America's #1 Rated Reverse Mortgage Lender*

Best Reverse Mortgage Lenders of 2026 – Rates, Reviews & How to Choose

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Looking for the best reverse mortgage lender in 2026? Whether you’re just starting to explore your options or comparing interest rates and closing costs, this guide breaks down the top reverse mortgage companies based on verified reviews, BBB ratings, complaint history, and lender transparency.

How We Chose the Best Reverse Mortgage Lenders in 2026

Choosing a reverse mortgage lender is a major financial decision, one that can impact your retirement security for years to come. That’s why this list isn’t based on sponsored links or paid placements. Our rankings are grounded in real, verifiable data.

Here’s the process we used:

- Verified BBB Ratings & Accreditation – Only lenders with an active BBB profile were included, with higher marks for maintaining a long-standing A+ rating.

- Years in Business – Lenders with 10+ years of reverse mortgage experience scored higher for stability and reliability.

- Customer Review Analysis – We reviewed thousands of borrower ratings from reputable platforms (BBB, Google, Yelp), filtering out duplicates or suspicious feedback.

- Complaint Volume & Resolution Rate – Companies with frequent unresolved complaints ranked lower.

- Transparency of Loan Terms – Lenders that disclose their margins, fees, and closing costs received higher scores.

- HUD Approval & NRMLA Membership – Only HUD-approved lenders were considered, with extra credit for NRMLA Code of Ethics membership.

This approach ensures you see a data-backed guide to lenders that consistently deliver the best borrower experiences.

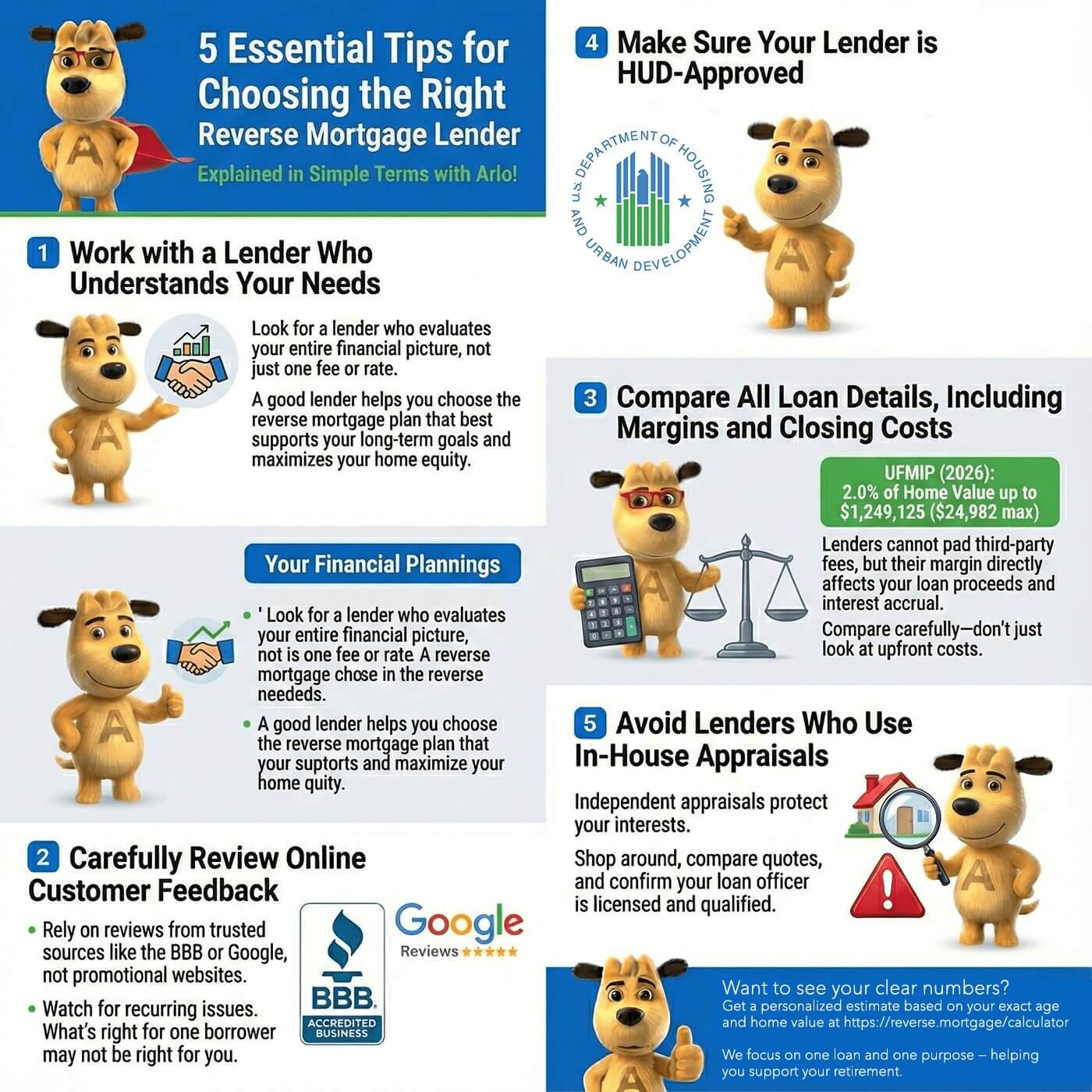

5 Essential Tips for Choosing the Right Reverse Mortgage Lender

1. Work with a Lender Who Understands Your Needs

Look for a lender who evaluates your entire financial picture, not just one fee or rate. A good lender helps you choose the reverse mortgage plan that best supports your long-term goals and maximizes your home equity.

2. Carefully Review Online Customer Feedback

Rely on reviews from trusted sources like the BBB or Google, not promotional websites. Watch for recurring issues. What’s right for one borrower may not be right for you.

3. Compare All Loan Details, Including Margins and Closing Costs

Lenders cannot pad third-party fees, but their margin directly affects your loan proceeds and interest accrual. Compare carefully — don’t just look at upfront costs. The Upfront Mortgage Insurance Premium (UFMIP) is typically 2.0% of your home’s value, up to $1,249,125 ($24,982 max in 2026).

4. Make Sure Your Lender is HUD-Approved

Verify approval through the HUD Lender List to ensure you’re working with a federally authorized lender.

5. Avoid Lenders Who Use In-House Appraisals

Independent appraisals protect your interests. Shop around, compare quotes, and confirm your loan officer is licensed and qualified.

Below is a comparison of the top 20 reverse mortgage lenders in the U.S., ranked by BBB rating, years in business, customer satisfaction, and complaint volume (as of October 13, 2025).

Top 20 Reverse Mortgage Lenders of 2025/2026 (National HECM Rankings & BBB Reviews)

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Did You Know? Not all lenders with an A+ BBB rating have strong borrower satisfaction. Some prominent names have hundreds of complaints despite their rating. Always dig deeper than the letter grade.

Best Reverse Mortgage Lenders in 2026 – Rankings, Ratings & Reviews

Choosing the right reverse mortgage lender isn’t just about the rate — it’s about who you can count on to be honest, responsive, and transparent. We’ve reviewed 2026’s top-performing lenders based on national HECM volume, BBB accreditation, customer satisfaction, and complaint history.

All Reverse Mortgage, Inc. (ARLO™)

- A+ BBB Rating

- 21 years in business

- 4.93 out of 5 stars from verified borrowers

- 99.0% positive reviews

- 0 BBB complaints

Borrowers consistently praise ARLO™ for accurate quotes, fast service, and clear explanations.

Other Top-Performing Lenders

These lenders also earned high marks for customer satisfaction and BBB ratings:

- HighTechLending Inc. – A+ BBB, 4.94/5 stars, 99.0% positive, 1 complaint

- Goodlife Home Loans – A+ BBB, 5.0/5 stars, 100% positive, 1 complaint

- New American Funding – A+ BBB, 4.68/5 stars, 94.0% positive, 143 complaints

- Fairway Independent Mortgage – A- BBB, 4.51/5 stars, 90.2% positive, 27 complaints

- Movement Mortgage – A+ BBB, 4.44/5 stars, 89.0% positive, 90 complaints

- Longbridge Financial – A+ BBB, 3.87/5 stars, 77.0% positive, 32 complaints

Lenders With Lower Satisfaction

Some well-known lenders have solid BBB ratings but continue to receive low customer scores and a high number of complaints:

- CrossCountry Mortgage – F BBB, 1.44/5 stars, 29.0% positive, 305 complaints

- Mutual of Omaha Mortgage – A+ BBB, 1.53/5 stars, 31.0% positive, 62 complaints

- Finance of America Reverse (FAR) – A+ BBB, 1.00/5 stars, 20.0% positive, 37 complaints

- Liberty Reverse Mortgage – A+ BBB, 1.00/5 stars, 20.0% positive, 1 complaint

- SmartFi Home Loans – A+ BBB, 1.00/5 stars, 29.0% positive, 0 complaints

Key Takeaway

A high BBB rating doesn’t always mean great service. Here’s how to choose the right lender:

- Read genuine customer reviews on BBB and Google

- Compare rate margins and closing costs — not just lender ads

- Verify HUD approval and experience with reverse mortgages

- Look for transparency in how quotes, timelines, and fees are presented

Source: RMInsight – Top 20 HECM Lenders, October 1, 2025, and Better Business Bureau data verified October 13, 2025.

What to Compare Before Choosing a Lender

| What to Compare | Why It Matters |

|---|---|

| Lender Experience & Reviews | HUD-approved lenders with strong public reviews are more trustworthy |

| Loan Margins & Interest | Lower margins increase loan proceeds and reduce interest paid over time |

| Closing Costs & Fees | Compare full loan estimates—not just teaser rates or partial fees |

| Support & Counseling | Great lenders offer pre-loan education and long-term borrower support |

| Appraisal Independence | Avoid lenders who use in-house appraisers to ensure objective property values |

| NRMLA Membership | Shows commitment to ethical industry standards and borrower protections |

| Direct vs. Broker | Direct lenders often provide faster and more transparent service |

Before You Choose: Reverse Mortgage Lender Checklist

- Run Your Own Numbers – Use our reverse mortgage calculator to see real-time rates before speaking with any lender.

- Request a Written Loan Estimate – Insist on margin, APR, and all closing costs in writing.

- Ask About Servicing – Know who will service your loan after closing.

- Compare Margins – Small differences can add up to thousands over time.

- Confirm HUD Approval – Check the HUD database.

- Check Independent Reviews – Use BBB and Google, not just the lender’s own site.

Ready to Compare for Yourself? Use our reverse mortgage calculator for a personalized quote with real-time rates, or call (800) 565-1722 to speak directly with an advisor at All Reverse Mortgage, Inc. (ARLO™).

Frequently Asked Questions

What banks offer reverse mortgages?

Who is the highest-rated reverse mortgage company?

Does HUD offer reverse mortgages?

Are all reverse mortgage companies the same?

How do I know I’m getting the best reverse mortgage?

How do reverse mortgage lenders determine interest rates?

Who actually lends the money in a reverse mortgage?

Which reverse mortgage companies have the lowest closing costs?

Can a reverse mortgage lender change without the homeowner’s knowledge?

Can a lender lower the borrower’s benefit amount after the loan closes?

Information for Past Customers of Inactive Companies

| Lender | |

|---|---|

| Wells Fargo Reverse Mortgage | Read More |

| Bank of America Reverse Mortgage | Read More |

| Financial Freedom Reverse Mortgage | Read More |

| MetLife Reverse Mortgage | Read More |

| RMS - Reverse Mortgage Solutions | Read More |

| LiveWell Financial | Read More |

| Resolute Bank | Read More |

| Liberty Reverse Mortgage (PHH) | Read More |

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

September 4th, 2024

September 4th, 2024