Serving Buckeye Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Buckeye Reverse Mortgage Lenders

At All Reverse Mortgage, Inc. (ARLO™), we are proud to be Arizona’s top-rated reverse mortgage lender, as recognized by the Better Business Bureau. We have a perfect 5-star rating and an A+ exemplary score. We’ve been serving Arizona homeowners since 2004 and are dedicated to providing reverse mortgages that help you enjoy your retirement years with peace of mind.

We understand that you deserve the best possible rate with the lowest costs. That’s why we focus solely on reverse mortgages, ensuring you receive expert guidance every step of the way. As a HUD-approved direct lender, we offer both national HECM programs and specialized jumbo Reverse Mortgages for homeowners with higher-value properties in Arizona.

We invite you to compare our customer reviews, lower rates, and closing costs with those of any other lender. We’re confident you’ll see the difference, and we look forward to helping you achieve your financial goals.

All Reverse Mortgage, Inc. is licensed by the Arizona Department of Financial Institutions (License/Registration #BK0934287)

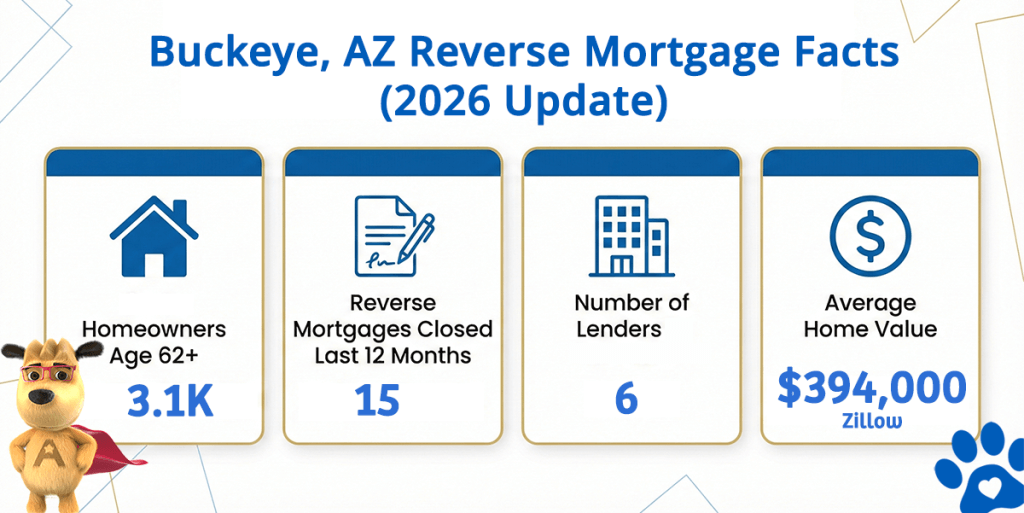

Buckeye Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Buckeye (est) | Avg. Home Value |

|---|---|---|---|---|

| Buckeye | 3,100 | 15 | 5 | ~$464,000 (Zillow) |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

HUD-Approved Direct Reverse Mortgage Lender

At All Reverse Mortgage, Inc. (ARLO™), we are a HUD-approved direct lender authorized to originate and service the FHA Home Equity Conversion Mortgage, commonly called a HECM or reverse mortgage.

The HECM program is federally insured and designed specifically for homeowners age 62 and older. It allows you to access a portion of your home equity while eliminating required monthly mortgage payments, as long as you continue to live in the home and meet basic homeowner responsibilities.

In Buckeye, we work with homeowners who want to:

-

Pay off an existing mortgage and remove that monthly payment

-

Access home equity for retirement income, medical costs, or reserves

-

Establish a line of credit that grows over time

-

Refinance an existing reverse mortgage when it makes financial sense

There are no hidden fees, and borrowers may repay the loan or sell the home at any time without a prepayment penalty.

About All Reverse Mortgage, Inc.

Reverse mortgages are all we do.

Our team has more than 20 years of experience helping older homeowners understand both the benefits and the tradeoffs of these loans. We were part of the team that developed and delivered the first fixed-rate jumbo reverse mortgage in 2008, long before most lenders entered the space.

Today, we offer:

-

FHA-insured HECM reverse mortgages

-

Jumbo and proprietary reverse mortgages for higher-value homes

-

Refinance and purchase reverse mortgage options

We take the time to explain how each option works, where it fits, and when it does not. The goal is clarity, not pressure.

Buckeye Reverse Mortgage Lending Limits

Buckeye is one of the fastest-growing communities in the Phoenix metro area, with a population just over 108,000. A meaningful share of residents are older homeowners who have built significant equity over time.

With an average home value around $464,000, most Buckeye properties fall well below the 2026 FHA HECM lending limit of $1,249,125. That means many homeowners can access the maximum benefit available under the standard HUD program without needing a jumbo loan.

For homeowners with higher-value properties or non-FHA-approved condominiums, proprietary jumbo reverse mortgage options may provide additional flexibility, though these loans are not FHA-insured and carry different features and risks.

Is a Reverse Mortgage a Good Fit in Buckeye?

For the right homeowner, a reverse mortgage can be a practical retirement planning tool.

Common reasons Buckeye homeowners explore this option include:

-

Eliminating a monthly mortgage payment to improve cash flow

-

Creating a standby line of credit for future needs

-

Staying in the home long-term without downsizing

-

Coordinating housing equity with other retirement assets

A reverse mortgage is not right for everyone. The loan balance grows over time, and the home will eventually need to be sold or refinanced when the last borrower leaves the property. Understanding those tradeoffs upfront is critical.

That is where good advice and accurate numbers matter.

Ready to Unlock Your Home’s Equity?

As Buckeye’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

As a fully licensed lender by the Department of Insurance and Financial Institutions (License #0911085), we’re committed to helping you secure the retirement you deserve.

Get Your Free Quote from Buckeye’s #1 Rated Reverse Mortgage Lender. Or call (623) 244-4664 to speak with one of our knowledgeable experts today.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald