Serving Loveland Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

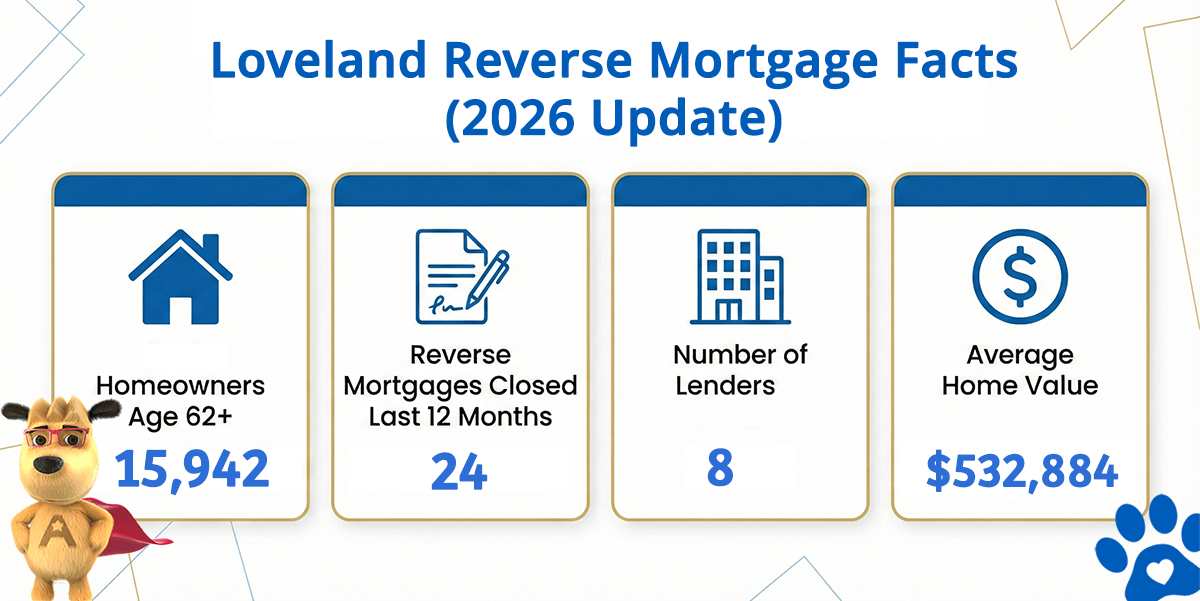

Loveland Reverse Mortgage Market at a Glance

Loveland Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Loveland (est) | Avg. Home Value |

|---|---|---|---|---|

| Loveland | 15,942 | 24 | 8 | $532,884 |

What the Numbers Tell Us About Reverse Mortgages in Loveland

Loveland stands as a vibrant Northern Colorado community positioned between Fort Collins and Denver along the I-25 corridor, with median home values around $532,884 and a growing population of established homeowners. For residents age 62 and older with substantial equity, a reverse mortgage represents a practical path to accessing their home’s value. At the current FHA lending limit of $1,249,125, most Loveland properties qualify for meaningful borrowing capacity, enabling retirees to unlock decades of equity without selling.

Loveland’s reputation as an arts and culture destination attracts creative professionals and active retirees who value quality of life. The community’s proximity to Big Thompson Canyon and outdoor recreation draws those planning to age in place while maintaining an engaged lifestyle. Many Loveland homeowners have built substantial equity over decades, creating a strong foundation for reverse mortgage eligibility. The demographic profile reflects a mix of long-term residents and newer arrivals seeking Colorado’s mountain-adjacent living.

With multiple FHA-approved lenders serving the Northern Colorado region, Loveland homeowners have genuine options when evaluating reverse mortgage partners. The essential question is whether this financial tool aligns with your specific retirement goals and long-term plans for your home.

Loveland’s neighborhoods range from established residential areas to newer developments, each offering distinct character and home values. Many residents chose Loveland specifically for its arts scene, community events, and natural setting along the Big Thompson River. The community’s appeal to those seeking an active retirement makes equity-release planning increasingly relevant for aging residents who want to enjoy their final decades while preserving financial flexibility.

How a Reverse Mortgage Works for Loveland Homeowners

A reverse mortgage is an FHA-insured loan exclusively for homeowners age 62 and older. Unlike traditional mortgages, you make no monthly payments. Instead, the lender advances funds based on your home equity, and repayment occurs when you sell, relocate, or pass away. The HUD HECM program has offered this structure since 1989, with built-in consumer protections and regulatory oversight.

For Loveland homeowners, the process is straightforward: you keep full ownership, retain complete control of all decisions, and benefit from FHA insurance protection. A reverse mortgage allows you to select your funding method—lump sum, monthly payments, line of credit, or combinations—based on what serves your financial needs.

Common Uses in Loveland

- Healthcare and Aging in Place — Loveland residents frequently use reverse mortgage proceeds for home modifications, in-home health aides, or medical equipment that allows them to remain in their cherished community. Explore examples of how retirees have used these funds strategically.

- Retirement Income Supplement — Those with limited Social Security or pension income use reverse mortgages to bridge gaps, reducing reliance on savings drawdown. Learn what rules apply to income-based planning.

- Home Restoration and Improvements — Colorado’s weather demands quality roofing and foundation maintenance. Reverse mortgage funds enable you to address critical repairs and updates without depleting reserves. Review property requirements to confirm your Loveland home qualifies.

- Legacy and Debt Resolution — Many use proceeds to settle accumulated debt or implement structured legacy plans while preserving certain assets. Understand non-recourse protection and how it safeguards your heirs.

Loveland Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | Must be at least 62 years old; review full age requirements for information on spousal options. |

| Home Ownership | You must own your Loveland home outright or hold substantial equity (typically 50%+). Condominiums require FHA approval. |

| Primary Residence | The home must be your primary place of residence; investment properties and vacation homes do not qualify. |

| Property Type | Single-family homes, townhomes, and FHA-approved condos qualify. Manufactured homes have specific eligibility guidelines. |

| Financial Assessment | Lenders conduct a financial assessment to verify your capacity to maintain property taxes and insurance. |

| Counseling | A HUD-approved counseling session (free, independent) must be completed before closing. |

Use our free reverse mortgage calculator to estimate how much you may qualify for based on your Loveland home’s current value and your age.

Understanding the Costs

Reverse mortgages involve real expenses: origination fees, appraisal, title insurance, and FHA mortgage insurance (upfront and annual). Costs typically range from 2% to 5% of your loan amount. Interest accrues and compounds until you leave your home. Understand closing costs in detail and weigh them against the benefits and drawbacks for your situation.

Is a Reverse Mortgage Right for You?

A reverse mortgage isn’t appropriate for everyone—it’s a financial tool with distinct advantages and limitations. If you plan to remain in your Loveland home, want to avoid monthly payments, and need accessible funds, it may suit your strategy. If you’re focused on maximizing legacy for heirs or are uncertain about aging plans, a HELOC might be worth exploring. Concerned about misleading claims? Read about reverse mortgage scams and learn how to evaluate the downsides thoroughly.

HUD-Approved Direct Lender Serving Loveland

All Reverse Mortgage Inc. is an FHA-approved HECM lender serving Loveland and all of Northern Colorado with direct lending authority. We guide Colorado retirees through the decision-making process with transparent communication, honest cost discussions, and thorough answers. Check our BBB profile for reviews and accreditation. Verify our HUD lender status at any time. For homes exceeding FHA limits, we offer jumbo reverse mortgage options.

All Reverse Mortgage Inc. holds licensure from Colorado’s Department of Regulatory Agencies (DORA) (License #100032569), meeting all state and federal regulatory standards for reverse mortgage lending.

Get a Reverse Mortgage Quote for Your Loveland Home

Use the ARLO™ calculator for an instant quote with real-time rates — no personal information required.

Related Resources

Comprehensive explanation of Home Equity Conversion Mortgages, including mechanics, funding options, and repayment structures.

Detailed information on age, equity, property type, and financial assessment criteria to check your eligibility.

Explore the flexibility of a credit line structure and how growth features can enhance your financial planning long-term.

Learn how lenders evaluate your Loveland home’s value and condition to determine borrowing capacity.

Complete statewide resource for FHA-approved lenders, regional lending statistics, and market activity data.

Denver metro market overview, HECM activity trends, and resources for homeowners in the greater Front Range region.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald