Reverse Mortgage Cost Quote

Reverse Mortgage Closing Costs Explained — Fees, Rates & How to Save

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

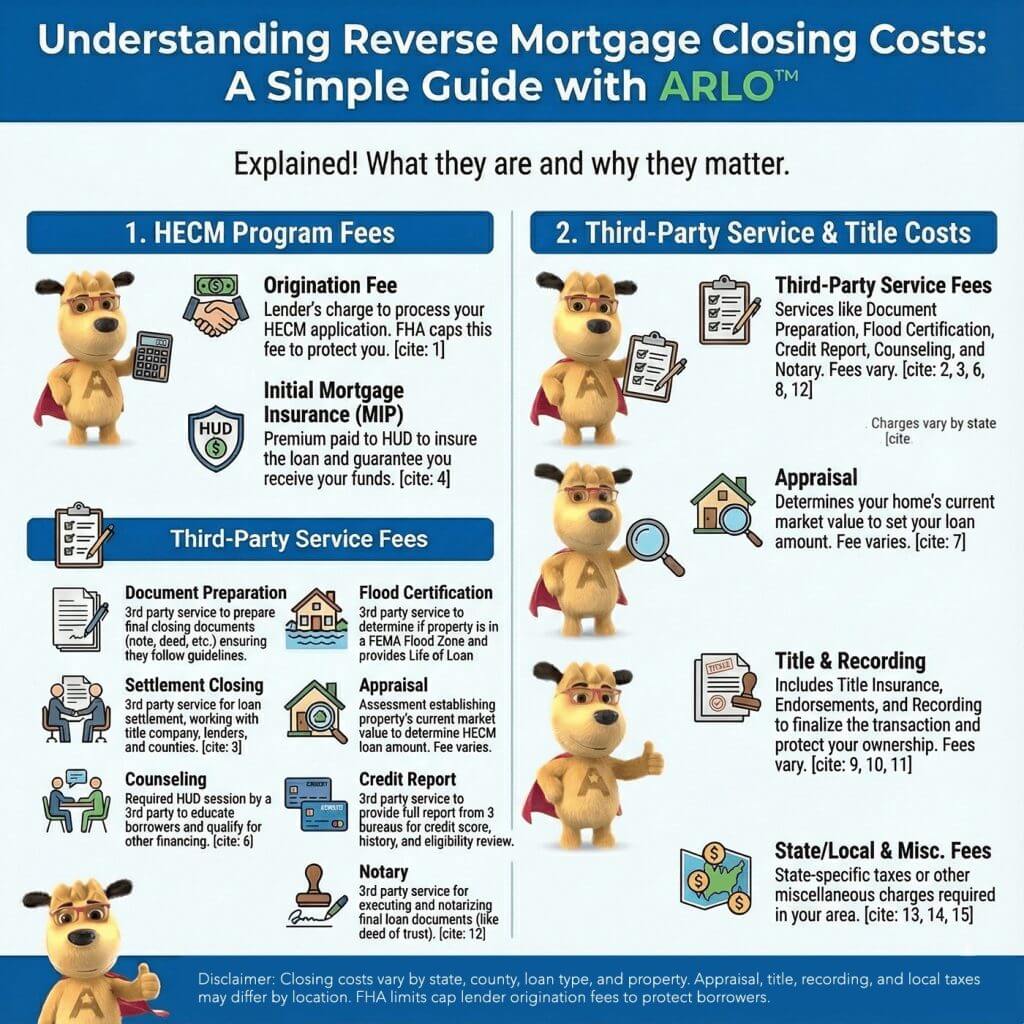

When considering a reverse mortgage, it’s important to understand the various costs involved. These expenses can vary significantly, not just between lenders but also by your home’s location.

To ensure you’re getting the best possible deal, it’s smart to shop around and compare lenders. Among the costs, the origination fees (which cover the setup of your loan) and the lender’s margin (determining your loan’s interest rate) are particularly important to pay attention to.

Interest rates are another important factor. They represent the cost of borrowing money and will affect how much you can get from your reverse mortgage and the total amount of interest that will add up over time.

My goal is to help you clearly understand these costs so that you can confidently make informed decisions about your reverse mortgage.

Breakdown of Reverse Mortgage Closing Costs

| Closing Cost | Estimated Amount | Service Provider | Description |

|---|---|---|---|

| Origination Fee | Varies | Paid directly to Lender | Charge for lender's services in processing HECM application. Limited by FHA to $2,500 or 2% of the first $200,000 plus 1% over $200,000, with a cap at $6,000. |

| Document Preparation | $190.00 | 3rd party service | 3rd party service for preparing final closing documents, ensuring compliance with guidelines. |

| Flood Certification | $15.00 | 3rd party service | 3rd party service for determining if a property is in a FEMA-defined Flood Zone, with a Life of Loan guarantee. |

| Initial Mortgage Insurance (MIP) | 2% of appraised value or HECM lending limit, whichever is lower | Paid directly to HUD | Insurance premium paid to HUD at closing for loan insurance under the HECM program. |

| Settlement Closing | Varies by State | Settlement Agent | 3rd party service for managing loan settlement or closing, coordinating with various parties. |

| Counseling | $125.00 - $150.00 | Paid directly to HUD counseling agency | 3rd party service providing counseling sessions to applicants, a HUD requirement. |

| Appraisal | Varies by State, Property Type, Property Location (Suburban vs Rural) and Property Size | 3rd party service (Appraisal Management Company or AMC) | Fee for home appraisal to establish current market value, varies by location. |

| Credit Report | $60.00 - $106.00 (Joint Credit Report for two borrowers more expensive than an individual report) | 3rd party service | 3rd party service for providing a full credit report from all 3 bureaus to assess creditworthiness. |

| Lender Title Insurance | Varies by State and Property Value | Title Company | 3rd party service for obtaining a title search and report. Insuring the lender. |

| Endorsements | Varies by State and Property Value | Title Company | Charges for lender-required endorsements to the title policy. |

| Recording | Varies by State and/or County | Fee charged by the county recorder’s office | Fee for recording the Security Instruments with the county recorder's office. |

| Notary | Varies by State | 3rd party service | 3rd party service for executing and notarizing loan documents, fee based on the signing service. |

| State Tax/Stamps Mortgage | Fee charged by the county recorder’s office. (Applicable in FL, GA VA) | State where property is located | State or county-specific charges for Real Estate transactions, varies by dollar amount shown on the Deed or Mortgage. |

| Intangible Tax | Fee charged by the county recorder’s office. (Applicable in FL, GA VA) | State where property is located | State-required charge for all Real Estate Transactions in some states, similar to State Tax/Stamps Mortgage. |

| Miscellaneous State-Specific Fees | Fee charged by the county recorder’s office. (Applicable in FL, GA VA) | State where property is located | Local or state fees varying from transaction to transaction, usually not too significant in dollar amount. |

Itemized Closing Cost Explanation

Origination Fee: This charge covers the lender’s services for processing your Home Equity Conversion Mortgage (HECM) application. It’s essentially the cost for a lender to process your loan from start to finish. FHA sets limits on how much lenders can charge for this fee to protect borrowers from high costs. Specifically, a lender can charge no more than $2,500 or 2% of the first $200,000 of your home’s value, plus 1% of any amount over $200,000. However, no matter what your home is worth, the origination fee for a HECM can’t exceed $6,000.

Document Preparation: This is a 3rd-party service selected by the lender to prepare the final closing documents, including the note, deed of trust, agreement, etc. They are responsible for ensuring the documents follow local and federal guidelines.

Flood Certification: This is a 3rd party service responsible for ascertaining whether a property is in a Flood Zone as determined by FEMA and provides a Life of Loan determination/guarantee.

Initial Mortgage Insurance (MIP): This insurance premium is paid directly to HUD at closing to insure the individual loan under the HECM program.

Settlement Closing: This is a 3rd party service responsible for handling the settlement or closing of the loan. They work with the title company to get the public records information, work with existing lenders to obtain payoffs, coordinate with the lenders for funding, and the counties to record the loan.

Counseling: This is a 3rd party service that provides counseling sessions to each Reverse Mortgage loan applicant in the beginning stage of the process. The counselors are tasked with educating the borrowers about Reverse Mortgages and determining if they may qualify for any other types of financing. This is a HUD requirement to start the Reverse Mortgage process.

Appraisal: The home appraisal is an important step in the reverse mortgage application. This assessment establishes your property’s current market value, a key figure that determines the amount you can qualify for with a reverse mortgage. This fee is part of this process, and it varies by location.

Credit Report: This is another 3rd party service. The credit company must provide a full credit report from all 3 bureaus (Experian, Transunion & Equifax) for each Reverse Mortgage applicant to determine the borrower’s credit scores, credit history, and any delinquencies or public record items. This is a necessary step in the process as a lender must review a borrower’s credit history for specific things to determine eligibility for the program.

Lender Title Insurance: This is a 3rd party service required for any loan that is done and not specific to Reverse Mortgages. For every loan done, a title report must be obtained from a Title Company, and the company must ensure the lender in the transaction for the required dollar amount based on appraised value, etc. The fee for title insurance usually varies by loan type and from state to state.

Endorsements: Lenders require various endorsements to the title policy based on the loan type. The charges for these endorsements will vary from state to state. For a Reverse Mortgage, some required endorsements are the Neg-Am and Environmental; to provide these endorsements to the procedure, there are usually additional charges. Other approvals needed can vary based on property type (ex., Condo, PUD, Manufactured Home).

Recording: Whenever a new loan is completed, the Security Instruments (Deeds of Trust or Mortgage — verbiage varies from state to state) must be recorded with the county recorder’s office to finalize the transaction. There is always a charge to record documents, so there is a Recording fee for all loans. Recording charges can vary from County to County and State to state.

Notary: All final loan documents must be executed before a notary, as some documents require notarization, such as the deed of trust. This is a 3rd party service based on the amount the signing service will charge for handling the signing and notarizing all necessary documents.

State-Specific and Miscellaneous Fees

State Tax/Stamps Mortgage: In some states (ex., Florida), there are state charges whenever you do any Real Estate transaction, including Refinances. These state or county-specific charges must be paid based on the dollar amount shown on the Deed or Mortgage.

Intangible Tax is like the State Tax/Stamps Mortgage and is required for all Real Estate Transactions in some states. Again, the example is Florida, which has a mandatory state charge.

Other States, such as Texas, Illinois, Pennsylvania, and New Jersey (to name a couple), have other miscellaneous additional charges not seen on all Good Faith Estimates, as they are either local or state fees that vary from transaction to transaction but usually do not add up to be too significant as far as the dollar amount of the cost.

Interest Costs — Choosing Between Fixed and Variable Rates

Interest rates are a significant factor that affects the cost of a reverse mortgage for borrowers. When choosing a reverse mortgage, you have two interest rates to consider: fixed and variable rates.

Fixed-rate reverse mortgages were once the go-to choice for many HECM borrowers because they offer the stability of an interest rate that doesn’t change over the years. However, recent regulatory changes have placed limitations on how much money you can access upfront with a fixed-rate loan, making it less attractive for some borrowers.

On the other hand, variable-rate reverse mortgages come with interest rates that can fluctuate over time, which means the cost of the loan may increase or decrease. It’s important to note that regardless of the type of interest rate, the entire loan balance becomes payable when the loan matures — typically when you sell your home, move out, or in the event of your passing.

Variable rates are known for their flexibility, especially with payment options. For instance, the line of credit plan is a popular choice among borrowers due to its adaptability and the possibility of the credit line growing over time.

2026 HECM vs. Traditional Mortgage Costs Compared

| Feature | HECM Reverse Mortgage | Traditional Mortgage |

|---|---|---|

| Lending Limit | $1,249,125 | $806,500 |

| Average Fixed Rate | 7.56% (8.99% APR) | 6.96% (7.25% APR) |

| Loan Duration | For Life | 15 or 30 Years |

| Upfront Insurance | 2% of Loan | $0 |

| Monthly Insurance | 0.50% | $0 |

| Low/No Closing Costs | No | Yes |

| Note: HECM lending limit corrected to $1,249,125 (as of 2026). Rates and APRs are averages. | ||

Lower Rates = More Money to YOU. Compare & save with All Reverse Mortgage, Inc. (ARLO™). Call (800) 565-1722 or get your cost quote with real-time rates and side-by-side program comparisons from ARLO™.

FAQs

How much are the closing costs on reverse mortgages?

Are reverse mortgage closing costs paid upfront or added to the loan?

Are closing costs on reverse mortgages deductible?

How is the interest paid on a reverse mortgage?

Do all lenders have the same closing costs?

Do you offer a “No Closing Cost” reverse mortgage?

What’s a typical APR for a reverse mortgage?

Can I use my reverse mortgage proceeds to pay the lender’s closing fees?

What percentage do you charge for the loan origination fee?

What percentage of the loan is charged for mortgage insurance?

Are there any reverse mortgages with no origination fee?

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

June 1st, 2023

June 7th, 2023

October 5th, 2020

October 7th, 2020

May 12th, 2025

May 30th, 2025

March 18th, 2019

March 18th, 2019