Virginia's #1 Rated Reverse Mortgage

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Experience Excellence with Virginia’s Top Reverse Mortgage Lender

For over 20 years, All Reverse Mortgage, Inc. (ARLO™) has helped Virginia homeowners access their home equity through HUD-approved HECM and jumbo reverse mortgages. As Virginia’s #1 Rated Reverse Mortgage Lender, we hold an A+ BBB rating with perfect 5-star reviews and zero complaints — a record that earned us recognition as a BBB Torch Award for Ethics Finalist three years running.

As a HUD-approved direct lender and proud member of the National Reverse Mortgage Lenders Association (NRMLA), we specialize exclusively in reverse mortgages — it’s all we’ve done since 2004. That singular focus is especially valuable in Virginia, where property values vary dramatically — from the Shenandoah Valley and Southwestern Virginia to high-value homes in Northern Virginia communities like McLean, Great Falls, and Arlington, waterfront properties along the Chesapeake Bay in Virginia Beach and the Hampton Roads corridor, and established Richmond neighborhoods like the Fan District and West End. With an average home value of $450,000, many Virginia homeowners fall within HECM lending limits, but the concentration of federal government and defense-sector professionals in Northern Virginia has driven property values well above the statewide average — making jumbo reverse mortgage expertise directly relevant for a significant portion of the market. Our team introduced the first fixed-rate jumbo reverse mortgage in 2008, giving us deep experience helping homeowners across that full spectrum navigate their options.

Whether your goal is to eliminate monthly mortgage payments, create a financial safety net with a growing line of credit, or access equity for retirement planning, we’re here to help you choose the right program with competitive rates and lower costs. Let us show you the difference two decades of dedicated experience can make.

Virginia Reverse Mortgage Eligibility & Key Facts

| Top 10 Reverse Mortgage Cities in Virginia |

|---|

| 1 Virginia Beach |

| 2 Alexandria |

| 3 Leesburg |

| 4 Fredericksburg |

| 5 Norfolk |

| 6 Reston |

| 7 Sterling |

| 8 Mechanicsville |

| 9 Suffolk |

| 10 Chesapeake |

| Data by MCA (January 2026) |

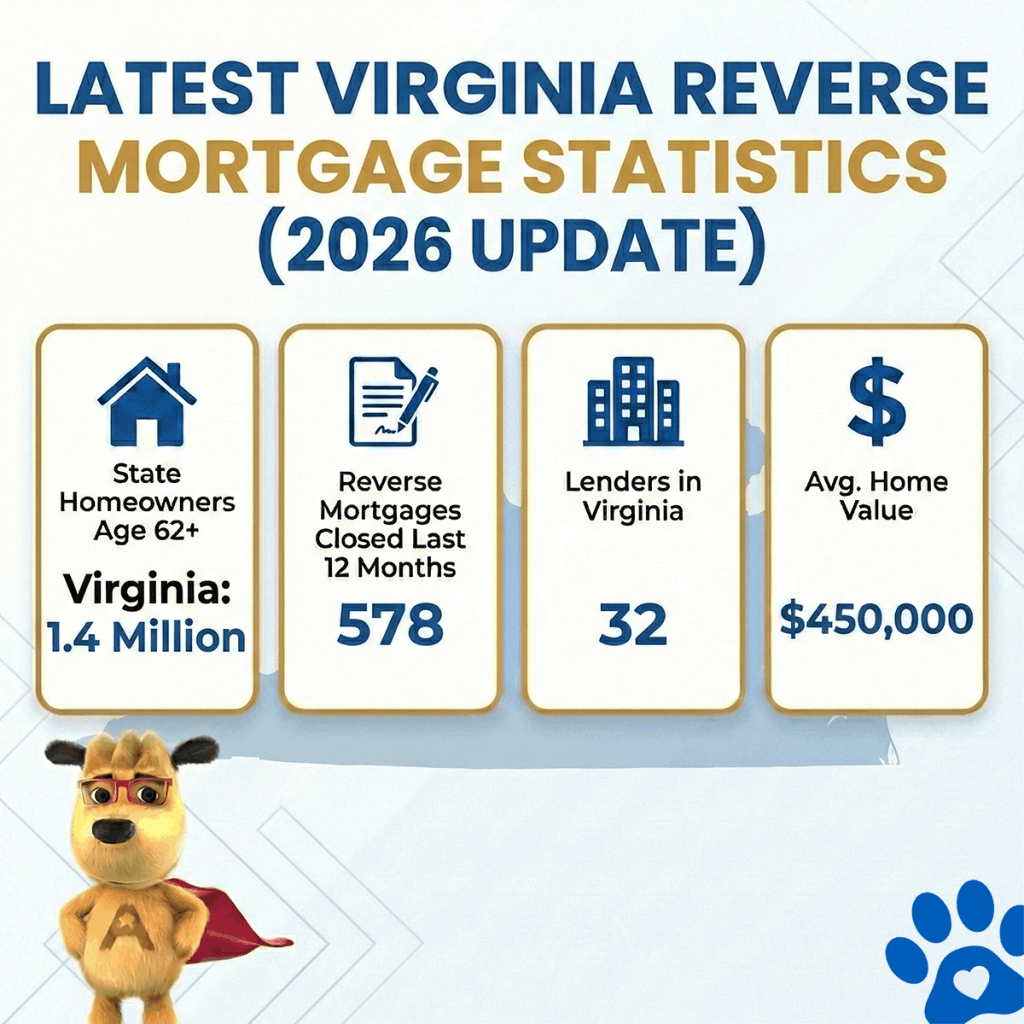

Latest Virginia Reverse Mortgage Statistics (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Virginia | Avg. Home Value |

|---|---|---|---|---|

| Virginia | 1.4 Million | 578 | 32 | $450,000 |

Latest Utah Reverse Mortgage Statistics (2026 Update)

| State | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Utah | Avg. Home Value |

|---|---|---|---|---|

| Utah | 350,000 | 764 | 34 | $577,500 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

Top Reverse Mortgage Lenders in Virginia

| Lender | BBB Rating | Accredited | Years in Business | Customer Rating (0–5) | % Positive Reviews | Complaints | Source |

|---|---|---|---|---|---|---|---|

| All Reverse Mortgage, Inc. (ARLO) | A+ | YES | 21 | 4.94/5 | 99.0% | 0 | Source |

| American Pacific Mortgage | F | NO | 28 | 1.75/5 | 35.0% | 6 | Source |

| CrossCountry Mortgage, LLC. | F | YES | 22 | 1.43/5 | 29.0% | 303 | Source |

| Fairway Independent Mortgage | A+ | YES | 29 | 4.51/5 | 90.0% | 26 | Source |

| Finance of America Reverse LLC (FAR) | A+ | YES | 22 | 3.71/5 | 74.0% | 36 | Source |

| Goodlife Home Loans | A+ | YES | 13 | N/A (Not enough reviews) | N/A (Not enough reviews) | 1 | Source |

| Guaranteed Rate | A+ | YES | 26 | 2.25/5 | 450% | 45 | Source |

| Guild Mortgage Company LLC | A+ | NO | 65 | 1.55/5 | 31.0% | 73 | Source |

| HighTechLending Inc | A+ | YES | 19 | 4.94/5 | 99.0% | 1 | Source |

| Liberty Home Equity Solutions Inc. | A+ | NO | 22 | 1.00/5 | 20.0% | 1 | Source |

| Longbridge Financial LLC | A+ | YES | 13 | 3.77/5 | 75.0% | 34 | Source |

| Luminate Bank | NR | NO | 84 | NA | NA | NA | Source |

| MCM Holdings | A+ | YES | 27 | NA | NA | NA | Source |

| The Money House | NR | NO | 28 | NA | NA | 0 | Source |

| Movement Mortgage, LLC | A+ | NO | 18 | 4.43/5 | 89.0% | 92 | Source |

| Mutual of Omaha Mortgage | A+ | YES | 12 | 3.31/5 | 66.0% | 65 | Source |

| New American Funding | A+ | YES | 26 | 4.65/5 | 93.0% | 147 | Source |

| Plaza Home Mortgage Inc | A+ | YES | 24 | 2.67/5 | 53.0% | 6 | Source |

| Smartfi Home Loans | A+ | YES | 6 | N/A (Not enough reviews) | N/A (Not enough reviews) | 0 | Source |

| South River Mortgage, LLC | A+ | NO | 6 | 3.79/5 | 76.0% | 14 | Source |

Virginia Reverse Mortgage Lending Limits

Virginia, known as “The Old Dominion State,” has a rich history and a population of over 8.7 million people. More than 1.4 million of these residents are homeowners aged 62 and older, making them eligible for a reverse mortgage.

As of January 2026, the average home value in Virginia is $450,000, well within the HECM reverse mortgage lending limit of $1,249,125. This makes reverse mortgages a viable option for many Virginians looking to access their home’s equity.

Virginia’s history is deeply intertwined with the founding of the United States — it was the birthplace of eight U.S. presidents, earning the nickname “Mother of Presidents.” Today, Virginia is a state of contrasts, blending historic landmarks like Colonial Williamsburg with a thriving technology sector anchored by Northern Virginia’s proximity to Washington, D.C. The state is also home to a significant veteran and military retiree population, particularly around the Hampton Roads area and along the I-95 corridor, many of whom have built substantial home equity over long careers of service.

If you’re a homeowner aged 62 or older in Virginia, a reverse mortgage could be a valuable financial tool for your retirement. Whether you’re looking to eliminate monthly mortgage payments or access additional funds from your home’s equity, All Reverse Mortgage, Inc. (ARLO™) is here to help. We’re ready to answer your questions and guide you through the process.

State-Specific Reverse Mortgage Laws in Virginia

Virginia adheres to federal reverse mortgage regulations set by the U.S. Department of Housing and Urban Development (HUD), ensuring that borrowers are protected under national standards for Home Equity Conversion Mortgages (HECMs). However, the state also enforces additional consumer protections and lending laws to safeguard borrowers. Here’s what you need to know about Virginia’s reverse mortgage regulations:

- Mandatory Counseling — Before applying for a reverse mortgage in Virginia, borrowers must complete a HUD-approved counseling session. This ensures that you understand the loan terms, costs, and potential alternatives. Counseling can be completed over the phone or in person, and a certificate of completion is required to proceed with the loan.

- Prohibition on Tied Financial Products — Virginia law prohibits reverse mortgage lenders from requiring you to purchase additional financial products, such as annuities or insurance, as a condition for obtaining a reverse mortgage. This ensures the process remains transparent and free from unnecessary pressure.

- Clear Disclosure Requirements — Lenders in Virginia are required to provide borrowers with detailed loan disclosures. These include interest rates, fees, repayment terms, and ongoing obligations such as paying property taxes, homeowners insurance, and maintaining the home.

- Cooling-Off Period — Virginia enforces a mandatory waiting period between the counseling session and closing the loan. This ensures borrowers have ample time to review the loan terms and make an informed decision.

- Licensed Lenders — All reverse mortgage lenders operating in Virginia must be licensed by the Virginia State Corporation Commission. This ensures that lenders meet the state’s standards for ethical practices, transparency, and professionalism.

- Non-Recourse Loans — Reverse mortgages in Virginia are non-recourse loans, meaning that neither the borrower nor their heirs will owe more than the value of the home when the loan is repaid. This protection ensures that you won’t be burdened with additional debt if the loan balance exceeds the home’s value.

- Spousal Protections — Virginia follows federal HUD guidelines to protect non-borrowing spouses. If certain conditions are met, a non-borrowing spouse may remain in the home after the borrowing spouse passes away or moves out.

HUD-Approved Reverse Mortgage Counseling Agencies in Virginia

| Name | Agency ID | Address | Phone | Web Site |

|---|---|---|---|---|

| CHILD & FAMILY SERVICES OF EASTERN VIRGINIA, INC. D/B/A THE UP CENTER | 81146 | 222 W 19th St, Norfolk, Virginia, 23517-2218 | (757) 622-7017 | theupcenter.org |

| COMMONWEALTH CATHOLIC CHARITIES, RICHMOND,VA | 81611 | 1601 Rolling Hills Dr, Richmond, Virginia, 23229-5011 | (804) 285-5900 | cccofva.org |

| FIRST HOME ALLIANCE | 84016 | 3138 Golansky Blvd Ste 202, Woodbridge, Virginia, 22192-4260 | (703) 580-8838 | firsthomealliance.org |

| KOREAN COMMUNITY SERVICE CENTER OF GREATER | 80370 | 7700 Little River Turnpike, ANNANDALE, Virginia, 22003-2406 | (703) 354-6345 Ext: 101 | firsthomealliance.org |

| HOUSING OPPORTUNITIES MADE EQUAL OF VIRGINIA, INCORPORATED INCORPORATED | 80354 | 626 E Broad St Ste 400, Richmond, Virginia, 23219-1890 | (804) 354-0641 | kcscgw.org |

| MONEY MANAGEMENT INTERNATIONAL - ALEXANDRIA VA | 80536 | SUITE 600 5680 KING CENTRE DR ALEXANDRIA, VA 22315-5757 | (866) 232-9080 | moneymanagement.org |

Did you know? Virginia does not mandate in-person counseling. Visit our counseling page for a list of phone-based counseling agencies and conduct your required counseling from the comfort of your home.

Other Areas of Interest in Virginia

Ashburn Chesapeake Hampton Suffolk Virginia Beach Woodbridge

Ready to Unlock Your Home’s Equity?

As Virginia’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

All Reverse Mortgage, Inc. is fully licensed by the Virginia State Corporation Commission (License #MC-5906), ensuring that you receive expert guidance every step of the way.

Get Your Reverse Mortgage Quote from Virginia’s #1 Rated Reverse Mortgage Lender* or call (800) 565-1722 to speak with a licensed expert.

Additional Resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald