VIEW EXAMPLE PAYMENT OPTIONS.

|

ARLO™REVERSE MORTGAGE

ASSISTANT |

Here are 3 Reverse Mortgage Examples in 2025

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Is there an example of how a reverse mortgage works?

We get this question all the time from borrowers, family members, and even others in the lending industry and other professional industries who don’t understand the product. Almost everyone seems to have an opinion on reverse mortgages, often based on virtually no factual knowledge.

Often, people base their opinions on something they heard; some report they read from a reporter who may not have had all the information themselves, was looking to make a sensational article or was just flat-out wrong.

We have debunked many such articles throughout the years and wanted to take an opportunity to let folks know just what a reverse mortgage is and give some factual examples as to how they work.

Firstly, reverse mortgages are not for everyone. They have a very important role in many borrowers’ retirement plans, but they don’t work for all borrowers. We recognize that, and with the examples we will give, we will also explain when this is not advantageous to borrowers and their families.

A reverse mortgage is a loan. It’s not a government grant.

If you take a reverse mortgage, it must be repaid either by you or your heirs with the eventual sale or refinancing of the home if you don’t have the cash assets to pay the loan off, and most borrowers do not have that money sitting in a bank account.

How Much You Can Receive (3 Examples)

A reverse mortgage is a loan that allows borrowers to use a portion of the home equity to obtain cash that requires no monthly repayment for as long as the borrower continues to live in the home and meet the loan requirements.

Borrowers must still pay their taxes, insurance, and other property assessments (i.e., HOA dues) and maintain the homes reasonably, just as with any other loan.

Let’s break that down. Borrowers are eligible to receive a portion of the equity in their home.

You do not get 100% of the value of your home, and because borrowers can live in the home, often for many years, without making a payment, that amount will be less than 50% of the home’s value.

How much you will be eligible for depends on several factors built into a calculator that HUD uses (or a jumbo-proprietary program that uses its own parameters but works in the same manner).

The borrower(s) age, the property value or the HUD maximum lending limit, current interest rates, and if the transaction is a purchase, the purchase price will all affect the amount for which the borrower is eligible.

The formula HUD uses considers actuarial tables since a 62-year-old borrower has a much greater propensity to accrue interest over their remaining life expectancy than an 80-year-old borrower.

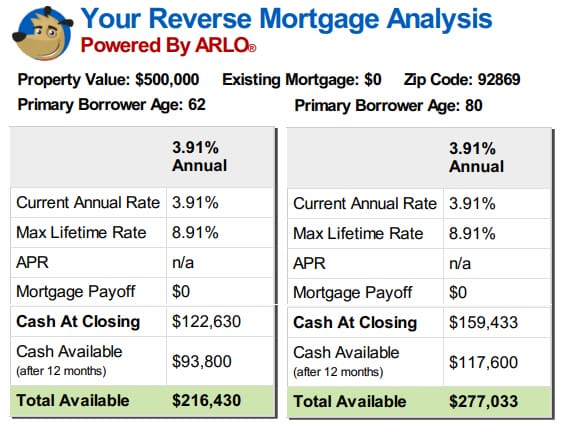

If you look at the examples below, you can see the difference in the proceeds between two borrowers living in the same valued homes with the same interest rate on their loans, but one borrower is 62 years of age, and one is 80.

First Example

Second Example

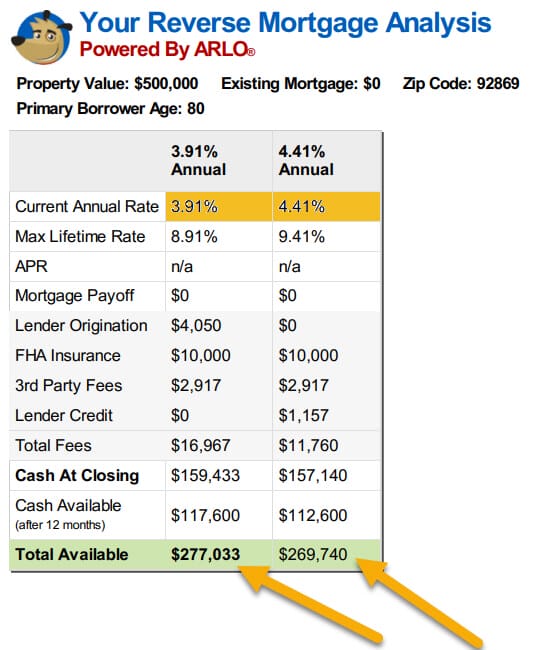

Look at the second set of examples below and notice what happens to the funds available to borrowers when rates rise just one-half to one percent.

It takes far more appreciation than most properties will experience to make up for the drop in the amounts borrowers receive, even with just a half-of a percent increase in the rates.

Current property values have helped many borrowers get more on their reverse mortgages, but rising rates will wipe that out if borrowers sit on the fence and wait for values to increase.

The next part of the statement about what a reverse mortgage is said borrowers could “…obtain cash that requires no monthly repayment…”.

All borrowers receive the same benefits on the reverse mortgage program based on the calculator results (which take into consideration their age, interest rates, and property values).

However, one of the most significant caveats affecting the funds available to most borrowers is that the reverse mortgage must be the only loan on the title when the borrower closes the loan.

Any current mortgages/liens must be paid in full.

Suppose you have two borrowers who both have a benefit of $200,000 under the program; one a current mortgage of $100,000, and the other borrower’s home is free and clear. In that case, the first borrower must pay off their existing loan and will be left with $100,000 to spend as desired, while the second borrower will have the entire $200,000 available.

The first borrower will not have as much cash available, but that borrower will no longer be paying the monthly payment on the old $100,000 loan.

Borrowers receive full disclosure of the amounts available to them for the life of the loan long before they close and have many options as to how they can receive their funds.

After any existing loans are paid in full, borrowers can choose to receive their remaining funds as a lump sum (fixed or adjustable, but there may be limits on fixed-rate draws in the first year if the funds are not being used to pay off existing liens or purchase a new home),

As a line of credit, you can access whenever you wish, borrowers can choose a monthly payment for a set amount or period that will be paid as long as they choose and as long as they have funds remaining in their loan (known as a term payment), or they can choose a payment as determined by the calculator that will continue for the life of the borrower as long as they live in the home (Tenure option).

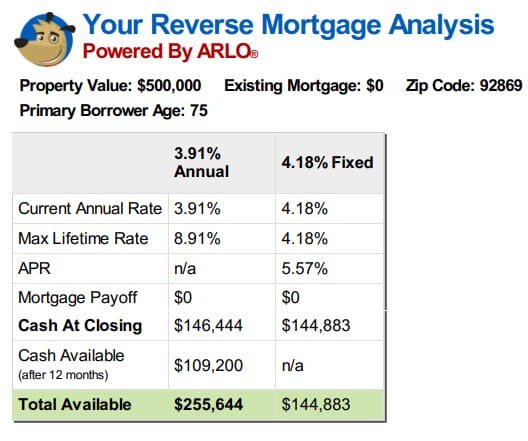

Third Example

Here are Some examples of options for a 75-year-old borrower with no existing mortgage to pay off.

Each Payment Option has its Pros and Cons

Each option has its positives and potential downside to a reverse mortgage. For example, the fixed-rate loan is a one-time draw only, and borrowers must take all the funds available at the inception.

If you need all the money from the start to purchase the home or to pay off your existing loan, this might be a good choice, keeping your interest rate from rising.

On the other hand, if you want a line of credit or a monthly payment option, the only available options are the adjustable rate options. The loans have annual and lifetime caps, but the rates can increase.

Line of Credit Growth Rate

Another positive factor of the adjustable rate options is that the loan amount you do not use will grow at the same rate your loan accrues interest and mortgage insurance.

In other words, if you have money on your line, that amount will grow annually by the interest rate plus the mortgage insurance accrual rate.

A $200,000 line of credit with a 5% interest plus the MIP accrual rate equates to $10,000 in the first year of growth. The following year, the line of credit would grow at the rate in effect at that time but on the new balance of $210,000.

This is not interest that anyone paid to you, and if it is ever explained to you this way, that is an absolute mischaracterization of the treatment of the line’s growth. This credit line increase is available because you didn’t use all your funds and accrue as much interest as someone who did.

If you use the line later, they are borrowed funds and would be repaid when the loan is repaid, unlike interest earned as in money in a bank account that belongs to you, and you don’t have to pay the bank back when you take it out of your account.

Line of Credit Growth Rate Example

Year (After 1st Year) Available Line of Credit

(Starts at $200,000)

1 $211,281

2 $223,119

3 $235,789

4 $249,090

5 $263,140

6 $277,983

7 $293,664

8 $310,229

9 $327,728

10 $346,215

Since a reverse mortgage is a loan, you accrue interest on the borrowed money. No payment is required, so the balance grows, and as the balance grows, so does the amount of interest you accrue.

There is never a payment due with a reverse mortgage, but there is never a prepayment penalty. Borrowers who do not wish to see their balance grow solely due to the accumulation of interest can make payments of any amount at any time.

Flexibility to Make Payments When You Wish

The beauty of this is that since there is no payment due, there are no due dates and no minimums due. If it is not convenient to make a payment in any given month, even if you want to, there are no negative ramifications to your credit if you choose not to pay sometimes.

Borrowers have complete control. They can allow their balance to grow, they can keep it level by paying any interest due, or they can reduce it by paying more than the accruing interest – but they don’t have to do anything but live in the home as their primary residence, pay the taxes and insurance along with any other assessments and maintain the home.

The last thing borrowers must consider is the loan’s effect on heirs.

Effects on Family Members

The biggest complaint I hear is mostly from heirs who may be current spouses who were not married to the borrower when the loan was received. These family members were shocked when they learned of the reverse mortgage or of others who moved in with the borrowers but now learned they could not remain in the home under the loan terms after the original borrowers had all permanently left home.

As I said, the loan uses certain known factors to determine benefits. Therefore, the reverse mortgage does not allow the assumption of the loan by new borrowers or the addition of new spouses after the loan has closed, which would skew all the loan assumptions.

Spousal & Survivor Considerations

If borrowers want new spouses to be included in the security of a reverse mortgage, they must be willing to refinance into a new reverse mortgage in both borrowers’ names.

Family members need to realize that discussing the ramifications of the reverse mortgage and its effects on the amounts left to heirs should take place long before the passing of the individual(s) who felt it necessary to get the loan in the first place.

If the senior homeowner feels that some assistance is necessary, but family members do not want to see their inheritance lowered, perhaps family members can all pool together and create a family reverse mortgage of their own whereby the family members provide for the seniors’ needs and then are repaid with the selling of the home.

Ultimately, the heirs would save the amount of the interest and costs, but they would have to be certain they had the money to meet the homeowners’ needs in addition to their cash expenditures until that time came.

Otherwise, the reverse mortgage allows senior homeowners the freedom to age in place or buy a home that better suits their needs without having to rely on family members when their income and savings would not otherwise permit or without requiring them to utilize all their savings.

It gives them the option of making a payment without the requirement to do so, and since they always own the home, they can sell or pay the loan off for any reason without penalty.

What makes a reverse mortgage right or wrong is whether it is right or wrong for your circumstances, not what happened to your friend’s mother’s uncle when he died, and the family didn’t get the inheritance they expected.

Example FAQs

Is there an example loan agreement available for reverse mortgages?

Is there an example of a monthly payment option for reverse mortgages?

Is there a reverse mortgage line of credit example?

How does a reverse mortgage work on a purchase work?

Is there a calculator that shows reverse mortgage examples?

Also, See:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

June 30th, 2025

February 13th, 2023

February 15th, 2023

February 1st, 2022

February 2nd, 2022

May 9th, 2020

May 9th, 2020

October 15th, 2019

October 15th, 2019

August 15th, 2019

August 15th, 2019

June 29th, 2019

July 2nd, 2019

June 20th, 2019

June 20th, 2019

April 12th, 2019

April 16th, 2019

March 26th, 2019

March 26th, 2019