America's #1 Rated Reverse Mortgage Lender*

Here’s the Truth About Reverse Mortgages (No BS)

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

A reader recently shared their skepticism about reverse mortgages, saying:

“I’ve read a lot about reverse mortgages, and it seems they’re more for the bank’s benefit than yours. They make it sound like they’re helping, but in reality, you’re giving away your home for a low price. If you get a reverse mortgage and pass away soon after, your home could be lost, and your family won’t be able to keep it, even with a will.”

We agree with one point: reverse mortgages aren’t for everyone. But it’s important to separate fact from fiction, so let’s clear up these common misconceptions.

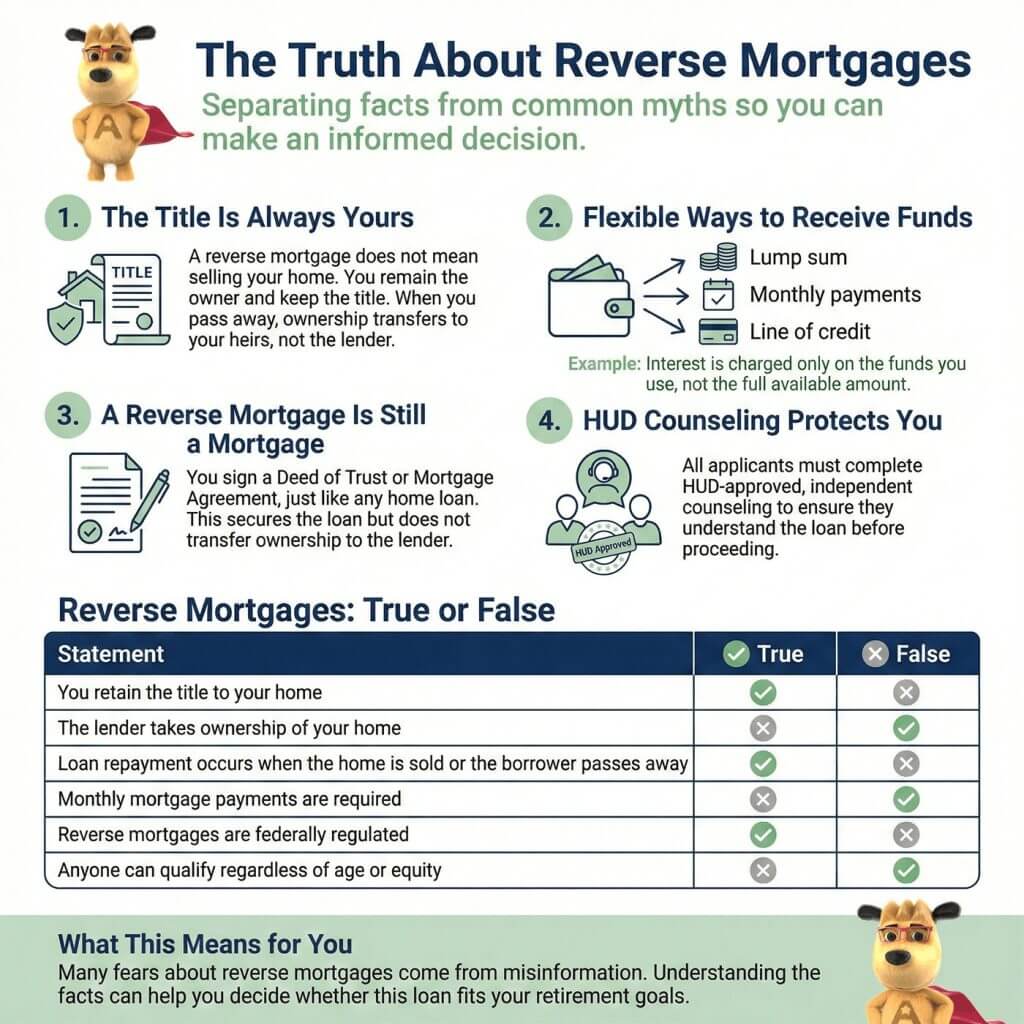

1. The Truth About Ownership: The Title Is Always Yours

Contrary to popular belief, a reverse mortgage does not mean selling your home to the bank. You remain the owner and keep the title. If you pass away, the title transfers to your heirs — not the bank.

Here’s how it works:

- The loan becomes due only when the borrower moves out permanently or passes away.

- Your heirs can choose to pay off the loan and keep the house, or they can sell the property to settle the loan.

The claim that a reverse mortgage automatically results in losing your home is simply not true.

2. Flexible Options for Funds

One of the best features of a reverse mortgage is the flexibility in how you receive funds:

- Lump sum: Access your money upfront.

- Monthly payments: Get consistent income to cover expenses.

- Line of credit: Withdraw funds only when needed, paying interest only on what you use.

For example, if you borrow $10,000 from a $100,000 line of credit, you’ll pay interest on only $10,000 — not the full amount. If you pass away soon after, your family only owes the outstanding balance plus minimal interest, not the entire home.

3. You Still Own Your Home

When you sign a reverse mortgage, you’ll complete a Deed of Trust or Mortgage Agreement, just like with any other home loan. This secures the loan but does not transfer ownership to the lender.

The myth that the bank “takes your home” stems from misunderstandings or inaccurate anecdotes. Misinformation like this can cause unnecessary fear.

4. Counseling Ensures You’re Informed

HUD requires all reverse mortgage applicants to receive counseling from approved, independent agencies. This step ensures you understand the terms, responsibilities, and benefits before making any commitments.

If you’re unsure whether a reverse mortgage is right for you, reach out to resources like HUD, AARP, or the National Reverse Mortgage Lenders Association (NRMLA) for accurate information.

Reverse Mortgages: True or False

| True | False |

|---|---|

| You retain the title to your home. | The lender takes ownership of your home. |

| The loan is repaid when the borrower sells the home or passes away. | You must make monthly payments to the lender. |

| You can receive funds as a lump sum, monthly payments, or a line of credit. | You only receive a one-time payment. |

| Reverse mortgages are regulated by the federal government. | Reverse mortgages are unregulated and risky. |

| Borrowers must meet certain age and property criteria. | Everyone is eligible for a reverse mortgage. |

| The amount you can borrow depends on age, home value, and interest rates. | You can borrow the full value of your home regardless of other factors. |

Want the Straight Scoop on Your Options? Get a no-nonsense reverse mortgage quote from All Reverse Mortgage, Inc. (ARLO™) — America’s #1 rated lender with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote — simple, trusted, 100% secure!

Top FAQs About Reverse Mortgages

How do reverse mortgages work?

Is a reverse mortgage a scam?

When is a reverse mortgage a good idea?

Do you pay interest on a reverse mortgage?

What are the drawbacks of taking a reverse mortgage?

If a person has a reverse mortgage and has no home equity left, do they have to move out?

Final Thoughts

A reverse mortgage can be a valuable tool for the right homeowner, but it’s not a one-size-fits-all solution. The key is education and understanding the facts before making a decision.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

October 16th, 2024

October 28th, 2024

August 31st, 2024

August 31st, 2024

July 9th, 2024

July 22nd, 2024

October 19th, 2022

October 30th, 2022

October 1st, 2020

October 1st, 2020

January 27th, 2023

January 31st, 2023

June 18th, 2020

June 23rd, 2020

July 20th, 2020

July 20th, 2020

May 21st, 2020

June 29th, 2020

March 19th, 2020

March 19th, 2020

January 13th, 2013

January 14th, 2013

February 3rd, 2020

February 7th, 2020

December 18th, 2012