Texas #1 Rated Reverse Mortgage

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Experience Excellence with Texas’s Top Reverse Mortgage Lender

For over 20 years, All Reverse Mortgage, Inc. (ARLO™) has helped Texas homeowners access their home equity through HUD-approved HECM and jumbo reverse mortgages. As Texas’s #1 Rated Reverse Mortgage Lender, we hold an A+ BBB rating with perfect 5-star reviews and zero complaints — a record that earned us recognition as a BBB Torch Award for Ethics Finalist three years running.

As a HUD-approved direct lender and proud member of the National Reverse Mortgage Lenders Association (NRMLA), we specialize exclusively in reverse mortgages — it’s all we’ve done since 2004. That singular focus is especially important in Texas, where the state constitution imposes unique home equity lending rules that don’t apply anywhere else in the country — including the requirement that both spouses be at least 62 and on the loan, and the prohibition on participating in property tax deferral programs while a reverse mortgage is in place.

An estimated 3.4 million Texas homeowners aged 62 and older have untapped equity across markets ranging from the high-value neighborhoods of Highland Park, River Oaks, and the Woodlands to Hill Country retreats around Fredericksburg and Kerrville, growing retirement communities in San Antonio and the Rio Grande Valley, and ranch properties throughout the state. With an average home value of $340,800, most Texas homeowners qualify within HECM lending limits, while higher-value properties in Dallas, Houston, and Austin may benefit from a jumbo reverse mortgage. Our team’s expertise with Texas-specific requirements — combined with experience across both programs — means we can help you navigate a process that many lenders find complex.

Whether your goal is to eliminate monthly mortgage payments, access equity for retirement planning, or evaluate a jumbo option for a higher-value property, we’re here to help you choose the right program with competitive rates and lower costs. Let us show you the difference two decades of dedicated experience can make.

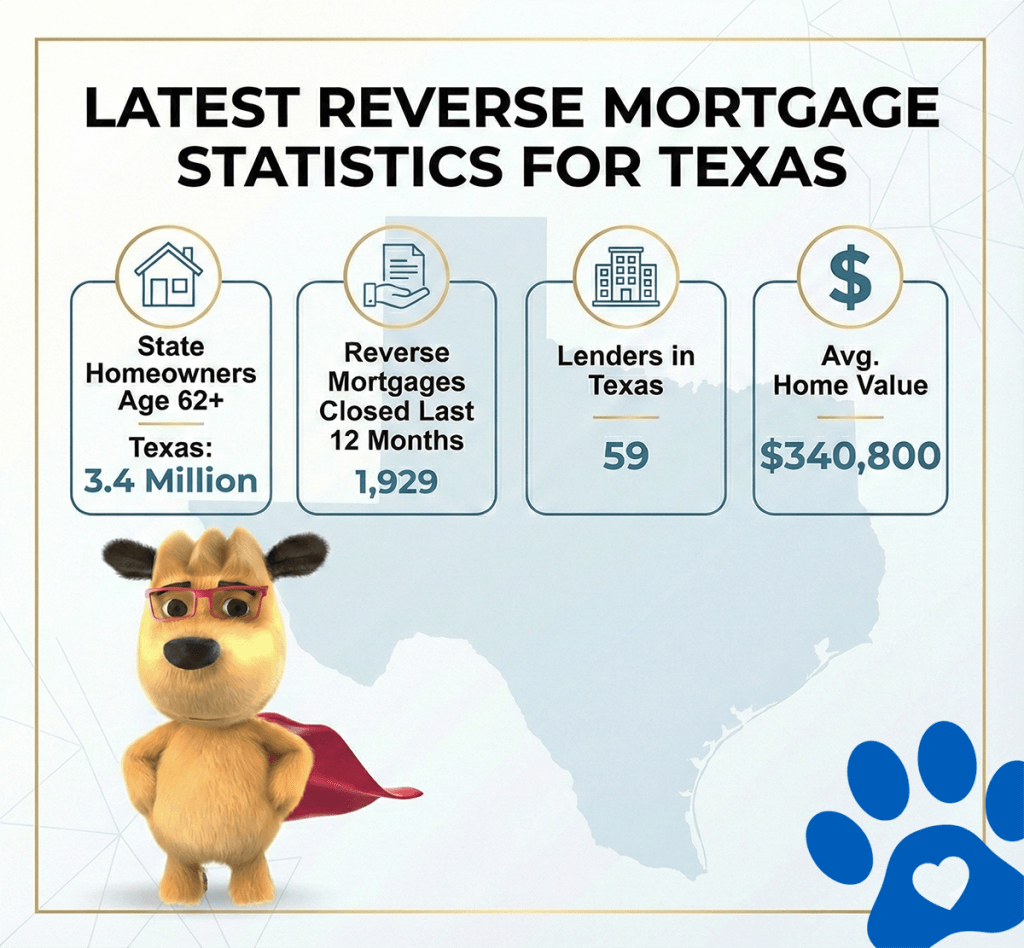

Latest Reverse Mortgage Statistics for Texas

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Texas | Avg. Home Value |

|---|---|---|---|---|

| Texas | 3.4 Million | 1,929 | 59 | $340,800 |

Top Reverse Mortgage Cities in Texas

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Active Lenders | Avg. Home Value |

|---|---|---|---|---|

| Arlington | 33 | 6 | $303,902 | |

| Austin | 55 | 10 | $489,253 | |

| Conroe | 11 | 4 | $311,069 | |

| Corpus Christi | 13 | 4 | $216,242 | |

| Cypress | 8 | 4 | $400,841 | |

| Dallas | 74 | 10 | $303,481 | |

| El Paso | 27 | 5 | $216,955 | |

| Fort Worth | 50 | 9 | $305,799 | |

| Georgetown | 15 | 5 | $443,477 | |

| Houston | 165 | 12 | $278,095 | |

| Irving | 11 | 5 | $343,215 | |

| Mansfield | 7 | 4 | $418,824 | |

| North Richland Hills | 11 | 5 | $321,876 | |

| Plano | 21 | 7 | $438,608 | |

| Richmond | 6 | 4 | $392,177 | |

| San Antonio | 241 | 19 | $278,316 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

How Does a Reverse Mortgage Work in Texas? (2026 Guide)

A reverse mortgage is a special type of home loan for homeowners 62 and older that allows them to convert part of their home’s equity into cash — without monthly mortgage payments.

Instead of making payments to the lender, the lender pays you based on the value of your home. The loan is repaid only when you sell the home, you move out permanently, or the last borrower passes away.

In Texas, reverse mortgages are regulated by both federal and state laws, ensuring borrower protections and strict guidelines on fees and eligibility.

Types of Reverse Mortgages Available in Texas

There are three main types of reverse mortgages:

- Home Equity Conversion Mortgage (HECM) — The most common type, insured by the FHA and backed by HUD. No restrictions on how you use the funds.

- Jumbo Reverse Mortgage — Designed for homes above FHA lending limits ($1,249,125 in 2026). These are not FHA-insured but allow larger loan amounts.

- HECM for Purchase (Reverse Mortgage for Buying a Home) — Allows retirees to buy a new home using a reverse mortgage while eliminating monthly mortgage payments.

Who Qualifies for a Reverse Mortgage in Texas?

To be eligible for a reverse mortgage in Texas, you must meet these requirements:

- Age: You must be 62 or older (both spouses if married).

- Homeownership: The home must be your primary residence (vacation homes and rentals don’t qualify).

- Equity: You must have substantial home equity — typically at least 50% or more.

- Property Type: The home must be a single-family residence, HUD-approved condo, townhouse, or a multi-unit property (up to four units) where you live in one unit.

- Financial Requirements: You must continue to maintain property taxes and homeowners insurance.

- Mandatory HUD Counseling: Texas law requires borrowers to complete HUD-approved reverse mortgage counseling before applying.

Benefits of a Reverse Mortgage in Texas

A reverse mortgage can offer several financial advantages for Texas homeowners:

- Tax-Free Funds — Since the money comes from home equity, it is not taxable income.

- Stay in Your Home — You keep ownership of your home as long as you meet loan requirements.

- No Monthly Mortgage Payments — Unlike traditional loans, you don’t make monthly payments unless you choose to voluntarily.

- Flexible Payout Options — Choose a lump sum, line of credit, or monthly payments based on your needs.

- Non-Recourse Loan Protection — You (or your heirs) never owe more than your home’s value, even if the balance exceeds the home’s worth when sold.

Is a Reverse Mortgage a Good Idea for Texas Homeowners?

A reverse mortgage can be a great financial tool, but it’s not for everyone. Here are some common situations where it makes sense:

- You need extra income for retirement but don’t want to sell your home.

- You have substantial home equity and want to tap into it without monthly payments.

- You plan to stay in your home long-term and can cover taxes & insurance.

- You want a flexible line of credit that grows over time.

Top 20 Reverse Mortgage Lenders in Texas

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Texas Reverse Mortgage Borrower Protections & Laws

Texas has some of the strongest borrower protections in the U.S.:

- Constitutional Protections — Reverse mortgages are explicitly regulated under Texas law to protect homeowners.

- Mandatory Counseling — All borrowers must complete a HUD-approved counseling session before applying.

- Non-Recourse Protection — You’ll never owe more than your home is worth at the time of sale.

- Homestead Exemption — Texas protects reverse mortgage borrowers from creditors outside the mortgage agreement.

- Spousal Protections — Unlike other states, Texas requires both spouses to be at least 62 to qualify.

Texas has additional reverse mortgage regulations: Unlike other states, Texas added reverse mortgage laws to its state constitution, providing extra borrower protections.

Texas-Specific FAQ: Your Questions Answered

What if my spouse is under age 62?

How does Texas homestead protection work with a reverse mortgage?

Can I get a reverse mortgage on my Texas ranch or rural property?

The short answer is maybe. A property that is rural or that has a larger than average acreage in and of itself does not disqualify you from being able to obtain a reverse mortgage loan as FHA will permit these properties as long as the home and property meet their guidelines. Each property is unique and must be evaluated on a case by case basis for eligibility. Some key factors include but are not limited to:

- Property must be residential in nature and zoned for residential use.

- Property cannot be a working farm (crops, livestock, etc.) or income producing.

- Property will need to have comparable sales similar in location, size, amenities, etc. to establish value and marketability.

Excess land will be given no value consideration. For example, if you have a 30 acre parcel and all available home sales in the area top out at 10 acres, then the appraiser would only be permitted to value your home structure and 10 of the 30 acres for the appraisal assignment.

Only the parcel of land that the home sits on can be considered for the reverse mortgage loan and property evaluation. For example, if you have a homestead parcel of 5 acres that the home sits on and then a separately taxed parcel of land with another 25 acres of vacant land, then only the 5 acre parcel would be considered for the reverse mortgage loan and the property value estimate as determined by an appraiser.

Well Water and Septic Tanks are permissible as long as they meet HUD guidelines.

Do I have to pay property taxes during the reverse mortgage?

What happens if I can’t pay my property taxes?

Does getting a reverse mortgage affect my homestead exemption?

HUD-Approved Reverse Mortgage Counseling Agencies in Texas

| Agency Name | Agency ID | Phone | Address | Website | Languages |

|---|---|---|---|---|---|

| CREDIT COALITION | 81768 | (713) 224-8100 | 3300 Lyons Ave, Houston, Texas, 77020-8252 | creditcoalition.org | English Spanish |

| CREDIT COALITION HECM-HOPE | 90347 | 713-224-8100 | 3300 Lyons Ave # 203A Houston, Texas 77020-8252 | creditcoalition.org | English Spanish |

| CREDIT.ORG - ARLINGTON, TX BRANCH | 90758 | (817) 583-7111 | 2000 E Lamar Blvd, Arlington, Texas, 76006-7346 | credit.org | English Spanish |

| DALLAS COUNTY HOME LOAN COUNSELING CENTER | 81704 | 214-819-6060 | 2377 N Stemmons Fwy Ste 724 Dallas, Texas 75207-2710 | dallascounty.org | English Spanish |

| HOUSING OPPORTUNITIES OF FORT WORTH | 80471 | 817-923-9192 | 1065 W Magnolia Ave Fort Worth, Texas 76104-4477 | housingoppsfw.com | English Spanish |

| MONEY MANAGEMENT INTERNATIONAL INC. | 82554 | (866) 232-9080 | 12603 Southwest Fwy, Stafford, Texas, 77477-3820 | moneymanagement.org | ASL English Spanish |

| MONEY MANAGEMENT INTERNATIONAL - HOUSTON | 82423 | (866) 232-9080 | 12603 Southwest Freeway Suite 450 Mb 8, Stafford, Texas, 77477 | moneymanagement.org | English Spanish |

| NAVICORE SOLUTIONS- DALLAS, TX | 81735 | 972-732-6767 | 17440 Dallas Pkwy Suite 134 Dallas, Texas 75287-7336 | navicoresolutions.org | English Spanish |

Texas does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies and conduct your required counseling from the comfort of your home.

How to Apply for a Reverse Mortgage in Texas

- Free Consultation — Speak with a licensed reverse mortgage expert to explore your options.

- HUD Counseling — Complete the required HUD-approved reverse mortgage counseling.

- Application & Documentation — Submit your loan application and property documents.

- Home Appraisal — A licensed appraiser will determine your home’s value.

- Loan Approval & Closing — Once approved, you’ll sign the final documents.

- Receive Your Funds — After the mandatory 3-day waiting period, your funds will be disbursed.

Ready to Unlock Your Home’s Equity?

As Texas’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

All Reverse Mortgage, Inc. is fully licensed by the Texas Department of Savings & Mortgage Lending (License #84280), ensuring that you receive expert guidance every step of the way.

Get Your Reverse Mortgage Quote from Texas’s #1 Rated Reverse Mortgage Lender* or call (800) 565-1722 to speak with a licensed expert.

Other Areas of Interest in Texas

Arlington Austin Conroe Corpus Christi Cypress Dallas El Paso Fort Worth Georgetown Houston Irving Mansfield North Richland Hills Plano Richmond San Antonio

Additional Resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald