Is a Reverse Mortgage Your Fit?

Is a Reverse Mortgage Right for You? 3 Key Considerations

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Like many of our readers who are navigating retirement, you might wonder if a reverse mortgage is right for you. You’ve likely seen your equity grow substantially, possibly even owning your home outright – a common scenario for many baby boomers.

Your home, often your largest asset, may lead you to consider the option of a reverse mortgage. At All Reverse Mortgage, we understand the importance of this decision. This article integrates our insights with 3 important questions, helping you evaluate whether a reverse mortgage fits your financial future.

We’ll guide you through understanding the pros and cons of a reverse mortgage, ensuring you make a choice that aligns with your retirement goals and financial stability.

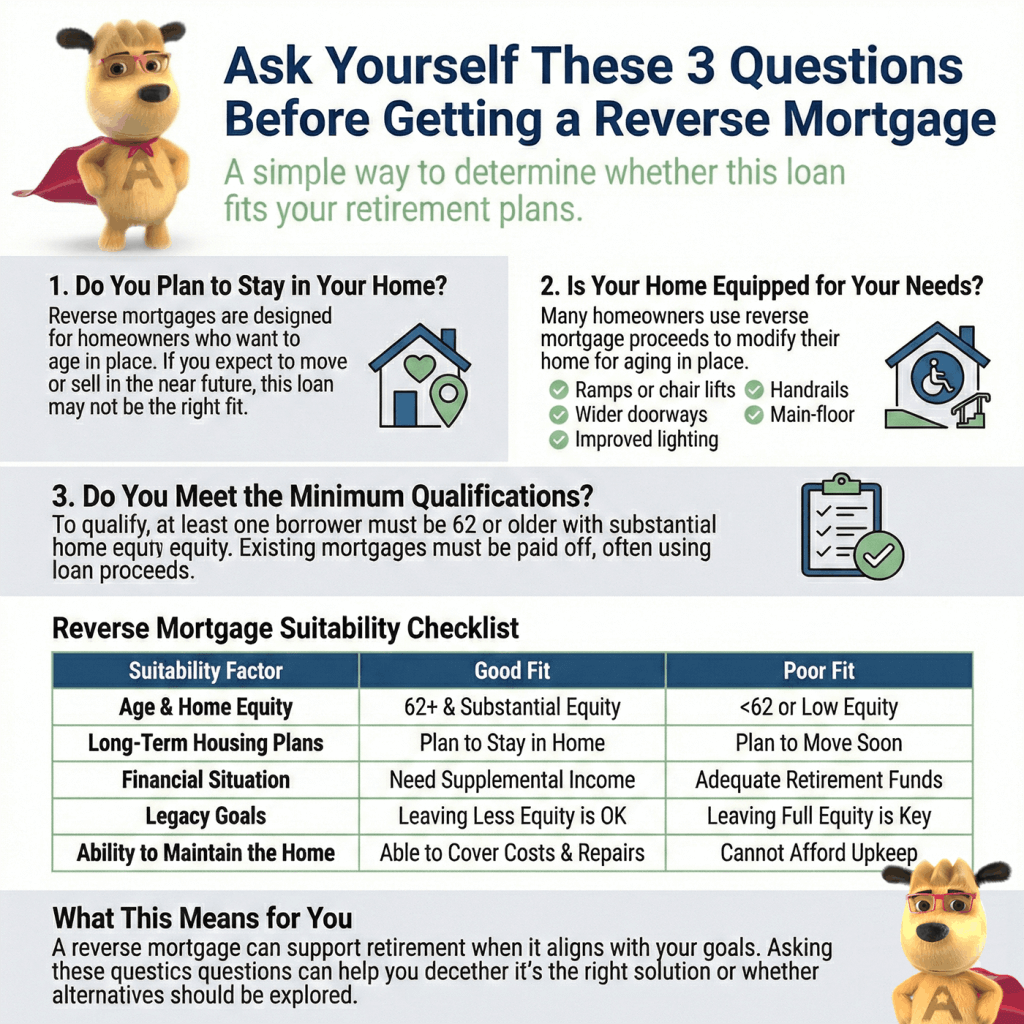

Ask yourself these three important questions to determine if a reverse mortgage is right for you:

1. Do you wish to stay in your home?

This is the most important question to ask yourself if you are considering getting a reverse mortgage versus putting your house on the market. If you don’t plan to stay in your home, or if you don’t plan to be there for the long term – a reverse mortgage may not be the right option.

If, like most Americans, you wish to remain in your home while you age, this type of loan, designed expressly for aging in place, is an option to consider.

2. How equipped is your home for your needs?

Borrowers can use reverse mortgage proceeds however they choose. Some use their proceeds to make home improvements or modifications so that the home is better suited for aging in place.

Some changes to consider may be:

- Wheelchair-accessible ramps or chair lifts

- Wider door frames

- Adding additional lighting

- Living quarters on the main floor

- Door pulls and handrails for easier access

Changing your home to meet your living standards through a reverse mortgage could allow you to remain in your home rather than move into a new residence.

Deciding where to live in retirement and whether you will move away from the home where your family has lived for years is a significant decision, as is taking out a loan to help you meet your financial needs in retirement.

3. Do you meet the minimum qualifications?

To qualify for a reverse mortgage, you must be 62 and have substantial home equity. All existing loans on the home must be paid off. Borrowers can use loan proceeds to pay off the existing mortgage and then receive any remaining proceeds through a lump sum, term or tenure payments, or as a line of credit.

Selling may be an option for you, but the recent housing crash has left many homeowners with less home value than they had five years ago. Getting a reverse mortgage with the potential to increase cash flow could be a viable alternative to selling at a loss.

Reverse Mortgage Suitability Checklist

| Suitability Factors | Good Fit for Reverse Mortgage | Poor Fit for Reverse Mortgage |

|---|---|---|

| Age and Home Equity | Older homeowners with significant home equity | Seniors with little equity |

| Long-term Plan | Plans to stay in the home for many years | Plans to move or sell the home soon |

| Financial Situation | Need for additional income, with limited cash flow options | Stable income sources that cover living expenses |

| Legacy Concerns | Less concerned about leaving home equity to heirs | Wants to preserve maximum home equity for heirs |

| Maintenance and Expenses | Able to maintain home and keep up with property-related expenses | Difficulty in maintaining home or paying property taxes and insurance |

Suitability FAQs

How do I know if the reverse mortgage will work for me?

Are there any alternatives to a reverse mortgage?

What if I do not want to stay living in my current home?

Can you lose your house with a reverse mortgage?

How long can I stay in my house if I get a reverse mortgage?

How to get the most out of a reverse mortgage?

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

August 31st, 2024

August 31st, 2024

September 18th, 2022

September 18th, 2022

May 18th, 2020

May 18th, 2020

April 27th, 2020

April 27th, 2020