How to Buy a Home With a Reverse Mortgage in 2026 – HECM Purchase Guide

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

If you’re thinking about moving, downsizing, or getting closer to family, a reverse mortgage can help you buy your next home without taking on a monthly mortgage payment.

Many homeowners are surprised to learn that you can use a reverse mortgage to purchase a home in one simple transaction. You bring a down payment, the reverse mortgage covers the rest, and you live in the home as your primary residence.

This 2026 guide walks you through how a reverse mortgage purchase works, who qualifies, the typical down payment required, and what recent HUD updates mean for today’s buyers.

Reverse Mortgage Purchase Basics

The HECM for Purchase (H4P) is an FHA-insured reverse mortgage that helps you buy a new home while financing part of the purchase with your home’s equity. You’ll use your own funds for a down payment, and the reverse mortgage covers the rest, letting you own your new home without required monthly mortgage payments as long as you live there.

To qualify, you must:

- Be at least 62 years old.

- Meet HUD’s financial guidelines for income and credit.

- Provide a sufficient down payment (the amount varies by age and interest rate).

After closing, you must:

- Move in and make the home your primary residence within 60 days.

- Keep the property in good repair and in compliance with FHA standards.

- Stay current on property taxes, homeowner’s insurance, and HOA dues (if applicable).

The most significant benefit of the H4P program is convenience. You buy your home and set up your reverse mortgage in a single transaction, avoiding the extra costs and delays of taking out a separate reverse mortgage later.

Expert Insight from Michael Branson, CEO: “The HECM for Purchase is ideal if you’re downsizing or moving closer to family, it simplifies the move into one transaction.”

Why HECM for Purchase Makes Sense for Repeat Buyers Over 62

The housing market presents very different conditions for repeat buyers later in life than it does for first-time buyers.

According to the National Association of REALTORS® 2025 Profile of Home Buyers and Sellers, repeat buyers now have the highest median age on record at 62, with roughly half of repeat buyers already over that age. These buyers tend to be financially established, equity-rich, and moving for practical reasons rather than market timing.

In most cases, they are not purchasing a first home. They are selling a property they have owned for many years and making a deliberate transition into the next phase of retirement.

Common characteristics of today’s repeat buyers include:

- Larger down payments, with a median of 23%, the highest level reported since 2003

- Substantial home equity accumulated over long-term ownership

- An increasing number choosing to pay all cash to avoid taking on a new mortgage payment

This buyer profile closely reflects how the HECM for Purchase program is commonly used. It is designed for homeowners who have equity available, want to simplify their housing expenses, and prefer not to reintroduce monthly mortgage payments later in retirement.

A Practical Alternative to Paying All Cash

Many buyers over 62 pay cash simply to eliminate monthly mortgage payments. While that approach avoids debt, it can also leave too much money tied up in the home.

A Reverse Mortgage for Purchase offers a middle ground.

Instead of depleting savings or tying up all sale proceeds, repeat buyers can:

- Use equity from the sale of their previous home as the down payment

- Eliminate required monthly mortgage payments for life in the new home

- Keep additional assets liquid for retirement income, healthcare, or emergencies

For buyers who value flexibility and cash flow, this can be a more balanced approach than paying all cash or taking out a traditional mortgage late in retirement.

Why Older Buyers Are Moving and How HECM for Purchase Fits

The NAR report also highlights why older repeat buyers are making a move in the first place. Among buyers over 62, the most common motivation is relocating to be closer to friends and family, not employment or investment reasons.

That reality matches the most common HECM for Purchase scenarios:

- Downsizing after selling a primary residence

- Moving closer to adult children or grandchildren

- Buying a more accessible or single-level home

- Relocating to a retirement-friendly area without adding a mortgage payment

Because the purchase and reverse mortgage happen in a single transaction, buyers avoid the cost and complexity of buying first and refinancing later.

Designed for Retirement Planning, Not Short-Term Leverage

For most repeat buyers over 62, the objective is not maximizing leverage or speculating on future appreciation. The priority is predictability, manageable housing costs, and the ability to live comfortably in the home they choose for the long term.

A HECM for Purchase can support that approach by eliminating required monthly mortgage payments while allowing homeowners to allocate their remaining assets toward retirement income, healthcare planning, and everyday living expenses.

This type of financing is not appropriate for every buyer. However, for those who have built substantial equity and prefer not to take on a new mortgage payment or commit all of their cash to a home purchase, it can be an efficient and well-structured way to buy a primary residence in retirement.

Once you understand who the HECM for Purchase is designed to serve, the next step is confirming borrower and property eligibility under current HUD guidelines.

Residency and Eligibility

HUD now requires that all HECM borrowers be U.S. citizens or lawful permanent residents. Borrowers with temporary or non-permanent residency status (such as work or visitor visas) are no longer eligible for FHA-insured reverse mortgages, including the HECM for Purchase program.

If you’re a U.S. citizen or hold a green card, you fully qualify under the current residency rules.

The HECM for Purchase program allows a wide range of home types, as long as they meet FHA standards and the property will be your primary residence.

Eligible properties include:

- Single-family homes

- Planned Unit Developments (PUDs)

- 2–4 unit dwellings (you must live in one of the units)

- HUD-approved condominiums

- Manufactured homes built after June 15, 1976

If you’re buying new construction, the final Certificate of Occupancy must be issued before closing.

Did You Know? HUD-approved condos, single-family homes, and 2–4 unit properties qualify. However, co-ops, homes still under construction, and older manufactured homes (built before June 15, 1976) are not eligible for HECM financing.

Ineligible Properties

Not every home type qualifies for a HECM for Purchase. HUD limits eligibility to ensure the property meets safety and long-term habitability standards.

Ineligible property types include:

- Homes still under construction or not yet habitable

- Mobile or modular homes not set on a permanent foundation

- Co-ops, boarding houses, or bed-and-breakfast properties

- New construction without a final Certificate of Occupancy

Important:

Certain manufactured homes may not qualify, particularly those built before 1976 or those that fail to meet HUD manufactured home requirements.

Estimating Your Down Payment

When you buy a home using a HECM for Purchase, you’ll need a larger down payment than with a traditional mortgage, but in exchange, you’ll have no required monthly mortgage payments for as long as you live in the home.

Most borrowers use the equity from the sale of their previous home. Others combine personal savings, retirement funds, or eligible gifts to meet the requirement.

Acceptable Funding Sources (2025/2026 Update)

HUD now allows several documented, non-repayable sources to help cover your down payment:

- Proceeds from the sale of your current or prior home

- Verified savings, retirement, or investment accounts

- Family gifts, employer assistance, or disaster-relief grants

- Other non-repayable funds approved by your lender

All funds must be fully documented, typically by wire transfer or cleared check before closing. Borrowed funds, unsecured loans, and credit-card advances are not permitted.

Expert Insight from Michael Branson, CEO: “Most borrowers use equity from selling their current home. This lets them buy their next property without taking on a monthly mortgage payment, and without paying all cash.”

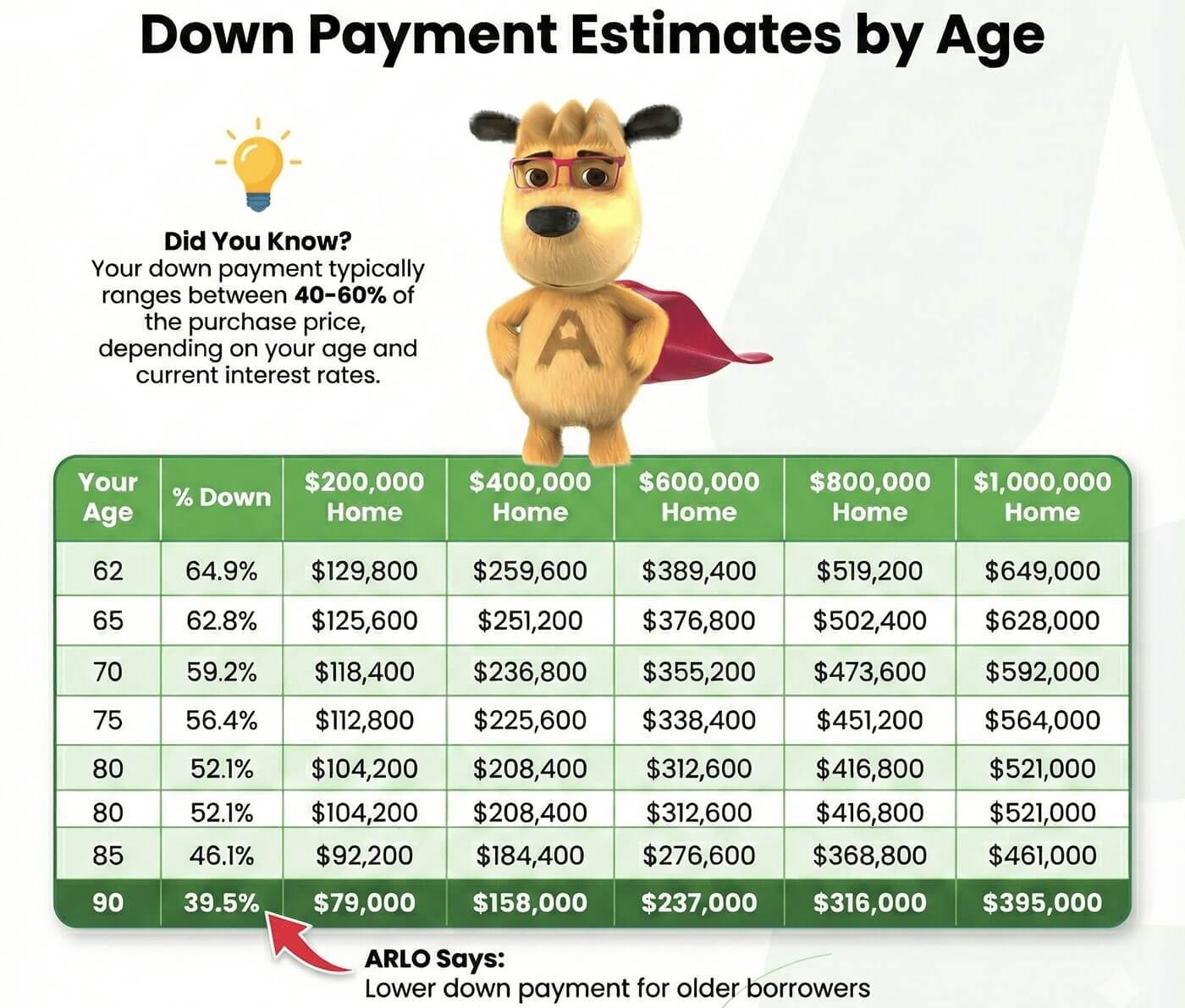

Typical Down Payment Range

The required down payment depends on:

- Age of the youngest borrower or spouse

- Current expected interest rate

- Home price or the 2026 HECM lending limit of $1,249,125, whichever is lower

Did You Know? Your down payment typically ranges between 40-60% of the purchase price, depending on your age and current interest rates.

2026 HECM Purchase: Down Payment Estimates by Age

| Your Age | % Down | $200,000 Home | $400,000 Home | $600,000 Home | $800,000 Home | $1,000,000 Home |

|---|---|---|---|---|---|---|

| 62 | 64.9% | $129,800 | $259,600 | $389,400 | $519,200 | $649,000 |

| 65 | 62.8% | $125,600 | $251,200 | $376,800 | $502,400 | $628,000 |

| 70 | 59.2% | $118,400 | $236,800 | $355,200 | $473,600 | $592,000 |

| 75 | 56.4% | $112,800 | $225,600 | $338,400 | $451,200 | $564,000 |

| 80 | 52.1% | $104,200 | $208,400 | $312,600 | $416,800 | $521,000 |

| 85 | 46.1% | $92,200 | $184,400 | $276,600 | $368,800 | $461,000 |

| 90 | 39.5% | $79,000 | $158,000 | $237,000 | $316,000 | $395,000 |

Seller and Third-Party Contributions (HUD Update 16-5)

HUD has updated HECM for Purchase rules to match conventional “forward” mortgage standards. Now, sellers, agents, and builders can contribute up to 6% of the home’s sales price or appraised value (whichever is lower) toward the buyer’s allowable closing costs and fees.

These contributions can be used for:

- Origination and lender fees

- Appraisal and credit-report costs

- Title and escrow/closing fees

- Prepaid taxes and insurance

- Discount points or interest-rate buydowns

- The initial FHA mortgage insurance premium (MIP)

Note:

- Typical seller-paid expenses, such as real estate commissions or home-warranty costs, do not count toward the 6% cap.

- PACE liens: If a seller pays off a Property Assessed Clean Energy (PACE) lien, it’s not treated as a contribution; it’s a required title condition under HUD’s updated rules.

Example of Reverse Mortgage Purchase

Example: A 70-year-old uses a reverse mortgage to buy a $500,000 home. The required down payment is $298,000 (about 59%). For illustration, assume a 4% annual home appreciation and an “expected rate” based on a 10-year index.

Under these assumptions, equity could be ~$309,251 in 5 years and ~$338,116 in 10 years, assuming no monthly mortgage payments. If the borrower later moves to assisted care, the loan becomes due. The home can be sold; any equity above the loan balance belongs to the borrower or heirs.

When that time comes, you can:

- Pay off the loan and keep the house

- Sell the home and keep any remaining proceeds

- Walk away and owe nothing (non-recourse)

Equity outcomes depend on appreciation, interest rates, timing/amount of draws (purchase funds are disbursed at closing), and any voluntary prepayments.

Also see: Ideal Reverse Mortgage Purchase Example

2026 Reverse Mortgage Purchase Rates: Fixed vs. Adjustable

| Lending Limit | Fixed Rate (APR) | Adjustable Rate |

|---|---|---|

| $1,249,125 (HECM) | 7.56% (8.06% APR) | 6.885% (2.125% Margin) |

| $4,000,000 (Jumbo) | 8.99% (9.25% APR) | 9.52% (5.875% Margin) |

| Note: Fixed APR example: 7.56% + 0.50% MIP =8.06% total interest for a $250,000 loan, including standard closing costs. | ||

2026 Reverse Mortgage Purchase: What You Need to Know at a Glance

| Key Topic | How It Works |

|---|---|

| Who Qualifies? | Homebuyers age 62+ who meet HUD’s financial guidelines |

| Down Payment Needed? | Yes – Typically 40-60% of the purchase price depending on age and rates |

| Monthly Mortgage Payments? | No – Just maintain property taxes, insurance, and upkeep |

| Eligible Property Types | Single-family homes, HUD-approved condos, 2–4 unit homes (owner-occupied) |

| Ineligible Properties | Co-ops, homes under construction, some manufactured homes |

| Best Funding Sources | Proceeds from selling your current home, savings, or eligible family gifts |

| Benefits of the Program | One transaction, no monthly payments, FHA-insured with non-recourse protection |

| Limitations to Consider | Higher down payment than traditional loans, upfront/ongoing MIP applies |

Pros and Cons of Purchasing with a Reverse Mortgage

The HECM purchase program can be an excellent option to consider during retirement, allowing you to move without monthly mortgage payments. However, like all loans, there are trade-offs.

Did You Know? FHA insurance guarantees a purchase HECM so that at the time of maturity, you’ll never owe more than your home’s value, no matter how long you live there or what the market does.

Additional Considerations

Select a real estate agent with experience in reverse-mortgage purchases. Your originator can help, but an agent who is familiar with HUD rules can streamline the process.

2025/2026 HECM Purchase Changes & Improvements (Summary)

- 6% seller/agent/builder contribution cap toward allowable borrower costs

- Expanded down-payment sources: verified gifts, employer assistance, or disaster-relief grants

- PACE lien payoffs excluded from concession limits

- Final Certificate of Occupancy required before closing

- Residency limited to U.S. citizens and permanent residents

- Trust ownership allowed at closing if FHA-compliant

Frequently Asked Questions

Can you get a reverse mortgage on a purchase?

Yes. Reverse mortgages have been available for purchases since 2008, allowing buyers to avoid two separate closings.

How does a reverse mortgage purchase work?

Loan proceeds are based on the age of the youngest borrower/spouse and interest rates. You bring funds to closing to cover the difference.

How much down payment is required?

It depends on age, rates, and HUD limits. Use the HECM purchase calculator for specifics.

Does the source of down payment matter?

Yes. Funds must be your own or from acceptable sources (e.g., verified savings, sale proceeds, or a bona fide family gift). Borrowed funds like credit card advances are not allowed.

Can life insurance proceeds be used for the down payment?

Yes, if you withdraw or sell the policy and document receipt of funds. You cannot borrow against the policy for down payment funds.

Does the home’s appraisal have to match the purchase price?

No. For a reverse mortgage used to buy a home (HECM for Purchase), HUD uses the lower of the home’s appraised value or the agreed-upon purchase price to calculate the loan.

If the appraisal comes in below the contract price, you can still complete the transaction if you wish but the HUD loan would be based on the appraised value and you would need to bring in the additional difference with your down payment to close the loan if you want to move forward anyway. If the appraisal comes in higher, HUD will still base the loan on the purchase price.

This is the same way valuations are treated for forward or traditional loans. It protects borrowers in that it ensures they have a safeguard against inflated values by giving them a tool to either renegotiate the selling price if the value is not supported, walk away if they need to or close the transaction when the situation warrants and the borrower feels strongly that this is in their best interest.

Are condos eligible?

Yes, if the project is HUD-approved. Some proprietary programs may allow non-FHA condos, but HUD HECM often offers better terms.

Can I buy a 2–4 unit property and live in one unit?

Yes. HUD allows up to four units if the property is owner-occupied.

What if I later move to assisted living?

You must occupy the home as a primary residence. Moving out makes the loan due per HECM rules.

Can I qualify after a bankruptcy three years ago?

Possibly, with re-established credit and a strong letter of explanation. A lender review is required.

Can my spouse be a non-borrowing spouse and I remain sole owner?

In states that allow it, yes — with counseling and required documentation. See non-borrowing spouse rules.

Can I sell the home later? Any restrictions?

You can sell anytime without prepayment penalties. If HUD incurs a loss from early departure on a prior HECM, you may be ineligible for another reverse mortgage until the loss is repaid.

Can I sell a home with a HECM and buy another with a new HECM the same time?

Yes, but the new purchase can only close after the prior HECM payoff is verified, which can add a brief delay.

How do I find realtors who understand HECM for Purchase?

Look for agents experienced with HECM purchases. Ask firms if they have HECM-savvy agents familiar with HUD rules.

“All Reverse Mortgage flawlessly handled my reverse mortgage purchase, providing clear explanations and great professionalism. They promptly answered my questions and returned calls quickly. I highly recommend them to friends and family.” — John P. (BBB)

Thinking About Buying a Home with a Reverse Mortgage? We Make It Simple. With the HECM for Purchase program, you can buy your next home without monthly mortgage payments. Call (800) 565-1722 or try our reverse mortgage purchase calculator to see how much home you can afford.

Videos from our YouTube Channel:

ARLO recommends these helpful resources:

- Client success story in Kiplinger’s Retirement Report

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

August 23rd, 2024

August 23rd, 2024

March 17th, 2024

March 19th, 2024

August 10th, 2021

August 10th, 2021

November 24th, 2020

November 24th, 2020

May 26th, 2020

May 26th, 2020

January 14th, 2013

January 15th, 2013

November 26th, 2012

December 4th, 2012

July 26th, 2024

July 29th, 2024