America’s #1 Rated Reverse Lender*

When is the Best Time to Take a Reverse Mortgage?

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

Ultimately the right time to get a reverse mortgage depends on what works out best for the borrower. The timing must be right for you and your needs. But we hear borrowers who are convinced that they want the loan but are thinking that they should wait a year or two until one of the borrowers is older so they can get more money from the loan.

We believe this is the wrong strategy and we will explain why in this article. This can lead to borrowers paying higher rates and ultimately getting less funds available at times (sometimes significantly less) and if the current market trend continues, borrowers who wait may see several negative effects.

Let’s start first with the amount of money that borrowers receive with a reverse mortgage. Most reverse mortgages being originated and closed are under the adjustable-rate program since the fixed rate program allows just one draw for the full amount available.

This typically limits the amount of money a borrower will receive under HUD’s rules and it is not advisable in most instances unless you need all the funds immediately to pay off existing loans or to purchase a new home.

Under the HUD rules, if you do not need all the funds to pay off an existing loan, you are capped at 60% of the full amount of the program benefits at the initial draw so borrowers receive much less money and are required to take a full draw of all the money they can take.

An example of how this affects borrowers negatively is for borrowers with a $100,000 benefit amount (Principal Limit), HUD caps the initial draw at $60,000 if the funds are not needed to pay off the existing liens and then since it is a single draw option only, the borrower never has the access to the remaining $40,000. They must take the entire $60,000 at the close of the loan on the fixed rate option, even if they do not need all the money at one time.

So, most borrowers opt for the line of credit, which is an adjustable-rate loan that allows them to draw only the funds they want/need, at their discretion. And under the adjustable rate program, the remaining 40% of the funds are available to the borrower after 12 months.

It is true that older borrowers receive more money based on the HUD formula and waiting for a next birthday may often bring more money to a borrower in the way of loan funds. However, an increase in interest rates that takes the rate above the interest rate floor can more than wipe away any additional funds the borrower would receive due to being another year older.

How rising rates can cost you

Let me illustrate what I am talking about. At the HUD floor rate of 3% (there is that pesky “floor rate” again and we will get into the meaning of the floor rate in a minute), a 62-year-old borrower will have a reverse mortgage benefit of 52.4% of the value of their home.

If the home’s value were $100,000, that would be $52,400. At 63 years old, that amount goes up to 53% or in this example, $53,000. But what happens when interest rates go up and the rate is above the HUD Floor?

That 52.4% for a 62-year-old borrower goes to 50.4% at just 3.5% and 51.1% for a 63-year-old borrower. So instead of gaining an additional $600 by waiting for a year to become 63 years old, if the rates are rising, in this example the borrower would lose about $1,300 even being a year older at 63 years of age at 3.5%.

If rates go up one full percent to 4% by that time, then the borrower would receive $4,700 less at 63 years old at the higher rate, than they would at 62 at the HUD Floor (current rates are right at the floor now). And since the loans above are based on percentages, if your home is worth more, there will be a larger difference in the drop you would see.

This makes a more significant difference to someone who has a $600,000 home with a current mortgage to pay off because in that case, the difference in the amount you would receive would be about $28,200 and might make a difference in your ability to pay off the existing loan without having to use additional cash.

Rising Rates = Lower Principal Limits

| AGE | 3% Expected Rate | 3.5% Expected Rate | 4% Expected Rate | 4.5% Expected Rate | 5% Expected Rate |

|---|---|---|---|---|---|

| 62 | 52.4% | 50.4% | 47.0% | 43.9% | 41.0% |

| 65 | 52.2% | 52.3% | 49.0% | 45.9% | 43.0% |

| 70 | 57.6% | 55.4% | 52.2% | 49.3% | 46.5% |

| 75 | 60.9% | 57.7% | 54.7% | 51.9% | 49.2% |

| 80 | 64.2% | 62.2% | 58.5% | 55.9% | 53.4% |

| 85 | 68.5% | 66.0% | 63.6% | 61.3% | 59.1% |

| 90 | 73.0% | 71.0% | 69.1% | 67.2% | 65.3% |

Source: https://www.hud.gov/program_offices/housing/sfh/hecm

Lower Principal Limits = Less Cash Benefit

| Home Value | 3% Rate (54.2% LTV) | 4% Rate (49.0%% LTV) | 5% Rate (43.0% LTV) | Cash Benefit Loss | Cash Benefit Loss |

|---|---|---|---|---|---|

| $100,000 | $54,200 | $49,000 | $43,000 | -$5,200 | -$11,200 |

| $200,000 | $108,400 | $98,000 | $86,000 | -$10,000 | -$22,400 |

| $300,000 | $162,600 | $147,000 | $129,000 | -$15,600 | -$33,600 |

| $400,000 | $216,800 | $196,000 | $172,000 | -$20,000 | -$44,800 |

| $500,000 | $271,000 | $245,000 | $215,000 | -$26,000 | -$56,000 |

| $600,000 | $325,200 | $294,000 | $258,000 | -$31,200 | -$67,000 |

| $700,000 | $379,400 | $343,000 | $301,000 | -$36,400 | -$78,400 |

What is the HUD Floor rate?

HUD established a Floor interest rate that if your Expected Rate is at or below, you would receive the maximum amount available under the program. The Expected Rate is not the initial interest accrual rate but rather is calculated by using a 10-year index and adding your margin to determine how much money you will receive under the program.

The Expected Rate is used to determine your proceeds and the illustrations for your amortization schedule, but your interest accrual will be based on your actual index plus margin (possibly a 1-Year CMT or soon to be the Secured Overnight Financing Rate or SOFR). The SOFR is replacing the LIBOR index after it was found that the LIBOR had many issues in that the banks were not giving accurate data to support the LIBOR figures.

The SOFR market is much more transparent and so the data is more easily verifiable. But back to the Expected Rate. The Expected Rate determines the amount of money the borrower will receive on the transaction, especially if that rate exceeds the HUD Floor of 3%.

All borrowers receive the maximum amount the program will allow up to an Expected Rate of 3% but when the rates start to exceed 3% the amount available to the borrower decreases. (HUD publishes their Principal Limit Factor Tables here).

So how does all this tie back into “when is the right time to get a reverse mortgage”? I’m glad you asked! Look at the rate table below.

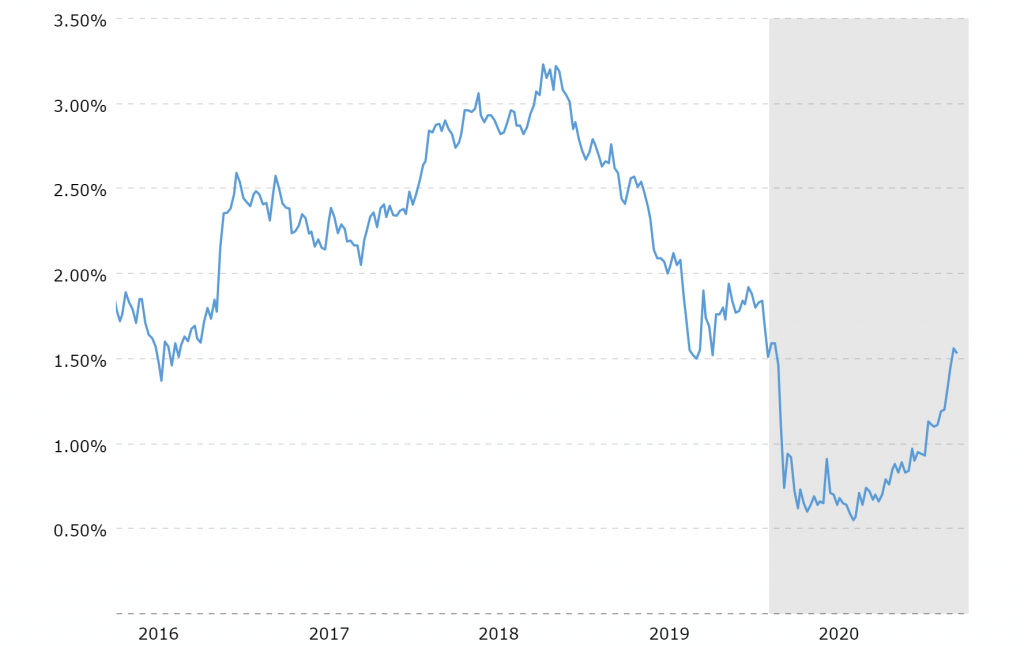

10- Year Treasury History (2016-2021)

These are the historical rates for the index behind the Expected Rate. Please note that the index was down to 1.65% in August of 2012. Then in August of 2016, the index began a quick rise to 2.47% in 2016 and then up to 3.15% in 2018 before falling again to a low of .64% in mid-2020.

With margins between 1.625% and 2.75% (the margin is the amount added to the index to determine the interest rate at which you accrue interest on the loan if you are talking about the interest accrual rate or at which HUD determines the Expected Rate), the fully indexed rate may or may not keep borrowers below the 3% floor and all borrowers would not receive the maximum amount allowed on the program so they need to watch the margins lenders are offering as it affects the proceeds they will receive (as well as their overall cost of borrowing).

But when you look at the rates since November of 2020, the index rate has shot up to 1.56% which indicates that with the same margins, the Expected Rate could very quickly exceed 3% once again.

This is especially concerning for reverse mortgage borrowers because if rates continue to rise, amounts available to borrowers will continue to fall. The economy is starting to recover from the shutdown of the pandemic, and we are starting to see inflation in many sectors.

If rates do continue to rise as many predict, borrowers will see their available loan amounts fall far more than any possible gains by waiting for their next birthday.

See: “4 Reasons a Reverse Mortgage Line of Credit is the Best Hedge Against Inflation”

Waiting for the right rate is not a winning strategy

There is also the effect of higher rates on the amount of interest borrowers will accrue on their loans. Since most of the loans are adjustable-rate mortgages, the interest rates are subject to change.

This has been a great feature for borrowers with existing loans as the rates have had ups and downs but have trended steadily down since they reached their high point on September 21, 1981.

Simply put, most adjustable-rate borrowers have not been hurt by having adjustable rates and many have benefited greatly. But for those contemplating a new loan now, waiting for the rate to go up and the proceeds to go down is not a winning strategy.

Especially since reverse mortgages have a fantastic growth feature on the line of credit. That growth feature works like this. Your line of credit grows in an amount equal to the interest you do not accrue on the funds you did not borrow.

In other words, the HUD calculation considers that you can borrow “X” amount based on the value of your home, your age, and the interest rates, assuming you will accrue interest on the money you borrow. If you do not borrow funds, HUD’s formula allows you to then borrow more money later to make up for the interest you did not accrue on the funds you did not borrow.

Simply put, your line of credit will grow in availability to you in an amount equal to the interest and Mortgage Insurance renewal premium (MIP renewal .50%) on the unused portion of the line.

Line of credit growth rate example

If you had a line of credit available in the amount of $100,000 that you did not use and your interest rate was 2.00% while your MIP renewal was .5%, your line would grow by 2.5% (compounded monthly) in the first year.

In the second year, you would have a line of credit available of over $102,500 with the compounding growth and then the growth rate on that amount would be determined by the interest rates that year. If rates go up, your growth rate also increases and you will have even more money available to borrow in later years.

It is important to remember that this is not interest that anyone is paying you, it is simply an increase to the line of credit available to you. As the line grows, the amount of money available for you to borrow increases but you do not owe any more unless you actually borrow the funds.

Had you waited a year, you would not have gotten that much more money for being a year older and if the rates had increased, you would have received a lot less.

Not to mention that if you wait, all interest rates are based on the higher market at the time you do close the loan and that includes the start rate, and the lifetime cap which determines the maximum interest rate the accrual rate can ever reach if rates do increase to that point at some time in the future.

So, the bottom line is this, if a reverse mortgage is not for you, there is never a good time to do it. However, if you are planning to get a reverse mortgage but you are thinking you may wait just a little longer for some reason, current interest rates and market trends point to the fact that now may be the best time for quite some time to start your loan process.

Once you fill out an application and the lender receives a Case Number from HUD, the Expected Rate is locked for 120 days. That means that even if the rates continue to rise after that, your loan proceeds will be protected because you will not be adversely impacted by a higher Expected Rate.

If you wait until the Expected Rate is over 3%, you may not only lose the availability of thousands of dollars on your loan, but may also accrue interest at a higher rate on what you do borrow as a result.

If you are considering a reverse mortgage and you are not sure if the numbers work for you, please feel free to contact us and let us show you how the current rates can work in your favor.

FAQs

What is the purpose of HUD HECM floor rate?

What is the expected rate on a reverse mortgage?

How is MIP calculated on a reverse mortgage?

What is the reverse mortgage growth of principal limit?

ARLO™ recommends these helpful resources:

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

March 28th, 2021

March 30th, 2021

March 25th, 2021

March 25th, 2021