America's #1 Rated Reverse Mortgage Lender*

Reverse Mortgage vs. HELOC — Which Is Smarter for Retirees? Line of Credit Comparison

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

As retirees seek ways to supplement their income or cover expenses, accessing the equity in their home can be a practical solution. Two popular options for doing so are the Home Equity Line of Credit (HELOC) and the Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage. While both allow homeowners to unlock the value of their property, they differ in terms of eligibility, repayment terms, and long-term impact on finances.

In this article, we’ll explore the key differences between a HELOC and a reverse mortgage, helping you decide which option is best suited to your retirement financial needs. Whether you need additional cash flow or are looking for a financial safety net, understanding these two options is crucial for making an informed decision about your future.

What Is a Reverse Mortgage Line of Credit?

In 2026, the reverse mortgage line of credit has become a flexible and strategic tool for tapping into your home equity, especially with the recent increase in lending limits by the U.S. Department of Housing and Urban Development (HUD). For older homeowners on fixed incomes, it can be an ideal alternative to a traditional Home Equity Line of Credit (HELOC).

Key Benefits of a Reverse Mortgage Line of Credit:

- Flexibility: One of the standout features of a reverse mortgage line of credit is its flexibility. Unlike conventional loans or HELOCs, you have the freedom to make voluntary payments whenever you choose — or not at all. This gives you the ability to borrow and re-borrow funds as needed, which can be particularly helpful for covering unexpected retirement expenses. This structure contrasts with fixed-rate, closed-end loans, which require fixed payments and do not allow reborrowing.

- Growth of Available Credit: Another unique benefit of a reverse mortgage line of credit is its ability to grow over time. Over time, the available credit increases, creating a larger financial cushion for future needs. This is especially beneficial for covering expenses such as medical costs, in-home care, or other unexpected retirement expenses. The growing credit line ensures that your available funds keep pace with inflation and future needs, providing greater financial security and peace of mind throughout retirement.

Reverse mortgages can offer retirees greater financial flexibility compared to HELOCs because they don’t require monthly payments. While a HELOC demands ongoing repayment and can be frozen or canceled by the lender during economic downturns, a reverse mortgage credit line grows over time and cannot be frozen, ensuring reliable access to funds when needed most. This unique growth feature and payment flexibility make reverse mortgages a smart financial tool for retirement planning.

How a Reverse Mortgage Allows for Flexible Repayments

A reverse mortgage is a unique loan that offers flexibility rarely found in traditional financing options. Although it accrues interest like any other loan, the major difference is that repayment is typically deferred until the loan becomes due — usually when the borrower moves out of the home or passes away.

For homeowners aged 62 or older, a reverse mortgage provides several repayment options, including:

- Monthly Installments

- Lump Sum Payments

- Line of Credit

This flexibility allows you to customize your reverse mortgage based on your specific financial needs and retirement goals.

Voluntary Interest Payments: An Advantage Over HELOCs

One often overlooked feature of a reverse mortgage is the ability to make voluntary interest payments before they are due. While making interest payments is not required, choosing to pay them down can help preserve your home equity over time. This option offers a significant advantage over traditional Home Equity Lines of Credit (HELOCs), which typically require regular monthly payments.

By offering such flexible repayment options, a reverse mortgage empowers you to stay in control of your finances — whether you want to defer payments or proactively manage your loan balance as part of your overall retirement planning.

Reverse Mortgage vs HELOC: Real-Life Examples

Understanding how a HELOC and a reverse mortgage work in real-life scenarios can help you make an informed decision. Below, we examine how each option may affect homeowners in various situations.

Scenario 1: Jack Chooses a HELOC

Jack is a 70-year-old homeowner with a $300,000 home and no existing mortgage. He decides to take out a Home Equity Line of Credit (HELOC) to access some of the equity in his home. Here’s how Jack’s HELOC might look:

- Loan Amount: Up to $240,000 (80% loan-to-value)

- Borrowed Amount: $100,000 from his available line

- Interest Rate: Prime + 2.00% (approx. 8.50%, based on a prime rate of 6.5% in 2024)

- Monthly Payments:

- $708 (interest-only payment)

- $876 (fully amortized payment)

- Rate Adjustments: Interest rate can change monthly based on the prime rate

- Closing Costs: Typically $0 – $500 for most lenders

While Jack enjoys a high loan-to-value ratio, he faces mandatory monthly payments and fluctuating interest rates. If the prime rate rises in the future, Jack’s monthly payments could increase, potentially creating financial strain — especially if he is on a fixed income in retirement.

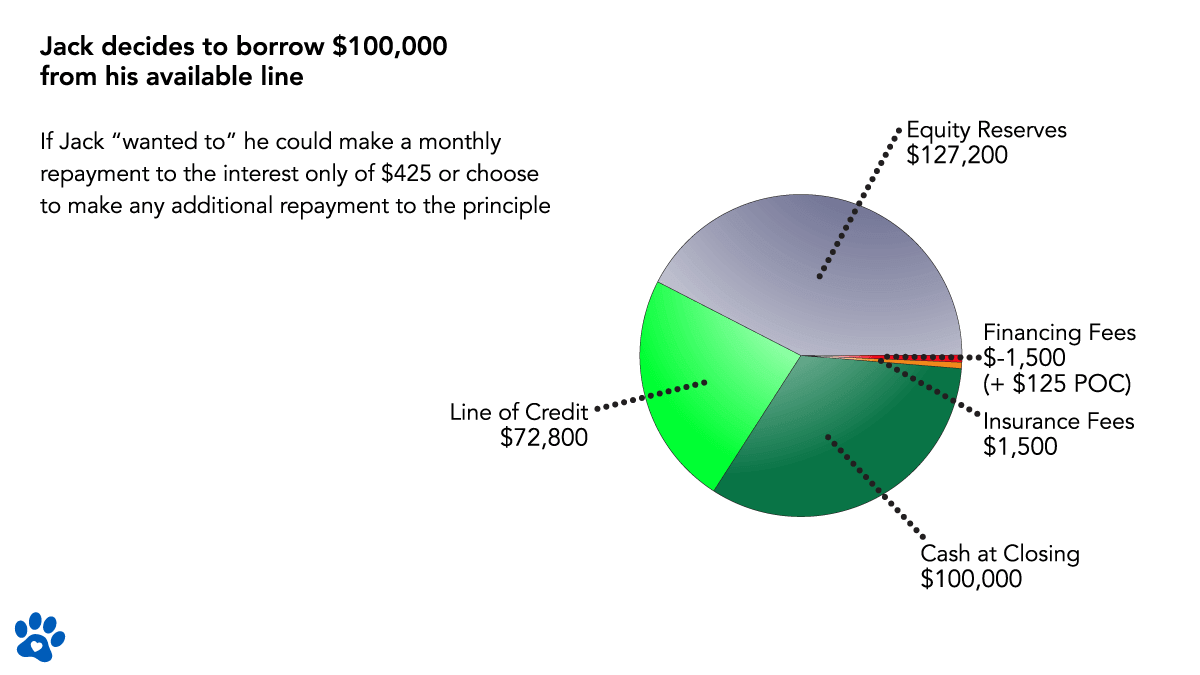

Scenario 2: Jack Chooses a Reverse Mortgage Line of Credit

Jack opts for a reverse mortgage line of credit on his $300,000 home, which has no existing mortgage. With a current principal limit of 40.9%, here’s how his reverse mortgage line of credit might look:

- Loan Amount: Up to $122,700 (40.9% loan-to-value ratio)

- Borrowed Amount: $100,000 from his available line

- Interest Rate: 1-year annual Treasury Constant Maturity Index (CMT) + 1.75% margin (approximately 6.0% fully indexed)

- Repayment Options:

- Voluntary Interest Payment: Approximately $500/month (interest-only)

- Additional Principal Payments: Optional and flexible

- Rate Adjustments: Limited to once per year

- Closing Costs: $0.00

Jack benefits from the flexibility to defer payments until the loan becomes due or to make optional payments on interest or principal. The annual interest rate cap offers stability compared to the frequent rate changes typically seen with HELOCs.

Which Option Works Best for Jack?

While a HELOC might provide a higher borrowing limit, it also requires monthly payments and exposes Jack to significant interest rate fluctuations. In contrast, the reverse mortgage line of credit allows Jack to manage his retirement finances more freely. With no required monthly payments, he can focus on accessing funds as needed while maintaining financial peace of mind.

For retirees like Jack, the reverse mortgage line of credit remains a strong choice, combining flexibility with stability.

Also See: HECM vs. Reverse Mortgage – Is There a Difference?

The Unique Growth Feature of Reverse Mortgages

While a Home Equity Line of Credit (HELOC) may offer a higher initial borrowing limit, a reverse mortgage line of credit provides unique long-term advantages, making it an appealing choice for many retirees.

What Sets a Reverse Mortgage Line of Credit Apart?

A standout feature of a reverse mortgage line of credit is its growth factor. With a Home Equity Conversion Mortgage (HECM), any unused portion of the credit line grows over time. This means that if Jack leaves his reverse mortgage credit line untouched, the available funds will increase, allowing him to access more of his home equity in the future.

This growth occurs independently of home value appreciation, offering a built-in safeguard against inflation or market volatility.

Who Benefits Most from the Growth Feature?

This feature is particularly beneficial for younger borrowers just meeting the qualifying age of 62. Many financial planners recommend using a reverse mortgage credit line as a financial tool to:

- Protect Against Future Uncertainties

- Maximize Retirement Income

- Build a Financial Safety Net

Enhanced Safeguards and Responsible Borrowing

Modern reverse mortgages include enhanced safeguards, such as financial assessments, ensuring borrowers can responsibly meet loan obligations. These measures have helped reverse mortgages become a trusted tool for retirement planning.

Proven Strategy for Retirement Success

Research has shown that retirees who strategically incorporate a reverse mortgage line of credit into their financial plans are less likely to run out of money in retirement. This credit line is often maintained as a “rainy day fund” or as part of a diversified financial strategy. By offering flexible access to home equity and the potential for growth, reverse mortgage lines of credit continue to gain popularity among retirees looking for long-term financial stability.

Easier Qualifications for a Reverse Mortgage

One of the key advantages of a reverse mortgage is its lack of required monthly payments, a feature that sets it apart from a Home Equity Line of Credit (HELOC). With a HELOC, borrowers must make ongoing repayments, which can strain cash flow. In contrast, reverse mortgages are designed to improve financial flexibility, making them especially appealing for retirees who want to boost their cash flow without the burden of monthly loan payments.

Simplified Qualification Requirements

Reverse mortgages are easier to qualify for compared to HELOCs, thanks to their tailored approach for older homeowners aged 62 and up. Here’s why:

- Less Stringent Financial Criteria: Borrowers with no existing mortgage and a stable financial history often find reverse mortgages more accessible.

- Fixed-Income Friendly: Unlike HELOCs, which require higher income and stricter credit standards, reverse mortgages accommodate the financial realities of retirees.

A Tailored Loan Amount for Retirees

Reverse mortgages also provide loan amounts better suited to the needs of older borrowers. While HELOCs may offer larger sums, they require regular repayment, which can be daunting for individuals on a fixed income. With a reverse mortgage, borrowers can:

- Access only what they need, reducing financial risk.

- Enjoy the flexibility to defer repayment until the loan becomes due, freeing up additional cash flow.

A Practical, Accessible Solution

By combining easier qualifications with flexible repayment options, reverse mortgages offer an accessible way to unlock home equity without financial strain. This unique design makes reverse mortgages an ideal choice for homeowners seeking a balance between financial freedom and stability in retirement.

Reverse Mortgage vs. HELOC: Feature-by-Feature Comparison

| Compare Features | HECM Reverse Mortgage (FHA-Insured) | Proprietary Reverse Mortgage (Non-FHA) | Traditional HELOC (Home Equity Line of Credit) |

|---|---|---|---|

| Minimum Age to Qualify | 62 | 55–62 (varies) | No minimum |

| Line of Credit Term | Lifetime | 10 years | 10–15 years draw period |

| Can It Be Frozen or Reduced? | No (protected by FHA)* | Yes* | Yes* |

| Line of Credit Growth | Yes, grows lifelong | Limited | Limited |

| Monthly Mortgage Payments Required | No | No | Yes |

| Income Requirements | Minimal (financial assessment) | Minimal (financial assessment) | Strict |

| Credit Score Needed | No minimum | No minimum | 620+ typical |

| Savings/Reserves Needed | No | No | Often required |

| Closing Costs | Yes (can be financed) | May be lower | Yes (can be financed) |

| Fixed Interest Rate Option | Available for lump sum | Available | Variable common |

| Rate Index | CMT or SOFR (2025) | Varies | Prime rate |

Top FAQs

What is the difference between a reverse mortgage and a HELOC?

Which is better, a Home Equity Line of Credit or a Reverse Mortgage?

The better option depends on your individual needs and financial situation. Here’s a breakdown of key differences to help you decide:

Home Equity Line of Credit (HELOC):

- Lower Upfront Costs: HELOCs are typically less expensive to establish, making them ideal for short-term financing needs.

- Mandatory Payments: Monthly payments are required from the start, which can strain your budget, especially during retirement.

- Limited Draw Period: Most HELOCs allow access to funds for up to 10 years, after which the loan enters the recast period. At this stage, payments increase significantly as the loan transitions from interest-only to principal-and-interest repayments.

- Risk of Freezing: HELOCs are not guaranteed and can be frozen or closed by the lender at any time, especially during economic downturns.

- Credit Risk: Missing payments can harm your credit and lead to foreclosure.

Reverse Mortgage (HECM):

- Higher Upfront Costs: Reverse mortgages come with mortgage insurance fees due to HUD, making them better suited for long-term financial planning rather than short-term needs.

- Guaranteed Access: Funds are insured by HUD and cannot be frozen or eliminated, regardless of market conditions.

- Flexible Options: Borrowers can access funds as a line of credit, scheduled monthly advances, a lump sum, or a combination of all three.

- Growth Feature: Unused funds in the credit line grow over time, increasing your available equity.

- No Mandatory Payments: There are no required monthly payments, so you won’t risk damaging your credit or facing foreclosure due to missed payments. Voluntary payments are allowed without prepayment penalties.

- Lasting Stability: Designed to be the “last loan you ever need,” reverse mortgages provide a stable solution for retirees seeking long-term financial flexibility.

Which Should You Choose?

If you need short-term financing and can handle mandatory monthly payments, a HELOC might be the better choice. However, a reverse mortgage offers unmatched flexibility and security if you’re looking for a long-term solution with guaranteed access to funds and no mandatory payments.

What Makes a Reverse Mortgage Line of Credit a Better Option?

A reverse mortgage line of credit offers unique advantages that make it an appealing choice for many retirees:

- Growth Feature: Unlike a HELOC, a reverse mortgage line of credit grows over time on the unused portion. This means the amount available increases if you don’t use all the funds early in the loan term, providing greater financial flexibility for future needs.

- Guaranteed Access: HUD insures the funds in a reverse mortgage line of credit and cannot be frozen or closed by the lender, even during market fluctuations. In contrast, a HELOC can be closed or frozen at the lender’s discretion, leaving you without access to the funds you may rely on.

- Long-Term Availability: A reverse mortgage line of credit remains available as long as you live in the home as your primary residence and keep up with property taxes and homeowners insurance. On the other hand, most HELOCs have a maximum draw period of 10 years, after which access to funds is restricted.

These features make a reverse mortgage line of credit a more secure and sustainable solution for those looking to access their home equity without risking losing their financial safety net.

What Are the Disadvantages of a Reverse Mortgage Line of Credit?

While a reverse mortgage line of credit offers many benefits, there are a few potential drawbacks to consider:

- Higher Upfront Costs: Establishing a reverse mortgage typically involves higher upfront costs, including mortgage insurance premiums required by HUD. These costs make it less ideal for short-term financial needs.

- Impact on Inheritance: If passing your home as a significant inheritance is a priority, a reverse mortgage may reduce the value of the asset you leave behind. Interest on the loan accumulates over time, which can reduce the remaining equity in the home. However, this consideration also applies to a HELOC, as borrowing against home equity inherently reduces the inheritance value.

- Loan Obligations: To keep the loan in good standing, you must continue living in the home as your primary residence and keep up with property taxes, homeowners insurance, and basic maintenance. Failure to meet these obligations could result in the loan becoming due.

Reverse mortgages are designed as long-term financial tools to enhance retirement stability. If your primary goal is preserving your home as a legacy, you may want to explore other options or consult a financial advisor.

Are the Qualifications Different for Reverse Mortgages vs. HELOCs?

Yes, the qualifications for reverse mortgages and HELOCs differ significantly due to the unique purposes and requirements of each loan type:

- Reverse Mortgages (HECM):

- Reverse mortgages use a residual income method for qualification, focusing on the borrower’s financial stability. This method calculates the borrower’s monthly income minus outgoing debts to ensure they have enough left over to cover living expenses.

- This approach is more accommodating for retirees, especially those on fixed incomes, as it considers their ability to maintain essential expenses rather than requiring high income-to-debt ratios.

- HELOCs:

- HELOCs use an ability-to-repay method, which evaluates the borrower’s total debt as a ratio of their total income. This stricter approach is designed to ensure borrowers can make the mandatory monthly payments required for HELOCs.

- Borrowers must demonstrate sufficient income and a strong credit profile, which can be challenging for retirees with limited income or assets.

Not Sure Which Equity Option Fits You? Get a free, custom quote from All Reverse Mortgage, Inc. (ARLO™) — America’s #1 Rated Lender with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote — simple, trusted, 100% secure!

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

April 6th, 2025

April 7th, 2025

July 11th, 2023

July 11th, 2023

June 13th, 2023

June 13th, 2023

April 4th, 2023

April 4th, 2023

March 31st, 2023

March 31st, 2023

November 4th, 2022

November 4th, 2022

June 30th, 2022

July 6th, 2022

January 29th, 2020

January 30th, 2020

October 15th, 2019

October 15th, 2019

April 9th, 2019

April 9th, 2019

May 11th, 2016