Beware: Reverse Mortgage Home Warranty Scam

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

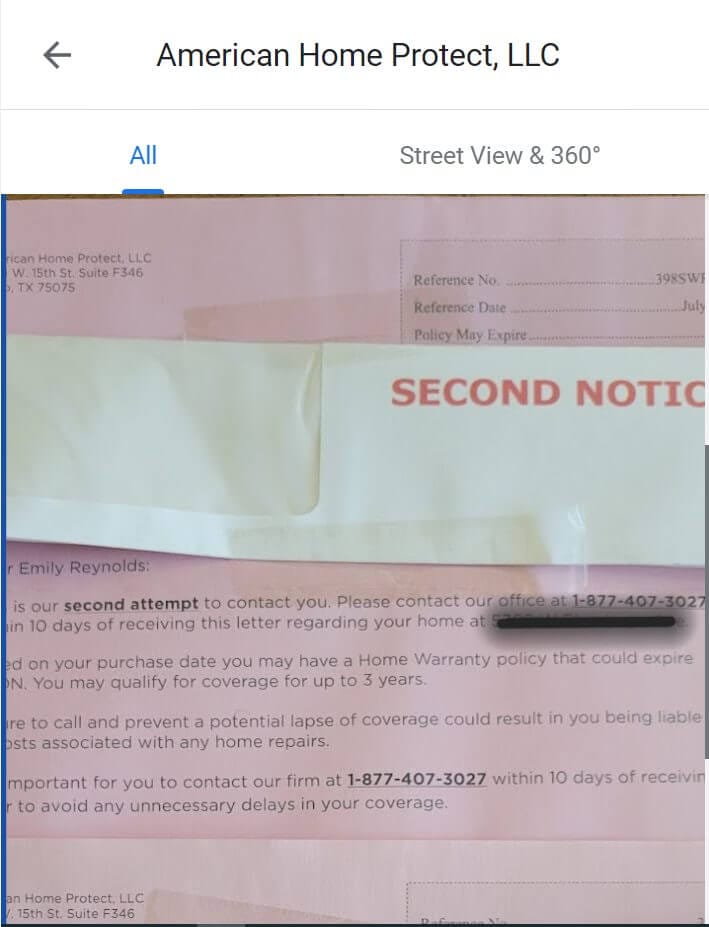

When I obtained a HECM through ARLO two years ago, the company never said anything about activating a Home Warranty Policy. The letters claim YOUR company took out a home warranty policy. Nothing in the stacks of documents provided by your company indicates this fact. I am now getting letters saying it will expire and that my home is subject to foreclosure if I do not sign up for a Home Warranty Policy. The letters claim that the policy is required to keep one’s home in proper repair. Such a policy costs several hundred dollars a month! Why did it release my information to these obvious predators? They are from Helping Hand Home Warranty of Palm Beach, FL—American Home Protect of Dallas, TX, and a third place that did not identify itself. I do not appreciate my personal information being released to third-party companies. This is a violation of HUD policy. I do not appreciate getting letters that look late on my billing. Letters plastered with SECOND NOTICE, THIRD, NOTICE, and FINAL NOTICE. Nor getting phone calls indicating they will foreclose on my loan if I do not return their calls. The company services my HECM and shows no issues with the status of my loan. -Nick

Hello Nick,

I want to take a moment to explain a couple of things to you as well as assure you that at no time have we ever given your information to any third parties other than the ones we initially disclosed to you (credit reporting agency, title company, the lender who now services your loan) but never anyone who seeks to sell you any services.

We did not activate a home warranty. The letter you received is a scam.

I have a copy of the letter (or a very similar one) you reference below, reported by other homeowners whom this company has also scammed with this same ploy. We have written about companies who commit this type of fraud and other scams for the sale of services or refinances on a few occasions on our website, but please allow me to address this for you.

A home warranty is not required as a condition of any reverse mortgage

First, let me assure you that a home warranty is not required as a condition of your reverse mortgage. In fact, it is not a condition for any loan of which I am aware. I have not seen the exact letter you received, but most are usually worded very carefully so that they are just touching the boundaries of illegality but not entirely stepping over where they suggest it might be a good idea or maybe needed but stop short of saying that it is a requirement of the loan.

Example home warranty solicitation

The letter you received may be the same or similar to the letter below that I pulled from complaints online about the company you referenced. The letter is carefully worded to say it is the second attempt to contact you. That failure to respond could result in a lapse of coverage but does not state that they will foreclose.

So, the second notice looks ominous but falls short of saying it is a loan requirement. If yours does say that, it is fraud.

What you can do:

You can choose to throw it either away (as well as any other solicitations you receive for similar services if you do not want them), or you can forward them to the Consumer Financial Protection Bureau (CFPB) complaint department, the Financial Trade Commission (FTC) Fraud Division, or through your state.

Again, I have yet to see the solicitation you received, but sending mail that falsely suggests that it comes from your lender or a government entity is illegal. The letter below also suggests that you may have a home warranty that could expire soon. That is their way of keeping the letter from being fraudulent by not saying you do, but based on the date of your purchase or last loan, you should probably get a new warranty. While misleading, it doesn’t say you do, so it isn’t untruthful.

Some letters mention who the lender is but in such a way that it has the lender’s name on it but doesn’t say it is from that lender. It is also confusing, but if you read the print, it clears them of being truthful.

How scammers get your information

Secondly, since there is no requirement for a home warranty with a reverse mortgage, there is no risk that the loan will be foreclosed unless you act to place such a policy on your home at this time. Scammers can get information about you, your property, and the loans on the home from public sources like the country recorder’s office just by looking at the information that is recorded with every loan online.

If I were a betting man, I would bet that there is no mention of the loan servicer name in the letters you received because the loan sale is done with an electronic transfer, and the scammers don’t have access to that information. They can only pull the public information available, which shows a copy of the original recorded Deed or Mortgage.

Finally, when I did a little research online for the company for your reference, American Home Protect of 3460 Lotus Drive in Plano, Texas, has terrible ratings with Google reviews and the BBB! Based on the online comments, many people say the same thing you said here: they are a scam. People post pictures of the letters they receive and recount their experiences; they all share the same stories.

Bottom line: This company is bad news and should be out of business.

Rest assured, you have no liability with them, and all you need to do is throw anything they send you in the trash. I wish I could tell you that there is some way to keep from receiving additional notices like this in the future from them or other scammers, but they don’t need anything other than public records to try to run their scams.

I have been a mortgage banker for over 45 years, but the first reverse mortgage I ever closed was for my mom in 2005. In her later years, I took over all her banking, bill paying, and mail for her. She received junk mail like this at least every other month and sometimes multiple times a month. I was astounded by the volume of “stuff” she received about her loan, other credit items, and the levels some went to to get her to send them money, order services, or refinance her loan. But seldom did it rise to the level of what this company is doing.

As an individual over the age of Medicare eligibility, my wife and I receive junk mail constantly, in addition to emails and calls trying to trick us into purchasing things or sending money for various reasons. The only advice I can give is to stay vigilant.

Please rest assured that we will never give any of your information to any third parties trying to sell you any services or for any reason, let alone fraudsters like this company.

Please contact us with any questions or concerns you may have.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

November 8th, 2025

November 19th, 2024

December 13th, 2024

January 31st, 2026

February 5th, 2026

May 4th, 2024

February 6th, 2024

December 28th, 2023

December 28th, 2023

September 14th, 2023

September 14th, 2023