Serving Fort Lauderdale Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Fort Lauderdale Reverse Mortgage Market Overview

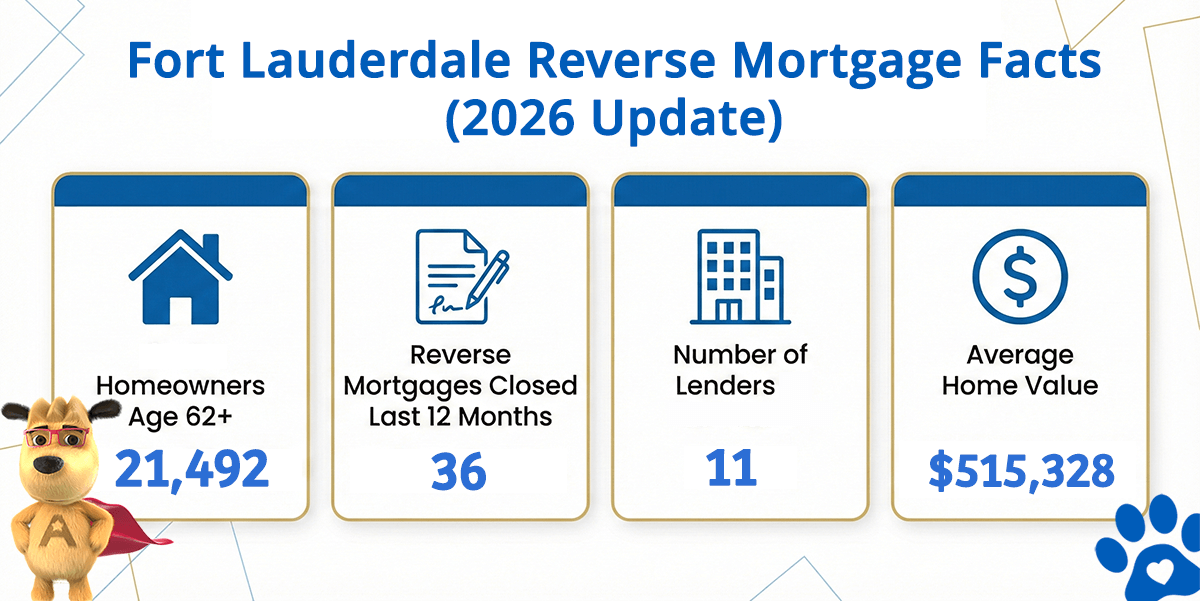

Fort Lauderdale Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Active Lenders | Avg. Home Value |

|---|---|---|---|---|

| Fort Lauderdale | 21,492 | 36 | 11 | $515,328 |

Fort Lauderdale: South Florida’s Urban Reverse Mortgage Market

Fort Lauderdale balances urban sophistication with coastal charm, serving 21,492 homeowners age 62 and older in one of South Florida’s most cosmopolitan settings. With an average home value of $515,328, Fort Lauderdale attracts both FHA HECM borrowers within the FHA’s $1,249,125 lending cap and those seeking jumbo programs for premium waterfront properties. The past 12 months saw 36 HECM loans closed across 11 active lenders, reflecting a market where retirees appreciate urban proximity, cultural amenities, and port access alongside traditional retirement living. Fort Lauderdale’s reverse mortgage borrowers are often professionals—retired executives, attorneys, physicians, accountants, and entrepreneurs—who spent careers building substantial equity and now seek sophisticated financial strategies.

Fort Lauderdale’s economy remains anchored by its iconic port—Port Everglades is one of the world’s busiest cruise ship and cargo ports, supporting thousands of maritime, logistics, and hospitality jobs. The downtown renaissance has attracted corporate office relocations, financial services headquarters, and tech startups. The Broward County school system and universities provide educational employment. Healthcare, particularly specialized medicine and cosmetic surgery, thrives in upscale neighborhoods. Many Fort Lauderdale retirees spent careers in maritime industries, international trade, law, medicine, or executive management—roles that provided wealth-building and now position them to consider high-value loan programs and the three reverse mortgage types with strategic intent.

