IS A REVERSE MORTGAGE RIGHT FOR YOU?

|

ARLO™REVERSE MORTGAGE

ASSISTANT |

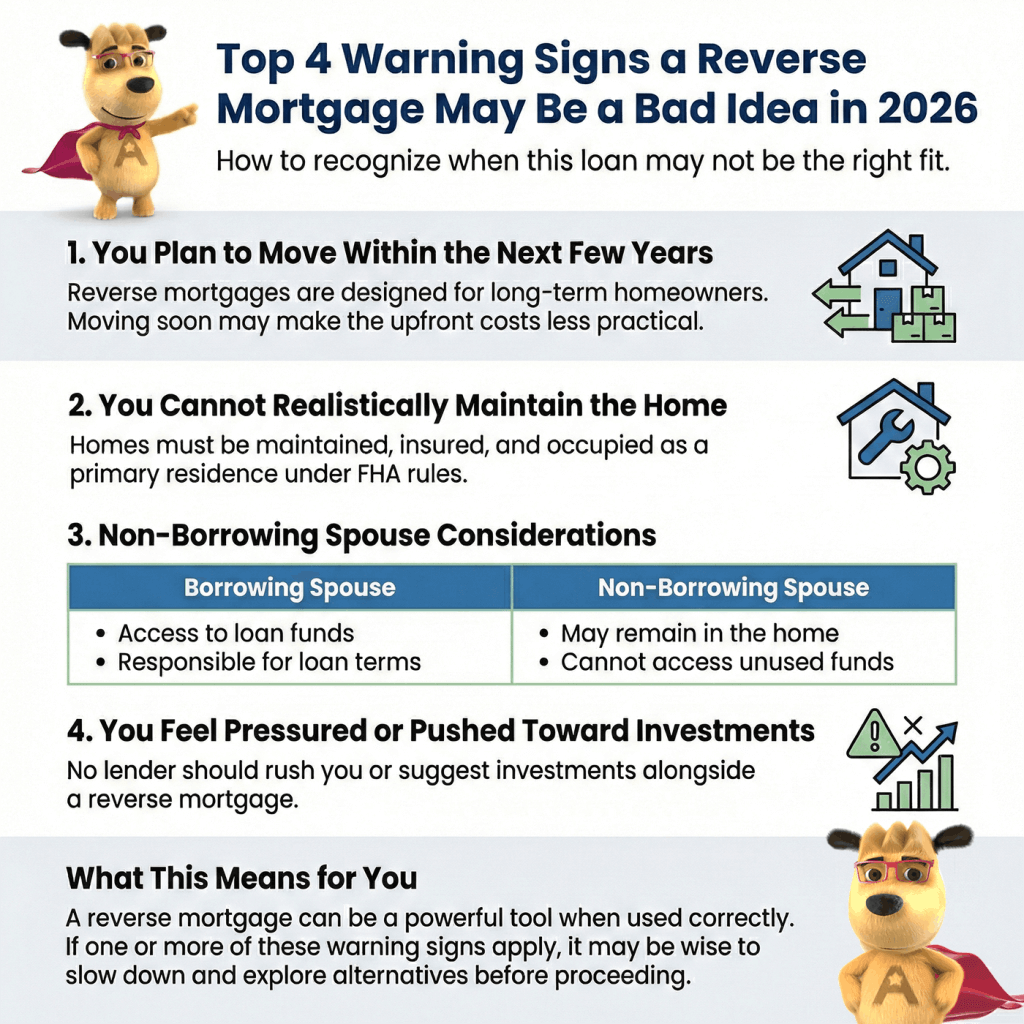

Top 4 Warning Signs a Reverse Mortgage May Be a Bad Idea in 2026

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

A reverse mortgage can be a useful tool for the right homeowner, especially for those who want to age in place and improve retirement cash flow. But it is not the right solution for everyone.

After working exclusively with reverse mortgages for more than two decades, I’ve learned that the biggest problems don’t come from the loan itself. They come from taking it in the wrong situation or without fully understanding the long-term implications.

Below are four clear warning signs that a reverse mortgage may not be a good idea for you right now, along with alternatives to consider.

What This Article Is (and Isn’t)

This is not a list meant to scare you away from reverse mortgages. It’s meant to help you avoid a poor fit.

If none of these warning signs apply to you, a reverse mortgage may still be a reasonable option. If one or more do apply, it’s usually worth slowing down and exploring alternatives.

1. You Plan to Move Within the Next Few Years

Reverse mortgages are designed for homeowners who expect to stay in their home long term.

The loan becomes due when:

- The home is sold

- You move out for more than 12 months

- The last borrower passes away

If you already know you plan to move closer to family, downsize, or transition to assisted living in the near future, the upfront costs of a reverse mortgage may not make sense.

In these cases, you may be better off waiting and exploring a reverse mortgage for home purchase later. That option allows you to buy a new home and use a reverse mortgage in a single transaction, avoiding multiple rounds of closing costs.

2. You Cannot Realistically Maintain the Home

A reverse mortgage is still a mortgage. FHA rules require that the home be:

- Kept in reasonable condition

- Maintained according to property standards

- Insured and occupied as a primary residence

If physical limitations make it unrealistic to maintain the home long term, that’s an important consideration.

It’s true that reverse mortgage proceeds can be used to pay for maintenance, repairs, or in-home assistance. However, if staying in the home itself is no longer practical, a reverse mortgage may only delay a necessary move rather than solve the underlying issue.

3. Your Spouse Lives With You but Is Not a Borrower

HUD changed its rules in 2014 to protect non-borrowing spouses. If a younger spouse is properly listed at the time the loan is taken, they are not forced to leave the home when the borrowing spouse passes away.

However, this protection is often misunderstood.

A non-borrowing spouse:

- May remain in the home

- Does not have access to unused reverse mortgage funds

- Is not a party to the loan

For example, if there is an unused $100,000 line of credit when the borrowing spouse permanently leaves the home, the non-borrowing spouse cannot draw on those funds.

This becomes especially important if:

- The borrowing spouse’s income ends at death

- Pensions or benefits stop

- The remaining spouse relies on the reverse mortgage proceeds to cover expenses

In those situations, it’s critical to evaluate whether the remaining spouse can realistically maintain the home and living costs without access to additional funds.

4. You Feel Pressured or Pushed Toward Investments

This is one of the biggest red flags I still see.

A reverse mortgage lender or broker should never:

- Pressure you to take the loan

- Encourage you to invest the proceeds

- Suggest annuities or financial products alongside the loan

Reverse mortgage professionals are prohibited from selling other financial products in connection with the loan. Any attempt to rush you or steer funds into investments should be treated as a warning sign.

A reverse mortgage decision should be made slowly, with clear explanations, and without pressure.

Warning Signs at a Glance

| Warning Sign | Why It Matters | What to Consider |

|---|---|---|

| You plan to move soon | Upfront costs may outweigh benefits | Waiting or a reverse mortgage for purchase |

| You cannot maintain the home | Maintenance is required under FHA rules | Alternative housing options |

| Your spouse is not a borrower | Non-borrowing spouses cannot access unused funds | Careful income planning for the surviving spouse |

| You feel pressure to proceed | Pressure often signals poor guidance | Seeking an unbiased, HUD-approved lender |

Top FAQs

Do people lose their homes with a reverse mortgage?

A Reverse mortgage is a loan, and the borrower has obligations to keep the loan in good standing. The property must be your primary residence, and you must pay your property taxes and homeowners’ insurance and keep the home reasonably. Failure to meet these obligations could result in the loan being called due and payable, and you may lose your home at a foreclosure sale.

Who benefits most from a reverse mortgage?

The borrower on the reverse mortgage benefits most from the loan program. The reverse mortgage allows a homeowner age 62 or older to borrow money without the burden of a mandatory monthly mortgage payment, allowing them to remain in their home.

What are the common mistakes when people use reverse mortgages?

Some of the most common mistakes center around the timing of obtaining the reverse mortgage and the utilization of the available proceeds. When it comes to proceeds, the biggest mistake is spending them too quickly, leaving homeowners with insufficient funds later in life. Regarding the timing of obtaining a reverse mortgage, there is such a thing as waiting too long. Given their financial situation, many homeowners will wait until it is almost too late to apply for the loan. A reverse mortgage should be considered early in the retirement planning process. A reverse mortgage with a low balance and a larger line of credit will benefit significantly from the line’s growth rate, providing even more available proceeds down the road.

Are there any reverse mortgage nightmare stories?

Who are reverse mortgages NOT suitable for?

A Final Perspective

A reverse mortgage works best when it:

- Solves a long-term need

- Fits the household’s physical and financial reality

- Is taken with full understanding of how it works

If you recognize one or more of these warning signs, that doesn’t automatically mean a reverse mortgage is wrong forever. It may simply mean it’s not the right time or the right structure.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

November 14th, 2023

November 15th, 2023

September 8th, 2019

September 8th, 2019

May 29th, 2019

May 29th, 2019

May 18th, 2017

May 18th, 2017

February 2nd, 2016

February 2nd, 2016

December 31st, 2014

December 31st, 2014

May 1st, 2013