America's #1 Rated Reverse Mortgage Lender*

Banks That Offer Reverse Mortgages in 2026 | Compare Rates & Reviews

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

In 2026, only a few regional and specialty banks offer reverse mortgages, including University Bank, The Federal Savings Bank, and Magnolia Bank. Most large banks left the market years ago, so many borrowers choose specialized non-bank lenders for better rates and service.

Do Banks Offer Reverse Mortgages in 2026?

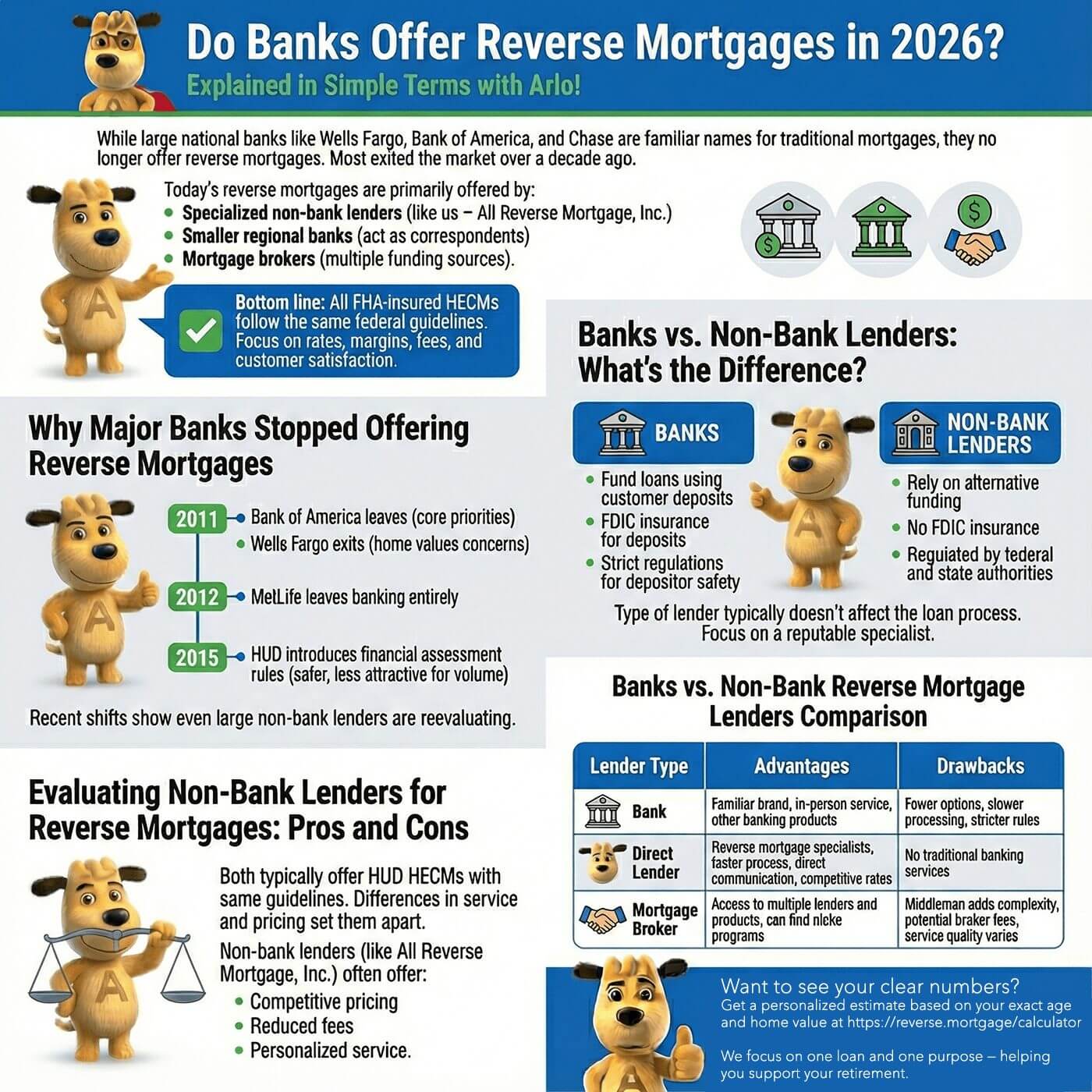

While large national banks like Wells Fargo, Bank of America, and Chase are familiar names for traditional mortgages, they no longer offer reverse mortgages. Most exited the market over a decade ago, citing regulatory changes, market risk, and shifting business priorities.

Instead, today’s reverse mortgages are primarily offered by:

- Specialized non-bank lenders (like us – All Reverse Mortgage, Inc.)

- Smaller regional banks that act as correspondents for wholesale reverse mortgage lenders

- Mortgage brokers with access to multiple funding sources

Bottom line: Whether you work with a bank or a non-bank lender, all FHA-insured Home Equity Conversion Mortgages (HECMs) follow the same federal guidelines — so your focus should be on rates, margins, fees, and customer satisfaction, not the brand name alone.

Why Major Banks Stopped Offering Reverse Mortgages

From the early 2000s to approximately 2012, major banks such as Wells Fargo, Bank of America, and MetLife Bank were significant providers of reverse mortgages. But several factors caused them to exit:

- 2011 – Bank of America leaves, citing that reverse mortgages no longer fit its core priorities.

- 2011 – Wells Fargo exits, citing concerns over home values and borrower obligations.

- 2012 – MetLife leaves banking entirely, selling its deposit business and ending reverse mortgage programs.

- 2015 – HUD introduces financial assessment rules, making the loans safer for borrowers but less attractive to large institutions focused on volume.

Recent industry shifts — such as AAG selling its servicing portfolio — indicate that even large non-bank lenders are reevaluating their approach to reverse mortgages.

Banks vs. Non-Bank Lenders: What’s the Difference?

When exploring reverse mortgage options, it’s important to understand the distinction between banks and non-bank lenders.

Banks fund loans with customer deposits and offer protection for those deposits through the Federal Deposit Insurance Corporation (FDIC). They operate under strict regulations to ensure the safety of depositors’ money. Non-bank lenders, on the other hand, rely on alternative funding sources and do not offer FDIC insurance, though they are still regulated by federal and state authorities.

Some lenders may operate as a hybrid, functioning as both a bank and a non-bank lender. However, for reverse mortgage borrowers, the type of lender typically does not affect the overall loan process. Regardless of the lender’s structure, the focus should remain on finding a reputable company that specializes in reverse mortgages and offers transparent terms.

Evaluating Non-Bank Lenders for Reverse Mortgages: Pros and Cons

When considering a reverse mortgage, both banks and non-bank lenders typically offer HUD Home Equity Conversion Mortgages (HECM) that follow the same federal guidelines. However, differences in service and pricing can set lenders apart.

While some borrowers may feel more comfortable with traditional banks, non-bank lenders like All Reverse Mortgage, Inc. often offer several advantages. These lenders frequently offer more competitive pricing, reduced fees, and personalized customer service while maintaining the same HECM loan terms.

Ultimately, the choice comes down to selecting a lender that meets your specific needs and delivers exceptional support throughout the reverse mortgage process. Comparing options ensures you get the best possible terms and experience.

Banks vs. Non-Bank Reverse Mortgage Lenders

| Lender Type | Advantages | Drawbacks |

|---|---|---|

| Bank | Familiar brand, in-person service, other banking products | Fewer reverse mortgage options, slower processing, stricter rules |

| Direct Lender | Reverse mortgage specialists, faster process, direct communication, competitive rates | No traditional banking services |

| Mortgage Broker | Access to multiple lenders and products, can find niche programs | Middleman adds complexity, potential broker fees, service quality varies |

Tip: Most borrowers choose direct lenders for faster service, specialized expertise, and lower costs.

Reverse Mortgage Banks in 2025/2026 — Performance & Reviews

| Bank Name | BBB Rating | Accredited | Years Open | Loans Last Year | Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|---|

| University Bank | A+ | Yes | 135 | 69 | N/A | N/A | 0 | View BBB Profile |

| The Federal Savings Bank | A+ | Yes | 13 | 48 | 4.3/5 | 86.0% | 64 | View BBB Profile |

| Magnolia Bank | A+ | Yes | 106 | 20 | 3.46/5 | 69.2% | 9 | View BBB Profile |

| Bank of Utah | A+ | No | 73 | 18 | N/A | N/A | 0 | View BBB Profile |

| Central Pacific Bank | A+ | No | 71 | 9 | 1.0/5 | 20.0% | 4 | View BBB Profile |

| Northpointe Bank | A+ | Yes | 2526 | 8 | 1.87/5 | 37.4% | 35 | View BBB Profile |

| Tri Counties Bank | A+ | No | 51 | 8 | 1.0/5 | 20.0% | 15 | View BBB Profile |

2026 Reverse Mortgage Bank Performance — Best & Worst

Based on 2026 data, University Bank and Bank of Utah stand out for having no BBB complaints and long-standing reputations for trust, although neither reported public star ratings. The Federal Savings Bank earned strong customer satisfaction scores (4.3/5 stars, 86% positive) but had a higher complaint count at 64.

On the other end of the spectrum, Central Pacific Bank, Northpointe Bank, and Tri Counties Bank received very low customer ratings (1.0–1.87 stars) with positive review rates under 40%, indicating a high level of borrower dissatisfaction.

Key takeaway: Even with an A+ BBB rating, service quality and borrower experiences vary widely between banks. Always compare, not just trust, scores, but also star ratings, positive review percentages, and complaint history before choosing a lender.

Frequently Asked Questions

Which banks currently offer reverse mortgages?

Does Chase Bank offer reverse mortgages?

Why don’t big banks offer reverse mortgages anymore?

Is there an advantage to using a bank instead of a mortgage lender?

Do banks offer proprietary or jumbo reverse mortgages?

Will the bank take my home if I have a reverse mortgage?

How can I be sure I’m choosing the right reverse mortgage company?

Key Takeaway: Banks and non-bank lenders offer reverse mortgages under the same FHA HECM guidelines. However, non-bank lenders often provide faster service, more competitive pricing, and specialized expertise, while banks may offer fewer options and slower processing times.

Get Expert Advice from All Reverse Mortgage, Inc. (ARLO™) — America’s #1 Rated Lender* with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote — simple, trusted, 100% secure!

Related Resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!