Serving Ocala Homeowners Since 2004

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

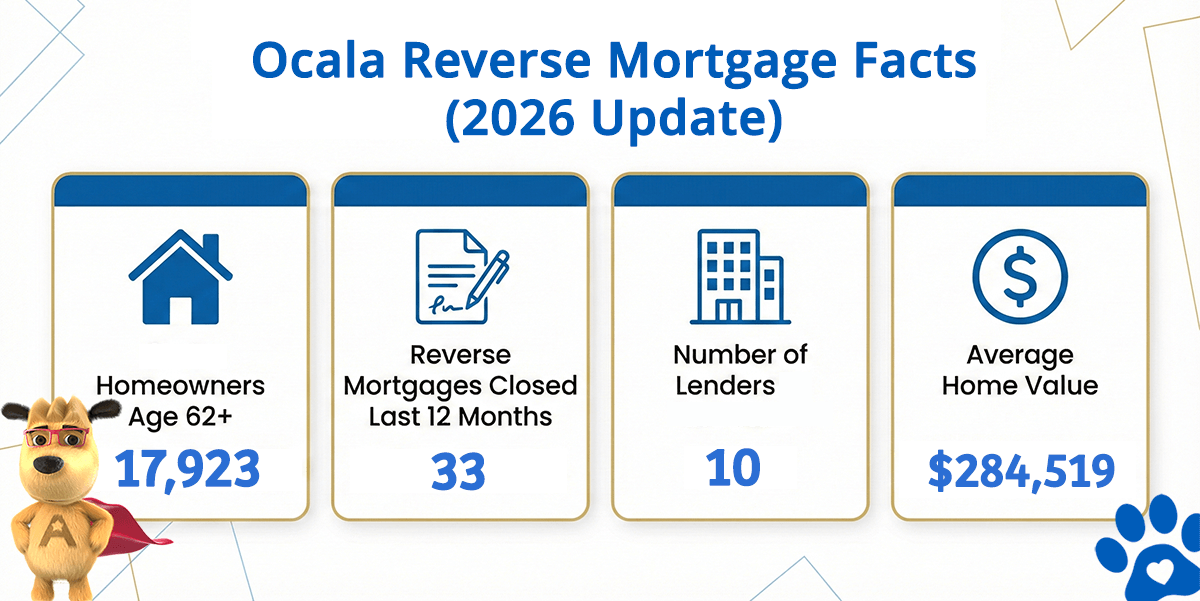

Ocala Reverse Mortgage Market at a Glance

Ocala Reverse Mortgage Facts (2026 Update)

| City | Homeowners Age 62+ | Reverse Mortgages Closed Last 12 Months | Active Lenders | Avg. Home Value |

|---|---|---|---|---|

| Ocala | 17,923 | 33 | 10 | $284,519 |

The Equine Heritage and Growing Retiree Market in Ocala

Ocala’s identity is shaped by two distinctive forces: its storied tradition as the horse capital of Florida, and its expanding population of retirees from the Northeast seeking affordable housing and warm winters. The Marion County market reflects this dual character—horse properties command premium prices in rural areas, while more modest neighborhoods have attracted northeast migrants who found Ocala’s cost of living far more manageable than Miami or Palm Beach. With nearly 18,000 homeowners age 62 and older, many of them long-term equity holders, the city has become a growing reverse mortgage market. The average home value of $284,519 sits comfortably below the FHA lending cap of $1,249,125, meaning most Ocala borrowers can access their equity through traditional FHA HECM programs without complications.

The economic drivers here differ from Florida’s major metros. Aside from equestrian-related businesses and agriculture, Marion County has invested heavily in healthcare infrastructure. Ocala Regional Medical Center and various satellite urgent care facilities employ hundreds of workers, creating pockets of long-career professionals nearing or in retirement. The tourism sector benefits from natural springs and recreational opportunities, but doesn’t dominate the employment base as it does in Orlando or Miami. What this means for reverse mortgage borrowers: many have built equity over 30, 40, or even 50 years in homes they never plan to leave. They worked locally in healthcare, education, small business, or agricultural sectors, raised families in the same neighborhoods, and now face the question of how to convert that substantial equity into income while staying put.

Neighborhood diversity in Ocala supports this demographic shift. The historic downtown near Silver Springs includes older, mid-century homes typical of Florida communities from the 1950s–1970s. Southeast Marion, where many northeast transplants settle, features affordable ranch and colonial-style homes built in the 1980s and 1990s. Horse country—areas like Lowell, Reddick, and the rolling properties west of town—commands higher prices but fewer units. And the Paddock Park area and newer developments appeal to younger retirees seeking modern master-planned communities. This range means reverse mortgage prospects come from all walks: empty-nesters in modest 1,200 sq ft ranches, empty-nesters in larger colonial revivals, and some with more substantial horse properties carved out of rural subdivisions. Understanding the basics of how reverse mortgages work helps borrowers in every neighborhood recognize whether this strategy fits their situation.

How a Reverse Mortgage Works for Ocala Homeowners

A reverse mortgage is fundamentally a loan secured by your home that allows homeowners age 62 and older to borrow against accumulated equity without making monthly mortgage payments. The most widely available form is the Home Equity Conversion Mortgage (HECM), insured by the Federal Housing Administration and regulated by HUD.

With a HECM, you keep the deed and remain the owner. You don’t make monthly payments as long as you live in the home, maintain it, and stay current on property taxes and homeowners insurance. When you sell, move permanently, or pass away, the loan balance comes due—and FHA insurance ensures you’ll never owe more than the home’s sale price.

Common Uses in Ocala

- Turning a modest equity stake into reliable retirement income through a credit line that grows over time

- Paying off an existing mortgage to eliminate monthly obligations entirely

- Covering unexpected medical expenses or home renovations without depleting savings

- Supporting adult children or grandchildren during education or family transitions

Ocala Reverse Mortgage Eligibility

| Requirement | Details |

|---|---|

| Age | 62 or older (at least one borrower) |

| Property | Primary residence — single-family, condo, or approved manufactured home on permanent foundation |

| Equity | Generally at least 50% equity in the home |

| Counseling | Counseling from a HUD-approved counselor is required before you can apply |

| Financial Assessment | The lender reviews your income, credit history, and capacity to maintain property taxes, insurance, and home upkeep |

Try our reverse mortgage calculator to see an estimate based on your Ocala home’s value and your age — results are instant and no personal information is collected.

Understanding the Costs

Reverse mortgage economics include origination fees, FHA mortgage insurance premiums, appraisal and inspection costs, title work, and interest that accumulates over the life of the loan. Unlike a traditional purchase or refinance, most costs can be financed into the loan itself—you don’t have to pay them from your pocket at closing. For insight into what these costs look like, read our guide to upfront and ongoing costs. To see how the benefits stack up against the financial picture, we also cover program fundamentals in straightforward language.

Is a Reverse Mortgage Right for You?

The program works best for homeowners committed to staying in their home long-term and seeking improved monthly cash flow or a financial safety net without selling. It’s less suitable for those planning to move within the next few years or who want to preserve every cent of equity for heirs.

Our resource on how the application and funding process works walks you through each stage from initial inquiry to funding. For families weighing the bigger picture, we explain what happens to the reverse mortgage after a borrower’s passing so heirs understand their responsibilities and options.

HUD-Approved Direct Lender Serving Ocala

All Reverse Mortgage, Inc. (ARLO) is a HUD-approved direct lender—we originate, process, and fund reverse mortgages directly, not through third-party brokers. This means Ocala homeowners get a dedicated contact from the first conversation through closing, with no confusion about who’s handling their loan.

Our credentials are verifiable through the HUD lender lookup tool, and our BBB profile documents over 20 years of borrower feedback. All Reverse Mortgage, Inc. is fully licensed by the Florida Office of Financial Regulation (License #MLD874), ensuring expert guidance and regulatory compliance throughout the process.

Get a Reverse Mortgage Quote for Your Ocala Home

Use the ARLO™ calculator for an instant quote with live rates — no personal information required.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald