America's #1 Rated Reverse Mortgage Lender*

Reverse Mortgage Line of Credit — Growth Feature, FHA Protections & HELOC Comparison

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Reverse Mortgage Line of Credit: Why It’s the Most Popular Option

A reverse mortgage line of credit is one of several ways to access funds through an FHA-insured Home Equity Conversion Mortgage (HECM). Over time, it has become the most commonly selected option, largely because it allows equity to be used gradually rather than all at once.

That preference is reflected in a national study conducted by the AARP Public Policy Institute, which surveyed homeowners who had completed HUD-required reverse mortgage counseling. Among these informed shoppers, roughly two-thirds chose the line of credit after reviewing all available payment options. Importantly, the study included both borrowers who moved forward and those who decided against a reverse mortgage, providing insight into real decision-making rather than marketing impressions.

For many homeowners, the appeal came down to flexibility. Expenses in retirement tend to arise over time, not all at once, and the line of credit allows access to equity without forcing unnecessary borrowing early on.

Although the AARP survey was conducted in 2006, it focused on HUD-counseled consumers, and the underlying HECM line of credit structure it examined remains in place today.

Why So Many Homeowners Choose the Line of Credit

The reverse mortgage line of credit gives you flexibility and control. At closing, HUD restricts how much of that amount can be accessed during the first 12 months. After that initial period, any remaining available funds may be accessed at the homeowner’s discretion. There is no requirement to draw the full amount and no schedule dictating when withdrawals must occur.

Unlike other loan types, you’re not required to take all your money upfront. You decide how much to use and when, which helps with long-term financial planning.

Why Flexibility Matters

Despite being offered only with an adjustable interest rate, many borrowers prefer the line of credit because of its structural flexibility.

With a reverse mortgage line of credit:

- Funds can be accessed over time rather than taken all at once

- Interest accrues only on funds that are actually borrowed

- Unused credit increases over time, expanding future borrowing capacity

This structure allows homeowners to preserve equity until it is needed, rather than borrowing funds prematurely.

How Interest Works With a Reverse Mortgage Line of Credit

Interest on a reverse mortgage line of credit is charged only on the money actually borrowed. Funds that remain unused do not accrue interest.

This distinction is important. With a lump-sum payout, interest begins accruing immediately on the entire borrowed amount. With a line of credit, unused funds remain untouched and do not increase the loan balance.

As long as there is unused credit available, that unused portion grows over time. The growth rate is tied to the loan’s adjustable interest rate plus the annual Mortgage Insurance Premium renewal. While interest rates may fluctuate, the growth feature itself is guaranteed for the life of the loan, provided the borrower continues to meet program requirements.

Why Fixed-Rate Reverse Mortgages Are More Limited

Fixed-rate reverse mortgages operate under a different structure. With a fixed-rate option, all available proceeds are taken as a single lump sum at closing. There is no line of credit and no ability to access additional funds later. Interest begins accruing immediately on the full amount borrowed.

This structure can be appropriate when a homeowner needs to pay off an existing mortgage balance in full and does not anticipate needing future access to equity. Outside of that narrow use case, fixed-rate reverse mortgages tend to limit flexibility later in retirement.

Benefits and Federal Protections of a Reverse Mortgage Line of Credit

Compared to a fixed-rate reverse mortgage, the line of credit option offers structural advantages that are designed for long-term use rather than one-time access.

- Funds can be accessed gradually over time.

- Interest only accrues on money that is actually borrowed.

- Unused credit increases over time.

- The loan is insured by the FHA.

Because the reverse mortgage line of credit is insured by HUD through the FHA, access to available funds cannot be reduced or frozen due to changes in home values, market conditions, or the financial condition of the lender.

As long as the homeowner continues to live in the home as their primary residence, maintains the property, and stays current on property taxes and homeowners insurance, the terms of the line of credit must be honored.

If a lender or loan servicer were to leave the business, HUD would transfer servicing of the loan to another approved servicer. The new servicer is required to honor the original loan terms, including access to the remaining line of credit, for the life of the loan.

These protections are specific to the FHA-insured HECM program. Traditional bank home equity lines of credit do not offer the same guarantees and can be reduced or frozen at the lender’s discretion, often during periods of economic stress when access to funds matters most.

Homeowner Responsibilities: A reverse mortgage does not eliminate homeowner obligations. Borrowers must continue to live in the home as their primary residence, pay property taxes and homeowners’ insurance, and maintain the home in reasonable condition. Failure to meet these obligations can result in the loan entering default, regardless of the selected payout option.

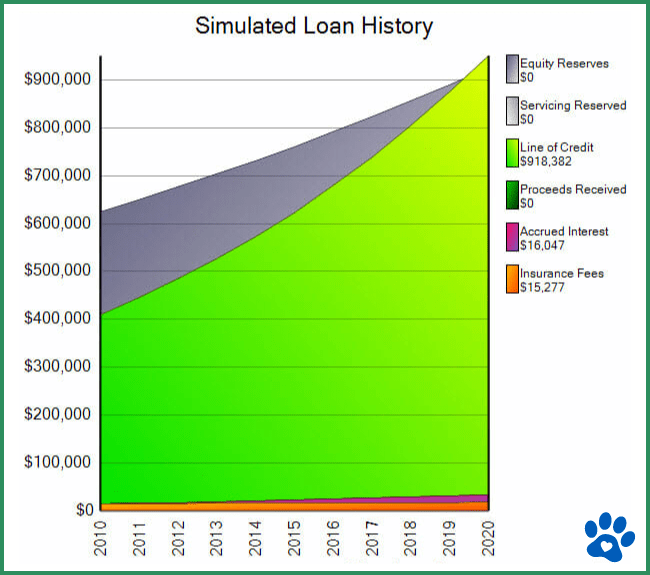

Understanding the Reverse Mortgage Line of Credit Growth Feature

The growth of a reverse mortgage line of credit is often misunderstood. It is not interest earned, and it is not income.

Instead, the unused portion of the credit line increases at the same rate as the loan balance accrues interest, plus the Mortgage Insurance Premium renewal. This increase applies only to the unused portion of the credit line.

Example of How the Line of Credit Can Grow Over Time

Let’s walk through a simple example to show how your unused funds can grow over time. Suppose today’s interest rate (known as the fully indexed accrual rate) is 6.00%, and you add the Mortgage Insurance Premium (MIP) renewal rate of 0.50%. That gives you an effective annual growth rate of 6.50%.

Now, imagine your available loan amount after closing costs and calculations is $350,000. If you don’t use these funds right away, your line of credit will grow automatically month by month.

Here’s what that looks like:

Estimated Line of Credit Growth Over Time

| Time Period | Estimated Credit Line Value |

|---|---|

| Month 1 Growth | $1,895.83 |

| After 5 Years | $516,399 |

| After 10 Years | $714,086 |

If funds are partially used, the growth applies only to the remaining unused balance. As long as some unused credit remains, growth continues.

If interest rates increase in the future, the growth rate will increase as well, helping offset inflation over long retirement periods.

Reverse Mortgage Line of Credit Compared to a Traditional HELOC

A reverse mortgage line of credit shares some surface similarities with a traditional home equity line of credit, but the structure is fundamentally different.

- A reverse mortgage line of credit does not require monthly payments.

- There is no balloon payment after a set term.

- Income and credit score requirements are not used to qualify.

- Access to funds is guaranteed under FHA rules.

- Unused credit grows over time.

A traditional HELOC typically requires monthly payments, is subject to lender discretion, and does not include a growth feature.

Also See: Reverse Mortgage vs. HELOC and Home Equity Loans: Easier Qualifications and More Flexibility

2026 Reverse Mortgage Line of Credit vs. HELOC: Which Fits You?

| Feature | Reverse Mortgage Credit Line | Traditional HELOC |

|---|---|---|

| Monthly Payments Needed? | No | Yes |

| Balloon Payment After 10 Years? | No | Yes |

| Hard to Qualify on Fixed Income? | No | Yes |

| Minimum Credit Score Required? | No | Yes |

| Adjustable Rate? | Yes | Yes |

| Guaranteed Growth Rate? | Yes | No |

| Prepayment Penalty? | No | No |

Line of Credit FAQs

What is a HECM line of credit?

Which is better, a home equity line of credit or a reverse mortgage?

How does a reverse mortgage line of credit grow?

The HECM reverse mortgage line of credit includes a built-in growth feature. The growth rate equals your current interest rate plus the FHA mortgage insurance premium (0.50% as of January 2026).

With today’s 5.00% interest rate, the combined growth rate is 5.50% per year.

Each month, this rate is applied only to the unused portion of your line of credit. As long as funds remain unused, your available credit increases automatically over time. If you take money out, future growth is based on the remaining unused amount.

Example: If you have $100,000 of unused credit, a 5.50% annual growth rate adds about $458 per month to your available line of credit, or $5,500 per year. This calculation is repeated monthly for as long as the loan remains active.

If you already have a reverse mortgage, can you get a Home Equity Line of Credit (HELOC)?

How is the interest charged on a reverse mortgage line of credit?

Determining Whether This Option Fits Your Plans

The reverse mortgage line of credit is not designed to maximize cash upfront. It is designed to provide flexibility, preserve access to equity, and manage financial risk over time.

It tends to work best for homeowners who want optional access to funds, prefer to delay borrowing until needed, or want a long-term financial backstop rather than a one-time payout. Other homeowners may be better served by downsizing, using savings, or exploring alternative financing options.

Like any mortgage, a reverse mortgage is not appropriate for everyone. The decision should be based on timing, long-term plans, and a clear understanding of how the loan works.

Want to learn more? If you want to see how a reverse mortgage line of credit would work in your situation, you can get a personalized estimate with growth projections based on current rates. Our HECM line of credit calculator provides real numbers with no personal information required, or you can speak directly with one of our specialists at (800) 565-1722.

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

July 8th, 2024

July 13th, 2024

October 17th, 2023

October 17th, 2023

November 26th, 2023

December 4th, 2023

July 30th, 2023

July 30th, 2023

August 11th, 2023

September 3rd, 2023

March 8th, 2023

March 14th, 2023

June 27th, 2022

June 30th, 2022

May 2nd, 2022

May 2nd, 2022

April 24th, 2022

May 2nd, 2022

September 17th, 2021

September 22nd, 2021

August 5th, 2021

August 10th, 2021

July 17th, 2021

July 24th, 2021

July 25th, 2021

July 25th, 2021

August 2nd, 2021

August 22nd, 2021

July 30th, 2021

August 2nd, 2021

May 4th, 2021

May 4th, 2021

April 5th, 2021

April 7th, 2021

January 11th, 2021

January 11th, 2021

March 16th, 2020

March 16th, 2020

July 25th, 2020

July 27th, 2020

December 6th, 2019

December 14th, 2019

November 20th, 2019

November 20th, 2019

November 11th, 2019

November 11th, 2019

October 28th, 2019

October 28th, 2019

October 27th, 2019

October 27th, 2019

October 15th, 2019

October 15th, 2019

October 11th, 2019

October 11th, 2019

September 23rd, 2019

September 23rd, 2019

September 4th, 2019

September 4th, 2019

June 13th, 2019

May 1st, 2019

May 1st, 2019

April 1st, 2019

April 1st, 2019

March 28th, 2019

March 28th, 2019

March 19th, 2019

March 19th, 2019

August 28th, 2018

June 29th, 2018

June 29th, 2018

June 20th, 2018

June 20th, 2018

May 21st, 2018

May 21st, 2018

January 11th, 2018

January 23rd, 2018

August 28th, 2017

August 28th, 2017

July 19th, 2017

July 19th, 2017

June 19th, 2017

June 19th, 2017

April 6th, 2017

April 6th, 2017

March 24th, 2017

March 24th, 2017

February 16th, 2017

February 16th, 2017

January 24th, 2017

January 24th, 2017

August 30th, 2016

August 30th, 2016

June 24th, 2016

June 24th, 2016

June 1st, 2016

June 1st, 2016

June 1st, 2016

June 1st, 2016

May 26th, 2016

May 27th, 2016

May 27th, 2016

January 5th, 2016

January 5th, 2016

May 7th, 2015

May 7th, 2015

July 7th, 2014

July 8th, 2014

August 6th, 2013

August 12th, 2013

August 3rd, 2013

August 5th, 2013

August 16th, 2012

August 16th, 2012

July 4th, 2012

May 22nd, 2012

May 22nd, 2012

May 7th, 2012

April 11th, 2012