Reverse Mortgage Options for Veterans in 2025

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Question from our reader:

“We have a reverse mortgage, but we were never told there was a reverse mortgage for veterans. We have quite a bit of equity in our home. Can we refinance our current reverse mortgage to a VA reverse mortgage?”

Understanding Reverse Mortgage Options for Veterans in 2025

When exploring reverse mortgage options, it’s crucial to understand the roles of key government agencies like the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA). While both agencies are important in supporting homeowners, neither directly provides loans.

The FHA, a branch of the Department of Housing and Urban Development (HUD), insures loans to protect lenders and borrowers, while the VA guarantees a portion of loans to make homeownership more accessible for veterans. In both cases, the loans themselves are offered by private lenders, who partner with these agencies to provide insured or guaranteed financing options.

For veterans considering a reverse mortgage, understanding these mechanisms is the first step in evaluating the choices available to you in 2025.

The Elusive “Veteran Reverse Mortgage”

The Persistent Myth

Every so often, the term “reverse mortgage for veterans” reappears in financial discussions, giving the impression that a VA-backed reverse mortgage exists. You might have seen terms like “Veteran’s Reverse Mortgage” or “Kosher VA Reverse Mortgage” in advertisements or articles. However, after years of industry scrutiny, no such program officially exists. A reverse mortgage specifically tailored for veterans, with distinct guidelines and VA backing, has yet to materialize.

Personal Research and Findings

As someone committed to staying informed about reverse mortgage options (a fact my wife often teases me about), I revisited this topic recently in response to repeated inquiries. My investigation began with the U.S. Department of Veterans Affairs website, where lending programs for veterans are clearly outlined.

Among the options available, such as Purchase and Cash-Out Refinance Loans, Interest Rate Reduction Refinance Loans (IRRRL), and Native American Direct Loans, there’s no mention of a VA-guaranteed reverse mortgage. Interestingly, searching for reverse mortgages on the VA’s site redirects to a cautionary notice co-issued by the Consumer Financial Protection Bureau (CFPB) and the VA in 2012. This notice explicitly warns against misleading advertisements targeting veterans and older Americans with claims of non-existent “VA Reverse Mortgage” programs.

Staying Updated with Industry News

As a member of the National Reverse Mortgage Lenders Association, I regularly receive updates on emerging loan products. If a VA-backed reverse mortgage program were introduced, it would certainly make headlines in our industry. To date, no such program has been announced.

Clearing Up Common Misunderstandings

Many borrowers are understandably confused by marketing materials that use phrases like “VA Reverse Mortgage.” These terms often refer to the Home Equity Conversion Mortgage (HECM) program, which is administered by HUD and FHA—not the VA. While the HECM program may serve veterans well, it is not exclusive to them and does not carry VA guarantees.

Key Takeaway

Veterans exploring reverse mortgage options should be cautious of misleading advertisements and focus on understanding the programs that are actually available, such as the HECM program, to make informed financial decisions.

What the CFPB Says

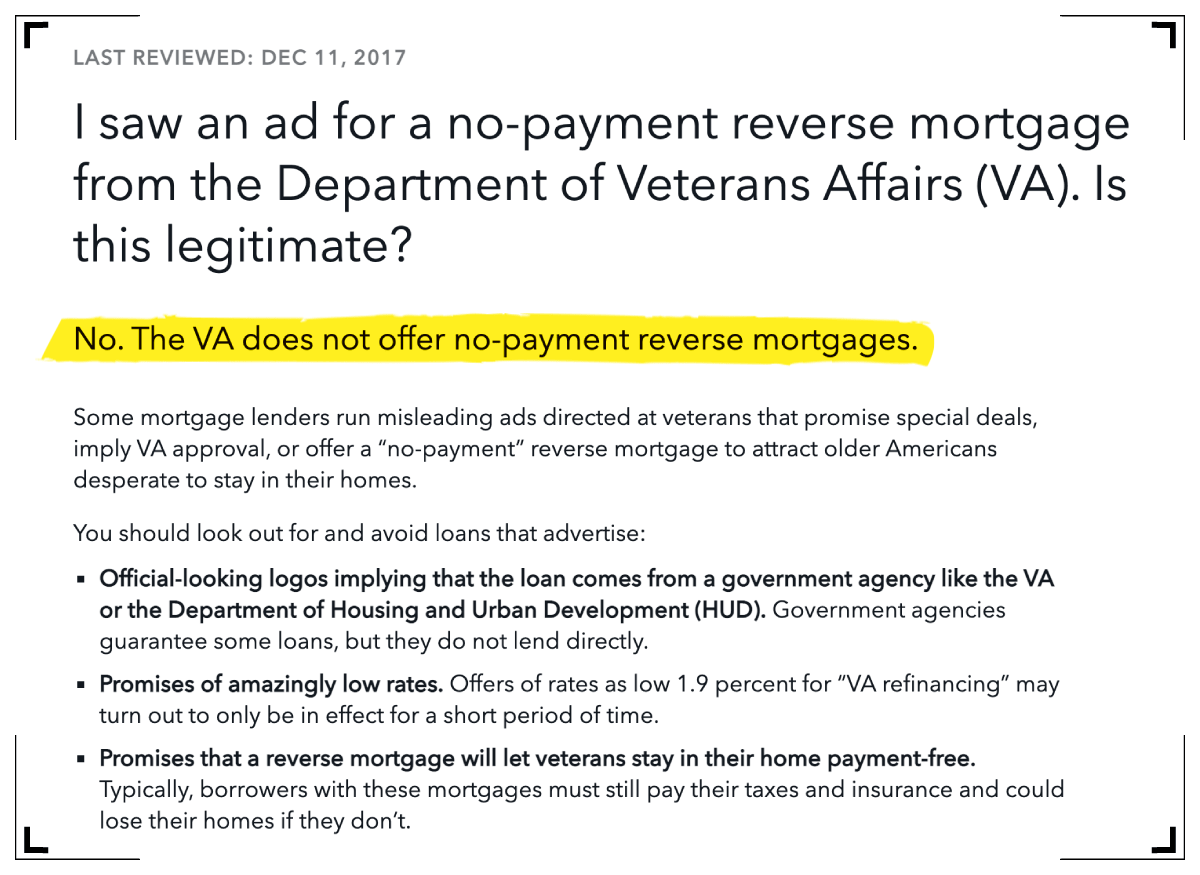

Finally, I checked the Consumer Financial Protection Bureau’s website and found the answer I sought.

This was on the official government consumer protection site regarding this exact issue:

So, there you have it.

I am sorry to say that the VA does not offer the program you seek, so the answer to your question is no, you would not be able to refinance your current reverse mortgage with a “VA reverse mortgage.” Furthermore, if you get an ad from someone saying they have such a program, I suggest you immediately toss it in the trash because that’s where it belongs!

VA Loan vs. HECM Reverse Mortgage Comparison

| Feature | VA Loan | HECM Reverse Mortgage |

|---|---|---|

| Min. Age | 18 | 62 |

| Lending Limit | $806,500 | $1,149,825 |

| Monthly Payments | Required | None Required |

| Income/Credit | Full doc, 660 min. score | Limited doc, no min. score |

| Loan Term | 15 or 30 years | For life |

| Closing Costs | Low/No | Standard |

| Best For | Buying or refinancing | Tapping equity in retirement |

FAQs

Does the VA offer reverse mortgages?

Can you refinance a VA loan to a reverse mortgage?

Can I sell my house if I have a reverse mortgage?

Would a military retired and disabled veteran be better off getting a VA guarantee equity home loan than a reverse mortgage?

Can a reverse mortgage impact my ability to secure a VA loan?

Can I use my GI bill (VA benefits) on a reverse mortgage?

Can I use my VA loan to repay my parent’s reverse mortgage?

Can I use a reverse mortgage to payoff my VA loan?

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

June 9th, 2023

June 9th, 2023

April 30th, 2022

May 10th, 2022

March 19th, 2022

March 22nd, 2022

March 9th, 2022

March 9th, 2022

July 23rd, 2021

July 25th, 2021

October 12th, 2019

October 12th, 2019

August 19th, 2019

November 30th, 2018

November 30th, 2018

November 5th, 2018

November 5th, 2018