Thornton's #1 Reverse Mortgage*

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Thornton Reverse Mortgage Lenders

At All Reverse Mortgage, Inc. (ARLO™), we’re honored to be recognized by the Better Business Bureau as Colorado’s top-rated reverse mortgage lender. We proudly hold a perfect 5.0-star rating and an A+ exemplary rating. With 20 years of experience, we’re dedicated to serving the needs of homeowners across 15 states, including right here in beautiful Colorado.

Since our founding in November 2004, we’ve focused exclusively on one thing: reverse mortgages. We believe in offering only the best, which is why we’re committed to providing you with the lowest rates and most competitive prices available.

As a HUD-approved direct lender, we offer the national HECM programs along with specialized non-FHA and jumbo reverse mortgages. This means we can help Colorado homeowners with high-value properties that exceed the national 2025 lending limit of $1,249,125.

We encourage you to compare our reviews, lower rates, and closing costs with those of any other major lender. The difference speaks for itself, and we’re excited to show you how we can help you maximize your home’s equity.

We are fully licensed by the Colorado Department of Regulatory Agencies (DORA), ensuring that you receive top-tier service and support from a trusted local partner. (License/Registration #100032569)

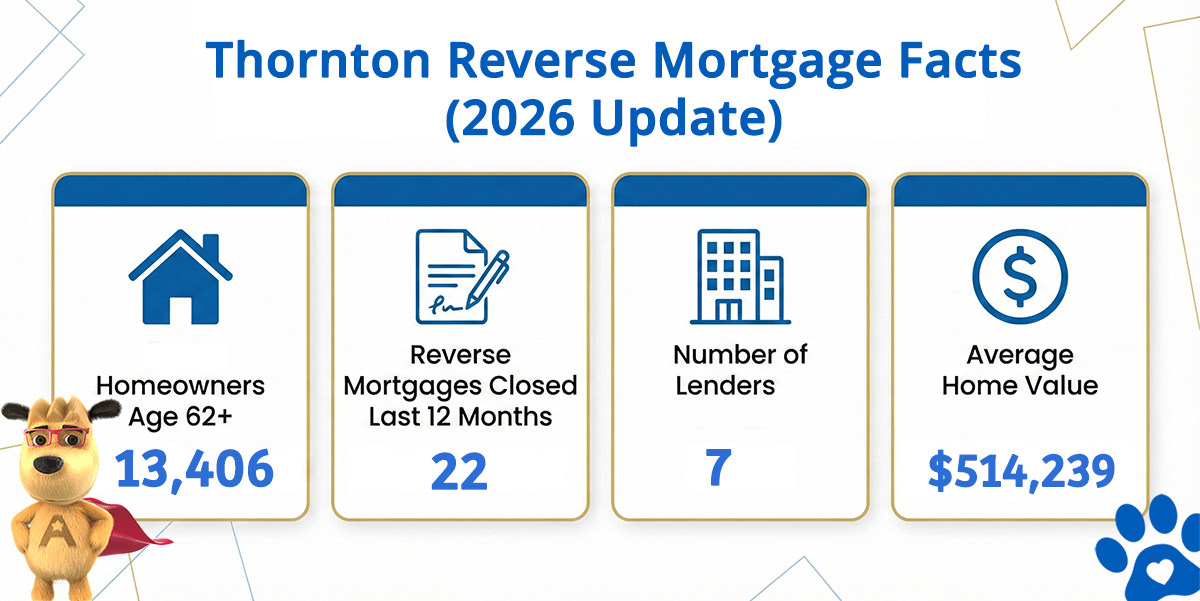

Thornton Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Thornton (est) | Avg. Home Value |

|---|---|---|---|---|

| Thornton | 13,406 | 22 | 7 | $514,239 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

HUD-Approved Direct Reverse Mortgage Lender Serving Thornton

All Reverse Mortgage, Inc. is a HUD-approved direct lender authorized to originate loans under the FHA Home Equity Conversion Mortgage (HECM) program, commonly known as a reverse mortgage.

A HECM is a federally insured loan available to homeowners age 62 and older. It allows eligible borrowers to access a portion of their home equity while deferring required monthly mortgage payments, provided they continue to occupy the home as their primary residence and meet standard homeowner obligations, including property taxes, homeowners’ insurance, and basic property maintenance.

This page is intended to provide local, factual context for homeowners in Thornton who are evaluating whether a reverse mortgage fits into their broader financial plans.

What the Thornton Data Shows

Thornton has 13,406 homeowners age 62 and older, with 22 FHA reverse mortgages completed in the most recent 12-month period.

This modest level of activity indicates that while many homeowners meet age and home-value eligibility requirements, most take a cautious, information-first approach before moving forward. A reverse mortgage is a long-term financial decision and should be evaluated carefully.

Homeowners in Thornton most commonly explore reverse mortgages to:

-

Pay off an existing mortgage and eliminate required monthly payments

-

Improve monthly cash flow during retirement

-

Establish a line of credit for future needs rather than immediate use

-

Compare FHA-insured HECM loans with proprietary jumbo reverse mortgage options

Borrowers retain title to their home and may sell or refinance at any time without a prepayment penalty.

Important requirement: The home must remain your primary residence, and you must continue to pay property taxes, homeowners’ insurance, and maintain the property in accordance with FHA guidelines.

Home Values and Reverse Mortgage Lending Limits in Thornton

The average home value in Thornton is $514,239, placing most owner-occupied homes well within the 2026 FHA HECM lending limit of $1,249,125.

For eligible homeowners, the FHA-insured HECM program includes several consumer protections, including:

-

Required independent HUD counseling

-

Non-recourse protection so neither the borrower nor heirs owe more than the home’s value

-

Flexible payout options, including a line of credit that can grow over time

Homes valued above the FHA limit may qualify for proprietary jumbo reverse mortgage programs. Because these loans are privately funded and not FHA-insured, understanding differences in structure, costs, and long-term protections is essential before proceeding.

About All Reverse Mortgage, Inc.

Reverse mortgages are all we do.

Our team has more than 20 years of experience helping older homeowners understand reverse mortgage options clearly and responsibly. We have worked exclusively in the reverse mortgage space since 2004 and were involved in the early development of fixed-rate jumbo reverse mortgage programs.

This experience is especially relevant in communities like Thornton, where:

-

Home values vary by neighborhood

-

FHA lending limits accommodate most homes

-

Proprietary programs may be relevant in select higher-value situations

Our role is to explain these distinctions clearly so homeowners can evaluate their options with a full understanding of potential outcomes.

Is a Reverse Mortgage a Good Fit in Thornton?

A reverse mortgage is not appropriate for every homeowner. In the right situation, however, it can be a practical retirement-planning tool.

Thornton homeowners often consider a reverse mortgage to:

-

Eliminate an existing mortgage payment

-

Improve monthly cash flow during retirement

-

Access home equity without selling the home

-

Remain in their home long term

Because reverse mortgages affect long-term finances and home equity, accuracy and transparency matter more than speed.

Ready to Unlock Your Home’s Equity?

As Thornton’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

As a fully licensed lender by the Colorado Department of Regulatory Agencies (DORA) (License #100032729), we’re committed to helping you secure the retirement you deserve.

Get Your Free Quote from Thornton’s #1 Rated Reverse Mortgage Lender, or call (303) 536-8890 to speak with a friendly expert today.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald