Reverse Mortgage Cost Quote

|

ARLO™REVERSE MORTGAGE

ASSISTANT |

Reverse Mortgage Closing Costs & Fees Explained

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

When considering a reverse mortgage, it’s important to understand the various costs involved. These expenses can vary significantly, not just between lenders but also by your home’s location.

To ensure you’re getting the best possible deal, it’s smart to shop around and compare lenders. Among the costs, the origination fees (which cover the setup of your loan) and the lender’s margin (determining your loan’s interest rate) are particularly important to pay attention to.

Interest rates are another important factor. They represent the cost of borrowing money and will affect how much you can get from your reverse mortgage and the total amount of interest that will add up over time.

My goal is to help you clearly understand these costs so that you can confidently make informed decisions about your reverse mortgage.

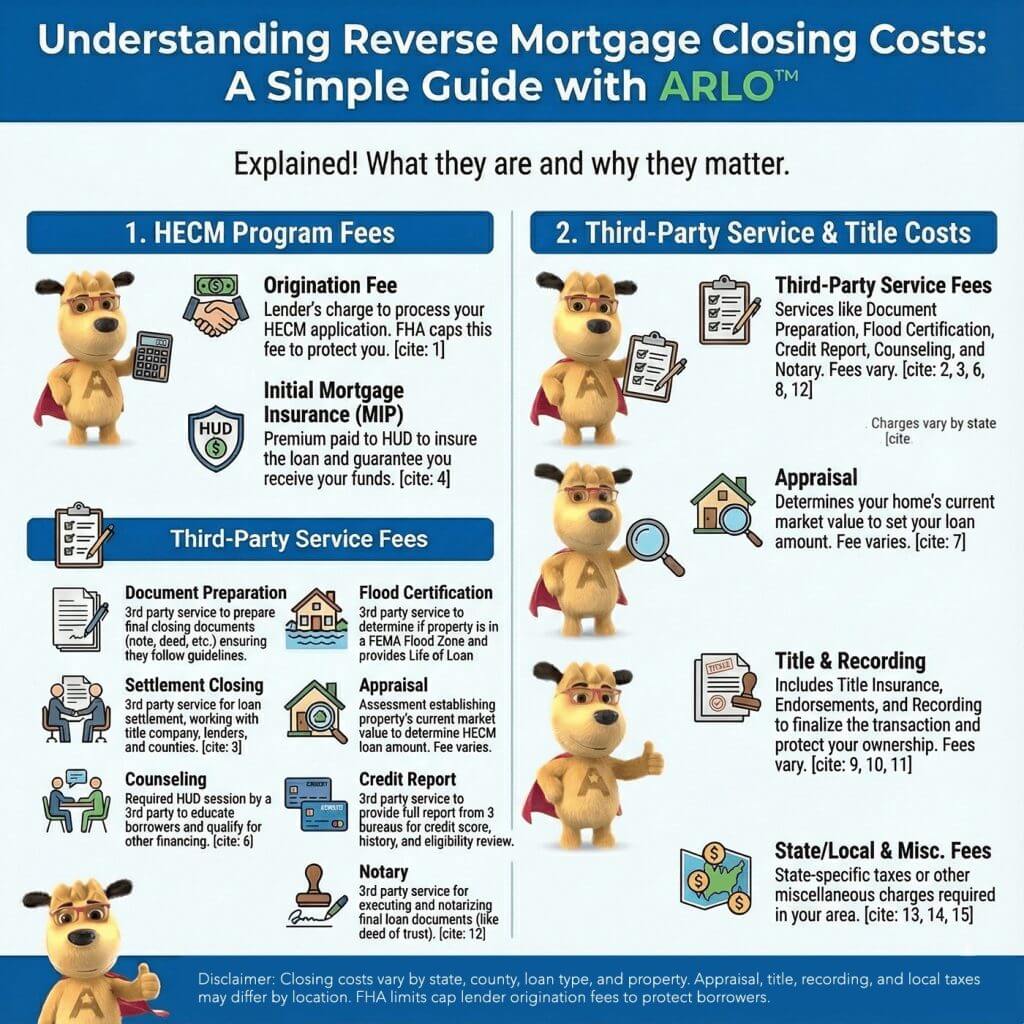

Breakdown of Reverse Mortgage Closing Costs

| Closing Cost | Estimated Amount | Service Provider | Description |

|---|---|---|---|

| Origination Fee | Varies | Paid directly to Lender | Charge for lender's services in processing HECM application. Limited by FHA to $2,500 or 2% of the first $200,000 plus 1% over $200,000, with a cap at $6,000. |

