America’s #1 Rated Reverse Lender*

HUD Can Help Seniors by Raising the Reverse Mortgage Floor Back to 5%

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

HUD has always been about serving the underserved. They even issued a Strategic Plan in March of 2022 outlining 5 areas they would concentrate on helping serve the community. You can find that plan online here.

What you cannot find anywhere in that 82-page plan is a mention of senior homeowners who have been decimated by high-interest rates and HUD cutbacks in the Home Equity Conversion Mortgage (HECM) reverse mortgage program since 2009 when HUD first started seeing problems with the HECM reverse mortgage program due in part to a volatile real estate market and in part to borrowers who were not paying their property charges (taxes, insurance, etc).

HUD raised the national limit to $625,500, which allowed homeowners with higher-valued homes to receive more money when their properties had higher values finally, but they also lowered the Principal Limit Factors (PLF) at that time which gave all borrowers less money as a percentage of the value of their home. This would not be the last time HUD lowered those PLFs.

HUD has always been about serving the underserved. They even issued a Strategic Plan in March of 2022 outlining 5 areas they would concentrate on helping serve the community. You can find that plan online here.

What you cannot find anywhere in that 82-page plan is a mention of senior homeowners who have been decimated by high-interest rates and HUD cutbacks in the Home Equity Conversion Mortgage (HECM) reverse mortgage program since 2009 when HUD first started seeing problems with the HECM reverse mortgage program due in part to a volatile real estate market and in part to borrowers who were not paying their property charges (taxes, insurance, etc.).

HUD raised the national limit to $625,500, which allowed homeowners with higher-valued homes to finally receive more money when their properties had higher values, but they also lowered the Principal Limit Factors (PLF) at that time which gave all borrowers less money as a percentage of the value of their home. This would not be the last time HUD lowered those PLFs.

Congress recognized a need for changes, and lawmakers pressured HUD to make those changes after 2012 financial results showed substantial losses to the program. By then, lawmakers were calling for immediate action. HUD started making changes as a series of knee-jerk reactions trying to play catch-up in 2013. HUD began with decreases to the Principal Limit Factors and increases in the costs to the borrowers for Mortgage Insurance Premiums (MIP). Still, those realizations meant that the actions would only come to fruition at the end of 2014.

Additionally, HUD implemented financial assessment guidelines in 2014, and HUD continued to tighten the parameters in the following years. Instead of waiting to see how these changes affected the MIP fund, HUD further changed the program in 2017, including further decreases to Principal Limit Factors across the board for all ages and lowered the floor rate. This was the single most significant cut to Loan-to-Values ever seen, and borrowers were hit hard at that time.

Lenders tried to ease some of the impacts by lowering margins as much as possible to reduce the expected rate. Still, their efforts could not make up for the move to 3% from 5%. If HUD had stayed at 5%, all HECM adjustable loans, except possibly those with the highest margins in 2018, would have received the maximum allowable under the program (and most often, those borrowers could find lower margins by shopping with multiple lenders). It is even worse today, with expected rates over 5% for all borrowers instead of just those at the highest margins.

We applauded HUD for making tough decisions to save the program for senior borrowers. We also criticized HUD when we felt the pendulum was swinging too far, too fast, though. We have written about both throughout the years. We felt at the time that the changes were too severe and that they didn’t look at some of their issues to cut losses and put everything on the backs of borrowers, and they are doing it again now.

We felt HUD needed to give the changes they had made a chance to take effect rather than continuing to tighten before they could determine their effectiveness. When the Mortgage Insurance Premium (MIP) fund was returned to solvency, we felt many improvements could be made to the program, both to help ensure the fiscal health of the MIP fund and to ensure the quality of the loans insured without making it harder for eligible seniors to get reverse mortgage loans. This includes the rampant servicing issues we see today—many by HUD’s servicers.

In our current inflationary times, reverse mortgages are becoming harder and harder for seniors to qualify for. We believe that HUD, even though it may be unintentional, has inflicted pain on the senior community, which is not warranted, and is now ignoring them in their time of need.

Let’s talk about what got us here.

The rapid appreciation of homes leading up to 2008/09 due to properties sold and financed with little or nothing down, with no income or asset documentation, created an unsustainable real estate market.

During that time, a HUD reverse mortgage required no income documentation, and borrowers defaulted in record numbers even after procuring their reverse mortgages on their taxes and insurance.

When the real estate market collapsed, people often found that their homes were financed for more than the homes’ value. Suddenly homes were not selling, and the loans often exceeded the value.

The losses sustained by the MIP fund were substantial on the forward business but were even worse on the reverse mortgage side. Losses were so significant that Congress pushed to shut down the Home Equity Conversion Mortgage (HECM) or FHA- insured reverse mortgage.

In 2012, the losses to the program were so significant that it was clear that changes to the program would be needed to keep the program active.

HUD makes sweeping changes to reverse mortgages

HUD was given the latitude to act independently to make sweeping changes to mitigate the losses. Those changes included lowering the money borrowers would receive on a reverse mortgage loan.

HUD implemented 3 different Principal Limit Tables since 2008. October 1, 2009, August 4, 2014, and October 2, 2017, lowering the amount borrowers received under the program for every age level.

In addition, the mortgage insurance premium that borrowers paid when they first got their loans, and their renewal premiums increased (after just 3 years, the renewal premiums dropped back down to their previous levels of 2% of the property value or HUD maximum lending limit, whichever is less).

HUD began implementing other steps to mitigate losses and lower borrower defaults. Those defaults of taxes and insurance resulted in HUD paying claims and advancing funds for taxes, insurance, and other third-party expenses.

HUD also implemented financial assessment guidelines that now required borrowers to qualify for reverse mortgages, while more leniently, in much the same way as forward loans with income and credit requirements.

HUD was still concerned about property values, so they implemented a system known as the EAD (Electronic Appraisal Delivery) Online Portal, which required appraisers to electronically deliver completed appraisals to HUD for reverse mortgages, even before the lender received them.

Additionally, HUD regulations permit HUD to mandate a 2nd appraisal be completed (which adds additional costs and delays to the loan), and the lower values must be used for the final loan numbers. The lender is required to use the lower of the two appraised values.

This means that reverse mortgage borrowers are already receiving more scrutiny on their appraisals than any other borrowers. They may be required to get a second appraisal on any application at HUD’s discretion and pay for both appraisals.

This system is still in effect today.

Lenders may only communicate a loan approval to a borrower after HUD has approved the appraisal. This appraisal requirement has resulted in as much as 15 – 20% of all loans requiring a second appraisal to meet HUD requirements.

HUD lowers “Floor Rate” from 5% down to 3%

With the MIP fund solvent and a substantial surplus, HUD still felt their changes needed to be revised. As stated earlier, in October 2017, HUD made the single most significant change to the Principal Limit Factors table, which significantly affected borrowers and is the critical change affecting borrowers still to this day.

They lowered the “Floor Rate” from 5% to 3%, applying further cuts to the Principal Limit Factors. The lowest rates available in the market were well over the 3% floor rate, drastically reducing the amount of money borrowers could receive.

One of the factors that determines how much money borrowers will receive with a reverse mortgage is the “Expected Rate.” As rates have begun to rise, these changes significantly impact homeowners seeking a reverse mortgage.

With these changes in place, it has cost borrowers tens of thousands of dollars in reverse mortgage proceeds. The table below demonstrates what borrowers receive based on their ages at today’s expected rate levels for the current 3% floor rate and what the borrower would receive if the floor were changed back to 5%.

As you can see, there is a tremendous difference in what the borrower will receive at 3% vs 5%. That can and often does make the difference in whether the borrower receives enough money with a reverse mortgage to pay off their existing mortgage (let alone get additional funds for needed expenses).

Comparing Reverse Mortgage 3% vs 5% Floor Rate Benefits

| AGE | PRINCIPAL LIMIT (3% FLOOR RATE) | PRINCIPAL LIMIT (5% FLOOR RATE) | % LOST | HOME VALUE EST $400K | HOME VALUE EST $800K |

|---|---|---|---|---|---|

| 62 | 39.6% | 52.2% | -12.6% | -$50,400 | -$100,800 |

| 65 | 41.7% | 54.0% | -12.3% | -$49,200 | -$98,400 |

| 70 | 45.2% | 57.0% | -11.8% | -$47,200 | -$94,400 |

| 75 | 47.9% | 59.3% | -11.4% | -$45,600 | -$91,200 |

| 80 | 52.2% | 62.7% | -10.5% | -$42,000 | -$84,000 |

| 85 | 58.0% | 67.2% | -9.2% | -$36,800 | -$73,600 |

| 90 | 64.4% | 72.0% | -7% | -$28,000 | -$56,000 |

PLF tables source: https://www.hud.gov/sites/dfiles/SFH/documents/FY%202018%20PLF%20Tables-Rvsd%20Introduction.xls

To further illustrate this point, many prospective borrowers today find they cannot qualify for sufficient money to pay off their existing loans based on the lower Principal Limit at the 3% Floor.

When you look at the table and see that a 62-year-old borrower at today’s 5% rates and a 3% floor receives less than 40% of their current home value (then deduct financed insurance and closing costs), it is not difficult to see why so many are not able to use the program that is supposed to serve their needs at this time.

Today, as many as 50% of applicants are short funds to close based on the current rate/floor parameters. HUD endorsements are down 50%, which further supports that the program is not helping enough seniors at this time – when they need it most (and lenders are forced to lay off staff as well).

HUD could help many seniors in need by moving the floor rate back to 5%

As stated, we felt that HUD swung the pendulum too far when making some of its changes in the past, but the movement of the floor when the MIP fund was no longer in danger, was too much. We believe HUD needs to consider moving it back to 5% now.

The calculations that HUD uses to protect the MIP fund use a worst-case scenario, and the surplus built up in the fund proves that the changes have been too conservative.

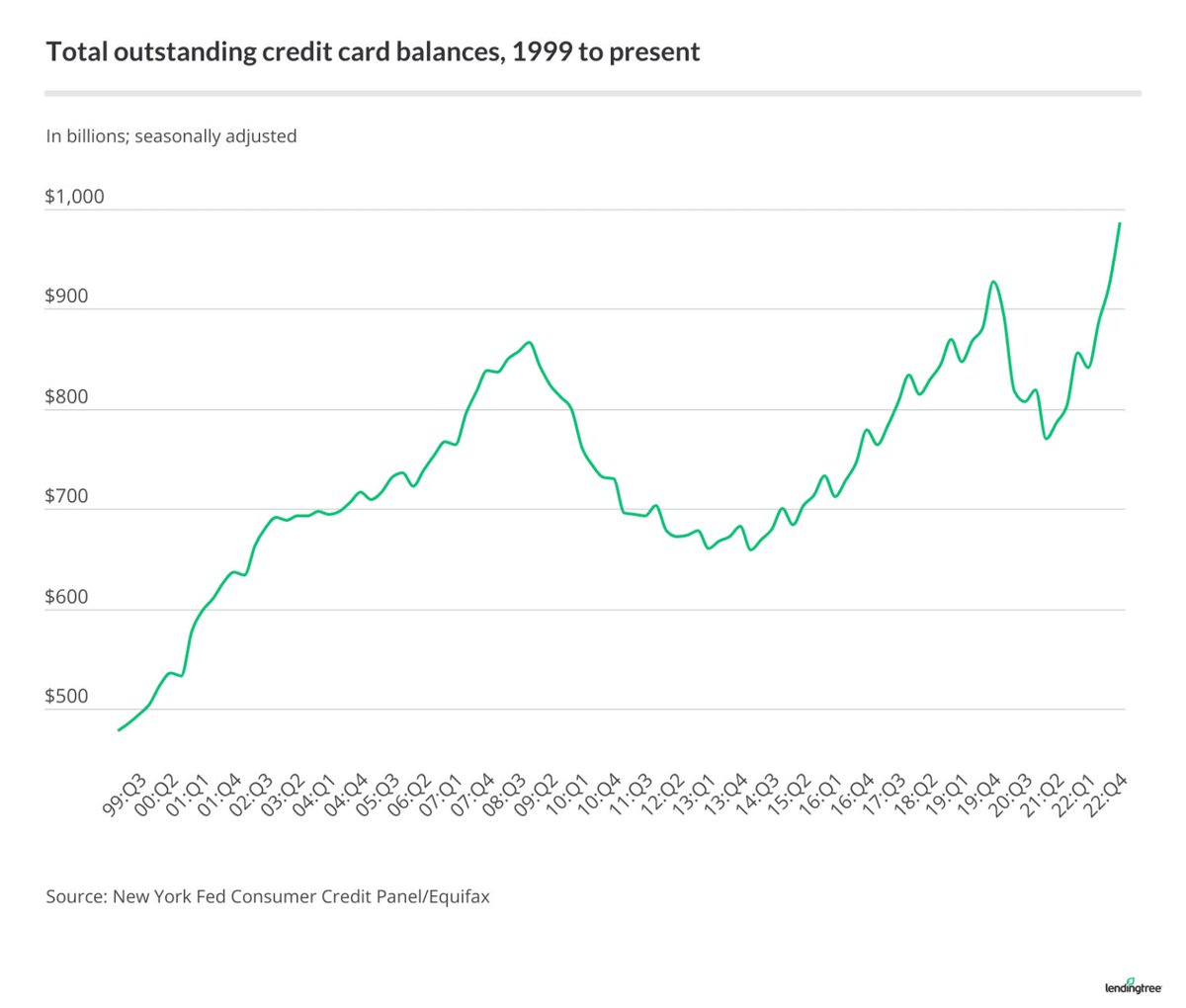

Senior borrowers need the help as more and more people, in general, are being forced to live off of credit cards, many with 25% interest rates, and this is a crime when these senior borrowers have equity in their homes they can’t access because the floor rate is too low.

HUD’s history of servicing and occupancy fraud

We have published numerous articles on HUD’s servicing failures, starting with NOVAD.

We are encouraged by their move to Celink/Compu-Link for future servicing, but we still hear regular accounts of houses long abandoned by reverse mortgage borrowers even after the servicer has been notified, family members of reverse mortgage borrowers who continue to live openly in a home with a reverse mortgage for years after the passing of the borrower and other instances of outright reverse mortgage fraud.

We have long advocated for the subsequent “tightening of the belt” to be around servicing and not at the expense of the borrowers who still need the program but find it increasingly difficult to access.

The HUD Strategic Plan does mention fraud prevention in its body, but not regarding reverse mortgages specifically. That doesn’t help seniors who can’t afford the inflation today and now can’t even borrow against their equity because the HUD Floor Rate is still at 3%.

Recommended additions to HUD strategic plan.

We are disappointed that HUD doesn’t even consider seniors in their Strategic Plan as a group that needs consideration but is encouraged they recognize the need to eliminate fraud.

We would encourage HUD to implement a hotline for family members, neighbors, and others to call or email to report reverse mortgage properties that are no longer occupied by reverse mortgage borrowers and then for the servicer, whether that is HUD’s servicer, Celink/Compu-Link or another entity, to move swiftly to mitigate further losses. Perhaps that would be another way they can justify bringing back the 5% margin.

The HUD Case Number is printed on the face of every recorded Deed of Trust or Mortgage so that HUD can determine every current servicer just by the number on the document.

I am unaware of a single HUD employee who was laid off during the pandemic or now that interest rates have risen tremendously, so HUD should have staff available to handle this type of detail. It is time that HUD thinks outside the box to serve this underserved portion of our community, including the seniors who need their help now more than ever.

They need HUD’s help now.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

May 21st, 2023