

| Cape Coral | 28,991 | 42 | 10 | $381,978 |

| Fort Lauderdale | 19,772 | 33 | 9 | $515,328 |

| Fort Myers | 12,604 | 19 | 7 | $375,811 |

| Hialeah | 8,406 | 8 | 4 | $411,224 |

| Jacksonville | 73,418 | 82 | 12 | $319,882 |

| Miami | 37,884 | 41 | 9 | $512,944 |

| Naples | 18,993 | 33 | 9 | $682,117 |

| Ocala | 13,116 | 19 | 7 | $284,519 |

| Orlando | 29,874 | 38 | 9 | $391,228 |

| Palm Beach | 3,941 | 7 | 4 | $1,287,904 |

| Palm Coast | 18,207 | 23 | 7 | $347,115 |

| Port St. Lucie | 25,884 | 24 | 8 | $379,886 |

| Sarasota | 24,662 | 42 | 10 | $517,394 |

| St. Petersburg | 42,113 | 41 | 10 | $403,118 |

| Tampa | 46,772 | 59 | 11 | $371,447 |

| The Villages | 56,304 | 43 | 10 | $394,215 |

Top 20 Reverse Mortgage Lenders in Florida

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Frequently Asked Questions: Florida-Specific Answers

How does Florida’s insurance crisis affect reverse mortgages?

Do I need flood insurance?

What about hurricane damage—am I covered?

How does Florida’s homestead exemption work?

What is Save Our Homes and how does it help?

Can I get a reverse mortgage on a condo in Florida?

What about property in The Villages?

Can I use a reverse mortgage if I’m a snowbird?

What if I want to become a Florida resident full-time?

How does no state income tax benefit me?

Can I sell my Florida home if I have a reverse mortgage?

What if hurricane damage makes my home uninhabitable?

Can my children inherit my Florida home?

What if home values drop after a hurricane?

HUD-Approved Reverse Mortgage Counseling Agencies in Florida

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| CONSOLIDATED CREDIT SOLUTIONS, INC. | 84804 | 5701 W Sunrise Blvd, Plantation, Florida, 33313-6269 | (800) 435-2261 | consolidatedcredit.org |

| CONSUMER CREDIT AND BUDGET COUNSELING, DBA NATIONAL FOUNDATION FOR DEBT MANAGEMENT | 81555 | 13921 Icot Blvd, Clearwater, Florida, 33760-3738 | (866) 395-5769 | nfdm.org |

| CREDIT CARD MGMT SVCS, INC DBA REVERSEMORTGAGEHELPER.ORG AND DEBTHELPER.COM | 81215 | 1325 N Congress Ave, West Palm Beach, Florida, 33401-2005 | (561) 472-8000 | reversemortgagehelper.org |

| CREDIT.ORG - JACKSONVILLE, FL BRANCH | 90756 | 4720 Salisbury Rd, Jacksonville, Florida, 32256-6101 | (904) 586-3157 | credit.org |

| DEBT MANAGEMENT CREDIT COUNSELING CORP | 90117 | 1330 SE 4th Ave Ste F, Fort Lauderdale, Florida, 33316-1958 | (866) 724-3328 | N/A |

| GREENPATH FINANCIAL WELLNESS | 90088 | 121 S Orange Ave, Orlando, Florida, 32801-3221 | (813) 374-2251 | greenpath.com |

| H.E.L.P. COMMUNITY DEVELOPMENT CORP. | 83570 | 63 E Kennedy Blvd, Eatonville, Florida, 32751-5345 | (407) 628-4832 | helpcdc.org |

| HOUSING FOUNDATION OF AMERICA | 84470 | 2400 N University Dr, Pembroke Pines, Florida, 33024-3629 | (954) 923-5001 | homeapproved.org |

| HOUSING FOUNDATION OF AMERICA | 90154 | 381 N Krome Ave Ste 203, Homestead, Florida, 33030-6047 | (786) 842-3843 | homeapproved.org |

| HOUSING FOUNDATION OF AMERICA - LAKE WORTH FLORIDA | 90343 | 8461 Lake Worth Rd, Lake Worth, Florida, 33467-2474 | (561) 713-1457 | homeapproved.org |

| HOUSING FOUNDATION OF AMERICA, LAUDERHILL FLORIDA | 90342 | 1773 N State Road 7, Lauderhill, Florida, 33313-5005 | (954) 923-5001 | homeapproved.org |

| HOUSING PARTNERSHIP, INC. | 82306 | 2001 W Blue Heron Blvd, Riviera Beach, Florida, 33404-5003 | (561) 841-3500 | cp-housing.org |

| REAL ESTATE EDUCATION AND COMMUNITY HOUSING | 90422 | 1451 W Cypress Creek Road, FORT LAUDERDALE, Florida, 33309-1961 | (954) 546-0844 Ext: 3000 | reach4housing.org |

| URBAN LEAGUE OF PALM BEACH COUNTY, INC. | 80365 | 1700 N Australian Ave, West Palm Beach, Florida, 33407-5623 | (561) 833-1461 | ulpbc.org |

Did you know? Florida does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies, and you can conduct your required counseling from the comfort of your home.

Ready to Unlock Your Home’s Equity?

As Florida’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

All Reverse Mortgage, Inc. is fully licensed by the Florida Office of Financial Regulation (License #MLD874), ensuring that you receive expert guidance every step of the way.

Get Your Reverse Mortgage Quote from Florida’s #1 Rated Reverse Mortgage Lender* or call (800) 565-1722 to speak with a licensed expert.

Other Areas of Interest in Florida

Bradenton Boca Raton Boynton Beach Cape Coral Fort Lauderdale Fort Myers Hialeah Jacksonville Miami Naples Ocala Orlando Palm Beach Palm Coast Port St. Lucie Sarasota St. Petersburg Tampa The Villages

Additional Resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald