See How Much You Could Qualify For

How Reverse Mortgages Work – Explained in plain English with ARLO™

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

For more than 20 years, I’ve helped older homeowners understand and use reverse mortgages safely. At All Reverse Mortgage, Inc., we focus on one loan and one purpose — helping you use the equity you’ve built to support your retirement with clear numbers and no pressure.

This guide walks you through the essentials in plain English: what a reverse mortgage is, how it works, what it costs, the different ways you can receive the funds, and what it means for your heirs. My goal is simple — to give you the facts so you can decide whether this loan fits the way you want to live in retirement.

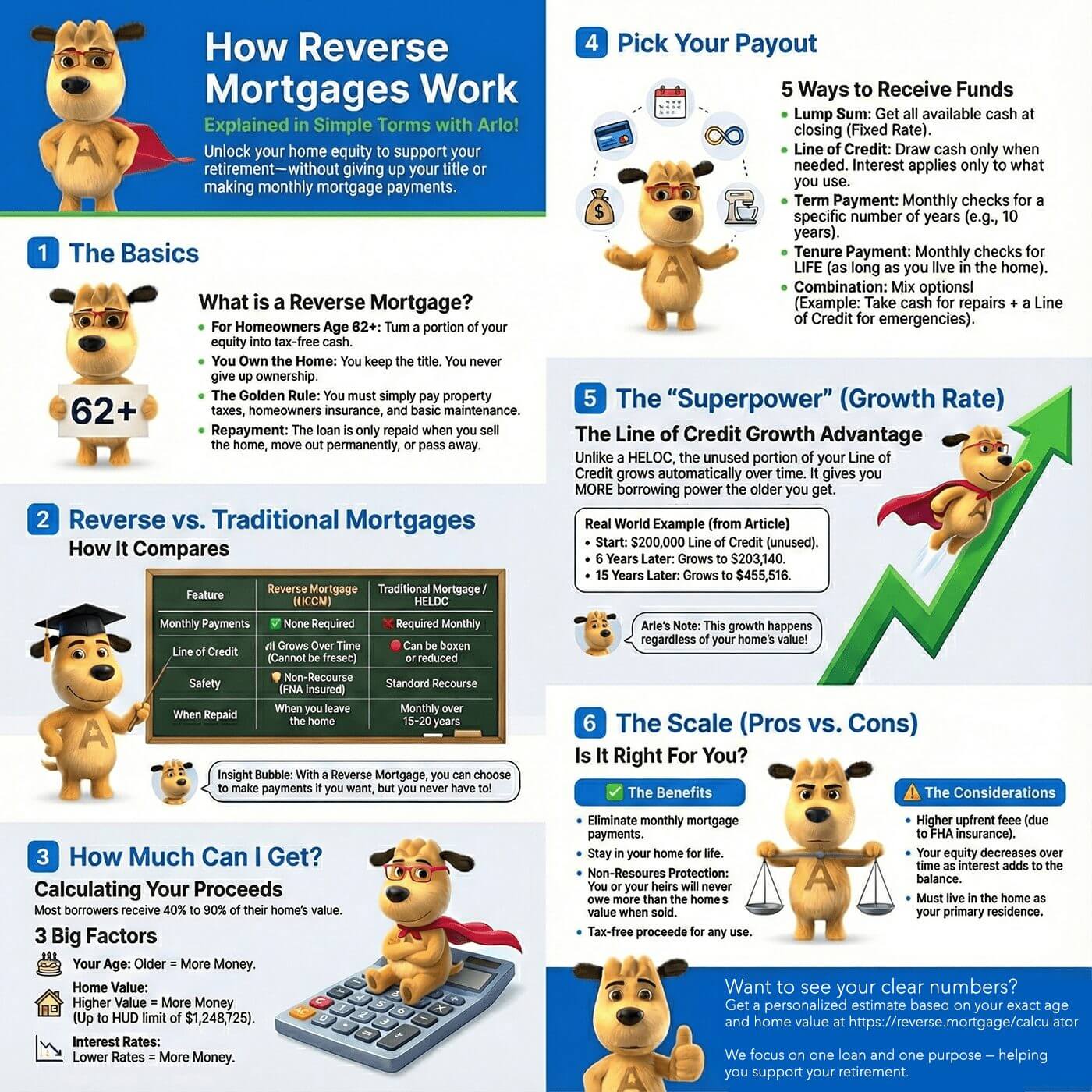

What is a reverse mortgage?

A reverse mortgage is a home loan for homeowners age 62 or older that lets you turn a portion of your home equity into tax-free loan proceeds without selling your home or making required monthly mortgage payments. You keep title to the home, must continue paying property taxes, homeowners insurance, and basic upkeep, and the loan is repaid when you sell the home, move out permanently, or pass away.

How does a reverse mortgage work?

A reverse mortgage works by letting you access part of your home equity without taking on a required monthly mortgage payment. Instead of paying the lender each month, the lender gives you funds as a lump sum, monthly payments, a line of credit you can tap when needed, or a combination of these choices. Interest and FHA mortgage insurance charges are added to the balance over time, and the loan becomes due when you no longer live in the home as your primary residence or if property taxes, homeowners insurance, or basic maintenance are not kept current. As long as those obligations are met, you remain the owner of your home and can live there for life.

Expert Insight from Michael Branson, CEO: “The more money you borrow at the beginning of the loan, the faster the interest will accrue on the larger balance. If you are looking to pass on the largest asset to your heirs, you can significantly reduce the amount of interest that accrues by borrowing smaller amounts and as late in the loan cycle as is comfortable or necessary.”

Reverse Mortgage vs. Traditional Mortgages and Home Equity Loans

When you think about borrowing against your home, you’re usually choosing between a traditional mortgage or a home equity line of credit. A reverse mortgage is different. It was built specifically for homeowners age 62 or older and doesn’t require monthly mortgage payments, making it a better fit for retirement planning. The chart below compares a reverse mortgage to other common home loan options so you can see the differences at a glance.

Here’s how they compare:

| Feature | Reverse Mortgage (HECM) | Traditional Mortgage | Home Equity Loan / HELOC |

|---|---|---|---|

| Age Requirement | 62 or older | 18 or older | 18 or older |

| Monthly Payments | Not required | Required every month | Required every month |

| How You Receive Funds | Lump sum, monthly payments, line of credit, or a combination | Lump sum at closing | Lump sum (loan) or a revolving line of credit (HELOC) |

| When the Loan Is Repaid | When you sell, move out permanently, or pass away | Paid monthly over 15-30 years | Paid monthly over a set term |

| Impact on Home Equity | Balance increases as interest adds to the loan (unless you make voluntary payments) | Balance decreases as payments are made | Balance decreases as payments are made |

| Borrower Protections | FHA-insured, non-recourse: you never owe more than the home’s value | Standard protections only | Standard protections only |

Key takeaway: With a reverse mortgage, you stay in your home and can choose whether or not to make payments. Unlike a HELOC or cash-out refinance, repayment isn’t required until you move out, sell, or pass away. That flexibility is why many older homeowners use a reverse mortgage to supplement retirement income while preserving monthly cash flow.

Expert Insight from Michael Branson, CEO: “If your goal is flexibility, the reverse mortgage line of credit is unmatched. It grows over time and gives you access to more funds in the future, unlike a HELOC that can be frozen or reduced by the bank.”

How Much You Can Get From a Reverse Mortgage

The amount you can receive from a reverse mortgage typically falls between 40% and 60% of your home’s appraised value. The exact figure depends on three things: your age, your home’s value (up to HUD’s lending limit of $1,249,125), and the interest rate at the time you apply. Older borrowers qualify for a higher percentage, and lower interest rates also increase the available amount.

Here are the factors that determine your loan amount:

- Age of the youngest borrower or eligible spouse

- Your home’s appraised value or the HUD lending limit, whichever is lower

- Current interest rates

If you’d like a personalized estimate based on your exact age, home value, and today’s rates, you can use our reverse mortgage calculator for an instant, no-obligation calculation.

How Age Affects Your Principal Limit

Your Principal Limit (loan amount) is the maximum amount that you can receive on a reverse mortgage for your specific scenario. It is based on the age of the youngest borrower (or eligible non-borrowing spouse), your home’s current property value or HUD lending limit (whichever is less), and current interest rates.

- The older you are, the more you will receive.

- The higher your home value, the more you will receive.

- The lower the interest rate, the more you will receive.

HUD uses Actuarial Tables data to determine the loan-to-value ratios available for the HECM (Home Equity Conversion Mortgage) program. An 85-year-old borrower does not have the same life expectancy as a 62-year-old borrower, and therefore, the amount they can borrow is more. Interest rates factor into the equation because the loan’s interest is added to the balance and compounds over time, with no monthly mortgage payments required. The higher the loan rate, the faster interest will accrue.

Key Point: When a homeowner has a reverse mortgage loan, they can live in their home for the rest of their life without any monthly mortgage payment being owed as long as they occupy the home as their primary residence, pay the property taxes, maintain homeowners insurance, and continue the upkeep of the property.

Pro Tip: If you are within 6 months of your next birthday at the time of loan closing, the calculator will round your age up to the next year. The reason this is important is that you are eligible for a slightly higher loan-to-value at every age increment.

How You Can Receive the Funds

One of the best features of a reverse mortgage is that there are multiple options for how you can receive your available proceeds, which provides homeowners with tremendous flexibility that you wouldn’t have with other loan products.

- Lump Sum: A one-time payout at the time of closing of all available proceeds (Fixed Rate loan).

- Line of Credit: Access funds when needed, and all unused funds are subject to a growth rate, which increases borrowing capacity over time.

- Term Payment: An automatic monthly disbursement of a set dollar amount for a predetermined amount of time, such as 5 or 10 years.

- Tenure Payment: An automatic monthly disbursement of a set dollar amount for life (as long as you live in the property and keep the loan in good standing).

- Combination: Combine 2 or more features to suit your goals as necessary.

Scenario Example:

A borrower, aged 66, owns a $500,000 home that is free and clear (no existing mortgage). At current interest rates, they could do the following combination:

- Take $80,000 initial advance to do a complete home renovation to upgrade multiple areas of the home.

- Set up a $1,000 per month term payment for 4 years to supplement income until they reach the age of 70, before they start collecting Social Security to achieve a higher monthly payout.

- Leave the remaining funds of ~$60,000 in a line of credit for emergencies. The funds left in the line of credit would be subject to the growth rate. The growth rate is always applied to the amount available in the Line of Credit.

Want to see how each payout option works? Explore real examples and discover which reverse mortgage payment plan best suits your needs. Learn more about Term, Ten-Year, and Tenure payments →

Expert Insight from Michael Branson, CEO: “A reverse mortgage can be a smart way to bridge the gap before claiming Social Security. By using monthly term payments or a line of credit to cover expenses, some homeowners delay filing for Social Security until a later age, allowing them to lock in a higher lifetime benefit. This strategy can increase long-term retirement income while still giving you the flexibility to use your home equity on your own terms. Your line of credit grows on the portion of the line you do not use, so you can begin allowing the line to grow, giving you greater borrowing power later if you need it. Be sure to check with your financial advisor to see what is right for you regarding your Social Security and/or pension plans.”

The Line of Credit Growth Advantage

The growth rate feature in the HECM (Home Equity Conversion Mortgage) is one of the most compelling aspects of the reverse mortgage program and truly sets it apart from other loan products. All unused funds in a reverse mortgage line of credit are subject to a growth rate equal to the actual loan interest rate plus the HUD mortgage insurance renewal rate, currently 0.50%.

Example:

Borrower has a starting line of credit of $200,000 with a growth rate of 5.50% and doesn’t access or withdraw any funds from it.

- 5 years of growth at 5.5% untouched = $263,140.75

- 10 years of growth at 5.5% untouched = $346,215.28

- 15 years of growth at 5.5% untouched = $455,516.75

Interest rate fluctuations and withdrawals from the line of credit will impact the overall growth and available line of credit, but as long as there are funds available in your line of credit, the growth rate will be applied to that amount and reflected on your mortgage statement every single month.

Important: This isn’t the interest that you are earning; it is simply an increase in borrowing capacity.

Expert Insight from Michael Branson, CEO: “Even if your reverse mortgage line of credit eventually grows larger than your home’s value, you can still withdraw every dollar tax-free and remain in your home for life. HUD guarantees full access to your line of credit, even if your lender goes out of business through built-in FHA mortgage insurance protections.”

Comparing Interest Rates and Closing Costs

Not all reverse mortgages are created equal, as interest rates, margins, and closing costs can differ significantly between lenders.

A lender with slightly lower upfront closing costs might appear attractive at first glance, but if their margin/interest rate is 0.50% higher, it will result in a lower available loan amount and higher interest accrual over the life of the loan.

Conversely, a loan with a slightly higher margin will give you a higher rate of growth on the unused funds in your line of credit, so if that is your goal, you will want to analyze that further.

What to Compare:

- Interest rate + margin

- Initial loan amount (Principal Limit), as well as the starting line of credit

- Closing costs (origination fee, appraisal, 3rd party service providers, etc.)

- Servicing Fees (if any) are rare in today’s market, but some lenders still charge monthly servicing fees.

Smart Strategy: Choose the option that will achieve your most important goals, whether that is maximizing the available loan amount, preserving as much equity as possible, or having the highest possible line of credit growth.

Expert Insight from Michael Branson, CEO: “Watch your financing terms. Don’t accept a larger margin that can end up costing you thousands of dollars in accrued interest over the years and leave you with less money available at closing, to save a little money on one fee. Look at all the terms offered and compare lenders.”

Reverse Mortgage Costs vs. Benefits in 2026

A reverse mortgage can be a powerful retirement tool, but, as with any financial decision, there are trade-offs. Here is the complete picture:

Key Benefits

- No required monthly mortgage payments — a reverse mortgage allows you to borrow money without the associated burden of a mandatory payment every month, which frees up your monthly cash flow.

- Stay in your home for life — as long as you live there as your primary residence, maintain taxes and insurance, and keep the home in good condition.

- Flexible Payout Options — choose from a lump sum, a monthly payment plan, line of credit, or a combination of two or more options.

- FHA-Insured Protections — HECM reverse mortgages are non-recourse loans. This means that you can never owe more than the value of the property at the time of maturity.

- Financial Flexibility — proceeds can be used for virtually anything. Home improvements, medical expenses, debt payoff, supplementing income, etc., are just a few examples.

- Line of Credit Growth — Unlike a traditional HELOC (Home Equity Line of Credit), your unused line of credit grows in availability over time, and it cannot be frozen or reduced because of market conditions.

Pro Tip: Before deciding on a reverse mortgage, think carefully about your long-term aging-in-place plans. Do you live in a two-story home? Is it fully accessible as you get older? In some cases, downsizing or “right-sizing” with a reverse mortgage for home purchase may be a smarter way to secure both comfort and financial flexibility for the years ahead.

Main Costs & Considerations

- Upfront Fees — reverse mortgages will have higher upfront fees than traditional loans due to the FHA mortgage insurance premium (MIP). It is due to the MIP, however, that you get the non-recourse feature of the loan program.

- Ongoing MIP Charges — the mortgage insurance renewal cost is currently 0.50%, and this amount is added to the balance, along with the interest that accumulates on the loan balance.

- Equity Reduction — as your loan balance increases, it is possible that the equity position in your home could be reduced if the home value is not increasing at a rate to offset the rising balance. This could reduce the inheritance left to heirs.

- Property Obligations Remain — you must continue to pay property taxes, homeowners insurance and the costs of maintaining the home. You are not selling the property, so as the owner of the home, you are responsible for these items.

- Primary Residence Requirement — you can’t use a HECM reverse mortgage on a vacation home or investment property. If you wish to move out of the home, the reverse mortgage must be paid off.

Pro Tip: If preserving home equity for your heirs is your top priority, consider making optional payments or taking smaller draws to retain a larger portion of your home’s equity.

| Feature | Pro | Con |

|---|---|---|

| Home Equity Access | Tap into your home’s value without selling or moving. | Equity decreases over time as loan balance grows. |

| Monthly Payments | No mortgage payments required. | Must still pay taxes, insurance, and maintenance. |

| Stay in Your Home | Live in your home for life. | Must remain your primary residence. |

| Payout Flexibility | Lump sum, monthly income, line of credit, or combination. | Larger upfront draws may reduce future access. |

| Government-Insured | FHA insurance guarantees borrower protections. | Requires upfront and ongoing MIP. |

| Heir Options | Heirs can sell the home at 95% of market value. | Inheritance may be reduced if balance is high. |

| Non-Recourse | You or heirs never owe more than the home’s value. | Heirs must act quickly to settle the loan after death. |

Frequently Asked Questions

Who owns the home with a reverse mortgage?

You remain the legal owner of your home when you take out a reverse mortgage. The lender does not take ownership. A reverse mortgage is simply a loan secured by your property, much like a traditional mortgage. You keep the title in your name, and the lender has only a lien on the home.

(Tip: Think of it just like a regular mortgage — the bank has a lien, not the deed.)

How much money can I get from a reverse mortgage?

The amount of money you can get from a reverse mortgage depends on three key factors:

- Age of the Youngest Borrower – The older you are, the more money you can access.

- Current Interest Rates – Lower rates allow you to borrow a higher percentage.

- Home’s Appraised Value – The higher your home’s value, the more funds may be available.

Together, these factors determine your Principal Limit Factor — the percentage of your home’s value you can borrow. To see how much you may qualify for, try our free reverse mortgage calculator at https://reverse.mortgage/calculator.

How is the loan amount determined?

The loan amount for a reverse mortgage is based on HUD guidelines, using a Principal Limit Factor (PLF). The PLF takes into account:

- Age of the Youngest Borrower (or Eligible Spouse) – Older borrowers qualify for a higher percentage.

- Current Interest Rates – Lower rates allow you to borrow more.

- Home Value (up to FHA’s lending limit) – Your home’s appraised value also plays a role.

Because interest rates can vary by lender, the amount you qualify for may differ depending on which lender you choose. Using a reverse mortgage calculator can give you a personalized estimate based on your specific age, home value, and current rates.

Do I need good credit to qualify?

You do not need perfect credit to get a reverse mortgage. Unlike traditional loans, reverse mortgages are more focused on your home equity and ability to keep up with property charges like taxes and insurance.

If your credit history shows past issues, HUD allows a Life Expectancy Set-Aside (LESA). This means a portion of the loan is set aside to pay your property taxes and homeowners’ insurance. As long as there’s enough room in your loan to cover the LESA, you may still qualify.

However, in some cases, the LESA requirement can reduce the available funds to the point where it may not fully pay off your existing mortgage, which could prevent you from moving forward.

Is an appraisal required?

Yes. An appraisal is required for every reverse mortgage. Most reverse mortgages are part of the FHA-insured HECM (Home Equity Conversion Mortgage) program, which requires an FHA-approved appraisal of your home.

The appraisal confirms the home’s value and ensures it meets HUD’s minimum property standards. If you’d like to review those standards, you can visit HUD’s official site: HUD Minimum Property Standards.

Can you make payments on a reverse mortgage?

Yes. While one of the most significant benefits of a reverse mortgage is that you don’t have to make monthly payments, you can choose to make voluntary payments at any time.

Making payments can help reduce your loan balance or increase the available funds in your line of credit. There are no prepayment penalties, so you can pay off part or even all of the loan whenever you wish.

What is the 95% rule on a reverse mortgage?

The 95% rule applies to heirs after a reverse mortgage comes due. If the loan balance exceeds the home’s current value, heirs can opt to retain the property by paying only 95% of its current appraised value, rather than the full loan balance.

This HUD protection ensures that heirs will never owe more than the home is worth, even if the loan balance exceeds the property’s value.

What are the downsides of a reverse mortgage?

Reverse mortgages can be a valuable tool, but there are a few downsides to consider before deciding if it’s right for you:

- Higher Upfront Costs – Most reverse mortgages are FHA-insured HECM loans, which include a one-time Mortgage Insurance Premium of 2% of the home’s value (up to HUD’s current lending limit of $1,249,125 as of January 2026). While this insurance provides important protections, it adds to the initial costs.

- Growing Loan Balance – Because no monthly payments are required, interest and fees are added to the balance each month. This means your loan balance will increase over time, reducing the equity in your home.

A reverse mortgage works best as a long-term solution. If you’re only planning to stay in your home a short time, the upfront costs may outweigh the benefits.

Can I lose my home with a reverse mortgage?

Yes. Just like with any mortgage, you could lose your home if you don’t meet the loan requirements. With a reverse mortgage, you must:

- Live in the home as your primary residence

- Stay current on property taxes and homeowners insurance

- Keep the home in reasonable repair

If these obligations aren’t met, the lender can call the loan “due and payable.” At that point, the balance must be repaid either by refinancing, selling the home, or paying it off with other funds. If the loan is not repaid, foreclosure is possible.

The good news is that as long as you follow the occupancy, tax, insurance, and maintenance requirements, you remain the owner of your home and can stay there for life.

What if I outlive my home’s value?

One of the biggest benefits of a reverse mortgage is that it’s a non-recourse loan. This means you can never owe more than your home is worth, no matter how long you live there or how much your loan balance grows.

For example, if your reverse mortgage balance grows to $500,000 but your home is only worth $450,000 when you leave, neither you nor your heirs are responsible for the $50,000 difference. The FHA Mortgage Insurance Fund covers that shortfall.

In other words, you can stay in your home for life without worrying about outliving its value, and your estate is protected from owing more than the home’s worth.

How does a reverse mortgage get repaid?

A reverse mortgage is usually repaid when the borrower permanently leaves the home, but repayment can happen at any time since there are no prepayment penalties. Common ways to repay include:

- Selling the Home – The loan is paid off from the sale proceeds.

- Refinancing – You can refinance into another mortgage product if it makes sense.

- Using Other Funds – Borrowers or heirs may use savings, life insurance, or other assets to pay off the balance.

Most often, repayment happens through the sale of the home after the borrower passes away or moves out. Any remaining equity after the loan is repaid belongs to the homeowner or their heirs.

How long do you have to pay back a reverse mortgage?

A reverse mortgage does not need to be repaid until a maturity event occurs. This typically means:

- The last surviving borrower (or eligible non-borrowing spouse) permanently leaves the home, either by moving out or passing away.

- The borrower fails to meet the loan requirements, such as paying property taxes, maintaining homeowners’ insurance, or keeping the home in good repair.

Once the loan becomes due and payable, the servicer will contact the borrower or heirs. Standard repayment options include selling the home, refinancing, or paying off the balance with other funds.

If heirs plan to sell the property, servicers generally allow extensions of up to 1 year in 90-day increments, as long as good-faith efforts to sell are being made. If there is no cooperation or repayment plan, foreclosure may proceed, with timelines varying by state law.

Key Takeaways: How Reverse Mortgages Work in 2026

- Lets you convert home equity into tax-free loan proceeds without monthly mortgage payments.

- The most common program is the Home Equity Conversion Mortgage (HECM), which the FHA insures.

- You must be 62 or older and live in the home as your primary residence.

- Loan amount depends on your age, home value, and current interest rates.

- Repayment is only due when you sell, move out permanently, or pass away.

- Non-recourse rules protect your heirs. They’ll never owe more than the home’s value.

- You keep ownership of your home and can sell or pay off the loan at any time, with no prepayment penalties.

Expert Insight from Michael Branson, CEO: The biggest advantage of a reverse mortgage is flexibility. You’re not locked into monthly payments, but you can still make them if preserving equity is your goal.

Need Personalized Answers? All Reverse Mortgage, Inc. (ARLO™) is here to help. Access our reverse mortgage calculator to estimate your lending limit, or call us Toll-Free at (800) 565-1722. We’re here to help you make informed decisions so you can continue enjoying your retirement.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

September 19th, 2025

September 20th, 2025

July 1st, 2025

July 1st, 2025

You can pay it off using your own available funds,You can refinance it with another loan of your choosing,Or you can sell the home and use the proceeds to repay the reverse mortgage.

There is never a prepayment penalty, so you're free to choose whichever option works best for you.Please let us know if you'd like help exploring the next steps.May 13th, 2024

May 13th, 2024

April 29th, 2024

May 5th, 2024

March 7th, 2023

March 7th, 2023

January 8th, 2023

January 12th, 2023

July 21st, 2022

July 21st, 2022

May 17th, 2022

May 17th, 2022

December 30th, 2021

January 11th, 2022

October 27th, 2020

October 27th, 2020

You can take a lump sum of cash (lump sum option).You can take a set payment for life (tenure option).You can determine the payment you wish to take until you exhaust the funds (term payment).You can leave the money in a line of credit and draw from the line as you wish (line of credit option).

Or you can mix the line of credit with the tenure or term options to have both a payment for life or of your choosing and that would be either a modified tenure or modified tenure. In your case, you could choose the line of credit option, draw the amount you want, and the other funds would remain in the line, available to you. If you never draw the money, you never accrue any interest on the funds and you, or your heirs do not need to repay them. You only pay back what you use (plus any interest that accrues on those funds). In addition, the line of credit grows in availability on the unused funds over time. This means that the longer you have funds available on the line, the more money will be available to borrow later should you need them. Again, if you never need them you are not required to repay them but if you ever do need them for any reason, they are always available unlike a Home Equity Line of Credit that the bank can close at their discretion or that goes into a repayment period after 10 years.July 25th, 2020

July 27th, 2020

July 7th, 2020

July 7th, 2020