How Bankruptcy Can Affect Your Reverse Mortgage Eligibility

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

We recently had several borrowers who had previously obtained a reverse mortgage call and asked us what the effect would be on those reverse mortgages if they had to begin a bankruptcy proceeding.

While we are not attorneys and would always advise you to seek competent legal advice from an attorney in your state, we wanted to contact an expert in the field of reverse mortgage loan servicing to obtain additional information we could pass along.

We contacted Ryan LaRose, Chief Operating Officer of CELINK, the nation’s largest reverse mortgage sub-servicer, to ask what happens when a borrower files for bankruptcy.

Ryan told us there is a myth about reverse mortgages and bankruptcies – that many believe the lender would immediately call the loan due and payable upon notification of a bankruptcy. He stated that this was not the case.

The servicing agent receives notice of the filing and, in turn, sends it to their attorneys to file a “Proof of Lien,” which protects the reverse mortgage lenders interest in the property during the bankruptcy proceeding.

There are other steps the servicer must complete before the bankruptcy is dismissed or discharged, but calling the loan due and payable is different.

How Bankruptcy Can Affect Your Existing Reverse Mortgage

While the servicing company does not provide the courts with an accounting of any remaining funds available to borrowers on their existing credit lines and under monthly payment provisions, borrowers cannot receive funds from their reverse mortgage during the bankruptcy proceeding.

This is because the Bankruptcy Trustee must approve any funds the borrower receives during this time, as borrowers are prohibited from incurring new debt during the Bankruptcy period.

Mr. LaRose warns that borrowers planning to file for protection under the bankruptcy laws and then live off their reverse mortgage proceeds may be in for a big surprise when they learn they can obtain additional funds only after the bankruptcy is complete.

This is another area that reverse mortgage borrowers should discuss with their attorneys before they file. But it is comforting to get the facts rather than the myths about bankruptcies and existing reverse mortgages.

As we stated at the beginning, this is not legal advice. Be sure to consult your attorney before you do anything that may affect your circumstances!

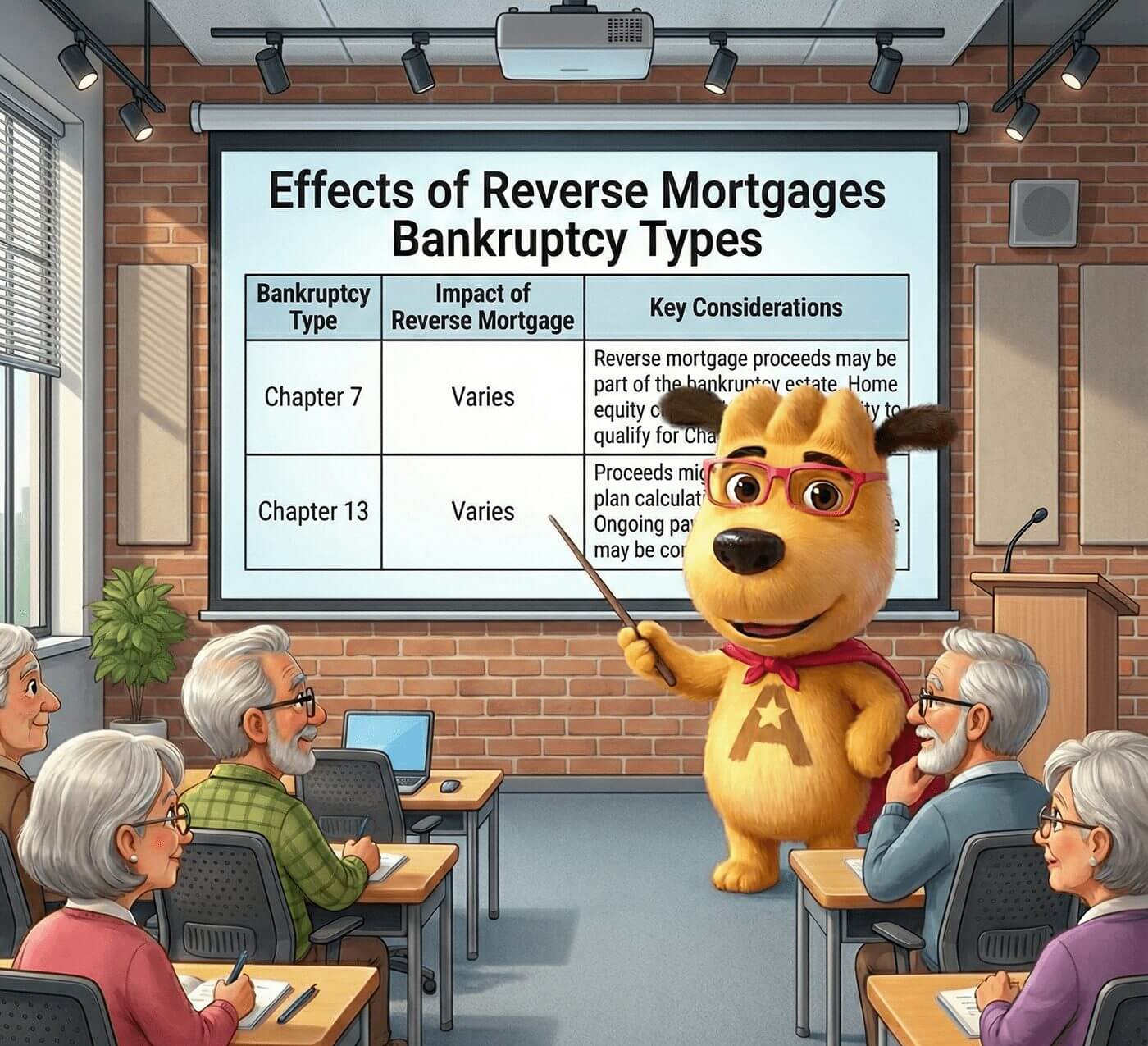

Effects of Reverse Mortgages Bankruptcy Types

| Bankruptcy Type | Impact of Reverse Mortgage | Key Considerations |

|---|---|---|

| Chapter 7 | Varies | Reverse mortgage proceeds may be part of the bankruptcy estate. Home equity could affect the ability to qualify for Chapter 7. |

| Chapter 13 | Varies | Proceeds might impact repayment plan calculations. Ongoing payments from the reverse mortgage may be considered income. |

The type of bankruptcy (Chapter 7 or Chapter 13).

The general impact a reverse mortgage might have on each bankruptcy type.

Key considerations or factors that might influence this interaction.

The actual impact can vary greatly based on individual circumstances, and this table serves as a general guide. For specific legal and financial advice, it's crucial to consult with a bankruptcy attorney and/or financial advisor familiar with both reverse mortgages and bankruptcy laws.

FAQs

Can you do a reverse mortgage while in Chapter 13 bankruptcy?

What happens if you file bankruptcy after getting a reverse mortgage?

What happens to my reverse mortgage if my lender goes bankrupt?

Does a reverse mortgage protect you from creditors?

Can a reverse mortgage go into foreclosure?

Does a bankruptcy trigger a default on a reverse mortgage?

What happens if your reverse mortgage lender files for bankruptcy?

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

December 28th, 2025

December 28th, 2025

January 8th, 2024

January 8th, 2024

October 17th, 2023

October 17th, 2023

June 14th, 2023

June 14th, 2023

October 13th, 2022

October 13th, 2022

August 16th, 2022

August 16th, 2022

November 17th, 2021

November 17th, 2021

October 20th, 2020

October 20th, 2020

October 9th, 2020

October 9th, 2020

September 13th, 2022

September 14th, 2022

May 16th, 2020

May 18th, 2020

January 30th, 2020

January 30th, 2020

September 4th, 2019

September 4th, 2019

May 2nd, 2019

May 2nd, 2019

March 27th, 2019

March 27th, 2019

September 22nd, 2016

September 23rd, 2016

March 27th, 2015

February 12th, 2015

February 12th, 2015

December 12th, 2014

December 15th, 2014

December 9th, 2014

December 9th, 2014

May 3rd, 2013

May 7th, 2013

February 25th, 2013

February 25th, 2013

January 6th, 2013

January 9th, 2013

December 17th, 2012

March 3rd, 2017

March 3rd, 2017

September 17th, 2012

September 20th, 2012

March 19th, 2012

March 20th, 2012

September 19th, 2016

September 20th, 2016

February 6th, 2023

February 11th, 2023