Jumbo Reverse Mortgage — Loan Amounts Up to $4 Million

Jumbo Reverse Mortgage: 2026 Rates, LTV Chart & Costs (Up to $4M) | ARLO™

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

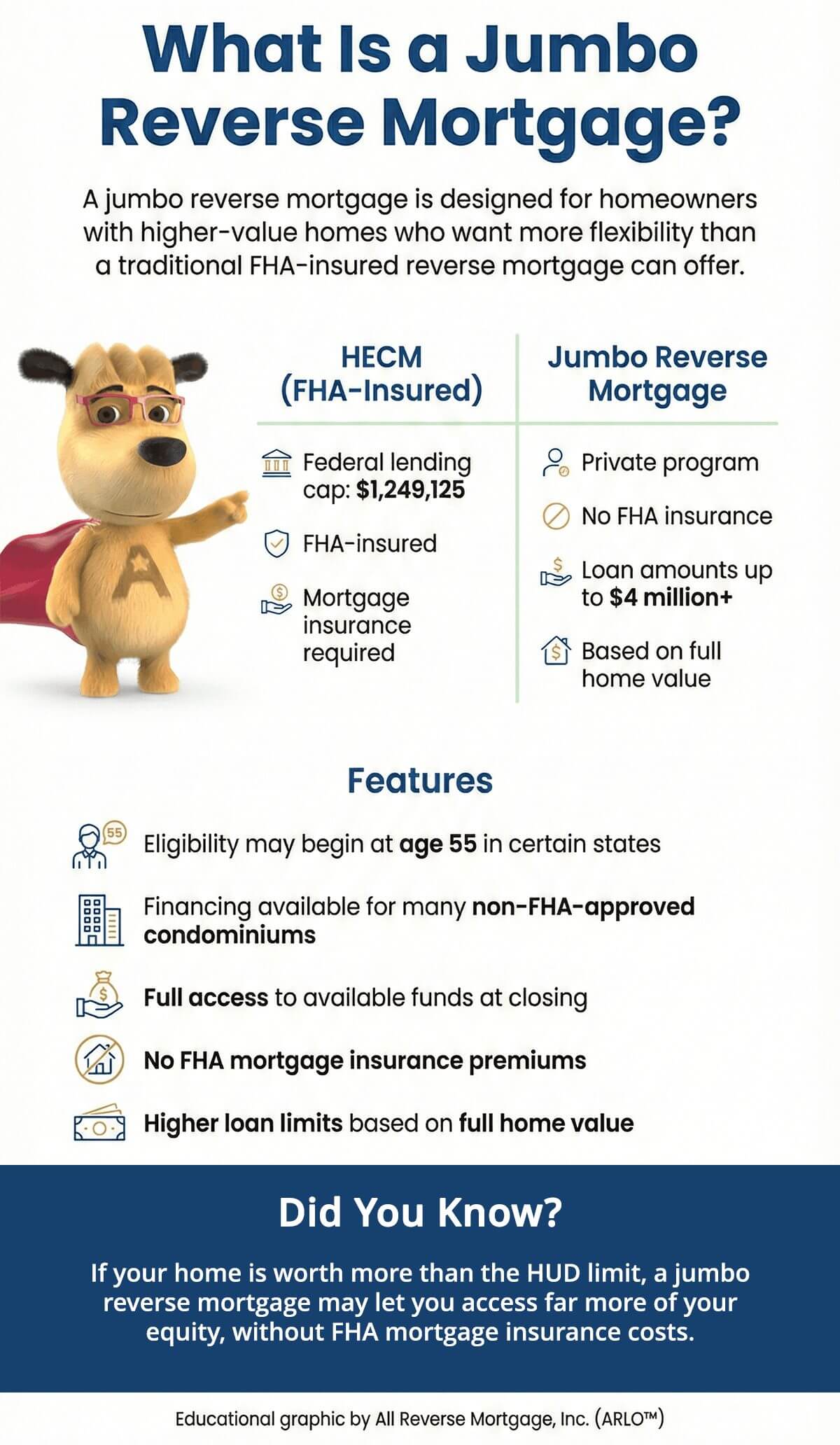

A jumbo reverse mortgage is a privately funded loan that lets you access more equity than what HUD’s HECM program allows. If your home is worth more than the 2026 HECM lending limit of $1,249,125, or if it doesn’t meet FHA guidelines, a jumbo (also called a proprietary reverse mortgage) can lend up to $4 million with no FHA mortgage insurance premiums. I’ve been originating these loans for over two decades, and in this guide, I’ll walk you through how they work in 2026, how they compare to a HECM, and when each option actually makes more sense.

Quick Summary: Jumbo Reverse Mortgages in 2026

- Designed for higher-value homes, often above FHA limits

- Privately funded, not FHA-insured

- Can offer higher loan amounts but fewer features and protections

- Best compared side-by-side with a HECM before choosing

What is a Jumbo Reverse Mortgage?

A jumbo reverse mortgage is a proprietary loan, meaning it is not FHA-insured and is not part of the HUD HECM program. It is designed for homeowners with higher-value properties, or for people who need features that HUD simply does not offer. The HECM is capped at the national FHA lending limit of $1,249,125 for 2026. Jumbo programs can go up to $4 million.

Because these are private programs, lenders set their own guidelines. That flexibility gives you options the HECM does not:

- Eligibility starting at age 55 in certain states

- Financing for non-FHA-approved condos

- Full upfront access to your proceeds

- No FHA mortgage insurance premiums

- Higher loan limits based on your home’s full value

Did You Know? If your home is worth more than the 2026 FHA limit of $1,249,125, a jumbo reverse mortgage may let you access far more of your equity, without FHA mortgage insurance costs.

Why 2026 Is a Key Year for Jumbos

Lenders and borrowers alike entered 2026 with expectations of lower interest rates and concerns about the cost of living. The three-quarter percent in interest rate decreases by the Federal Reserve in 2025, in three separate quarter-percent increments, have eased rates slightly but have not had a notable effect on the 10-Year Constant Maturity Treasury (CMT) rate as of this time (it was actually lower in September of 2024 than it is today, and that was before any interest rate cuts). It is that 10-Year rate that determines how much you will receive in your reverse mortgage proceeds. During the past 5 years, property values have also continued to rise. When looking at Zillow Property Analytics, single-family home values rose 45 to 50% nationally. Condominiums lagged a bit but still rose 32 to 38% nationally.

Several years ago, in a move to shore up a program experiencing heavy losses, HUD tightened up their guidelines for the HUD Home Equity Conversion Mortgage (Reverse Mortgage). They lowered the amounts you would receive based on age while at the same time lowering the amount available based on interest rates. As rates climbed, the amount available decreased. Prior to this move by HUD, there was a much larger difference between available amounts in the HUD program and proprietary or jumbo programs. HUD limits the amount you can receive at closing or in the first 12 months to 60% of the available funds if the funds are not being used to pay off existing loans on the property or buying a home with a reverse mortgage. The jumbo or proprietary programs give you immediate access to all your funds. We do not advise drawing more funds than you need, but if you do have a need for all your funds, the proprietary programs give you that option. The combination of these factors (rates, increased property values, and HUD’s tightened guidelines) begins to make the jumbo or proprietary programs make a lot more sense for a lot more people.

Another thing that took place as a result of the high appreciation was that a property on which you might need a traditional “jumbo loan” suddenly became a property located in more than 15 Metropolitan Statistical Areas in the United States. Many of them consisted of single-family homes of under 2,500 square feet. When you hear Jumbo Loans and High-Priced Housing, many people think of mansions and properties at the beach, the lake or in high-rise units in town, but now homes in many family neighborhoods around the country where seniors have lived for 30+ years were selling in the multi-millions when they may have originally sold 30 years ago in the thousands. For many, their expenses and taxes keep going up but savings and their fixed incomes do not.

So, while HUD has also raised its limits over the years, its current limit of $1,249,125 needed a boost with the jumbo products. But that’s not the only way the proprietary programs help. These programs can accept homeowners down to age 55 whereas the HUD HECM product stops at age 62. You need to verify whether your state has any state law that mandates a higher age if you are not yet 62, as is the case with states like Texas, but those are few. Another area where the proprietary program can help is with non-approved condominium projects. As mentioned, the values of condos have not seen the same appreciation over the last 5 years, but 32 to 38% is not bad either. And while there is a minimum value your unit must meet to be eligible, that minimum is lower today than ever and more homeowners can utilize these programs when their projects have not been HUD approved.

Now, the FHA HECM lending limit for 2026 increased to $1,249,125, but that was only a 3.25% bump, the smallest annual increase we’ve seen in more than a decade. For years, HECM limits climbed rapidly as home values surged. This modest 2026 adjustment tells us the market is cooling, and in many high-priced regions, values may flatten or soften further.

What does that mean for you? If your home is already above the HECM cap, waiting for next year’s limit increase probably isn’t going to move the needle enough to matter. And if your home value has been sitting just above the FHA limit, you may find that a jumbo program gives you access to a much larger share of your equity than the HECM formula can. That said, every situation is different. I always recommend running the numbers on both options before making a decision.

Did You Know? The HECM increase in 2026 was the lowest percentage increase in years. Many markets show values stable or declining slightly, so waiting for further increases in HECM limits could be counterproductive if future values drop.

When a Jumbo Can Make Sense Even Below the HECM Limit

This is something I get asked about a lot. People assume that if their home is below the FHA limit, a jumbo doesn’t apply to them. That’s not always the case. Here are a few situations where a jumbo can still make sense:

- Your condo is not FHA approved, but the jumbo investor will accept it

- Your property has accessory units or other features that don’t fit HUD property requirements but work fine under private guidelines

- You need full lump-sum access at closing and don’t want the 60% first-year restriction, even if you’d be giving up the HECM line of credit growth feature

How much of your home’s value you can borrow depends on your age, current interest rates, and the property itself.

Did you know? While jumbo reverse mortgages can offer much higher loan limits than a HECM, they are designed primarily for higher-value homes. If your home value is close to the FHA limit and otherwise qualifies for a HECM, the difference in available funds may be modest. This is why I always recommend comparing both options side by side before choosing.

How Jumbo Reverse Mortgages Work in 2026

Several lenders offer jumbo reverse mortgages today. Because these are proprietary loans, they are not required to follow HUD HECM rules. That gives them flexibility, but it also means you need to pay close attention to the specific terms each program offers. Not all jumbos are the same.

Here’s what you’ll typically see on jumbo programs in 2026:

- Minimum ages as low as 55 in some states

- Willingness to lend on non-FHA-approved condo units

- The option to take your full loan amount as a lump sum at closing

- Some programs now include open lines of credit instead of a lump sum only

- No FHA mortgage insurance premiums

At the same time, many jumbo programs mirror important HECM protections:

- Non-recourse protection, so neither you nor your heirs owe more than what the home is worth when it is sold

- Counseling requirements prior to closing

- The same basic occupancy rules: the home must remain your primary residence, and you must stay current on taxes, insurance, and basic maintenance

Some jumbo programs allow homeowners as young as 55, which is seven years earlier than the minimum HECM age of 62, where state law permits.

Did you know? Because jumbo reverse mortgages involve larger loan amounts, lenders apply stricter valuation standards. Higher-value homes may require additional appraisal review, and in some cases, more than one appraisal. When multiple appraisals are ordered, lenders typically rely on the lower of the two values. These standards are common on high-balance mortgages and are not unique to reverse mortgages.

Refinancing Into a Jumbo Reverse Mortgage

Refinancing from a HECM or another reverse mortgage into a jumbo is not automatic, and it shouldn’t be. Most jumbo programs require a seasoning period between transactions and a clear financial benefit to you. This is how it should work. A jumbo refinance needs to put you in a clearly better position than you were in before, not just give you short-term access to more cash. We look at the long-term outcome to make sure a refinance actually makes sense for your situation.

Jumbo Vs. HECM: Key Differences

| Feature | Jumbo Reverse Mortgage | FHA HECM Reverse Mortgage |

|---|---|---|

| Minimum Age | 55 (varies by lender and state) | 62 |

| Max Lending Limit | Up to $4,000,000 (some programs may allow more) | $1,249,125 (HUD national limit) |

| Eligible Property Types | Single-family, FNMA-warrantable condos, 1–4 units | Single-family, HUD-approved condos, 1–4 units |

| Upfront Access | 100% lump sum available at closing | Limited (typically 60% or obligations + 10% in first year) |

| Line of Credit Term | 10-year draw period | Lifetime draw period |

| Line of Credit Growth Rate | 1.5% for 7 Years | Note Rate + .50 MIP for Life |

| FHA Insurance | No mortgage insurance premiums (MIP) | Yes, MIP required (upfront and annual) |

| Younger Spouse Protections | Varies by lender – not guaranteed | Fully protected by HUD regulations |

| Use for Home Purchase | Yes | Yes |

| Note: *HECM lump sum capped at 60% of Principal Limit or obligations + 10% in first 12 months. | ||

Jumbo Reverse Mortgage Loan-to-Value by Age Chart

Loan-to-value percentages in this table are based on an interest rate of 8.99% (9.602% APR). Loan amounts are illustrative estimates rounded to the nearest thousand and may vary based on final loan terms, closing costs, and borrower qualifications.Today's Jumbo Reverse Mortgage Rates

| Rate Type | Rate/APR | Lending Limit |

|---|---|---|

| Fixed | 7.990% (8.069%e APR) | $4,000,000 |

| Fixed | 8.950% (8.957%e APR) | $4,000,000 |

| Fixed | 8.980% (9.134%e APR) | $4,000,000 |

| Fixed | 8.990% (9.600%e APR) | $4,000,000 |

| Adjustable | 9.185% (5.625 Margin) | $4,000,000 |

| Note: Fixed: Lump Sum only. Adjustable: Lump Sum or Line of Credit. APR for a 70-year-old, $1M loan in CA. | ||

Jumbo vs. HECM Reverse Mortgage Closing Costs

| Cost Item | Jumbo / Proprietary | HECM (HUD-Insured) |

|---|---|---|

| Origination Fee | $6,405.00 | $6,000.00 |

| Mortgage Insurance Premium (Upfront) | Not Required | $24,982.50 |

| Appraisal Fee | $800.00 | $665.00 |

| Credit Report | $72.20 | $234.60 |

| Settlement / Escrow Fee | $700.00 | $700.00 |

| Title Insurance | $1,070.00 | $1,070.00 |

| Notary / Signing | $400.00 | $250.00 |

| Recording Fees | $188.00 | $188.00 |

| Flood Certification | $5.50 | $15.00 |

| Document Preparation | $140.00 | $206.00 |

| Counseling Fee | $145.00 | $145.00 |

| Misc. Title / Endorsements / Tax Cert / Sub Escrow | $710.00 | $525.00 |

| Total Estimated Settlement Costs | $10,685.65 | $35,006.05 |

Expert Insight from Michael Branson, CEO: “Look at the closing cost comparison above. On a $1.5 million home, the jumbo borrower saves over $24,000 just by not paying FHA mortgage insurance. That’s real money back in your pocket on day one, and you’re still protected by the same non-recourse feature that makes reverse mortgages safe for borrowers and their heirs.”

Who Should Be Cautious About a Jumbo Reverse Mortgage

I want to be upfront here: a jumbo reverse mortgage is not the right solution for everyone. If you expect to sell within a few years, if you really value FHA insurance protections like the guaranteed line of credit growth rate, or if your home value is close to the FHA lending limit, a HECM may be the better fit. The right choice depends on your goals, your timeline, and how you plan to use the funds.

Jumbo vs HECM: Which May Be a Better Fit?

One of the most common questions I hear is “should I go with a HECM or a jumbo?” The honest answer is that it depends on your situation. Here’s a side-by-side comparison based on the current 2026 program guidelines:

| Feature | HECM (FHA-Insured) | Jumbo (Proprietary) |

|---|---|---|

| Backing | FHA-insured, HUD-regulated | Privately funded, lender guidelines |

| Maximum loan amount | Up to $1,249,125 (2026) | Up to $4,000,000 |

| Minimum age | 62 | 55 (varies by state) |

| FHA mortgage insurance | Yes (2% upfront + 0.50% annual) | None |

| Payment options | Lump sum, line of credit, term, tenure, or combination | Lump sum; some programs now offer line of credit |

| Line of credit growth | Yes, guaranteed by FHA | Not available on most programs |

| 60% first-year draw limit | Yes (unless paying off existing liens) | No, full access at closing |

| Non-recourse protection | Yes | Yes |

| Non-FHA condo eligible | No | Yes |

| Interest rates | Lower (see current HECM rates) | Higher, but no MIP offsets the cost |

A jumbo may be worth exploring if:

- Your home value is well above the HECM lending limit

- Your property does not meet FHA guidelines

- You want access based on your full home value, not a capped limit

- You are comfortable with private-lender terms and disclosures

A HECM may be the better choice if:

- Your home value is near or below the HECM lending limit

- You want standardized HUD protections and FHA insurance

- You value long-term line of credit growth

- Protecting a younger or non-borrowing spouse is a priority

Neither option is universally better. I tell people this all the time: the right solution depends on your specific situation, not just the loan size. Run the numbers on both.

Jumbo Reverse Mortgage Market History and 2026 Outlook

I’ve been in this business long enough to have seen these programs come, go, and come back again. Jumbo reverse mortgages first emerged in the early 2000s. They were programs offered by private lenders and had a small niche because at the time, HUD’s limits on the HECM product were very low and varied based on regional Metropolitan Statistical Areas (MSAs) that varied across the nation. For example, California was considered a “high-cost” MSA and their maximum lending limit was $252,700. Even with lower values at that time, this left quite a need for products that exceeded this limit. These programs disappeared though with the housing crash of 2008 when many secondary market programs did not survive the collapse of the market.

Private programs began to reappear in 2014 as investors saw the need and viability of the programs along with the stabilizing of the mortgage market. Several new jumbo products have been introduced in recent years, offering different rates, terms, and features thanks to further appreciation and the needs of senior homeowners. Today, senior homeowners hold a record $14.39 to $14.7 trillion in home equity according to the NRMLA/RiskSpan Reverse Mortgage Market Index. NerdWallet estimates the median savings of borrowers aged 65–74 is just $200,000 (median savings is used because the average savings is inflated by high-net-worth individuals).

What does that mean for you? More seniors have more equity in their homes than ever before, even though many do not have nearly enough in the bank to see them through their retirement years. The outlook for 2026 is strong because you can lock in your loan while values are high, and programs with growth features give you access to even more money in the future. With a little planning, you can make sure you have the funds you need by putting the equity in your home to work.

If you are considering a jumbo reverse mortgage, comparing lenders on the specific terms they offer is essential. Important details include the maximum amount you can borrow, how you will receive the loan proceeds, and the protections available for non-borrowing spouses, if applicable. These are the details that will make the difference in your decision.

For a deeper look at how the jumbo market evolved, read my analysis published at Forbes.com.

Expert Insight from Michael Branson, CEO: “I’ve been originating jumbo reverse mortgages since these programs first came back after the 2008 crash. What I can tell you from two decades in this market is that today’s programs are nothing like the early versions. The rates are more competitive, the borrower protections are stronger, and for the first time we’re seeing line-of-credit options that didn’t exist even two years ago. If you’ve been waiting for these programs to mature, they have.”

Jumbo FAQs

What is a jumbo reverse mortgage?

What is the difference between a HECM and a jumbo reverse mortgage?

What is the difference between jumbo and proprietary loans?

How much can you get from a jumbo reverse mortgage?

Do I need a jumbo reverse mortgage if my home is worth $1.3 million?

What are the rates for jumbo reverse mortgages?

What is the maximum jumbo reverse mortgage?

Can you get a jumbo reverse mortgage line of credit?

How does a jumbo reverse mortgage compare to a Home Equity Line of Credit (HELOC)?

Both allow homeowners to access equity, but they work very differently:

| Feature | Jumbo Reverse Mortgage | HELOC |

|---|---|---|

| Monthly payments | None required | Required (interest + principal) |

| Age requirement | 55+ (varies by state) | Any age (18+) |

| Income/credit requirements | Financial assessment (residual income) | Strict debt-to-income ratio |

| Maximum loan amount | Up to $4,000,000 | Varies by lender (typically lower) |

| Non-recourse protection | Yes, never owe more than the home’s value | No, full recourse loan |

| Upfront costs | Higher (no MIP, but closing costs apply) | Low ($0–$500) |

| Risk if you can’t make payments | No payments required (taxes/insurance still due) | Foreclosure risk |

| Best for | Eliminating payments, long-term cash flow, and aging in place | Short-term needs with reliable income to repay |

For retirees on fixed incomes, the biggest difference is payment obligation. A HELOC requires monthly payments that can increase as rates rise. A jumbo reverse mortgage eliminates that payment risk entirely, though the loan balance grows over time. Each has trade-offs, and the right choice depends on your income stability, how long you plan to stay in the home, and your comfort with each structure.

What are the disadvantages of a jumbo reverse mortgage?

What lenders offer jumbo reverse mortgages?

How long does it take to process a jumbo reverse mortgage?

What about my property tax and insurance with a jumbo reverse mortgage?

Are jumbo reverse mortgages still non-recourse?

Can you have more than one jumbo reverse mortgage?

Can I rent rooms privately, with a rental company, or Airbnb if we have a jumbo reverse mortgage?

Want to see how these numbers look for your home? The right choice isn’t about getting the biggest number. It’s about choosing the option that fits your home, your plans, and your comfort level with the protections available. If you want to compare both options side by side using real-time rates and current 2026 limits, you can get an instant quote here or call us Toll-Free at (800) 565-1722.

Have a Question About Reverse Mortgages?

Over 2000 of your questions answered by ARLO™

Ask your question now!

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

August 19th, 2025

August 28th, 2025

January 19th, 2023

January 31st, 2023

July 15th, 2022

July 19th, 2022

February 15th, 2022

February 15th, 2022

February 9th, 2022

February 15th, 2022

August 20th, 2021

August 24th, 2021

September 22nd, 2020

September 22nd, 2020

October 1st, 2019

October 6th, 2019