America's #1 Rated Reverse Mortgage Lender*

Tom Selleck Reverse Mortgage — Is It a Scam? A 20-Year Lender Responds

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

We just received this comment on our blog:

It boils down to the saying, If it’s too good to be true, then it is. I watched this actor named Tom Selleck pitching for a reverse mortgage on a TV commercial. That sounds very convincing, even when he swears to have done his homework on the matter and told the truth. An actor worth millions, and before him was another actor, Robert Wagner. Yet, does he really need to do a reverse mortgage on his estate? With his king of dough? Back in the day, they called it snake oil salesmen. How can they look at the camera and say that the house remains yours when you have signed a lien on it? Yes, they give some cash, but at what price? Don’t get me wrong, without demand, there’s no supply. Economics 101. This is the same as payday loans. It’s totally legal yet seizing on the necessity of the poor.

First, let’s understand what a reverse mortgage is. It’s a loan secured by your home. Like any mortgage, it places a lien on your property. Having a lien doesn’t mean you don’t own your home; it simply means you owe money to the lender.

You still have complete control over your property. You can live in it, make changes, or sell it whenever you want. When you decide to sell, the title company will ensure the lender is paid from the sale proceeds, and the new owner receives a clear title. This process works the same way as traditional (forward) mortgages.

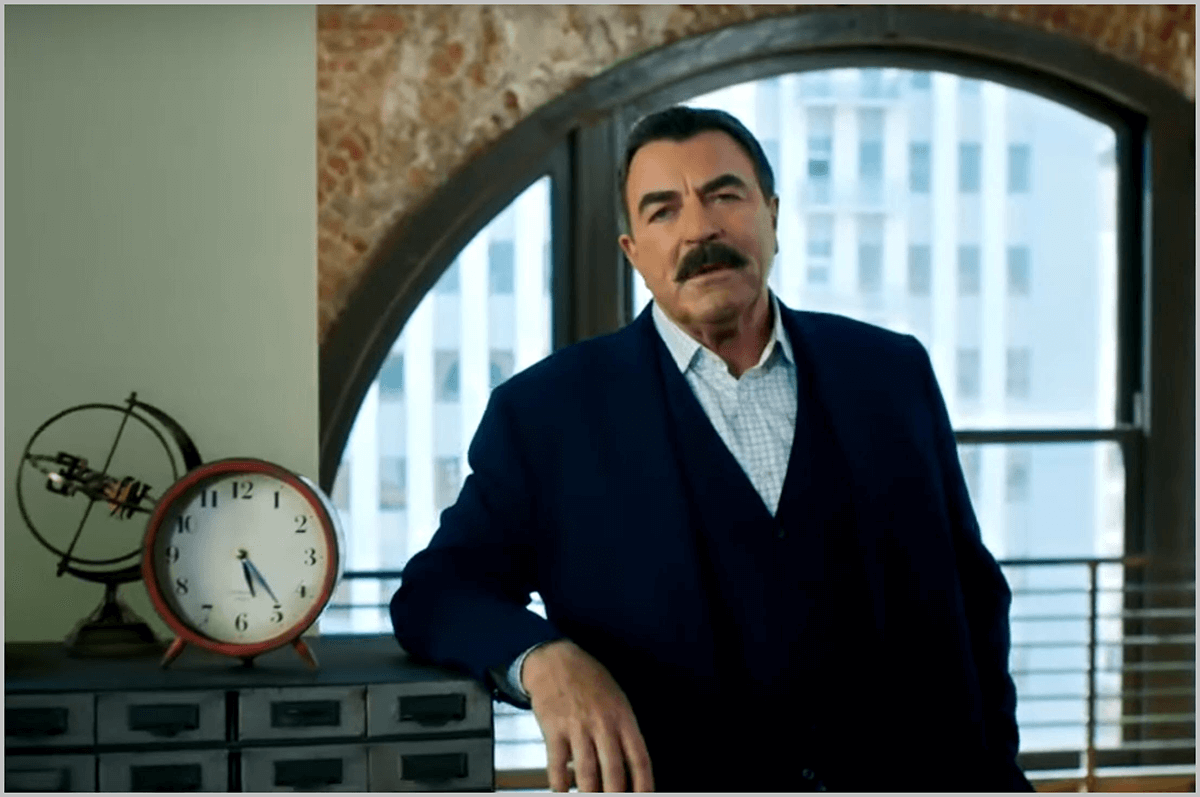

Yes, Tom Selleck Is a Paid Spokesperson

Tom Selleck is a paid spokesman for another reverse mortgage lender. Over the years, several well-known celebrities have also represented reverse mortgage companies. These include Robert Wagner, Henry “The Fonz” Winkler, former US Senator Fred Thompson, and Jerry Orbach from “Law and Order.”

Lesser-known celebrities, such as Bill Medley of the Righteous Brothers and 1950s pop singer Pat Boone, have also appeared in reverse mortgage commercials. Even David Spade has done parody commercials about reverse mortgages. However, it’s important to remember that these are paid actors doing commercials.

Did Tom Selleck do his homework before representing a reverse mortgage company? I can’t say for sure, but I have no reason to doubt him. When my mother asked me about reverse mortgages, I had to admit that I had never originated one despite being a mortgage banking professional for nearly 30 years. I had to research it myself to give her accurate information.

This doesn’t mean I needed or qualified for a reverse mortgage at that time, but I had to learn about it to help my mother. Similarly, I don’t think Mr. Selleck is lying. He likely doesn’t need the loan personally, but if he says he researched the program, I have no reason to doubt his word.

Addressing Common Misconceptions

I would never consider myself a snake oil salesman, and I would never do anything to harm my mom. My mom owned her home outright, but she had a problem. She had enough income to get by each month, but by the middle of the month, she had to stop all extra spending.

She was very active and loved to bowl and golf, but she had to cut back. More importantly, she was delaying necessary home improvements. For example, her aluminum sliding windows were so worn out that they were difficult to open and close. The air conditioning system in her 45-year-old home no longer worked, and she wanted to update her kitchen and bathrooms.

She found a way to fix these issues but wanted my advice since I was the family mortgage banker. We looked into the reverse mortgage terms for her on a modified tenure program. This allowed her to make the necessary improvements and enjoy her home for over 10 years with the loan. She received some cash to do the upgrades and a monthly income from the loan.

Understanding the Impact of Borrowing from Your Equity

So, what is the downside of a reverse mortgage? There was not as much equity when we were forced to sell the home when mom had to leave, so my brother, sister, and I will not get as large an inheritance later. Oh well! That was my mom’s house. She bought and paid for it, and if she had used every dime of her equity to live happily there, I would not have been disappointed.

I am thrilled that my mom could live without monetary concerns with her reverse mortgage. It was immediately after we did her loan that we became a full-time reverse mortgage lender. I have been originating reverse mortgages for almost 20 years now, and I have helped save homes from foreclosure and helped seniors live full lives. I have never been happier as a lender.

But then again, we have always believed that a reverse mortgage is not suitable for everyone from the start. The loan does not help everyone, and we aren’t afraid to tell people when it isn’t the right choice. Our job is to inform, educate, and let borrowers make an informed decision — not sell a product.

The loan can be wrong for several reasons. I’m afraid that’s not right if you still can’t afford to pay your taxes and insurance and live comfortably after the loan closes. If this is a temporary situation, you should seek other options as the fees, including the HUD mortgage insurance, do not make the loan an affordable short-term option.

Exploring All Your Options

If you want to leave a large inheritance for your family, you need to think about a few things. One option is to make payments on the reverse mortgage to prevent the interest from growing. Remember, while you are not required to make payments on a reverse mortgage, you can do so at any time without penalty.

If you don’t plan to stay in your current home, consider downsizing or moving before using your home’s equity. You have control over the interest on the loan. If you don’t want the balance to increase, you can choose to pay the interest monthly. You can also pay more than the interest to reduce the balance or pay less, which will cause the balance to rise more slowly. The choice is yours.

Another option is to talk to your family members about creating a reverse mortgage for you. They could lend you the money, and you would repay them with the home’s equity when you pass away. This way, they benefit too by helping you maintain the home and avoid foreclosure.

Involving Your Family in the Decision

We recommend you talk to your family before finalizing a reverse mortgage. If you are not estranged from your family and have heirs, it’s important to let them know what you are planning. Explain what you are doing, what options they will have, how to exercise them, and make necessary provisions while you are alive and well.

You can sign all the paperwork and express your wishes while you are alive and competent. Waiting until you pass without a family trust or will can cause conflicts among family members. It’s best to set up your heirs with your lenders before you pass so they can communicate with them later.

Maintaining Control of Your Finances

It’s true that nothing is ever free, and borrowing money comes with costs. This applies to all home loans. However, with a reverse mortgage, you do not have to make monthly payments, allowing you to live in your home for life as long as you pay your taxes and insurance.

If you choose to make payments and something unexpected happens, you don’t have to worry about missing a payment one month. There is no negative impact on your credit or risk of foreclosure because there was no required payment in the first place. This is one of the benefits of a reverse mortgage.

With a reverse mortgage, you are not getting free money or a handout. Instead, you are using your home equity to support your living expenses. It’s not a payday loan, bridge loan, or Home Equity Line of Credit. You are not juggling short-term loans.

Assessing If It’s Right for Your Retirement

A reverse mortgage could be the last loan you ever need. If it suits your needs and wants, it might be the perfect solution. If not, it’s best to avoid it. Many knowledgeable borrowers and economists use reverse mortgages when they make sense for them.

We don’t hire celebrity spokespersons because we prefer to offer our borrowers the best loan terms at the lowest possible costs. We encourage you to compare several lenders to find the best deal.

While we don’t use celebrity endorsements, we respect Mr. Selleck’s motives and believe he has done his homework. We’ve done ours, too, and we offer an honest program. It’s a great option for some, but not for everyone. Only you can decide if it’s right for you.

Reverse Mortgage Facts: Easy Breakdown

| What You Might Wonder | The Real Story |

|---|---|

| Do I Still Own My Home? | Yes – It’s yours to live in, change, or sell anytime. A lien just means you owe money. |

| Is It Free Money? | No – It’s your home equity turned into cash, with interest you’ll repay later. |

| Can I Lose My Home? | Only if you stop paying taxes or insurance – otherwise, you’re safe. |

| Celebrity Pitch True? | They’re paid to advertise – but the loan’s real. Check the facts yourself! |

| Good for Everyone? | No – Great if you need cash and plan to stay; not if you’re moving soon. |

Lien: A legal note saying you owe the lender, like with any home loan.

Equity: The value of your home you own outright.

Repay: Paid back when you sell, move out, or pass away.

Want the Truth About Reverse Mortgages? Get a custom reverse mortgage quote from All Reverse Mortgage, Inc. (ARLO™) — America’s #1 Rated Lender with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote — simple, trusted, 100% secure!

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

August 31st, 2024

September 3rd, 2024

April 10th, 2023

April 16th, 2023

October 4th, 2023

October 5th, 2023

March 8th, 2024

March 11th, 2024

June 23rd, 2024

June 25th, 2024

January 11th, 2024

July 21st, 2022

July 25th, 2022

September 29th, 2020

September 30th, 2020

December 10th, 2022

September 24th, 2020

September 14th, 2020

September 15th, 2020

April 20th, 2021

April 21st, 2021

April 27th, 2021

June 30th, 2021

March 4th, 2022

March 4th, 2022

July 16th, 2020

July 17th, 2020

March 5th, 2021

March 6th, 2021

July 15th, 2020

July 15th, 2020

December 22nd, 2020

December 28th, 2020

October 19th, 2022

October 20th, 2022

June 16th, 2020

June 18th, 2020

June 30th, 2020

June 30th, 2020

October 21st, 2020

June 25th, 2020

June 26th, 2020

June 13th, 2020

June 5th, 2020

June 8th, 2020

May 19th, 2020

May 19th, 2020

May 29th, 2020

June 2nd, 2020

May 14th, 2020

May 15th, 2020

May 13th, 2020

May 13th, 2020

May 8th, 2020

May 6th, 2020

March 5th, 2020

March 6th, 2020

February 21st, 2020

March 1st, 2020

April 7th, 2020

February 13th, 2020

January 10th, 2020

January 10th, 2020

May 11th, 2020

May 11th, 2020

February 5th, 2020

February 5th, 2020

February 27th, 2020

April 20th, 2020

April 20th, 2020

April 30th, 2020

May 3rd, 2020

May 11th, 2020

May 11th, 2020

June 25th, 2020

June 26th, 2020

November 8th, 2022

November 15th, 2022

February 27th, 2020

April 22nd, 2020

May 3rd, 2020

November 8th, 2022

November 14th, 2022

December 10th, 2022