Serving St Petersburg Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

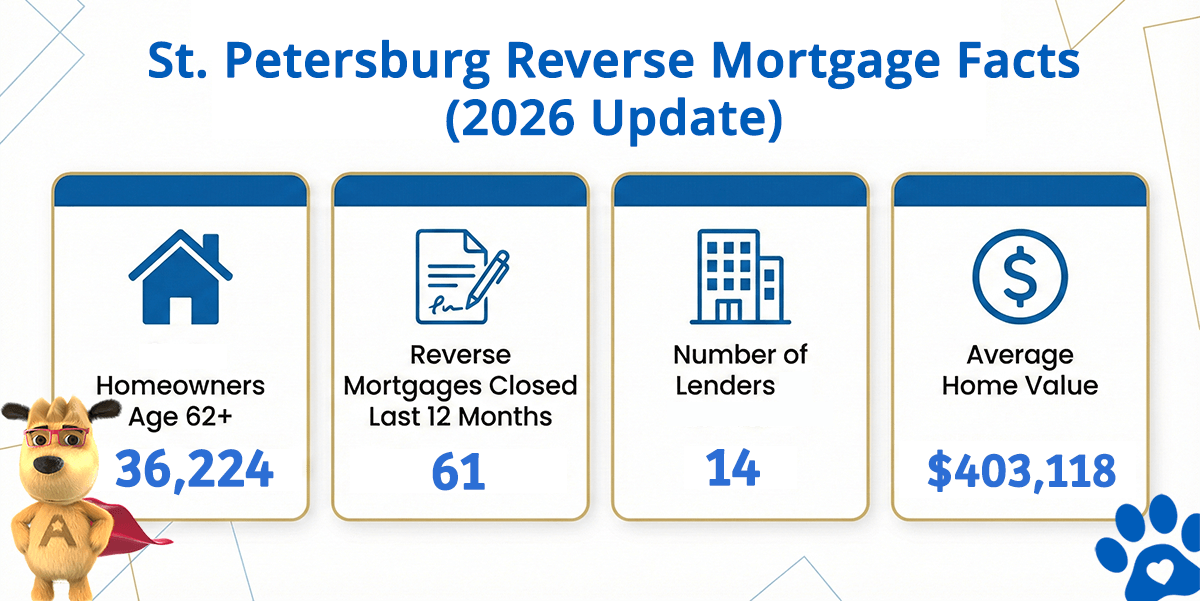

St. Petersburg Reverse Mortgage Market at a Glance

St. Petersburg Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Active Lenders | Avg. Home Value |

|---|---|---|---|---|

| St. Petersburg | 36,224 | 61 | 14 | $403,118 |

What the Numbers Tell Us About Reverse Mortgages in St. Petersburg

St. Petersburg, known as the “Sunshine City,” has undergone a remarkable renaissance over the past decade, transforming from a sleepy retirement enclave into a vibrant, walkable urban center with thriving arts and cultural districts. The city is home to approximately 36,224 owner-occupied households headed by residents age 62 and older, representing a mature demographic with deep community roots and decades of accumulated home equity. The average home value in St. Petersburg stands at $403,118, reflecting both the historic charm of early neighborhoods and the appeal of newly renovated waterfront and downtown properties. With the FHA lending limit of $1,249,125, the vast majority of St. Petersburg’s older homeowners qualify for conventional HECM products, making reverse mortgages an accessible wealth-access option for this significant demographic segment.

St. Petersburg’s neighborhoods tell the story of historic Florida authenticity meeting modern urban revitalization. Historic neighborhoods like Roser Park, Kenwood, and Shore Acres feature 1920s–1950s bungalows and cottages with mature trees, authentic character, and increasingly appreciated market values—perfect for long-time residents with paid-off or nearly paid-off mortgages. Downtown St. Petersburg has undergone a spectacular transformation, with lofts, condos, and mixed-use developments attracting downsizing professionals and active retirees who value walkable access to restaurants, galleries, museums, and the waterfront. Harborview, directly on Tampa Bay, offers modern townhomes and waterfront properties appealing to affluent 55+ buyers. Gulfport, St. Petersburg’s charming beach village south of downtown, features a historic pier, independent shops, and a strong community identity attracting creative retirees. North St. Petersburg and Lakewood include mid-range single-family homes and condos attracting middle-income retirees with solid equity positions and desire for affordable coastal living.

St. Petersburg’s economy reflects its identity as a modern cultural hub with diversified employment. The downtown arts district—including the Mahaffey Theater, The Dali Museum, and the Museum of Fine Arts—drives direct employment, tourism, and cultural tourism spending. Tourism and hospitality remain significant, anchored by waterfront hotels, beach resorts, and the cruise port that brings destination visitors and retirees to the area. Healthcare is substantial, with Bayfront Health St. Petersburg and multiple outpatient clinics serving the aging demographic. Finance and professional services have expanded downtown with regional headquarters and back-office operations. Education—including USF St. Petersburg campus—provides stable employment and attracts educated professionals and retirees. This economic diversity means St. Petersburg’s reverse mortgage borrowers include retired artists, healthcare workers, educators, small business owners, and executives who built equity over 30+ years and now prioritize accessing it to enhance the lifestyle the city offers—dining, culture, travel, and family experiences.

How a Reverse Mortgage Works for St. Petersburg Homeowners

A reverse mortgage is a loan secured by your home that allows homeowners age 62 and older to convert a portion of their equity into usable funds. The most common type is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration and regulated by HUD.

With a HECM, you retain full ownership of your home. No monthly mortgage payments are required as long as you continue living in the property, maintain it, and stay current on property taxes and homeowners insurance. The loan balance is repaid when you sell, move out permanently, or pass away — and FHA insurance guarantees you will never owe more than the home is worth.

Common Uses in St. Petersburg

- Supporting downtown and cultural engagement — St. Petersburg’s renaissance has brought world-class dining, theater, and museums directly to the city; reverse mortgage proceeds enable retirees to enjoy season subscriptions, dining experiences, and cultural travel without the guilt of reducing fixed retirement income.

- Creating flexible emergency reserves with a growing line of credit — St. Petersburg’s waterfront location means property tax increases and hurricane insurance can be unpredictable; a growing line of credit provides accessible reserves for emergencies and unexpected expenses without selling the home.

- Funding home renovations and aging-in-place upgrades — Many St. Petersburg homeowners want to stay in their historic neighborhood homes long-term; reverse mortgage funds enable accessibility renovations, first-floor bedroom conversions, updated plumbing and electrical, and enhanced safety features.

- Helping adult children and grandchildren in the Tampa Bay region — St. Petersburg attracts younger professionals to the region; many retirees use reverse mortgage proceeds to help adult children with down payments, fund grandchildren’s education, or host extended family stays in the Sunshine City. Proprietary reverse mortgage programs offer additional flexibility for higher-value properties.

St. Petersburg Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | 62 or older (at least one borrower) |

| Property | Primary residence — single-family home, condo, townhome, or approved dwelling |

| Equity | Sufficient equity in the home (typically 50% or more) |

| Counseling | HUD-approved reverse mortgage counseling session required before application |

| Financial Assessment | Lender evaluates income, credit history, and ability to maintain property obligations |

Use our free reverse mortgage calculator to estimate how much you may qualify for based on your St. Petersburg home’s current value and your age.

Understanding the Costs

Reverse mortgage costs include an origination fee, FHA mortgage insurance premium, third-party closing fees, and interest that accrues over the life of the loan. These are comparable to a traditional refinance in structure but differ in timing — most costs can be financed into the loan rather than paid upfront.

For a full breakdown of what to expect, review our guide to reverse mortgage closing costs. Borrowers should also weigh the benefits against the long-term impact on home equity, which we cover in our pros and cons overview.

Is a Reverse Mortgage Right for You?

A reverse mortgage works best for homeowners who plan to stay in their home long-term and want to improve monthly cash flow, enjoy their city and lifestyle more fully, or create a financial safety net without selling. It is not ideal for those planning to relocate within a few years or who need to preserve every dollar of equity for heirs.

Our guide on how reverse mortgages work explains the full process from application to funding. For families considering the long-term picture, we also address what happens to a reverse mortgage when the borrower passes away and options for refinancing an existing reverse mortgage if circumstances change.

HUD-Approved Direct Lender Serving St. Petersburg

All Reverse Mortgage, Inc. (ARLO) is a HUD-approved direct lender — not a broker or lead generator. We originate, process, and fund reverse mortgages in-house, giving St. Petersburg homeowners a single point of contact from first conversation through closing.

You can verify our credentials through the HUD lender lookup tool or review our BBB profile, which reflects more than two decades of client feedback. For homeowners whose property value exceeds FHA limits, we also offer jumbo reverse mortgage programs with no mortgage insurance requirement.

All Reverse Mortgage, Inc. is fully licensed by the Florida Office of Financial Regulation (License #MLD874), ensuring that you receive expert guidance every step of the way.

Get a Reverse Mortgage Quote for Your St. Petersburg Home

Use the ARLO™ calculator for an instant quote with real-time rates — no personal information required.

Related Resources

Compare HECM, single-purpose, and proprietary options for St. Petersburg homeowners

Detailed breakdown of fees and what affects your net proceeds

Sarasota County market data and programs for southwest Florida homeowners

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald