Serving Peoria Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

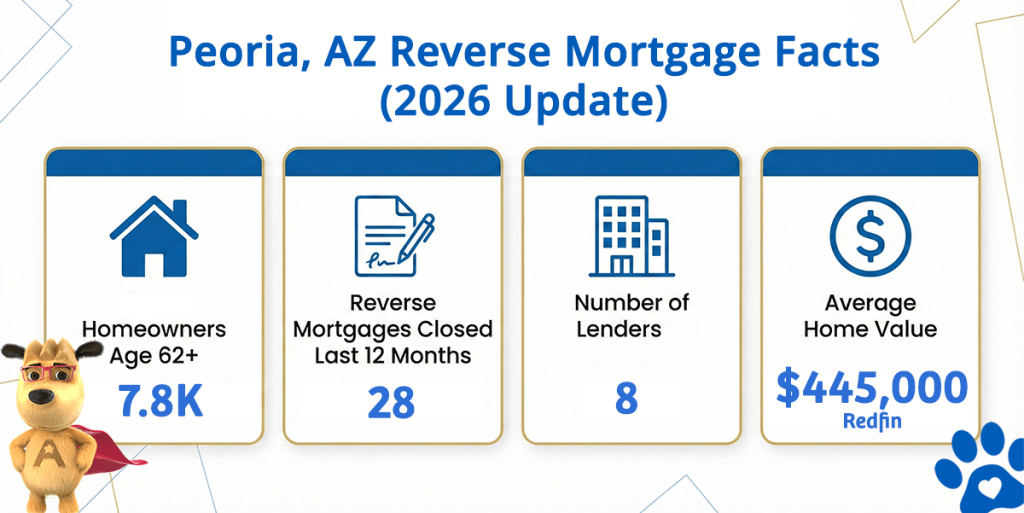

Peoria Reverse Mortgage Market at a Glance

Peoria Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Purchase Reverse Mortgages Closed Last 12 Months | Lenders in Peoria (est) | Avg. Home Value |

|---|---|---|---|---|---|

| Peoria | ~7,800 | 28 | 8 | 8 | ~$445,000 (Redfin) |

What the Numbers Tell Us About Reverse Mortgages in Peoria

Peoria is a thriving West Valley community with a median home value around $445,000, attracting families and retirees seeking suburban comfort with urban proximity. For homeowners age 62 and older who have built substantial equity, a reverse mortgage can unlock financial options without forcing a move. At the FHA lending limit of $1,249,125, most Peoria residences qualify for meaningful borrowing capacity, providing retirees with strategic flexibility for managing their later years.

The West Valley region—encompassing Glendale, Surprise, Sun City, and Phoenix—has become a magnet for active adults and established families alike. Many Peoria homeowners have spent decades building equity, and now face decisions about how to best leverage that wealth during retirement. Whether supplementing income, funding healthcare, or maintaining independence in their long-time homes, the reverse mortgage market continues to evolve as a legitimate option deserving careful consideration.

With multiple FHA-approved lenders serving the West Valley, Peoria residents benefit from competition and choice. The reverse mortgage landscape has matured considerably over recent years, with enhanced consumer protections and transparent lending standards. Understanding your options—and whether a reverse mortgage aligns with your personal financial goals—requires honest conversations and reliable information.

Peoria’s neighborhoods reflect the community’s diversity—from newer master-planned subdivisions to established residential areas with mature landscaping and strong community bonds. Many residents represent multiple generations of Arizona living, with deep roots and clear intentions to age in place. This stability, combined with solid home equity appreciation, makes Peoria an attractive market for reverse mortgage providers seeking to serve committed homeowners genuinely interested in long-term financial planning.

How a Reverse Mortgage Works for Peoria Homeowners

A reverse mortgage is an FHA-insured loan exclusively for homeowners age 62 and older. Unlike traditional mortgages requiring monthly payments, the lender advances funds based on your home equity—repayment occurs when you sell, relocate, or pass away. The HUD HECM program has offered this product since 1989, with consumer protections and regulatory oversight built into every transaction.

For Peoria homeowners, the mechanics are straightforward: you retain full ownership, maintain complete control of all decisions, and benefit from FHA insurance protecting against lender default. An HECM (Home Equity Conversion Mortgage) lets you choose your funding structure—lump sum, monthly payments, line of credit, or a blend—tailored to your individual retirement needs.

Common Uses in Peoria

- Healthcare and Aging-in-Place Support — Peoria residents commonly use reverse mortgage proceeds for home modifications, medical equipment, or in-home care services that enable them to remain independent. Discover how real homeowners have funded these needs.

- Retirement Income Supplementation — Those relying on Social Security or fixed pensions often tap home equity to bridge monthly shortfalls, reducing financial strain during inflationary periods. Review income requirement guidelines to understand the application process.

- Major Home Maintenance and Repairs — Arizona’s heat demands regular HVAC replacement, roof repairs, and plumbing work. Reverse mortgage funds provide accessible capital for these essential investments without depleting retirement savings. Learn about property standards to confirm your home qualifies.

- Debt Resolution and Legacy Preservation — Many use proceeds to clear credit cards, medical bills, or property taxes while protecting inheritance for children and grandchildren. Understand non-recourse protections that shield heirs from borrowing shortfalls.

Peoria Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | Minimum 62 years old; review age requirement details including spousal protections and joint borrower considerations. |

| Home Ownership | You must own your Peoria home outright or with significant equity (typically 50%+). Condominiums require FHA approval under specific guidelines. |

| Primary Residence | Your Peoria home must be your primary residence; rental properties, vacation homes, and investment properties do not qualify. |

| Property Type | Single-family homes, townhomes, and approved condominiums qualify. Manufactured homes follow distinct FHA guidelines and may qualify under specific conditions. |

| Financial Assessment | Lenders conduct a financial assessment to verify your ability to manage property taxes, insurance, and ongoing maintenance costs. |

| Counseling | A HUD-approved counseling session (free, independent) is mandatory before closing and protects your interests. |

Use our free reverse mortgage calculator to estimate your borrowing capacity based on your Peoria home value and current age.

Understanding the Costs

Reverse mortgages carry real costs: origination fees, appraisal expenses, title insurance, and FHA mortgage insurance (both upfront and annual). Combined costs typically range from 2% to 5% of the loan amount. Rather than monthly payments, interest accrues and compounds until you leave the home. Understand closing costs in detail and weigh them against the documented pros and cons relevant to your situation.

Is a Reverse Mortgage Right for You?

A reverse mortgage is not suitable for everyone—it’s a specialized financial tool with distinct advantages and limitations. If you intend to stay in your Peoria home long-term, want to eliminate monthly payments, and need accessible liquidity, it may make sense. If you prioritize leaving a large inheritance or worry about future care costs, a HELOC may deserve consideration as an alternative strategy. For those concerned about scams or misleading claims, separate fact from fiction about reverse mortgages and review debunked myths circulating in the market.

HUD-Approved Direct Lender Serving Peoria

All Reverse Mortgage Inc. is an FHA-approved HECM lender serving Peoria and the West Valley with direct lending authority. We specialize in guiding Arizona retirees through the reverse mortgage decision-making process with transparency and patience. Our team provides honest cost discussions, clear explanations, and genuine answers to your questions—no pressure tactics, no surprises. Verify our BBB accreditation and customer reviews for independent validation. Confirm our HUD lender status anytime. We also offer jumbo reverse mortgages for higher-value properties exceeding standard FHA limits.

All Reverse Mortgage Inc. is licensed by the Arizona Department of Financial Institutions (License #BK0934287), meeting all state and federal compliance requirements for reverse mortgage lending.

Request Your Personalized Peoria Reverse Mortgage Quote

Try the ARLO™ calculator for an instant estimate with current rates — no personal details needed upfront.

Related Resources

Clear explanation of mechanics, payout options, and repayment structure for retirees considering this loan.

In-depth review of age, equity, property type, and financial criteria needed to determine your eligibility.

Detailed analysis of these two primary funding methods and which structure best supports your retirement objectives.

Essential guidance on how reverse mortgage funds may impact your eligibility for means-tested government programs.

Statewide market data, FHA lending limits, and comprehensive lender directory

Phoenix metro HECM data and lending activity across the greater Valley region

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald