America’s #1 Rated Reverse Lender*

Downright Illegal Reverse Mortgage Advertising Scams

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Downright Despicable (and illegal) Advertising

Every once in a while, we run into misleading or questionable advertising. Then there are times we see things that are downright misleading and illegal, and we should bring those to people’s attention so that borrowers and their families will not fall prey to bad actors.

I was at my mom’s house over the weekend, helping her with her bills. I opened an envelope she had set aside in which she said she would call the people on the letter because she felt it was necessary.

It had no return address on the envelope, just the word VERIFY stamped boldly in red on the face, with my mom’s name and address showing through the envelope window. My mom has a reverse mortgage and knows she must complete her annual occupancy certification.

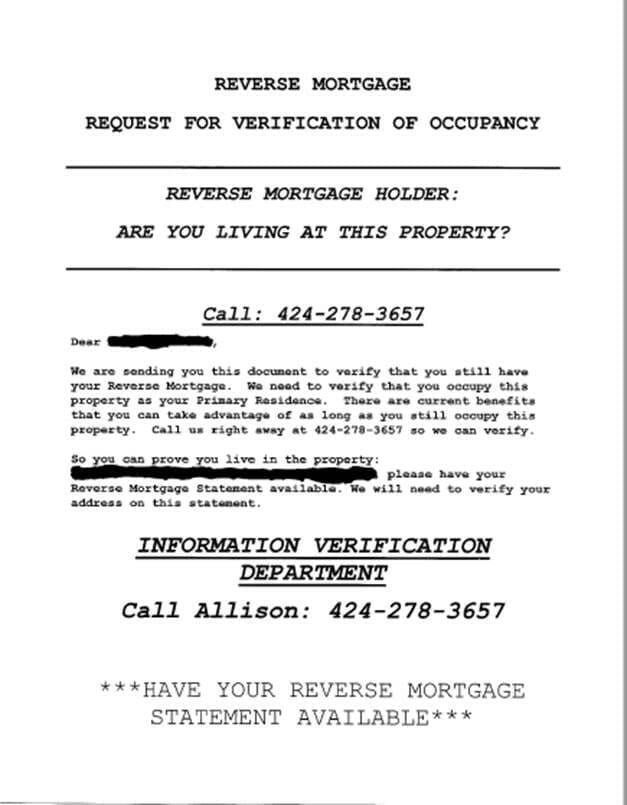

This is what came to her home:

(No return address)

(Letter with no NMLS number, company info, etc.)

My mom was confused because although this does not say it is from her lender, it doesn’t say who it is from, and it does say they need to verify her occupancy.

It doesn’t say anywhere who the lender is, there is no state licensing information or NMLS number, and my mom was rightly confused, so she set it aside to ask me for help before calling (thank goodness).

Folks, this kind of solicitation is illegal and unethical!

We tried to call the number on the form, and a man’s voice answered an answering machine. It did not identify a company, licensing information, or where you just called. After several searches, we can only determine that the number is a cell phone number. Still, no listed company or person exists for this number, and reverse number searches turn up nothing. The name “Allison” reveals nothing.

We can only deduce that this is a scam trying to make you believe your current lender is doing an occupancy inspection. More than that, it is illegal because it does not give you any of the information for the person/company trying to obtain your financial information.

We hate to see borrowers scammed, and if they get you to call them on pretenses, you can’t believe that the loan they will quote you will be truthful, either. In fact, there is no way to know if the company or person who sent this out is licensed to do so.

All advertisements must be clear about the sender’s intent and the relationship but must also identify the licensing information of the individual who sent it. Not only do we not have “Allison’s” complete name information, but there’s also not even a license number or company name for borrowers to check.

Make sure any advertising you consider answering has good company and individual information. There should be a notice telling you the originator’s full name, who they are licensed by, and their license number. There should be an address and a working phone number, not just one number to a cell phone voicemail, with no other way to contact them.

Folks, if you or a family member receives something like this, throw it immediately in the trash or use it only to contact the Office of the District Attorney to report the financial crime of false advertising, consumer fraud, and unlawful and unfair business practices in the county in which you reside.

Most DA websites have information on how to file a complaint right on the front page, and if you feel so inclined, let them hear from you.

We will send this one out because it is deceptive and potentially harmful to seniors. I am pleased that my mom put this one aside and was not scammed, and I hope that by posting this information, you or one of your loved ones are not either!

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!