| Document Preparation | $190.00 | 3rd party service | 3rd party service for preparing final closing documents, ensuring compliance with guidelines. |

| Flood Certification | $15.00 | 3rd party service | 3rd party service for determining if a property is in a FEMA-defined Flood Zone, with a Life of Loan guarantee. |

| Initial Mortgage Insurance (MIP) | 2% of appraised value or HECM lending limit, whichever is lower | Paid directly to HUD | Insurance premium paid to HUD at closing for loan insurance under the HECM program. |

| Settlement Closing | Varies by State | Settlement Agent | 3rd party service for managing loan settlement or closing, coordinating with various parties. |

| Counseling | $125.00 - $150.00 | Paid directly to HUD counseling agency | 3rd party service providing counseling sessions to applicants, a HUD requirement. |

| Appraisal | Varies by State, Property Type, Property Location (Suburban vs Rural) and Property Size | 3rd party service (Appraisal Management Company or AMC) | Fee for home appraisal to establish current market value, varies by location. |

| Credit Report | $60.00 - $106.00 (Joint Credit Report for two borrowers more expensive than an individual report) | 3rd party service | 3rd party service for providing a full credit report from all 3 bureaus to assess creditworthiness. |

| Lender Title Insurance | Varies by State and Property Value | Title Company | 3rd party service for obtaining a title search and report. Insuring the lender. |

| Endorsements | Varies by State and Property Value | Title Company | Charges for lender-required endorsements to the title policy. |

| Recording | Varies by State and/or County | Fee charged by the county recorder’s office | Fee for recording the Security Instruments with the county recorder's office. |

| Notary | Varies by State | 3rd party service | 3rd party service for executing and notarizing loan documents, fee based on the signing service. |

| State Tax/Stamps Mortgage | Fee charged by the county recorder’s office. (Applicable in FL, GA VA) | State where property is located | State or county-specific charges for Real Estate transactions, varies by dollar amount shown on the Deed or Mortgage. |

| Intangible Tax | Fee charged by the county recorder’s office. (Applicable in FL, GA VA) | State where property is located | State-required charge for all Real Estate Transactions in some states, similar to State Tax/Stamps Mortgage. |

| Miscellaneous State-Specific Fees | Fee charged by the county recorder’s office. (Applicable in FL, GA VA) | State where property is located | Local or state fees varying from transaction to transaction, usually not too significant in dollar amount. |

Itemized Closing Cost Explanation

Origination Fee: This charge covers the lender’s services for processing your Home Equity Conversion Mortgage (HECM) application. It’s essentially the cost for a lender to process your loan from start to finish. FHA sets limits on how much lenders can charge for this fee to protect borrowers from high costs. Specifically, a lender can charge no more than $2,500 or 2% of the first $200,000 of your home’s value, plus 1% of any amount over $200,000. However, no matter what your home is worth, the origination fee for a HECM can’t exceed $6,000.

Document Preparation: This is a 3rd-party service selected by the lender to prepare the final closing documents, including the note, deed of trust, agreement, etc. They are responsible for ensuring the documents follow local and federal guidelines.

Flood Certification: This is a 3rd party service responsible for ascertaining whether a property is in a Flood Zone as determined by FEMA and provides a Life of Loan determination/guarantee.

Initial Mortgage Insurance (MIP): This insurance premium is paid directly to HUD at closing to insure the individual loan under the HECM program.

Settlement Closing: This is a 3rd party service responsible for handling the settlement or closing of the loan. They work with the title company to get the public records information, work with existing lenders to obtain payoffs, coordinate with the lenders for funding, and the counties to record the loan.

Counseling: This is a 3rd party service that provides counseling sessions to each Reverse Mortgage loan applicant in the beginning stage of the process. The counselors are tasked with educating the borrowers about Reverse Mortgages and determining if they may qualify for any other types of financing. This is a HUD requirement to start the Reverse Mortgage process.

Appraisal: The home appraisal is an important step in the reverse mortgage application. This assessment establishes your property’s current market value, a key figure that determines the amount you can qualify for with a reverse mortgage. This fee is part of this process, and it varies by location.

Credit Report: This is another 3rd party service. The credit company must provide a full credit report from all 3 bureaus (Experian, Transunion & Equifax) for each Reverse Mortgage applicant to determine the borrower’s credit scores, credit history, and any delinquencies or public record items. This is a necessary step in the process as a lender must review a borrower’s credit history for specific things to determine eligibility for the program.

Lender Title Insurance: This is a 3rd party service required for any loan that is done and not specific to Reverse Mortgages. For every loan done, a title report must be obtained from a Title Company, and the company must ensure the lender in the transaction for the required dollar amount based on appraised value, etc. The fee for title insurance usually varies by loan type and from state to state.

Endorsements: Lenders require various endorsements to the title policy based on the loan type. The charges for these endorsements will vary from state to state. For a Reverse Mortgage, some required endorsements are the Neg-Am and Environmental; to provide these endorsements to the procedure, there are usually additional charges. Other approvals needed can vary based on property type (ex., Condo, PUD, Manufactured Home).

Recording: Whenever a new loan is completed, the Security Instruments (Deeds of Trust or Mortgage – verbiage varies from state to state) must be recorded with the county recorder’s office to finalize the transaction. There is always a charge to record documents, so there is a Recording fee for all loans. Recording charges can vary from County to County and State to state.

Notary: All final loan documents must be executed before a notary, as some documents require notarization, such as the deed of trust. This is a 3rd party service based on the amount the signing service will charge for handling the signing and notarizing all necessary documents.

State-Specific and Miscellaneous Fees

State Tax/Stamps Mortgage: In some states (ex., Florida), there are state charges whenever you do any Real Estate transaction, including Refinances. These state or county-specific charges must be paid based on the dollar amount shown on the Deed or Mortgage.

Intangible Tax is like the State Tax/Stamps Mortgage and is required for all Real Estate Transactions in some states. Again, the example is Florida, which has a mandatory state charge.

Other States, such as Texas, Illinois, Pennsylvania, and New Jersey (to name a couple), have other miscellaneous additional charges not seen on all Good Faith Estimates, as they are either local or state fees that vary from transaction to transaction but usually do not add up to be too significant as far as the dollar amount of the cost.

Interest Costs – Choosing Between Fixed and Variable Rates

Interest rates are a significant factor that affects the cost of a reverse mortgage for borrowers. When choosing a reverse mortgage, you have two interest rates to consider: fixed and variable rates.

Fixed-rate reverse mortgages were once the go-to choice for many HECM borrowers because they offer the stability of an interest rate that doesn’t change over the years. However, recent regulatory changes have placed limitations on how much money you can access upfront with a fixed-rate loan, making it less attractive for some borrowers.

On the other hand, variable-rate reverse mortgages come with interest rates that can fluctuate over time, which means the cost of the loan may increase or decrease. It’s important to note that regardless of the type of interest rate, the entire loan balance becomes payable when the loan matures—typically when you sell your home, move out, or in the event of your passing.

Variable rates are known for their flexibility, especially with payment options. For instance, the line of credit plan is a popular choice among borrowers due to its adaptability and the possibility of the credit line growing over time.

2026 HECM vs. Traditional Mortgage Costs Compared

Feature HECM Reverse Mortgage Traditional Mortgage

Lending Limit $1,249,125 $806,500

Average Fixed Rate 7.56% (8.99% APR) 6.96% (7.25% APR)

Loan Duration For Life 15 or 30 Years

Upfront Insurance 2% of Loan $0

Monthly Insurance 0.50% $0

Low/No Closing Costs No Yes

Note: HECM lending limit corrected to $1,249,125 (as of 2026). Rates and APRs are averages.

FAQs

How much are the closing costs on reverse mortgages?

Closing costs vary based on the program you are selecting. An automatic 2% mortgage premium is paid to FHA on the federally insured home equity conversion mortgage. In contrast, proprietary and jumbo reverse mortgages are free of additional insurance charges. Your initial loan amount may also influence the overall closing cost as larger loan amounts offer more value to lenders and their ability to waive origination fees.

Are reverse mortgage closing costs paid upfront or added to the loan?

Very few closing costs are paid upfront; most are added to the loan. Often, you’ll need to pay the appraisal fee directly to the appraiser at the time of service and possibly the counseling fee. However, if the lender is familiar with the local sales market, they might be willing to cover the appraisal fee for you. But be cautious; this might not be as advantageous as it appears. If a lender readily offers to pay the appraisal fee upfront, thoroughly review their rates and fees. Some larger lenders also own appraisal management companies. While this might seem convenient initially, it can become problematic if you switch lenders for better rates or lower fees later on. These lender-owned management companies often do not cooperate with new lenders. Any issues with the original appraisal reports, which occur frequently, are not corrected by these companies, making the reports unusable and forcing the borrower and new lender to pay for new appraisals, thus incurring more costs and delays. A word of caution: if you choose a lender that uses their own appraisal management company, make sure to get all competitive quotes you’re considering before letting them order an appraisal. An appraisal fee that initially seems $100 cheaper can cost you much more later in other fees or higher rates. It’s wise to compare options before committing.

Are closing costs on reverse mortgages deductible?

Specific loan origination and appraisal fees may be deductible. We recommend you speak to your trusted tax advisor for full disclosure, as mortgage lenders do not carry licensing to advise on tax purposes.

How is the interest paid on a reverse mortgage?

Interest is paid on a reverse mortgage when the loan is repaid, partially or in full. No monthly mortgage payments are required on a reverse mortgage, so you only pay the interest that accrues when you intentionally do so by making a voluntary repayment or paying the loan in full by selling the property, refinancing the loan, or paying it off with other funds.

Do all lenders have the same closing costs?

No. On a federally insured HECM loan, all lenders will charge the uniform 2% upfront mortgage insurance premium, which is required of the loan and paid to HUD. However, each lender offers its own interest rates, margins, and a set of closing costs, as private companies operate on their margins. It pays to shop around and compare both rates and total costs. Generally, you will find that brokers have higher costs as they serve more as a middleman to a direct lender.

Do you offer a “No Closing Cost” reverse mortgage?

The availability of a “No Closing Cost” reverse mortgage depends on the lender’s willingness and ability to cover these costs for you. It’s important to understand that all loans have associated costs. However, there were periods when lenders could absorb these costs for the borrower, thanks to the revenue they anticipated from selling the loan, meaning the borrower didn’t have to pay these costs directly. Currently, there are still options where lenders might cover the closing costs for borrowers, but these options are less common and come with more restrictions. It’s worth checking if you qualify for a loan with no or minimal closing costs that you have to pay out of pocket or add to your loan balance. Even if it turns out you’re not eligible for a loan with no closing costs, comparing offers from multiple lenders might reveal opportunities to find a loan where the lender agrees to cover a portion of the costs, thus reducing your overall loan expenses. This is particularly true for jumbo or proprietary loan programs, which don’t require initial mortgage insurance premiums.

What’s a typical APR for a reverse mortgage?

There’s no “typical” APR (Annual Percentage Rate) for a reverse mortgage because rates vary widely. They change over time, and different lenders offer different programs. Unlike traditional loans, a reverse mortgage line of credit doesn’t use an APR but rather a TALC rate, which stands for Total Annual Loan Cost. This means all fees are included upfront and added to the loan balance. The cost-effectiveness of a reverse mortgage improves the longer you hold onto the loan, as the upfront fees get spread out over its duration. However, if you pay off the loan within a year, it becomes quite expensive because these initial fees are not spread out over time, making early payoff generally not cost-effective. When looking into reverse mortgages, comparing proposals from several lenders is crucial. Focus on the full range of features, not just a single aspect like a lower appraisal fee, which could be offset by higher interest rates or other costs. Sometimes, choosing a lender based on slightly lower initial fees can lead to paying significantly more in interest or having access to fewer funds in the long run. Be cautious if a lender is eager for your social security number or reluctant to provide a written proposal; these could be red flags. Remember, the right reverse mortgage should meet your specific needs, possibly serving as the last loan you’ll ever need. Take your time to ensure it’s the best fit for your situation.

Can I use my reverse mortgage proceeds to pay the lender’s closing fees?

Except for any fees required of you to start the loan (usually the appraisal and counseling fees and possibly credit reports), all other fees are paid with the reverse mortgage proceeds. There may be other fees specific to your transaction that your lender would need to discuss with you (i.e., HOA charges for needed documents, charges for property inspections due to manufactured housing requirements, etc.). At times, lenders may work with you on the appraisal, but that would be up to the lender because if you decide not to complete the transaction, the lender would not be able to recoup this cost, and this would be money they would need to front or pay on your behalf. Also, remember that a lender who pays for your appraisal may be using an appraisal management company they own all or in part, and if you find a better deal on a loan or need to move your loan later to close it, due to HUD appraisal requirements, you may run into issues with the valuation or with a new lender being able even to use that appraisal all while you would be locked into the value reported. There are times when you may be able to find a credit counseling provider with grant money available that can provide counseling services without charge to the borrower. But lenders never know when those funds are available to which counseling agencies and are not allowed to “steer” borrowers to any counseling providers anyway. It would be up to you to search the internet for no-cost counseling when you were ready to receive your services if that was important to you.

What percentage do you charge for the loan origination fee?

The origination fees for reverse mortgages are not calculated as a percentage of the loan amount but are capped by HUD. This cap is because borrowers often can take no money at closing. While lenders determine the origination fee, HUD imposes a cap based on the home’s value, ensuring that it does not exceed $6,000 for a HUD HECM reverse mortgage, regardless of the home’s worth. Therefore, shopping around and obtaining multiple quotes from different lenders is crucial to securing the best terms.

What percentage of the loan is charged for mortgage insurance?

HUD sets mortgage insurance, and the up-front fee is 2% of the property value or the HUD maximum loan limit, whichever is less. The HUD lending limit is currently $1,249,125, so if your home value is $1,249,125, your initial mortgage insurance would be based on the HUD lending limit, not the higher value. ($1,249,125 x 2% = $24,982). The annual renewal premium is .50% of the outstanding balance of your loan.

Are there any reverse mortgages with no origination fee?

The ability to offer a reverse mortgage with no origination fee depends on market conditions and the value of the loans at any given time. In addition, costs can sometimes be subsidized by the lender by offering a slightly higher interest rate and then lowering or not charging an origination fee. If the rates are favorable enough, it might even be possible for lenders to offer credits to pay other fees, and this has been the case many times in the past. At this time, though, the combination of the higher interest rates and the fact that HUD lowered the interest rate floor several years ago has made no origination fee loans and lender credits much more complex. They are virtually nonexistent at this time. Because any increase in the rate means the borrowers receive less money in their loan, lenders cannot raise the rate a little to offset some of the costs. When the expected rate was lower than the HUD floor rate, quoting a slightly higher rate gave borrowers a choice between a slightly higher rate and lower closing costs or a lower rate and higher fees, but they could still receive the same amount of money with their loan. Remember, one of the factors that determines how much money you will receive with a reverse mortgage is the interest rate. Now that rates have risen all expected rates are above the HUD floor, so every rate increase decreases borrower funds. HUD floor is the rate at which anything at or below means borrowers receive the maximum amount available under the program, but any rate over that floor lowers the amount of money the borrowers receive less, and they keep receiving less and less as the rate rises. This often makes many borrowers who must pay off a current mortgage “short to close,” meaning the only way they can get a reverse mortgage would be to take money out of their pocket because the loan will not pay all costs and existing loans. When this happens, there is no sense in raising the rate, which would further lower the funds to the borrower to try to offer no closing costs. The best thing you can do is visit several online calculators like ours and compare your results with the proposals from other lenders. Then, pull up reviews from actual consumer sites like the Better Business Bureau (not a paid site that works for the lenders they “review”) and see what people who have used the lenders to see what they have to say about those lenders. It pays to do a little research for such an important decision.

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

June 1st, 2023

June 7th, 2023

October 5th, 2020

October 7th, 2020

May 12th, 2025

May 30th, 2025

March 18th, 2019

March 18th, 2019