Fort Lauderdale’s neighborhoods define urban-coastal living. The historic downtown and Las Olas Boulevard area feature restored art deco architecture, modern condominiums, and boutique residences. Intracoastal waterfront communities command premium prices with deepwater yacht access. Residential islands like Las Olas Isle and Harbor Beach offer gated exclusivity. Broward Boulevard corridor hosts mid-rise condos popular with active retirees. Federal Hill preserves historic single-family neighborhoods with older construction and established character. Sailboat Bend appeals to urban downsizers seeking artistic, eclectic environments. The range means reverse mortgage borrowers include downtown condo dwellers, waterfront estate owners, and those in character-home neighborhoods, with valuations spanning $350,000 to $1.2 million.

Understanding Reverse Mortgages for Fort Lauderdale Homeowners

A reverse mortgage converts home equity into accessible funds for homeowners age 62 and older, with no monthly mortgage payments required. The Home Equity Conversion Mortgage (HECM) is the federally-insured standard, protecting borrowers, heirs, and lenders alike.

You maintain full ownership and can occupy your home indefinitely, provided property taxes, insurance, and maintenance remain current. The loan is repaid when you sell, move permanently, or pass away. FHA insurance guarantees you will never owe more than your home’s value—critical protection for high-net-worth borrowers and their families.

Common Uses in Fort Lauderdale

- Consolidating debt and simplifying cash flow — Affluent borrowers use reverse mortgages to pay off multiple obligations and establish a single flexible funding source, improving financial clarity.

- Funding luxury travel and lifestyle expenses — Fort Lauderdale retirees often prioritize world travel, second homes, and memberships; reverse mortgage proceeds support these pursuits without liquidating investment portfolios.

- Supporting family business ventures and investments — Retired entrepreneurs use proceeds to fund adult children’s businesses, real estate investments, or startup ventures.

- Preserving tax-advantaged investments — Rather than sell appreciated stocks or bonds triggering capital gains, retirees access home equity, maintaining their investment strategy.

Fort Lauderdale Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | 62 or older (at least one borrower) |

| Property | Primary residence — single-family, townhome, condo, or FHA-approved manufactured home |

| Equity | Sufficient equity; typically 50% or greater ownership |

| Counseling | Independent counseling from a HUD-certified agency required |

| Financial Assessment | Lender evaluates income, credit history, and property maintenance capacity |

For a personalized look at your options, our online calculator estimates reverse mortgage proceeds using your Fort Lauderdale home value, age, and current interest rates.

Evaluating Your Options: Costs and Considerations

Reverse mortgage costs parallel traditional refinances: origination fees, FHA insurance, appraisal, title, and closing expenses. Most costs finance into the loan rather than require upfront payment. Understanding the cost structure is essential for high-net-worth borrowers evaluating alternatives.

Explore fees and costs and pros and cons analysis to ensure a reverse mortgage aligns with your broader financial plan.

Is a Reverse Mortgage Right for Your Fort Lauderdale Home?

A reverse mortgage is ideal for homeowners committed to remaining in their home long-term and seeking financial flexibility without selling. It may not suit those planning to relocate or whose primary goal is to maximize inheritance.

Gain comprehensive understanding through our guides on how reverse mortgages work from start to finish and options for refinancing if your circumstances evolve.

Your Fort Lauderdale Reverse Mortgage Partner

All Reverse Mortgage, Inc. (ARLO) is an FHA-direct lender serving Fort Lauderdale and Broward County with deep market expertise. We originate, process, and fund loans directly, ensuring consistent communication and transparent pricing for sophisticated borrowers.

Verify our credentials through the HUD lender lookup tool and review our BBB profile reflecting extensive Broward County experience. For homes exceeding FHA limits, we specialize in proprietary reverse mortgage programs designed for premium properties.

All Reverse Mortgage, Inc. holds full licensure from the Florida Office of Financial Regulation (License #MLD874), guaranteeing expertise and regulatory compliance.

Get Your Fort Lauderdale Reverse Mortgage Quote

ARLO’s calculator provides real-time rate information instantly — completely private, no personal information required.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald