Serving Palm Coast Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Palm Coast Reverse Mortgages: A Planned Community Approach

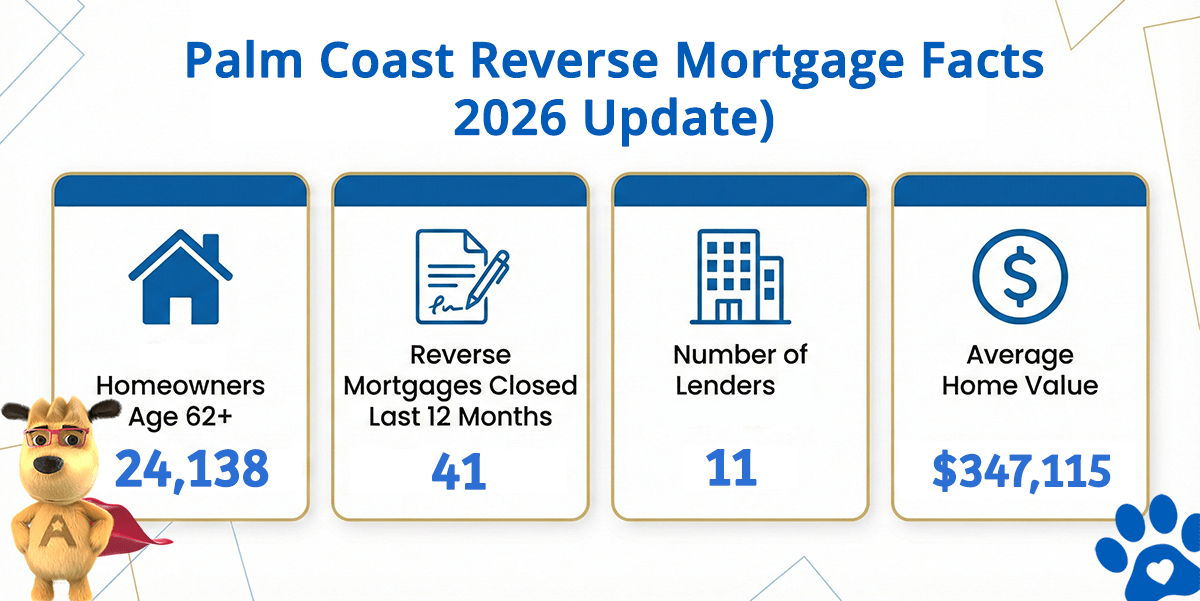

Palm Coast Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Active Lenders | Avg. Home Value |

|---|---|---|---|---|

| Palm Coast | 24,138 | 41 | 11 | $347,115 |

Florida’s Master-Planned Retirement Haven

Palm Coast is a planned community with a particular character—approximately 94,000 residents living in a carefully designed city built from scratch in the 1970s and 1980s. Unlike organic Florida communities that grew haphazardly around historical centers, Palm Coast was conceived as a complete neighborhood where single-family homes, townhomes, and planned amenities create a cohesive, walkable environment. This design intentionally appeals to retirees and older adults, and the demographics reflect it: Palm Coast has one of Florida’s highest percentages of residents age 62 and older, with the community actively marketed as a retirement destination.

The Flagler County market where Palm Coast anchors is characterized by solid, predictable housing values in the $300K–$450K range for a typical owner-occupied home. The average property value of $357,164 sits well below the FHA’s cap, which means homeowners here can access reverse mortgage funding through traditional FHA HECM programs. The economic base is relatively quiet—no major corporations dominate the landscape—but retirees from the Northeast, the Midwest, and other parts of Florida have chosen Palm Coast for its planned amenities, active adult communities, low tax burden compared to some states, and proximity to the Atlantic coast. Many have paid off homes entirely or carry minimal debt against accumulated equity built over 30, 40, or 50 years of ownership.

Neighborhoods in Palm Coast follow the master plan: the original sections near the town center and waterfront neighborhoods offer classic Palm Coast homes from the 1970s–1980s, typically 1,800–2,400 sq ft ranch or split-level layouts. Mid-coast communities and newer sections have added colonial revivals and contemporary designs. Scattered townhome and condo developments provide variety. This consistency of design means reverse mortgage borrowers tend to fall into predictable equity bands—homes were built with intention, neighborhoods have aged well, and relative value stability appeals to borrowers seeking to remain in place. Many have raised families here, retired here, and want to tap equity without displacing themselves or their community connections.

How a Reverse Mortgage Works for Palm Coast Homeowners

A reverse mortgage allows homeowners age 62 and older to borrow against home equity without requiring monthly mortgage payments. The Home Equity Conversion Mortgage (HECM) is the most widely available option, insured by FHA and regulated by HUD.

You keep the title and continue living in your home. Monthly payments are not required as long as you occupy the property, keep it maintained, and pay property taxes and homeowners insurance. The loan is repaid when you move out, sell the home, or pass away—FHA insurance ensures you’ll never owe more than the home’s value.

Common Uses in Palm Coast

- Converting home equity into income supplements for those on fixed Social Security and pensions

- Paying off any remaining mortgage to eliminate monthly obligations

- Funding healthcare or long-term care expenses without selling

- Supporting grandchildren or other family members during transitions

Palm Coast Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | 62 or older (at least one borrower) |

| Property | Primary residence — single-family, townhome, condo, or HUD-approved manufactured home on permanent foundation |

| Equity | Minimum 50% equity in the home, typically |

| Counseling | HUD-approved reverse mortgage counseling is a mandatory prerequisite |

| Financial Assessment | Lender reviews income, credit, and your ability to maintain taxes, insurance, and property condition |

Palm Coast homeowners can check their estimated eligibility using our calculator — enter your approximate home value and age for a quick result.

Understanding the Costs

Reverse mortgage costs include an origination fee, FHA mortgage insurance premium, appraisal and title work, and interest accrual. Most of these can be financed into the loan, avoiding upfront out-of-pocket payment. For a detailed breakdown of reverse mortgage closing fees, and to weigh key tradeoffs before moving forward, consult these guides.

Is a Reverse Mortgage Right for You?

The fit is strongest for Palm Coast homeowners committed to staying in their homes long-term, who want to improve monthly cash flow or build a financial buffer. It’s less suitable if you expect to move within a few years or want to maximize the inheritance left to your heirs.

Learn how reverse mortgages work from start to finish, and understand what happens to the loan when you pass away, so your family is prepared.

HUD-Approved Direct Lender Serving Palm Coast

All Reverse Mortgage, Inc. (ARLO) is a HUD-approved direct lender specializing in FHA reverse mortgages and proprietary programs nationwide. We originate, process, and fund loans directly—no brokers or middlemen—so Palm Coast homeowners work with one dedicated team from initial inquiry through closing.

Our credentials can be verified through the HUD lender lookup tool and our BBB profile, which documents over 20 years of consistent service. All Reverse Mortgage, Inc. is fully licensed by the Florida Office of Financial Regulation (License #MLD874) and meets all regulatory requirements.

Get a Reverse Mortgage Quote for Your Palm Coast Home

Use the ARLO™ calculator for an instant quote with today’s rate information — no personal information required.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald