Serving Greeley Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

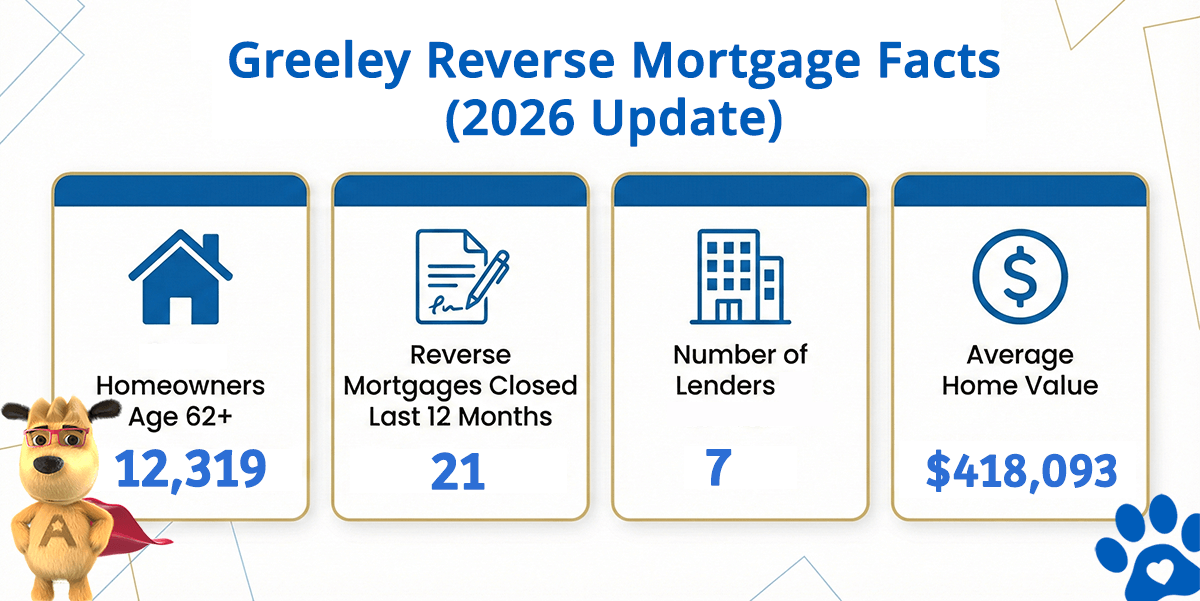

Greeley Reverse Mortgage Market at a Glance

Greeley Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Greeley (est) | Avg. Home Value |

|---|---|---|---|---|

| Greeley | 12,319 | 21 | 7 | $418,093 |

What the Numbers Tell Us About Reverse Mortgages in Greeley

Greeley, Weld County’s county seat, blends agricultural heritage with modern economic diversification, anchoring Northern Colorado’s secondary market. With median home values near $418,093 and a resilient population of 12,319 residents age 62 and older, homeowners here maintain meaningful equity in their primary residences. At the current FHA lending limit of $1,249,125, most Greeley properties qualify for substantial borrowing capacity, offering retirees genuine options for accessing their equity without selling.

Greeley attracts families and retirees seeking community stability with lower costs than Colorado Front Range metros. The city’s blend of agricultural identity and growing tech-sector presence creates diverse employment backgrounds among long-term residents. With strong homeownership rates and established neighborhoods, Greeley homeowners have typically built solid equity positions over their tenure, making equity-based strategies increasingly relevant as they transition into retirement.

The Northern Colorado lending ecosystem includes active FHA-approved lenders serving Weld County. This competitive dynamic ensures you have meaningful choices when evaluating reverse mortgage partners and comparing available terms.

Greeley’s residential character spans from historic downtown revitalization areas to newer suburban developments northeast of I-25. Many residents chose to stay in Greeley for family, community connections, and genuine quality of life—factors that often correlate with aging in place intentions. This long-term residential commitment, paired with building equity over decades, positions many Greeley homeowners as natural candidates for reverse mortgage exploration.

How a Reverse Mortgage Works for Greeley Homeowners

A reverse mortgage is an FHA-insured loan exclusively for homeowners age 62 and older. Unlike traditional mortgages, you make no monthly payments. Instead, the lender advances funds based on your home equity, and repayment occurs when you sell, relocate, or pass away. The HUD HECM program has offered this structure since 1989, with comprehensive consumer protections and federal regulatory oversight.

For Greeley homeowners, the mechanism is transparent: you keep full ownership, maintain all decision-making control, and benefit from FHA insurance protection. Reversing your mortgage obligations allows you to choose your funding method—lump sum, monthly payments, line of credit, or combinations—aligned with your specific retirement needs.

Common Uses in Greeley

- Healthcare and Assisted Living Transitions — Greeley homeowners frequently use reverse mortgage funds for home health services, assisted living supplements, or medical care enabling them to maintain independence. Explore how retirees have used these proceeds for life transitions.

- Pension Gap Solutions — Those with modest Social Security or pension income bridge income gaps during retirement without drawing down savings aggressively. Understand the rules governing income supplementation.

- Critical Home Repairs and Maintenance — Rural and semi-rural properties demand attention to roofing, heating, and foundation work. Reverse mortgage capital allows you to address maintenance without liquidating reserves. Check property qualification criteria for your Greeley home.

- Family Support and Grandchild Education — Many use proceeds to support family members or fund educational goals while preserving primary assets. Learn about non-recourse loan protection and how it secures your heirs’ interests.

Greeley Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | Must be at least 62 years old; explore age-related options for married couples and spousal considerations. |

| Home Ownership | You must own your Greeley home outright or hold substantial equity (typically 50%+). Condominiums require FHA project approval. |

| Primary Residence | The home must be your primary residence; rental properties and secondary residences are not eligible. |

| Property Type | Single-family homes, townhomes, and FHA-approved condos qualify. Manufactured homes have distinct eligibility pathways. |

| Financial Assessment | Lenders conduct a financial assessment to confirm your capacity to maintain property taxes, insurance, and any applicable HOA dues. |

| Counseling | A HUD-approved counseling session (free and independent) is required before loan closing. |

Use our free reverse mortgage calculator to discover your potential borrowing amount based on your Greeley home value and age.

Understanding the Costs

Reverse mortgages involve legitimate expenses: origination fees, appraisal charges, title insurance, and FHA mortgage insurance (both upfront and annual). Total costs typically range from 2% to 5% of your loan amount, with accruing interest compounding until you leave your home. Understand closing cost details thoroughly and weigh them carefully against the documented benefits and trade-offs for your specific situation.

Is a Reverse Mortgage Right for You?

A reverse mortgage isn’t appropriate for everyone—it’s a specialized financial tool with specific advantages and limitations. If you intend to remain in your Greeley home, want to eliminate monthly loan payments, and need flexible funds, this strategy may serve your goals. If your priority is maximizing the inheritance left to heirs, or if you’re uncertain about your long-term housing plans, comparing a home equity line of credit might be valuable. Concerned about misleading tactics? Read about reverse mortgage fraud protection and carefully evaluate legitimate drawbacks before committing.

HUD-Approved Direct Lender Serving Greeley

All Reverse Mortgage Inc. is an FHA-approved HECM lender serving Greeley and all of Northern Colorado with direct lending authority. We guide Colorado retirees through the evaluation process with transparent communication, honest fee discussions, and thorough guidance. Verify our BBB reputation for independent reviews and accreditation. Check our HUD lender verification anytime. For homes exceeding FHA lending limits, we offer jumbo reverse mortgage programs.

All Reverse Mortgage Inc. maintains licensure from the Colorado Department of Regulatory Agencies (DORA) (License #100032569), meeting all Colorado and federal requirements for reverse mortgage lending.

Get a Reverse Mortgage Quote for Your Greeley Home

Use the ARLO™ calculator for an instant quote with real-time rates — no personal information required.

Related Resources

In-depth explanation of HECM loan fundamentals, available funding options, and how repayment works.

Complete details on age minimums, equity thresholds, property type standards, and financial qualification criteria.

Understand how a credit line structure delivers flexibility, includes growth features, and adapts to changing financial circumstances.

Learn what lenders evaluate during financial assessments and property reviews to determine your loan eligibility.

Statewide directory of FHA-approved reverse mortgage lenders, market statistics, and HECM volume data.

Denver metro reverse mortgage trends, market activity, and resources for Front Range homeowners.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald