|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 20 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Why All Reverse Mortgage Calculator

Looking for a reverse mortgage estimate you can trust? Our calculator uses real-time interest rates and local closing costs to provide an instant, personalized quote you can count on.

We are the only calculator that provides “to-the-penny” accurate proceeds, including real-time rates, actual APR, and a complete estimate of closing costs based on your location.Key Features

- Real-Time Rates & APR: Updated daily to reflect current market conditions.

- Local Lending Limits: Customized based on your ZIP code and property location.

- Accurate Closing Costs: Includes taxes, county fees, and all financed costs.

- Loan Comparisons: Review HECM, jumbo, and proprietary reverse mortgages side by side.

- Amortization Schedules: See how your balance and equity change over time.

How to Use the Reverse Mortgage Calculator

Getting your estimate is simple:

- Enter Your ZIP Code: This sets local lending limits and fees.

- Confirm Your Home Value: The calculator utilizes current sales data to estimate your home’s value.

- Provide Age & Mortgage Balance: Age determines your eligibility and payout.

Compare Reverse Mortgage Options—Side by Side

Our calculator shows four scenarios to help you find the best fit:

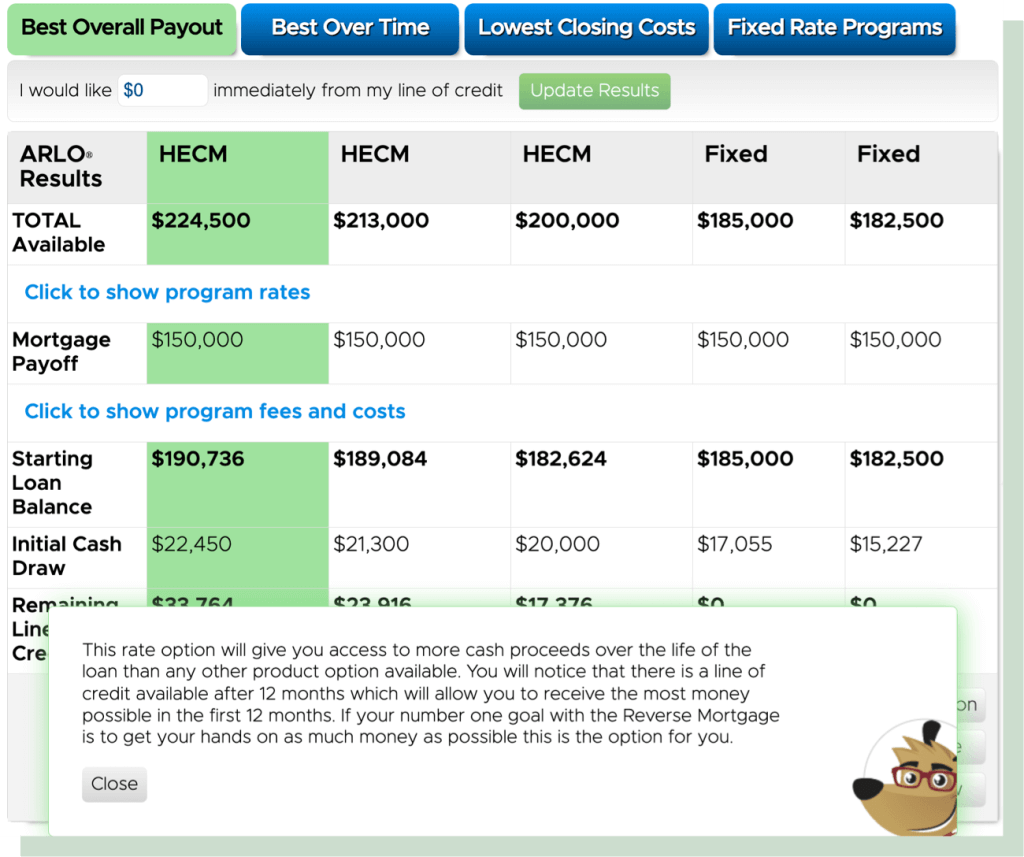

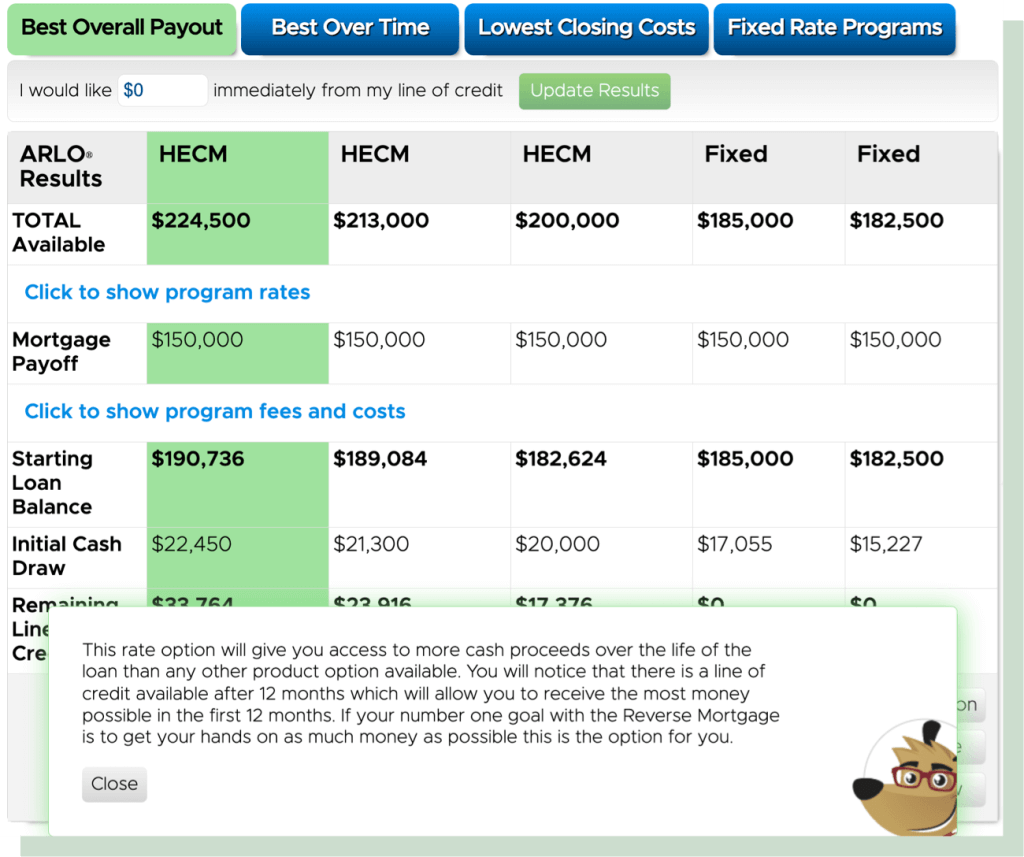

1. Max Cash Out (Highest Payout)

This option allows you to receive more cash over time than any other reverse mortgage product available. It’s designed to maximize the amount of money you can access, especially in the first year. After 12 months, a line of credit will also become available, giving you even more flexibility to withdraw additional funds if you need them later.

Best for: If your primary goal is to maximize the amount of money you can receive from your reverse mortgage, this is likely the best option for you.

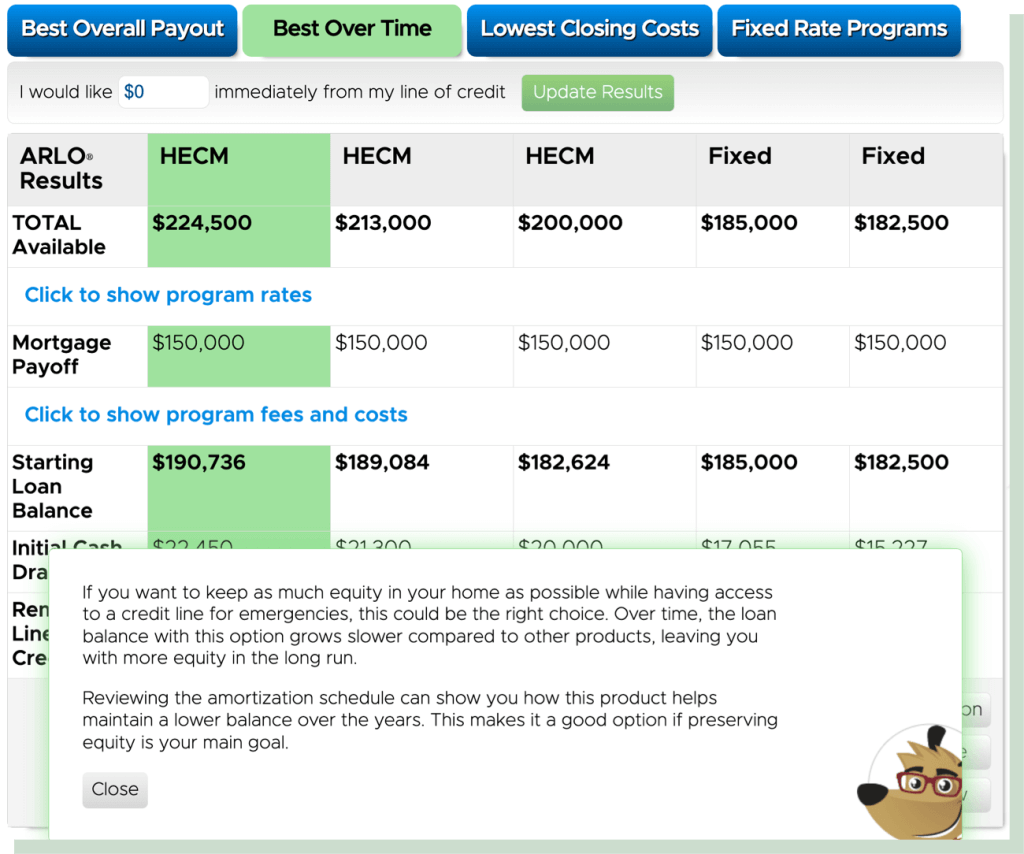

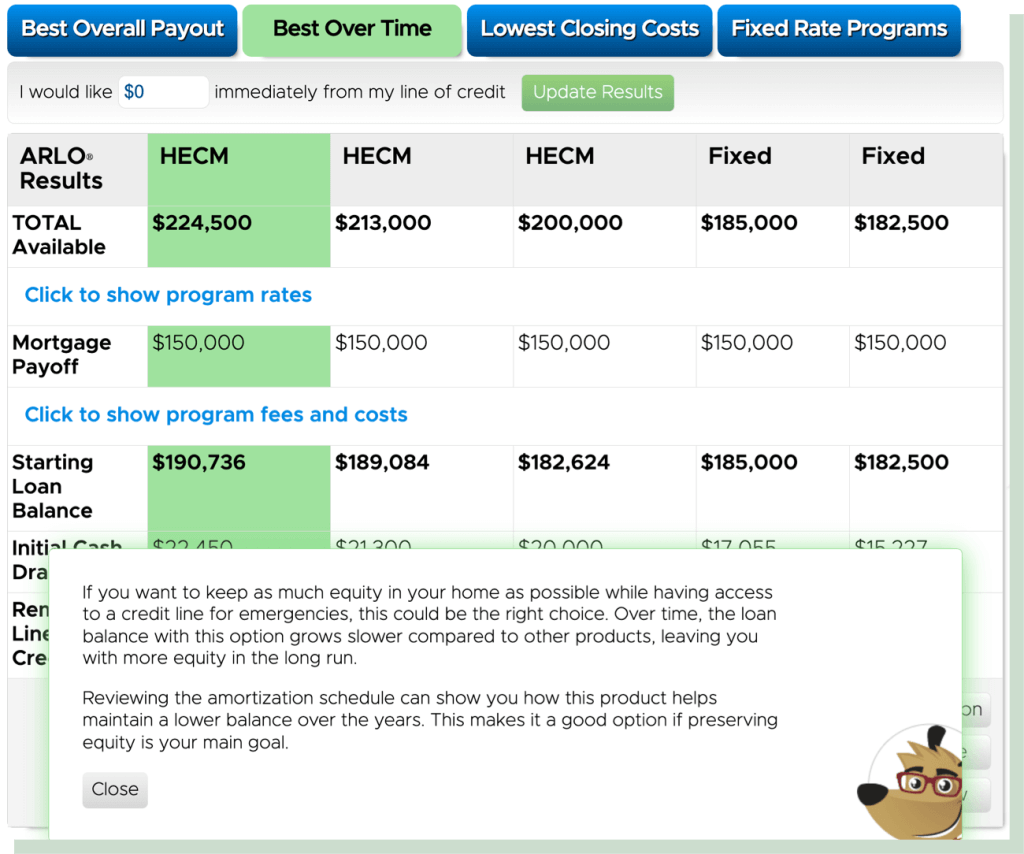

2. Grow Equity Over Time (Lower Interest)

If your goal is to retain as much equity in your home as possible while still having a safety net for emergencies, this option may be the right fit. With this plan, the loan balance grows slower than other reverse mortgage options, helping you keep more of your home’s value over time.

You can review the amortization schedule to see how this option works to preserve equity year after year. It’s a smart choice for homeowners who want peace of mind knowing they’re borrowing conservatively.

Best for: Homeowners who want access to funds but value leaving more equity for later.

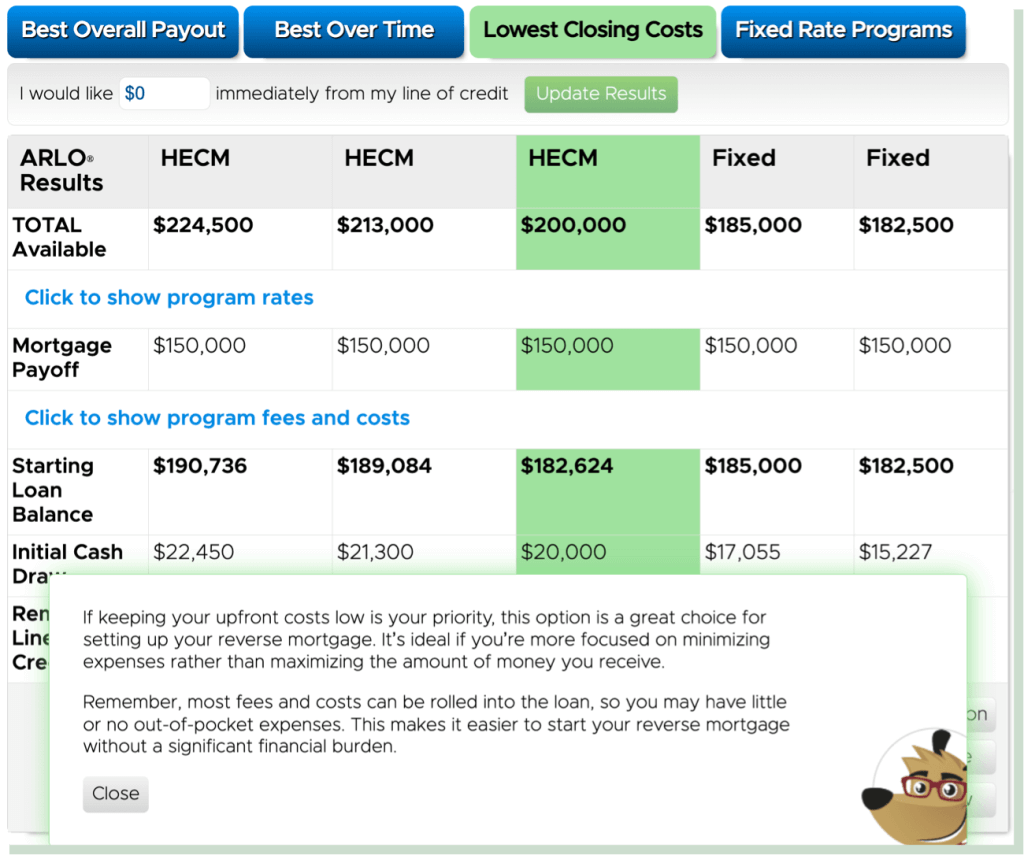

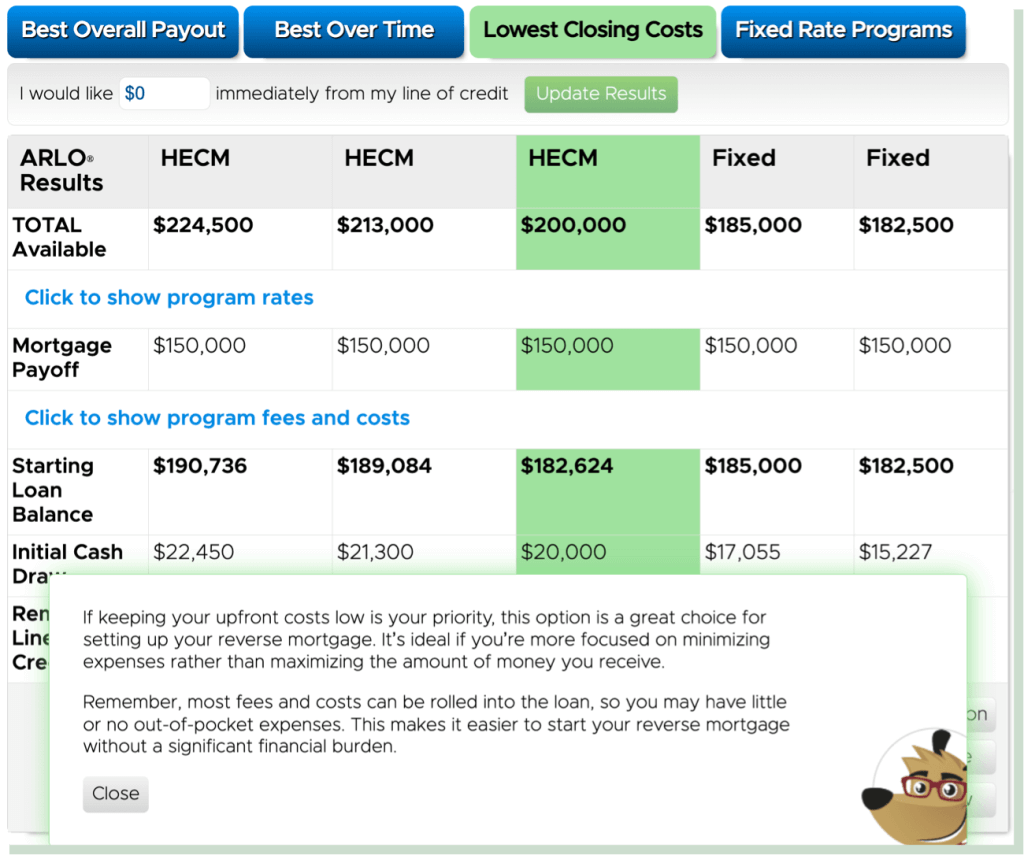

3. Lowest Upfront Costs

If your main priority is keeping financed closing costs as low as possible, this option may be the best fit for you. It’s designed for homeowners who are more interested in minimizing expenses than in getting the maximum loan amount.

Most fees and costs are financed in the loan itself, meaning you may have little—or even no-out-of-pocket expenses.

Best for: Homeowners with a shorter-term outlook who want to limit financed closing costs.

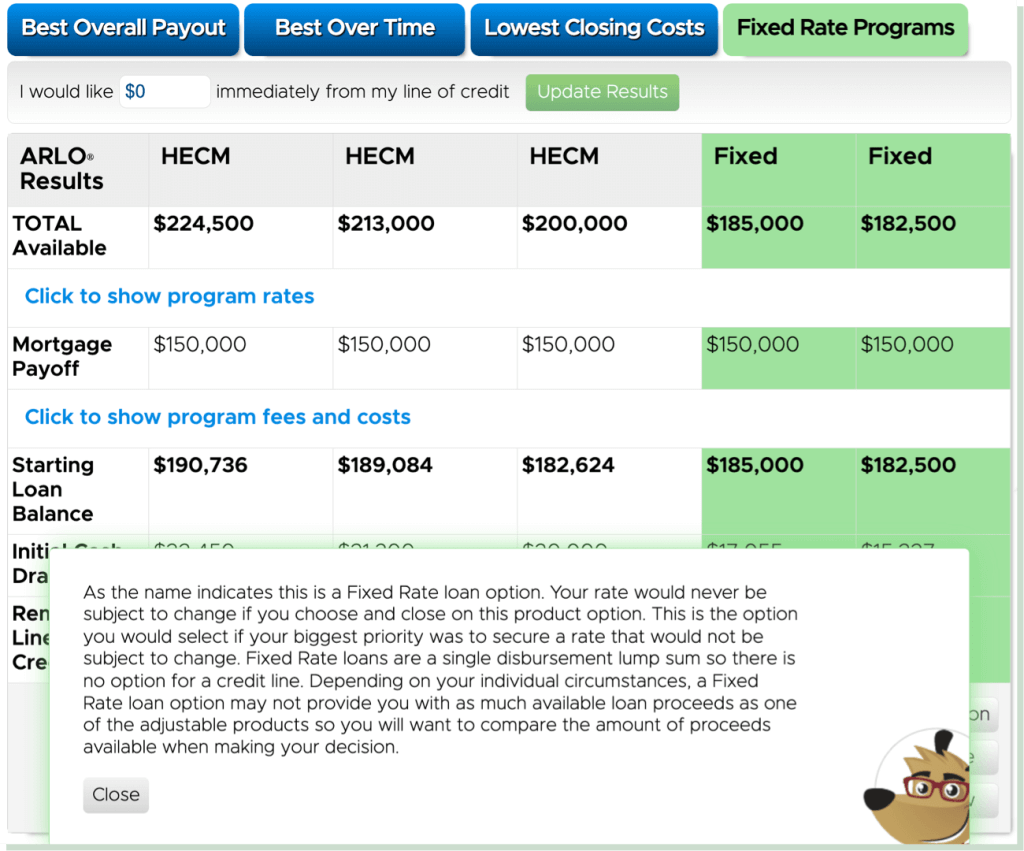

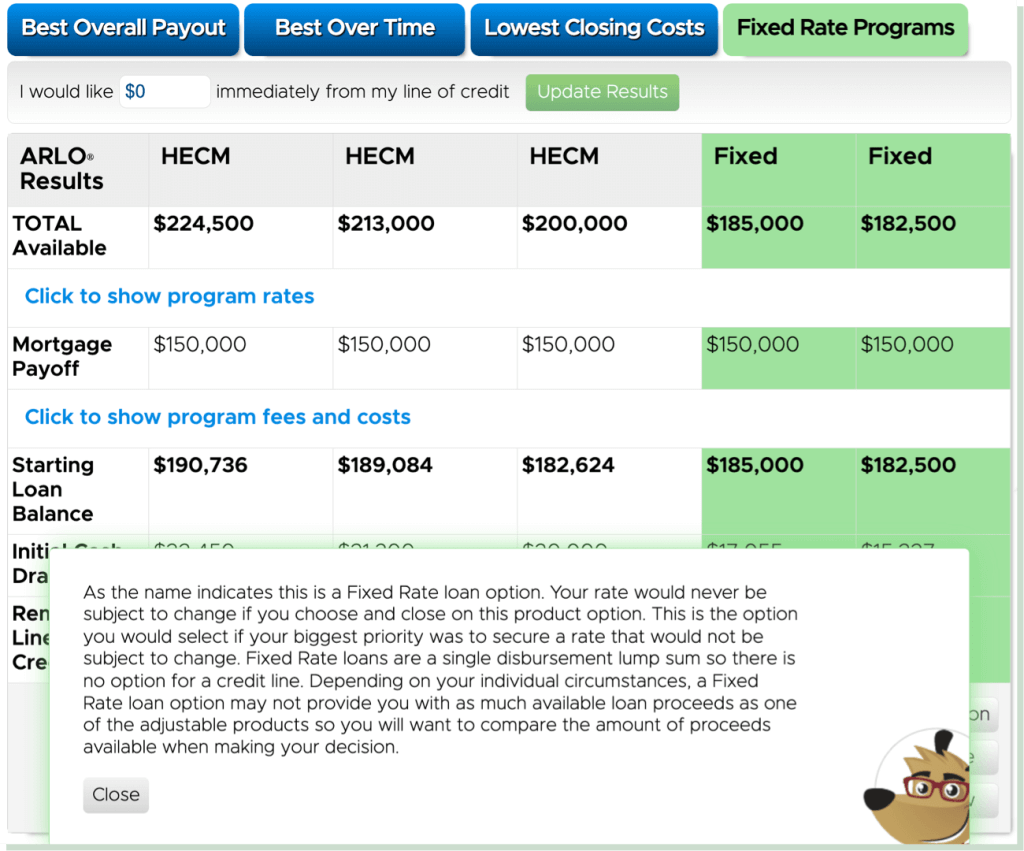

4. Fixed-Rate Lump Sum Option

This is a fixed-rate reverse mortgage, which means your interest rate will remain unchanged once the loan is closed. If locking in a stable, unchanging rate is your top priority, this could be the right option for you. With a Fixed Rate loan, you’ll receive your funds as a one-time lump sum payment. There is no credit line or monthly payments available with this option.

Keep in mind that, depending on your situation, a Fixed-Rate loan may not offer as much flexibility as an adjustable-rate option. It’s a good idea to compare the available proceeds from both choices before deciding what’s best for you.

Best for: Homeowners seeking stability and predictability.

Tips to Maximize Your Reverse Mortgage Payout

Simple steps can help you qualify for more:

- Include a Younger Spouse’s Age: Even if they’re not on the loan, this can enhance protections and sometimes increase proceeds.

- Consider Waiting for Your Next Birthday: HUD uses age in whole years. If you’re within six months of your next birthday, waiting may boost your payout.

- Enter All Current Mortgage Balances: This ensures that your quote accurately reflects the amount you’ll receive after paying off your existing loans.

Why Our Calculator Stands Out in 2025

| Feature | All Reverse Mortgage | Other Calculators |

|---|---|---|

| Daily Rate & APR Updates | ✅ Yes | ❌ No |

| Closing Cost Estimates | ✅ Local fees included | ❌ Rarely detailed |

| Amortization Schedules | ✅ Full projections | ❌ Often missing |

| AI-Powered Insights | ✅ Custom recommendations | ❌ Generic |

| HECM & Jumbo Results | ✅ All types shown | ❌ Limited options |

What Homeowners Are Saying

Reverse Mortgage Calculator FAQs

How does a reverse mortgage calculator work?

A reverse mortgage calculator estimates how much you may qualify to borrow based on:

- Your age (or the age of the youngest borrower)

- Your home’s value or the HECM lending limit (whichever is lower)

- Current interest rates

- FHA guidelines (Principal Limit Factors)

These factors are used to calculate your “Principal Limit,” which is the maximum amount available through a reverse mortgage. The calculator gives you an accurate estimate of this amount before any official appraisal or application.

Are all reverse mortgage calculators the same?

No. While all calculators rely on the FHA Principal Limit Factors (based on your age and interest rates), they’re not equally accurate. Many calculators give only rough estimates and don’t show full costs or rate options.

Our calculator is different. It:

- Provides to-the-penny accurate quotes using real-time interest rates.

- Breaks down costs, fees, and rate options for your area.

- Includes an amortization schedule for each rate option, not just one scenario.

How much money do you get on a reverse mortgage?

The amount you can borrow depends on:

- Your age (older borrowers qualify for more).

- Your home’s value (or the FHA limit of $1,209,750).

- Current interest rates.

- Any existing mortgage balance that must be paid off.

Our reverse mortgage calculator takes into account all of these factors to provide you with a personalized estimate in seconds.

How do interest rates affect the reverse mortgage calculation?

How is the line of credit growth rate calculated?

How are monthly payments calculated?

Monthly payments depend on:

- How much money you qualify for.

- Your age and life expectancy.

- The interest rate.

- Whether you choose a Term Plan (set payments for a fixed number of years) or a Tenure Plan (guaranteed payments for as long as you live in the home).

For example, a 15-year Term Plan spreads payments over 180 months, while a Tenure Plan continues for life as long as you stay in the home and keep the loan in good standing. Also See: Reverse Mortgage Payment Options: Term, Ten Year & Tenure Explained

How is the lump sum calculated?

Ready to find out how much you qualify for? Use our real-time reverse mortgage calculator now or call (800) 565-1722. All Reverse Mortgage, Inc. is America’s #1 rated reverse mortgage lender with 20+ years of experience and a 4.99/5 customer satisfaction rating.

Compare Our Suite of Reverse Mortgage Calculators

| Explore our full suite of tools designed to help you estimate payments, credit line growth, refinance opportunities, home purchase, and long-term loan projections. | |||

|---|---|---|---|

| Calculator Type | What It Does | Key Features | Includes Rates/APR |

| All Reverse Calculator | Figures out payments, lump sums, and credit lines | AI-powered: Recommends the best loan for your goals | Yes |

| Free Quick Calculator | Estimates payments, lump sums, and credit lines | No personal info needed—just a fast estimate | No |

| Line of Credit Calculator | Shows HECM credit line and growth over time | Projects how your credit line grows | No |

| Refinance Calculator | Checks if refinancing your HECM pays off | Uses home value, rates, and 5x benefit rule | No |

| Purchase Calculator | Plans buying a home with a reverse mortgage | Estimates down payment and sale proceeds | Yes |

| Amortization Calculator | Tracks loan balance and equity over years | Downloadable Excel file for your records | Yes |

Why All Reverse Mortgage Calculator

Looking for a reverse mortgage estimate you can trust? Our calculator uses real-time interest rates and local closing costs to provide an instant, personalized quote you can count on.

We are the only calculator that provides “to-the-penny” accurate proceeds, including real-time rates, actual APR, and a complete estimate of closing costs based on your location.Key Features

- Real-Time Rates & APR: Updated daily to reflect current market conditions.

- Local Lending Limits: Customized based on your ZIP code and property location.

- Accurate Closing Costs: Includes taxes, county fees, and all financed costs.

- Loan Comparisons: Review HECM, jumbo, and proprietary reverse mortgages side by side.

- Amortization Schedules: See how your balance and equity change over time.

How to Use the Reverse Mortgage Calculator

Getting your estimate is simple:

- Enter Your ZIP Code: This sets local lending limits and fees.

- Confirm Your Home Value: The calculator utilizes current sales data to estimate your home’s value.

- Provide Age & Mortgage Balance: Age determines your eligibility and payout.

Compare Reverse Mortgage Options—Side by Side

Our calculator shows four scenarios to help you find the best fit:

1. Max Cash Out (Highest Payout)

This option allows you to receive more cash over time than any other reverse mortgage product available. It’s designed to maximize the amount of money you can access, especially in the first year. After 12 months, a line of credit will also become available, giving you even more flexibility to withdraw additional funds if you need them later.

Best for: If your primary goal is to maximize the amount of money you can receive from your reverse mortgage, this is likely the best option for you.

2. Grow Equity Over Time (Lower Interest)

If your goal is to retain as much equity in your home as possible while still having a safety net for emergencies, this option may be the right fit. With this plan, the loan balance grows slower than other reverse mortgage options, helping you keep more of your home’s value over time.

You can review the amortization schedule to see how this option works to preserve equity year after year. It’s a smart choice for homeowners who want peace of mind knowing they’re borrowing conservatively.

Best for: Homeowners who want access to funds but value leaving more equity for later.

3. Lowest Upfront Costs

If your main priority is keeping financed closing costs as low as possible, this option may be the best fit for you. It’s designed for homeowners who are more interested in minimizing expenses than in getting the maximum loan amount.

Most fees and costs are financed in the loan itself, meaning you may have little—or even no-out-of-pocket expenses.

Best for: Homeowners with a shorter-term outlook who want to limit financed closing costs.

4. Fixed-Rate Lump Sum Option

This is a fixed-rate reverse mortgage, which means your interest rate will remain unchanged once the loan is closed. If locking in a stable, unchanging rate is your top priority, this could be the right option for you. With a Fixed Rate loan, you’ll receive your funds as a one-time lump sum payment. There is no credit line or monthly payments available with this option.

Keep in mind that, depending on your situation, a Fixed-Rate loan may not offer as much flexibility as an adjustable-rate option. It’s a good idea to compare the available proceeds from both choices before deciding what’s best for you.

Best for: Homeowners seeking stability and predictability.

Tips to Maximize Your Reverse Mortgage Payout

Simple steps can help you qualify for more:

- Include a Younger Spouse’s Age: Even if they’re not on the loan, this can enhance protections and sometimes increase proceeds.

- Consider Waiting for Your Next Birthday: HUD uses age in whole years. If you’re within six months of your next birthday, waiting may boost your payout.

- Enter All Current Mortgage Balances: This ensures that your quote accurately reflects the amount you’ll receive after paying off your existing loans.

Why Our Calculator Stands Out in 2025

| Feature | All Reverse Mortgage | Other Calculators |

|---|---|---|

| Daily Rate & APR Updates | ✅ Yes | ❌ No |

| Closing Cost Estimates | ✅ Local fees included | ❌ Rarely detailed |

| Amortization Schedules | ✅ Full projections | ❌ Often missing |

| AI-Powered Insights | ✅ Custom recommendations | ❌ Generic |

| HECM & Jumbo Results | ✅ All types shown | ❌ Limited options |

What Homeowners Are Saying

Reverse Mortgage Calculator FAQs

How does a reverse mortgage calculator work?

A reverse mortgage calculator estimates how much you may qualify to borrow based on:

- Your age (or the age of the youngest borrower)

- Your home’s value or the HECM lending limit (whichever is lower)

- Current interest rates

- FHA guidelines (Principal Limit Factors)

These factors are used to calculate your “Principal Limit,” which is the maximum amount available through a reverse mortgage. The calculator gives you an accurate estimate of this amount before any official appraisal or application.

Are all reverse mortgage calculators the same?

No. While all calculators rely on the FHA Principal Limit Factors (based on your age and interest rates), they’re not equally accurate. Many calculators give only rough estimates and don’t show full costs or rate options.

Our calculator is different. It:

- Provides to-the-penny accurate quotes using real-time interest rates.

- Breaks down costs, fees, and rate options for your area.

- Includes an amortization schedule for each rate option, not just one scenario.

How much money do you get on a reverse mortgage?

The amount you can borrow depends on:

- Your age (older borrowers qualify for more).

- Your home’s value (or the FHA limit of $1,209,750).

- Current interest rates.

- Any existing mortgage balance that must be paid off.

Our reverse mortgage calculator takes into account all of these factors to provide you with a personalized estimate in seconds.

How do interest rates affect the reverse mortgage calculation?

How is the line of credit growth rate calculated?

How are monthly payments calculated?

Monthly payments depend on:

- How much money you qualify for.

- Your age and life expectancy.

- The interest rate.

- Whether you choose a Term Plan (set payments for a fixed number of years) or a Tenure Plan (guaranteed payments for as long as you live in the home).

For example, a 15-year Term Plan spreads payments over 180 months, while a Tenure Plan continues for life as long as you stay in the home and keep the loan in good standing. Also See: Reverse Mortgage Payment Options: Term, Ten Year & Tenure Explained

How is the lump sum calculated?

Ready to find out how much you qualify for? Use our real-time reverse mortgage calculator now or call (800) 565-1722. All Reverse Mortgage, Inc. is America’s #1 rated reverse mortgage lender with 20+ years of experience and a 4.99/5 customer satisfaction rating.

Compare Our Suite of Reverse Mortgage Calculators

| Explore our full suite of tools designed to help you estimate payments, credit line growth, refinance opportunities, home purchase, and long-term loan projections. | |||

|---|---|---|---|

| Calculator Type | What It Does | Key Features | Includes Rates/APR |

| All Reverse Calculator | Figures out payments, lump sums, and credit lines | AI-powered: Recommends the best loan for your goals | Yes |

| Free Quick Calculator | Estimates payments, lump sums, and credit lines | No personal info needed—just a fast estimate | No |

| Line of Credit Calculator | Shows HECM credit line and growth over time | Projects how your credit line grows | No |

| Refinance Calculator | Checks if refinancing your HECM pays off | Uses home value, rates, and 5x benefit rule | No |

| Purchase Calculator | Plans buying a home with a reverse mortgage | Estimates down payment and sale proceeds | Yes |

| Amortization Calculator | Tracks loan balance and equity over years | Downloadable Excel file for your records | Yes |

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald