America’s #1 Rated Reverse Lender*

Reverse Mortgage Solutions Bankruptcy & Effects on Seniors

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

What if my reverse mortgage with Reverse Mortgage Solutions (RMS) files chapter 11 bankruptcy? – Hilda

Hello Hilda,

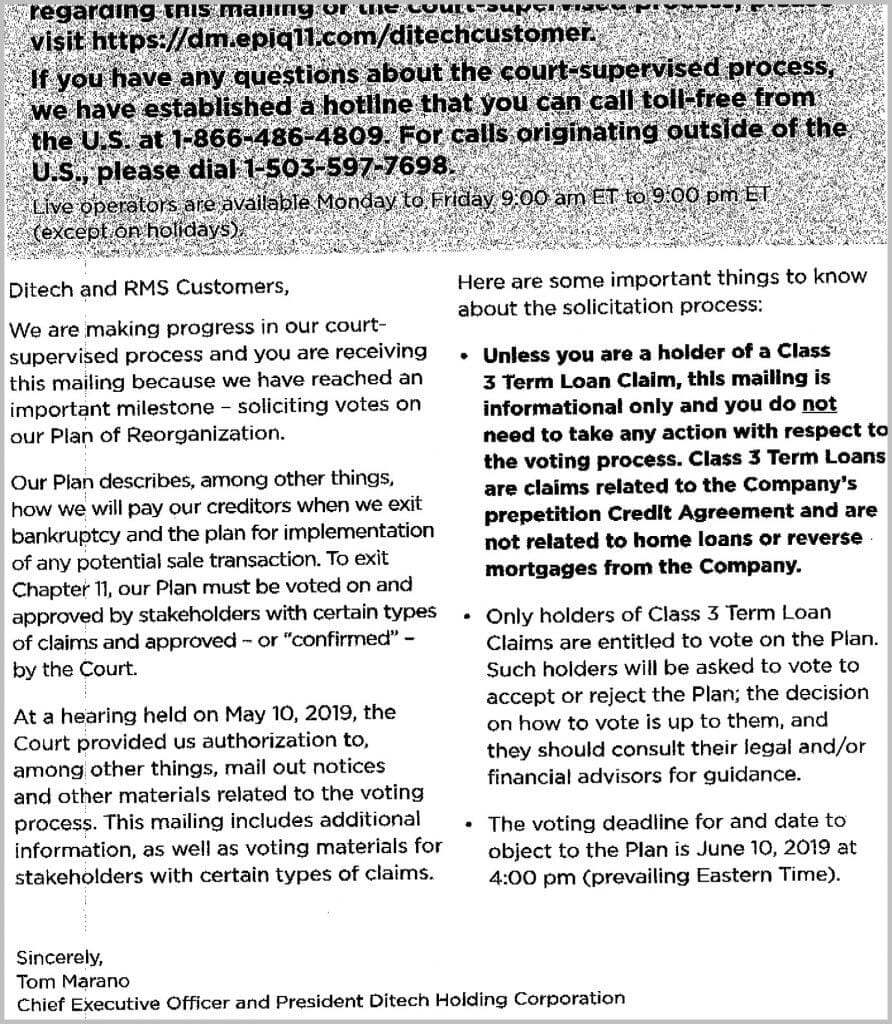

I believe you are referring to the letter that went out to all customers of Reverse Mortgage Solutions, Inc. (RMS) and their affiliates.

We cannot give you legal advice so this is a quick reminder of how the reverse mortgage works and if you feel you need further legal advice, we can only encourage you to contact your attorney.

HECM Loans are Guaranteed by HUD

Firstly, if you have a reverse mortgage that is the HUD/FHA Home Equity Conversion Mortgage (HECM or “Heck-um”), your loan is insured by the federal government and HUD will step in to ensure that you will always receive any funds due to you on that loan.

If you have a jumbo or proprietary reverse mortgage with a line of credit (and I do not know if they were even servicing any), you may want to determine if all your funds have been disbursed to you or not.

If you already have all your proceeds, the servicer can change at any time and you should not be adversely affected because there are no further disbursements to be made.

Mortgage loans being serviced are an asset for the lender.

If this lender can do whatever is needed to continue operations through their attempt at Chapter 11 restructuring, there may be no need to do anything and you may be operating the same as always for the life of the loan.

But since the loans held in their servicing portfolio are saleable assets, they could sell the loans to another lender/servicer at any time.

If Reverse Mortgage Solutions (Ditech Financial) is unsuccessful at their debt restructuring and they must exit lending entirely, your loan would be sold to another lender who also services reverse mortgages.

Refinance to a New Reverse Mortgage Servicer

If you feel concerned and want to check a refinance availability, there is nothing that would stop you from doing so.

It might be a great opportunity to check your availability to additional funds, but I would tell you that this is not something you should do as a panic move.

If you are interested in finding out if you are eligible to refinance the loan and what those options may look like, we can help you with that.

But those with the HUD HECM loan should take heart in the knowledge that they have the HUD assurances and that they will not be left high and dry no matter how the circumstances turn out.

And as I stated, anyone who has taken a full draw of the funds available to them, regardless of the loan program, should not be adversely affected due to the limited role the servicer has with the borrower at that point.

If you have concerns, if you need any specific questions answered, you really do need to reach out to your trusted legal advisor.

This explanation is only to help explain what the safeguards for borrowers are with the program.

As stated, we cannot give you legal advice (even the notice sent to borrowers says they cannot either) so if you are asking about legal ramifications, possible claims, liability, etc., you absolutely must contact your attorney.

ARLO recommends these helpful resources:

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

December 9th, 2022

December 15th, 2022

April 5th, 2021

April 7th, 2021

March 15th, 2021

March 16th, 2021

September 29th, 2020

September 30th, 2020

June 10th, 2020

June 10th, 2020

September 29th, 2019

September 29th, 2019

August 19th, 2019

August 19th, 2019

June 20th, 2019

June 20th, 2019

May 31st, 2019

May 31st, 2019

May 30th, 2019

May 30th, 2019

May 20th, 2019

May 20th, 2019

May 20th, 2019

May 20th, 2019