America’s #1 Rated Reverse Lender*

Quicken Reverse Mortgage Review (2023 Update)

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

The national reverse mortgage landscape comprises lenders large and small. Some are regional, some are national; some are banks, others are non-bank lenders. Over the course of the last 10 years, the lender landscape has shifted from one that had several banks, to today where most of the top lenders by volume are non-bank mortgage lenders.

One of those companies is Quicken Reverse Mortgage, which carries a very prominent national presence and originates reverse mortgages through its One Reverse business channel. Over the years, Quicken has held a steady presence in the reverse mortgage space, typically appearing as one of the top 10 lenders by volume year after year.

Summary:

- One Reverse Mortgage, operated by national lender Quicken Loans, holds a steady place among the top reverse mortgage lenders by volume.

- One Reverse operates as a business channel under Quicken, which is known for its innovation of the mortgage process and user-friendly online platform

- Quicken originates loans over the phone via licensed professionals

Quicken entered the reverse mortgage market when it purchased One Reverse Mortgage in 2008 for an undisclosed sum. In a short period of time, it ramped up its reverse mortgage production and rose the ranks to become one of the top lenders.

Its volume peaked in 2015 with more than 5,300 loans annually, before reverse mortgage product changes were made by the Federal Housing Administration that impacted volume nationwide.

Quicken Reverse Mortgage Facts

| PROS |

|---|

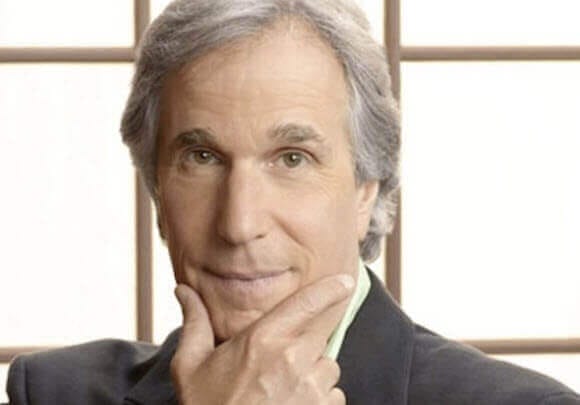

| Recognizable brand that uses Henry Winkler pitchman on National TV |

| Founded in 1985 and currently employs 17,000 with branches in Detroit, Michigan; Cleveland, Ohio; Phoenix, Arizona; San Diego, California and Charlotte, North Carolina. |

| Offers both HECM and Proprietary Jumbo program (HERO) |

Quicken Reverse Mortgages Originated

| Year | Loans | National | Market Share |

|---|---|---|---|

| 2018 | 3,002 | 17,784 | 16% |

| 2017 | 3,093 | 55,322 | 6% |

| 2016 | 3,696 | 48,902 | 7% |

| 2015 | 5,372 | 58,043 | 9% |

| 2014 | 4,857 | 51,642 | 9% |

| 2013 | 5,306 | 60,091 | 9% |

| 2012 | 4,907 | 54,822 | 9% |

| 2011 | 4,361 | 73,131 | 6% |

| 2010 | 3,083 | 79,106 | 4% |

| 2009 | 2,698 | 114,692 | 2% |

| 2008 | 537 | 112,154 | .05% |

Source: https://apps.hud.gov/pub/chums/f17fvc/hecm.cfm

Quicken and reverse mortgages

Quicken has risen to become one of the most prominent lenders in the country, in part due to its national presence and multimillion dollar national advertising efforts. It is known for advertising extensively on TV, including media buys in major events, such as the Super Bowl.

Its reverse mortgage division has partnered with celebrity spokesmen and spokeswomen including Henry Winkler, or “The Fonz,” of Happy Days fame.

Quicken’s rise in reverse mortgages

- 2008 — Quicken enters reverse mortgage market with One Reverse Mortgage purchase

- 2009 — Quicken names Jay Farner CEO of One Reverse. Farner brings experience from Quicken’s Web Mortgage Banking group

- 2013 — One Reverse volume peaks

- 2018 — One Reverse rolls out proprietary product HELO

What’s new with Quicken reverse mortgages?

Quicken’s One Reverse Mortgage company continues to be prominent in the reverse mortgage space. Recently, the company announced the launch of a proprietary reverse mortgage, which it offers in addition to the Home Equity Conversion Mortgage product insured by the Federal Housing Administration.

One Reverse has major offices in Detroit, alongside Quicken’s headquarters, as well as San Diego area. The company maintains a national presence. After long being a retail reverse mortgage lender, meaning One Reverse Mortgage originated all of its loans through its own originators, the company decided to launch a wholesale channel.

Through the wholesale channel, One Reverse can also close loans that are originated through independent mortgage brokers. Also more recently, the company entered the proprietary reverse mortgage market with its “HELO” product in August 2018.

The Home Equity Loan Optimizer (HELO), is available to qualifying homeowners with high-value homes, including some condominiums and homes with solar panels. The amount clients may receive in proceeds is up to $4 million with the HELO product.

Where to get a reverse mortgage

There are many active lenders in the reverse mortgage space today — including banks and non-bank lenders — as well as brokers who can help prospective borrowers navigate the different loan options and interest rates that are available.

A good place to begin is gathering a few pieces of information including your age (and the age of your spouse, if you are married), and your home address so that a reverse mortgage calculator can give a rough estimate of the amount you may be able to borrow.

Visit ARLO, the All Reverse Loan Optimizer, to help you get started.

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

November 26th, 2020

November 26th, 2020

September 8th, 2020

September 8th, 2020

January 21st, 2020

January 21st, 2020

October 12th, 2019

October 12th, 2019

July 29th, 2019

July 29th, 2019

June 23rd, 2019

June 23rd, 2019

May 11th, 2019

May 14th, 2019

May 10th, 2019

May 10th, 2019