America's #1 Rated Reverse Mortgage Lender*

Reverse Mortgage Principal Limit & Maximum Claim Amount — How Your Loan Amount Is Calculated

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

I am 87 and received a HECM Loan. The maximum claim is $250,000. Due to age and other factors, the credit limit was expected to reach the maximum claim limit. Withdrawals were denied when the balance was around $225,000, and no withdrawals have been allowed since the servicer has been getting compound interest each month. HUD has been assessing fees and premiums. Maybe I’m delusional, but something doesn’t add up here. Am I wrong?

Understanding the Maximum Claim Amount

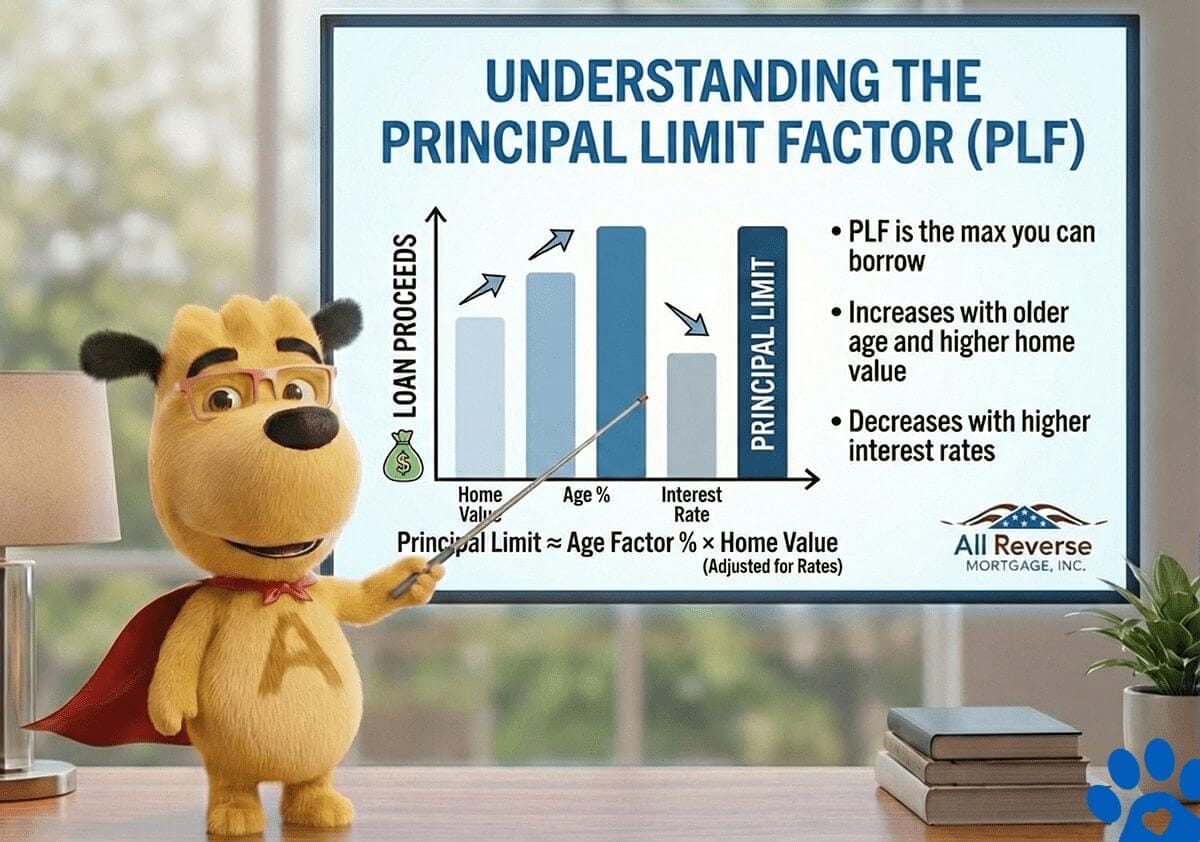

The Maximum Claim is used to determine your reverse mortgage benefits or loan proceeds, which is known as the Principal Limit. The Maximum Claim Amount is determined by the lower of one of three things: the appraised value of the property, the purchase price on a purchase transaction, or the HUD lending limit in effect at the time.

Once the Maximum Claim Amount is determined, the HECM calculator then considers other factors, age(s) of the borrower(s), value, and current interest rates at the time to determine the Principal Limit or proceeds available for the borrower(s) under the reverse mortgage program.

Borrowers need to remember, though, that the Maximum Claim Amount that they see at the start of their loan is defined by the CFPB as:

The lesser of the appraised value of the home, the sale price of the home being purchased, or the maximum limit HUD will insure. The maximum claim amount is one factor used to calculate how much a homeowner can borrow with a reverse mortgage loan. -CFPB

Maximum Claim Amount in Principal Limit Calculations

The Maximum Claim Amount is just one of the factors used in the calculation to determine how much money the borrower will receive in the Principal Limit or loan amount. It is not a maximum benefit to be paid out to the borrower with the loan.

The Maximum Claim Amount will usually be the appraised value of the property but, at times, can be less if the transaction is a sale when the home is sold at a price that is less than the appraised value or when a property is valued higher than HUD’s stated Maximum Claim Amount for the program.

When a borrower’s home is valued above the Maximum Claim Amount, it doesn’t mean they cannot get a reverse mortgage. It means they will not receive further proceeds when the home is valued above that limit.

A borrower with a home valued at $1,500,000 with all the same factors (age, rates, etc.) would receive the same amount of money as a borrower with a property valued at $1,249,125 due to the Maximum Claim Amount, but depending on how they draw their funds and how they allow their lines of credit to grow, either one could far outlast the other based on their borrowing patterns.

HECM Lending Limits and Benefits by Age (2026)

| Age of Borrower | Principal Limit Factor | Current Lending Limit |

|---|---|---|

| 62 | 40.3% | $1,249,125 |

| 63 | 40.9% | $1,249,125 |

| 64 | 41.6% | $1,249,125 |

| 65 | 42.3% | $1,249,125 |

| 66 | 43.1% | $1,249,125 |

| 67 | 43.8% | $1,249,125 |

| 68 | 44.6% | $1,249,125 |

| 69 | 45.4% | $1,249,125 |

| 70 | 45.8% | $1,249,125 |

| 71 | 45.8% | $1,249,125 |

| 72 | 46% | $1,249,125 |

| 73 | 46.9% | $1,249,125 |

| 74 | 47.7% | $1,249,125 |

| 75 | 48.6% | $1,249,125 |

| 76 | 49.2% | $1,249,125 |

| 77 | 50.2% | $1,249,125 |

| 78 | 51.2% | $1,249,125 |

| 79 | 51.7% | $1,249,125 |

| 80 | 52.8% | $1,249,125 |

Curious About Your Principal Limit? Get a clear quote from All Reverse Mortgage, Inc. (ARLO™) — America’s #1 Rated Lender with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote — simple, trusted, 100% secure!

Understanding the Growth Feature of Your Reverse Mortgage Line of Credit

You have the line of credit program (if you had the fixed-rate program, you would have been required to take a full draw at the start of the loan, and no additional funds would have been available for subsequent payments).

It has a growth feature that allows the funds remaining in the line to grow at the same percentage as your interest plus your Mortgage Insurance Premium (MIP) combined.

So, for example, if the interest on your loan was 2.5% and your MIP is .5%, the unused funds in your line of credit would grow in availability at 3%. Each year, that rate changes as your interest accrual rate changes.

Therefore, your Principal Limit, or the loan proceeds available to you, will fluctuate based on the draws you take (your Principal Limit is reduced by the amount of draws you take from your line) and the growth of your credit line (your line increases by the amount of the growth on the line based on the unused portion).

Initial Disclosures and the Importance of Monthly Statements

Borrowers receive initial disclosures with amortization schedules that give examples of the relationship between the Maximum Claim Amount and the Principal Limit, but unfortunately, they are only estimates and cannot possibly accurately foretell future interest rates or borrowers borrowing habits.

They are only examples and can vary significantly once borrowers begin taking draws and interest rates change. This is why borrowers need to pay attention to the monthly statements they receive from their servicer.

The statement breaks down everything that happens on the loan each month. We have an article online to help people read and understand their statements at: https://reverse.mortgage/understanding-statement.

Steps to Take If You Have Questions

If this general explanation doesn’t answer all your questions or if your servicer’s statement is different and doesn’t look the same, don’t hesitate to contact them and have them explain it to you.

If you need further assistance, there are attorneys and counseling companies that advertise low-cost assistance who can advocate for you so that you don’t wait until after you are out of funds to find out there was a misunderstanding of the Maximum Claim Amount and Principal Limit.

Also, if you received your loan that long ago, you might benefit from refinancing now under the new values and Maximum Claim Amounts, and that’s worth looking into.

FAQs

What is the principal limit on a reverse mortgage?

Who sets the principal lending limit factors? (PLF)

How is the reverse mortgage principal limit calculated?

What percentage of equity can you get on a reverse mortgage?

What is a reverse mortgage maximum claim?

ARLO recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

December 28th, 2025

December 28th, 2025

July 31st, 2024

July 31st, 2024

June 28th, 2024

June 29th, 2024

April 2nd, 2024

April 17th, 2024

October 23rd, 2023

October 26th, 2023

February 5th, 2026

February 6th, 2026

March 19th, 2020

March 19th, 2020

May 28th, 2020

June 2nd, 2020

January 9th, 2020

January 9th, 2020

November 20th, 2019

November 20th, 2019