Reverse Mortgage Calculator — Powered by ARLO™

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

When you’re looking into a reverse mortgage, you should have numbers you can rely on, backed by a HUD-approved direct lender with more than 20 years of experience helping older homeowners make informed decisions.

Most online calculators leave out the details that matter most to you. They don’t show the actual interest rate you may receive, the real APR, or the closing costs based on where you live.

Our reverse mortgage calculator, powered by ARLO™, was built to change that. It gives you accurate, lender-verified results in real time. ARLO™ helps you understand your eligibility, compare reverse mortgage options side by side, and see which program best fits your goals before you ever pick up the phone.

Here’s what makes our calculator different:

Because the calculator uses the same pricing engine we use for live loan scenarios, your results match exactly what you would receive from our team.

- Real-Time Rates and APR — Updated daily with both fixed and adjustable options.

- Accurate Closing Costs by ZIP Code — No generic numbers. You see the actual fees for your loan.

- Smart Loan Matching — Based on your input, the calculator shows which programs fit your goals, including both HUD-insured HECM options and jumbo programs.

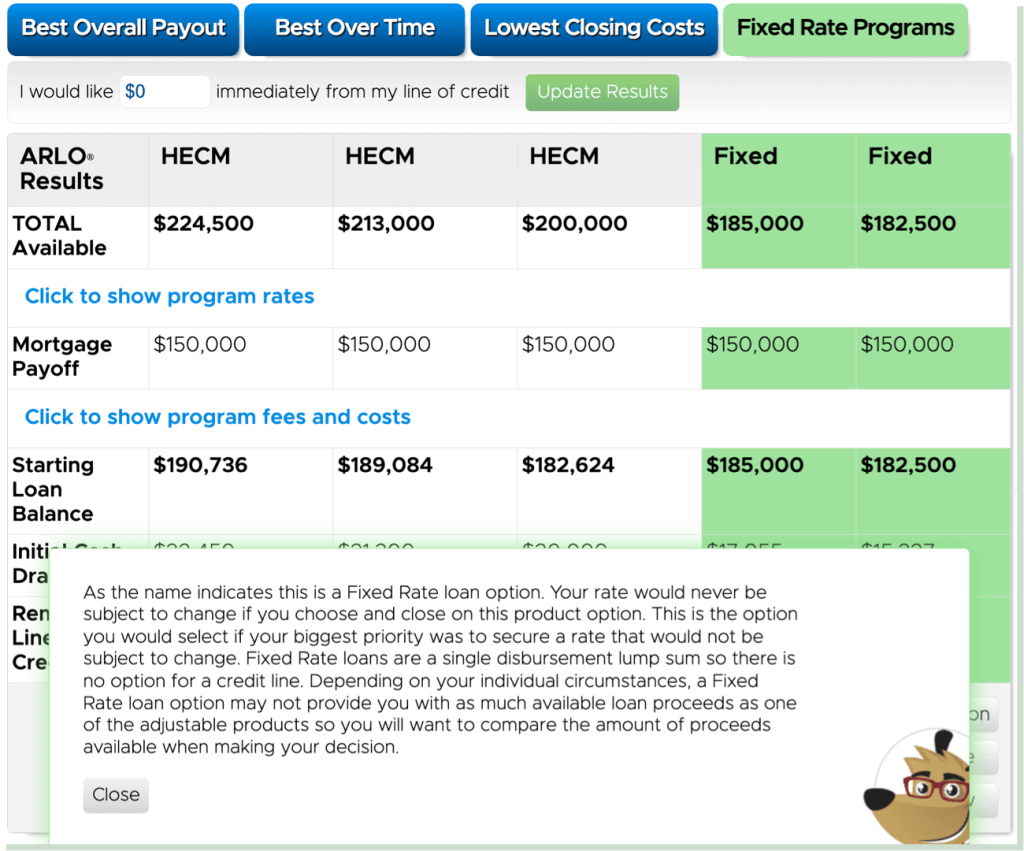

- Side-by-Side Comparisons — Review HECM, jumbo, and proprietary loans together and compare payout options like a lump sum, monthly payments, or a line of credit.

- Custom Inputs — Adjust the loan amount, interest rate, monthly advances, and more to reflect your actual plan.

- Amortization Breakdown — See how your loan balance and home equity may change each year.

What Homeowners Are Saying: “All Reverse Mortgage offered the clearest calculator with detailed results immediately. Their rates were lower, and their team quickly answered all our questions. Highly recommended!” — Peter H., (Verified BBB Review)

How to Use the Calculator (Step-by-Step)

- Enter Your ZIP Code — ARLO™ checks HUD lending limits and state-specific fees.

- Confirm Your Home Value — Uses online property value data with the ability to manually adjust higher or lower if necessary.

- Add Age, Mortgage Balance & Annual Interest Rate — Essential reverse mortgage inputs to calculate your potential loan amount and available proceeds. Be sure to enter the annual interest rate for accurate results. If you have a co-borrower, enter their age as well to ensure eligibility and precise calculations.

- Enter All Relevant Reverse Mortgage Inputs — Include age, home value, mortgage balance, annual interest rate, and desired loan features to customize your scenario.

You can adjust all inputs as many times as you’d like before deciding if you want to speak with someone or request a full written quote.

Compare Reverse Mortgage Options — Side by Side

Our calculator lets you compare several scenarios at once so you can choose what truly supports your retirement plans. You can consider lump-sum payouts, steady monthly payments, or a growing line of credit to decide which draw strategy best fits your needs and comfort level.

Every homeowner’s goals are different, so the calculator also shows how each type of reverse mortgage affects your available funds, interest, costs, and long-term equity.

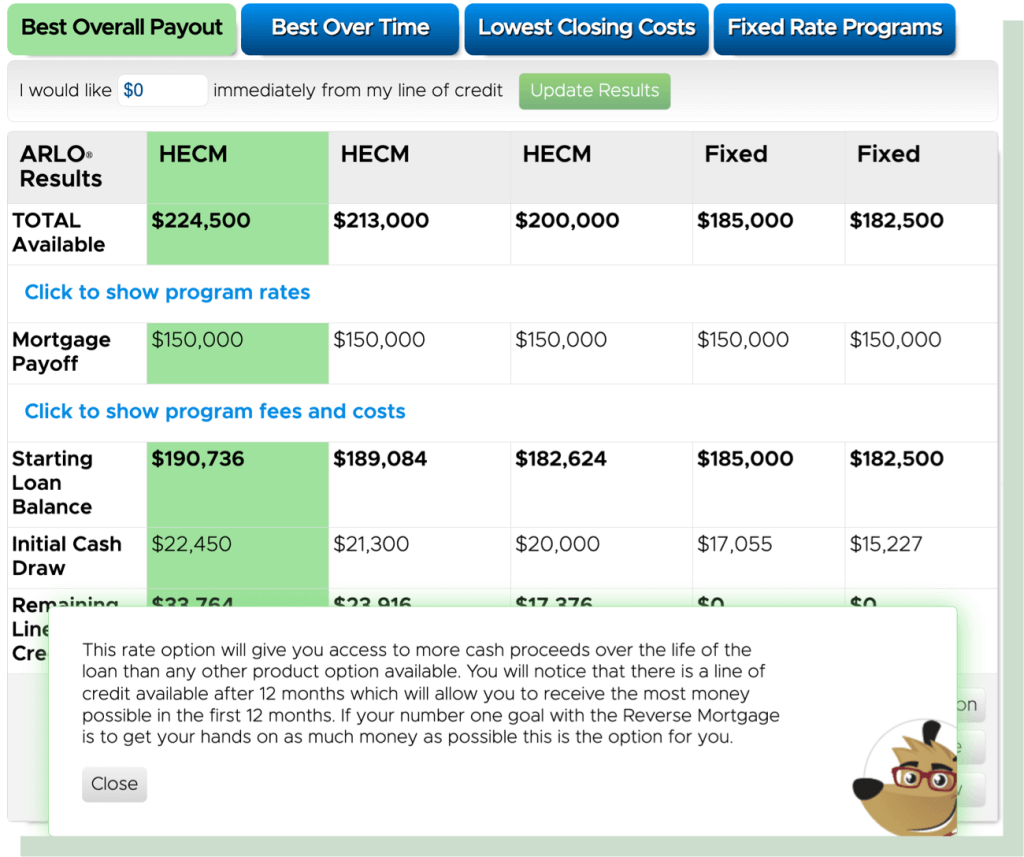

1. Max Cash Out (Highest Payout)

This option allows you to receive more cash over time than any other reverse mortgage product available. It’s designed to maximize the total amount of money you can access. With this option, you receive a lump-sum advance as your starting balance, which you can receive immediately at loan closing.

Best for: If your primary goal is to maximize the amount of money you can receive from your reverse mortgage, this is likely the best option for you.

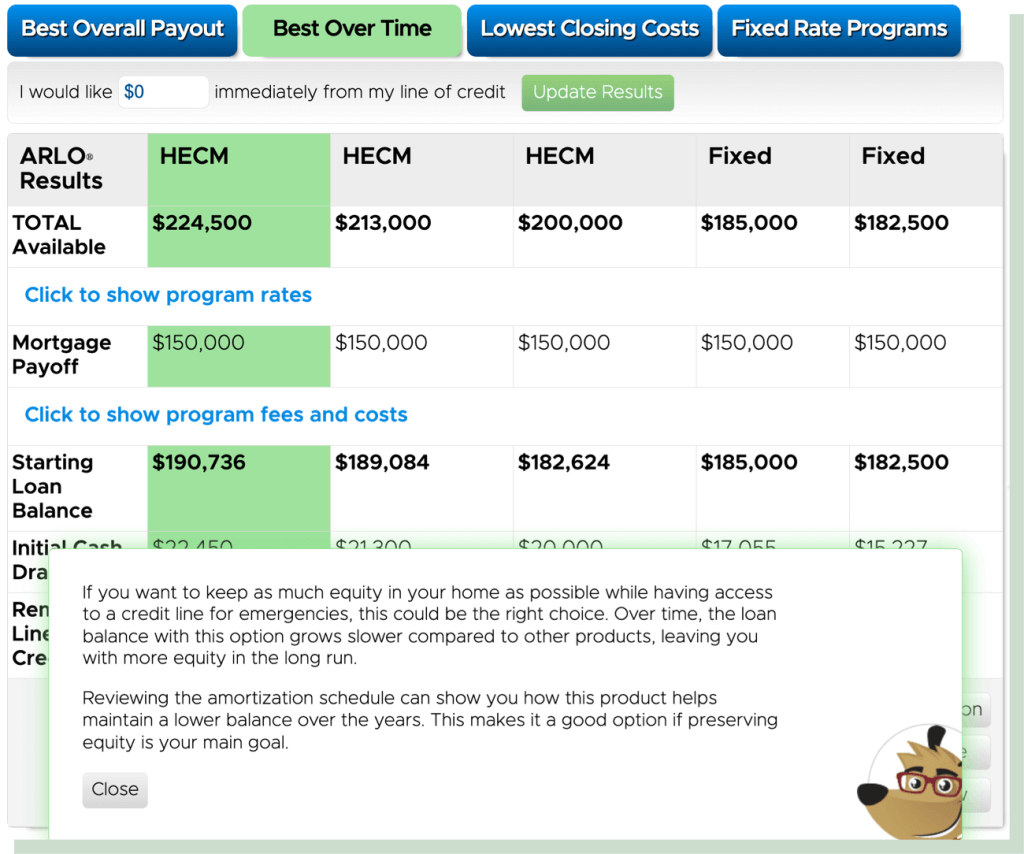

2. Grow Equity Over Time (Lower Interest)

If your goal is to preserve as much equity in your home as possible, while still having a safety net for emergencies, this option may be the right fit. With this plan, the loan balance grows slower than other reverse mortgage options, helping you preserve more of your home’s equity over time.

You can review the amortization schedule to see how this option works to preserve equity year after year. It’s a wise choice for homeowners who want peace of mind knowing they’re borrowing conservatively.

Best for: Homeowners who want access to funds but value retaining more equity.

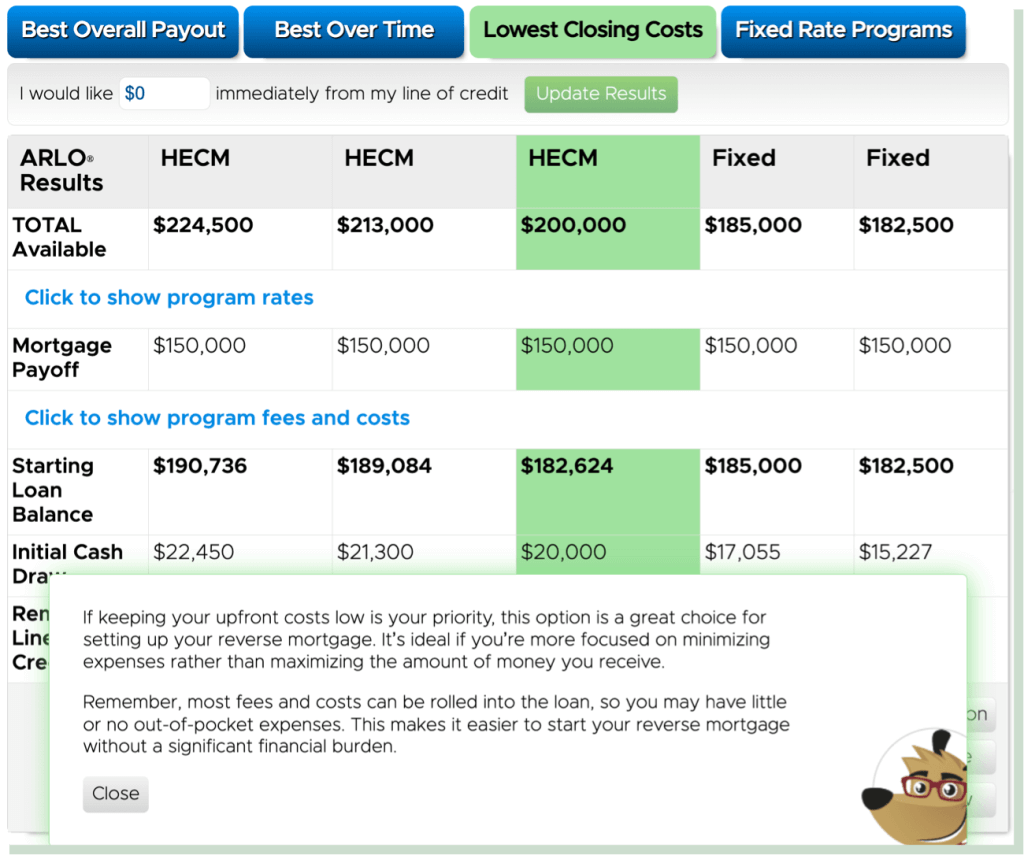

3. Lowest Upfront Costs

If your goal is to keep your upfront expenses as low as possible, this option helps you compare exactly how much you can save. It’s designed for homeowners who care more about minimizing closing costs than maximizing their loan amount. By choosing this route, you can reduce the financed origination fee and other upfront charges that would otherwise be added to your loan balance and accrue interest over time.

Best for: Homeowners who expect a shorter time horizon or simply want to limit the amount of closing costs rolled into the loan.

4. Fixed-Rate Lump Sum Option

This option gives you a fixed interest rate that never changes, which can be reassuring if stability is your priority. At closing, you receive your funds as a single lump sum, and the rate remains locked in for the life of the loan.

There are no monthly payments or a credit line with the fixed-rate program, so it’s important to consider how that fits with your long-term plans. Adjustable-rate options offer more flexibility and often provide greater access to funds. Comparing both will help you decide which structure truly supports your goals.

Best for: Homeowners who want a fixed rate and prefer a single lump-sum payout.

If you’re still exploring, the questions below address the most common concerns homeowners raise when using the calculator.

Frequently Asked Questions

How does a reverse mortgage calculator work?

Will using the ARLO calculator affect my credit?

How much money do you get on a reverse mortgage?

How do interest rates affect the reverse mortgage calculation?

How is the line of credit growth rate calculated?

How is the monthly tenure payment calculated?

How is a monthly term payment calculated?

What is the 60% rule for a reverse mortgage?

How much can a 70-year-old borrow on a reverse mortgage?

Compare Our Suite of Reverse Mortgage Calculators

| Explore our full suite of tools designed to help you estimate payments, credit line growth, refinance opportunities, home purchase, and long-term loan projections. | |||

|---|---|---|---|

| Calculator Type | What It Does | Key Features | Includes Rates/APR |

| Reverse Mortgage Calculator | Figures out payments, lump sums, and credit lines | Recommends the best loan for your goals | Yes |

| Free HECM Calculator | Provides a maximum loan amount for a quick estimate | No personal info needed for quote | No |

| Line of Credit Calculator (LOC) | Shows HECM credit line and growth over time | Projects how your credit line grows | No |

| Refinance Calculator (H2H) | Checks if refinancing your HECM pays off | Uses home value, rates, and 5x benefit rule | No |

| Purchase Calculator (H4P) | Plans buying a home with a reverse mortgage | Estimates down payment and sale proceeds | Yes |

| Amortization Calculator | Tracks loan balance and equity over years | Downloadable Excel file for your records | Yes |

See How Much You Could Qualify For Today: Explore your real-time estimate now or call (800) 565-1722 to speak with a member of our team. All Reverse Mortgage, Inc. is America’s #1 rated reverse mortgage lender* with 20+ years of experience and a 4.99/5 customer satisfaction rating.

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald