Serving Ashburn Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Ashburn Reverse Mortgage Lenders

At All Reverse Mortgage, Inc. (ARLO™), we are honored to serve the wonderful community of Virginia. With a perfect 5.0-star rating and an A+ rating from the Better Business Bureau, we’ve become the top-rated reverse mortgage lender in Virginia, a testament to our unwavering commitment to helping homeowners like you.

For over 20 years, we’ve focused exclusively on reverse mortgages, working tirelessly to understand and meet the unique needs of homeowners across Virginia. Since our start in November 2004, our mission has been simple: to provide you with the best rates and most competitive pricing, allowing you to make the most of your hard-earned home equity.

As a HUD-approved direct lender, we offer a variety of reverse mortgage options, including the widely respected Home Equity Conversion Mortgage (HECM) programs and specialized non-FHA and jumbo reverse mortgages. We understand that Virginia homeowners deserve choices, especially when it comes to high-value properties that exceed the national lending limit of $1,249,125 for 2024.

We encourage you to see the difference for yourself. Compare our customer reviews, lower rates, and competitive closing costs with other major lenders. We’re confident that you’ll find our approach uniquely tailored to your needs, with a focus on maximizing your home’s equity in a way that benefits you the most.

All Reverse Mortgage is fully licensed by the Bureau of Financial Institutions (License/Registration MC-5551), ensuring you receive the trusted service you deserve. We’re here to help you navigate your options and secure a brighter financial future in the comfort of your Virginia home.

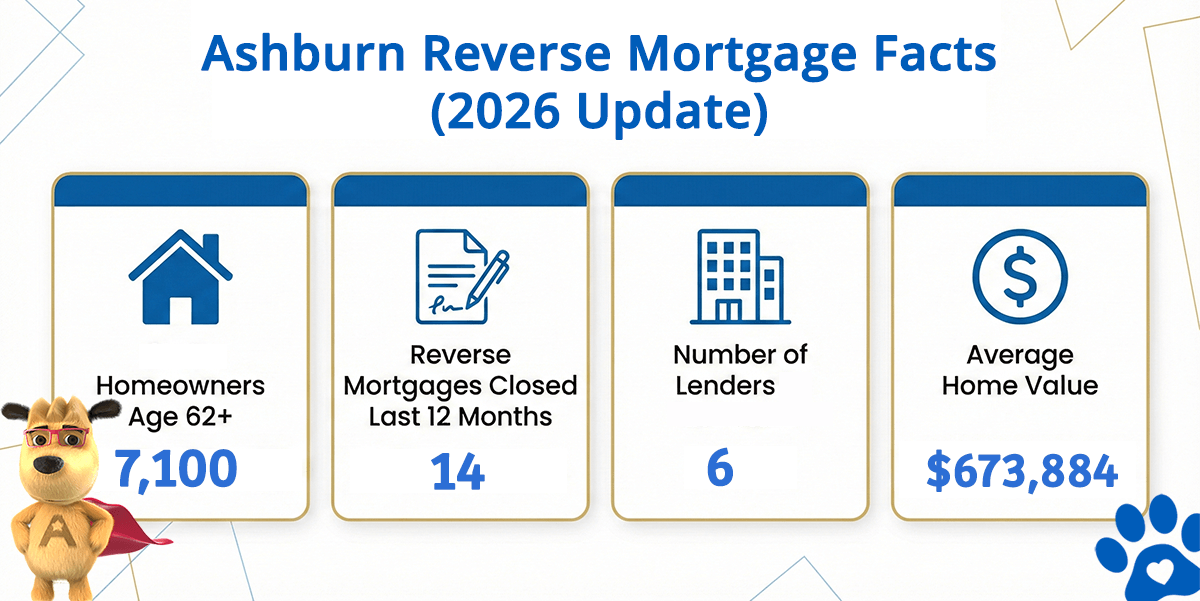

Ashburn Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Lenders in Ashburn (est) | Avg. Home Value |

|---|---|---|---|---|

| Ashburn | 7,100 | 14 | 6 | $673,884 |

How this data was derived: Reverse mortgage counts reflect FHA-insured HECM loans endorsed over a rolling 12-month period (Dec 2024–Nov 2025) using HUD HECM Snapshot data. Active lenders represent unique FHA sponsor numbers with at least one endorsed loan during this period. Estimated homeowners age 62+ are based on U.S. Census ACS 5-year owner-occupied households age 65+ as a conservative proxy. Home values are sourced from Zillow’s Home Value Index (latest available).

HUD-Approved Direct Lender

All Reverse Mortgage, Inc. (ARLO™) is approved by the Department of Housing and Urban Development (HUD) to originate, underwrite, and close the Home Equity Conversion Mortgage (HECM), the federally insured reverse mortgage program.

As a direct lender, we handle the process from application through closing, providing clear numbers and full transparency.

Local Reverse Mortgage Help in Ashburn

All Reverse Mortgage of Ashburn works with homeowners who want to:

-

Pay off an existing mortgage and eliminate required monthly payments

-

Access home equity while continuing to live in their home

-

Refinance an existing reverse mortgage

-

Use a reverse mortgage as part of a broader retirement strategy

Each option is reviewed carefully based on age, home value, and long-term housing plans.

About All Reverse Mortgage of Ashburn

All Reverse Mortgage, Inc. has focused exclusively on reverse mortgages for more than 20 years.

Our leadership team helped introduce the first fixed-rate jumbo reverse mortgage in 2008, giving us extensive experience across:

-

HUD-insured HECM loans

-

Proprietary jumbo reverse mortgage programs

-

High-value housing markets

That experience is especially important in communities like Ashburn, where home values often exceed national averages.

Straightforward Guidance, No Pressure

A reverse mortgage should be evaluated with clarity, not urgency.

Our licensed originators explain:

-

How much equity may realistically be available

-

The differences between HECM and jumbo reverse mortgage options

-

Ongoing homeowner responsibilities such as taxes, insurance, and maintenance

-

Long-term considerations for heirs and estate planning

You see real numbers first, then decide.

Ashburn Reverse Mortgage Lending Limits (2026)

Based on this 2026 update, Ashburn has an estimated 7,100 homeowners aged 62 and older, with 14 FHA-insured reverse mortgages closed during the most recent 12-month reporting period.

With an average home value of $673,884, Ashburn homeowners should know:

-

Many homes remain eligible for the 2026 federal HECM lending limit of $1,249,125

-

HUD-insured reverse mortgages are widely accessible in the area

-

Jumbo reverse mortgage programs may be appropriate for higher-valued properties

About Ashburn

Ashburn is a census-designated community in Loudoun County, located roughly 30 miles northwest of Washington, D.C. Known for its strong technology presence and high quality of life, Ashburn has attracted long-term homeowners who have accumulated significant equity. For many residents, reverse mortgages are explored as a way to reduce monthly expenses while remaining in the home long term.

Ready to Unlock Your Home’s Equity?

As Ashburn’s #1 Rated Reverse Mortgage Lender, All Reverse Mortgage, Inc. (ARLO™) is here to provide trusted guidance, real-time rates, and expert support to help you make informed decisions.

✔ No obligations. Just real-time rates and expert advice.

✔ Instant quote. No personal info required.

✔ Licensed experts. Get clear, honest answers.

As a fully licensed lender by the Virginia State Corporation Commission (License #MC-5906), we’re committed to helping you secure the retirement you deserve.

Get Your Free Quote from Ashburn’s #1 Rated Reverse Mortgage Lender, or call (703) 454-5711 to speak with a friendly expert today.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald