Serving Richmond Texas Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Richmond Reverse Mortgages

At All Reverse Mortgage, Inc. (ARLO™), we take great pride in being recognized by the Better Business Bureau as the top-rated reverse mortgage lender in Texas. Our commitment to excellence has earned us a perfect 5.0-star rating and an A+ rating, reflecting our dedication to outstanding service.

With over 20 years of specialized experience, we are devoted to meeting the needs of homeowners across 15 states, including the great state of Texas. Since our inception in November 2004, we have focused solely on reverse mortgages, striving to offer you the most favorable rates and competitive pricing available.

As a HUD-approved direct lender, we offer a range of reverse mortgage options, including the national Home Equity Conversion Mortgage (HECM) programs and non-FHA and jumbo reverse mortgages. This allows us to assist Texas homeowners with high-value properties that exceed the national 2026 lending limit of $1,249,125.

We invite you to compare our customer reviews, lower rates, and competitive closing costs with those of other major lenders. The difference is clear, and we are eager to demonstrate how we can help you maximize your home’s equity.

Rest assured, we are fully licensed by the Texas Department of Savings & Mortgage Lending (License/Registration #84280), ensuring you receive top-notch service and support throughout the state.

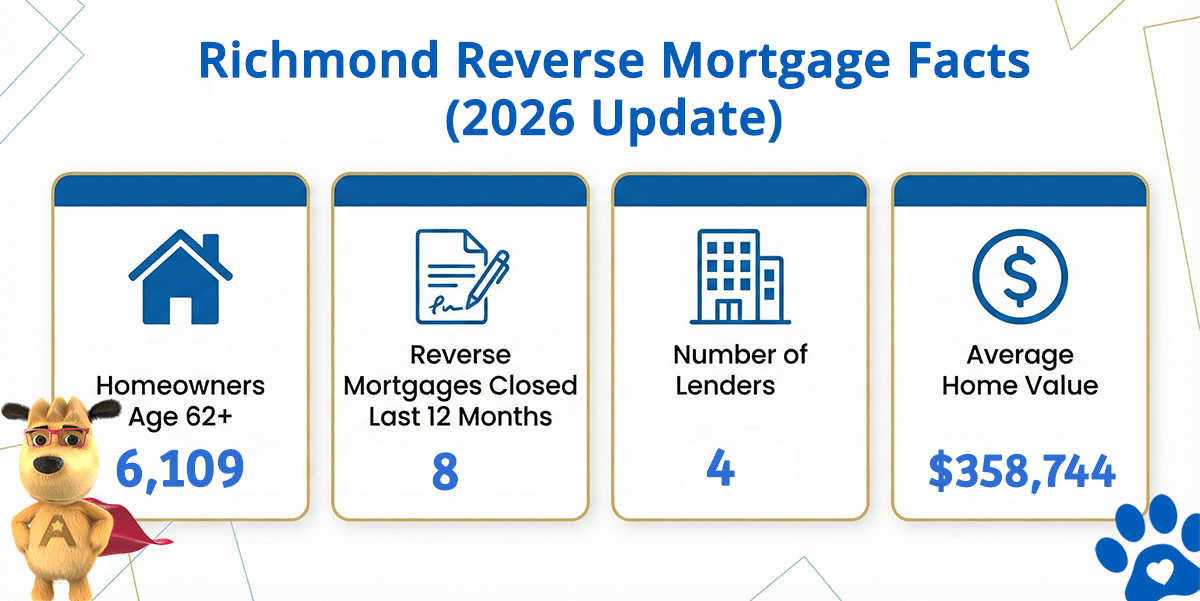

Richmond Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Richmond (est) | Avg. Home Value |

|---|---|---|---|---|

| Richmond | 6,109 | 8 | 4 | $358,744 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

HUD-Approved Direct Lender

At All Reverse Mortgage, Inc. (ARLO™), we are approved by the Department of Housing and Urban Development (HUD) to originate, underwrite, and close HUD’s Home Equity Conversion Mortgage (HECM), commonly known as a reverse mortgage. The HECM program allows eligible homeowners aged 62 and older to access a portion of their home equity without making monthly mortgage payments, as long as they continue to live in the home and meet basic property and tax obligations.

Our team serves homeowners throughout Richmond, Texas, and across Fort Bend County. We specialize exclusively in reverse mortgages, including refinancing existing loans and originating new HECMs. Whether your goal is to eliminate a monthly mortgage payment, improve retirement cash flow, or establish a standby line of credit, we focus on solutions designed for long-term financial stability.

About All Reverse Mortgage of Richmond

The leadership of All Reverse Mortgage, Inc. has more than 20 years of experience in the reverse mortgage industry and was involved in introducing the first fixed-rate jumbo reverse mortgage in 2008. That experience allows us to help homeowners evaluate both FHA-insured HECMs and proprietary reverse mortgage options when appropriate.

Our originators work only with reverse mortgages. They take the time to explain how each option works, including benefits, limitations, and long-term considerations, so you can make an informed decision without pressure. When a traditional HECM is the right fit, we’ll say so. When another option makes more sense, we’ll explain why.

For many homeowners over 62, a reverse mortgage is no longer viewed as a last resort. Used responsibly, it can be a practical financial tool to reduce monthly expenses, improve cash flow, and support retirement planning while remaining in the home you value.

Richmond, Texas Reverse Mortgage Lending Limits (2026)

Richmond is the county seat of Fort Bend County and part of the greater Houston metropolitan area. Known for its historic downtown and long-standing residential neighborhoods, Richmond has a strong base of long-term homeowners.

Based on current Census estimates, approximately 6,109 homeowner households in Richmond are headed by someone aged 62 or older, making reverse mortgages a relevant planning option for residents approaching or already in retirement.

During the most recent 12-month period, 8 reverse mortgages were closed in Richmond, supported by an estimated 4 active lenders serving the local market. This reflects modest but steady demand from homeowners using reverse mortgages as part of broader retirement and cash-flow planning.

As of late 2025, the average home value in Richmond is approximately $358,744. This places most Richmond homes well within the 2026 FHA HECM lending limit of $1,249,125, allowing many homeowners to qualify under the standard federally insured reverse mortgage program without needing a jumbo loan.

For homeowners with higher-value properties or more complex planning needs, proprietary or jumbo reverse mortgage options may also be available.

If you want to understand how much equity may be available based on your age, home value, and current rates, starting with accurate, lender-backed numbers can make the decision clearer.

Ready to Unlock Your Home’s Equity?

As Richmond’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

As a fully licensed lender by the Texas Department of Savings & Mortgage Lending (License #84280), we’re committed to helping you secure the retirement you deserve.

Get Your Reverse Mortgage Quote from Richmond’s #1 Rated Reverse Mortgage Lender* or call (281) 815-2212 to speak with a licensed expert.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald