#1 RATED REVERSE MORTGAGE.

What is AARP’s Role in Reverse Mortgages?

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

The American Association of Retired Persons (AARP) is a large, independent, nonprofit organization dedicated to helping people aged 50 and above achieve financial independence.

While the organization, which serves 37 million older Americans and counting, doesn’t offer reverse mortgage products directly, it does weigh in on them in some significant ways.

Here’s where AARP comes into play for retirees who may be considering a reverse mortgage as a means to age in place.

What does AARP think of reverse mortgages?

AARP has supported reverse mortgage products to help older Americans withdraw their home equity in retirement. While the organization does not offer reverse mortgages, it provides helpful information on this type of loan for those seeking more details from an independent third party.

On its website, AARP has a section devoted to reverse mortgages, which can be found here.

If you are wondering what the term “non-recourse” means or are preparing for your reverse mortgage counseling session, AARP offers a glossary of reverse mortgage terms and a wealth of information and questions to ask yourself if you are considering a reverse mortgage.

AARP influences reverse mortgage policy

In addition to its third-party role in providing information about reverse mortgages, AARP also takes a policy role through its Public Policy Institute. Representatives from AARP frequently appear before policymakers to discuss reverse mortgage protections and availability during congressional hearings.

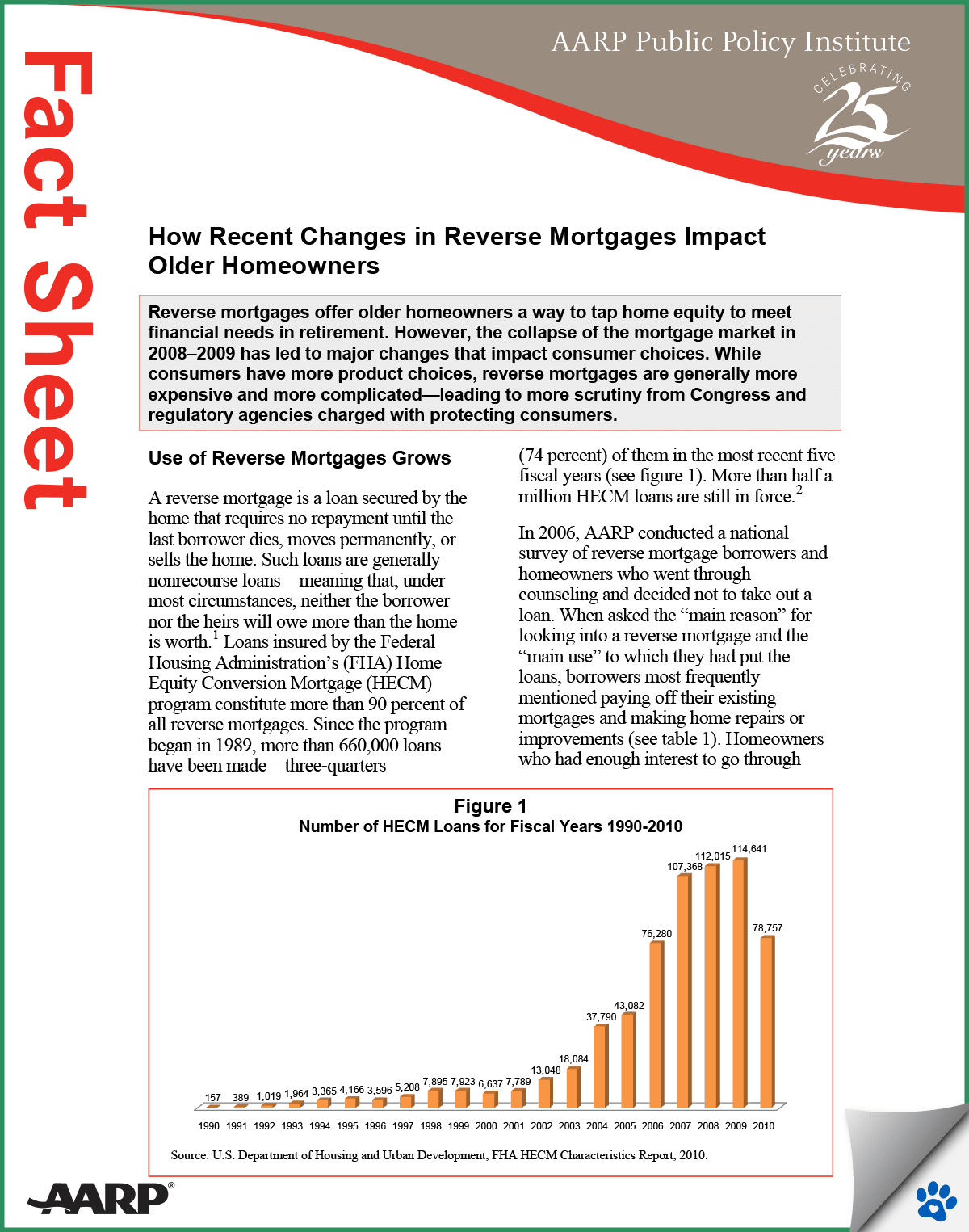

Through its public policy arm, AARP has also published reports and studies on reverse mortgages to guide decisions regarding the federally insured Home Equity Conversion Mortgage (HECM) program.

This loan program, which insures reverse mortgages under the Federal Housing Administration, comprises most reverse mortgages today and is sensitive to housing policy changes made in Washington, D.C.

Click here for a recent AARP Public Policy report on reverse mortgages.

AARP’s Role in Reverse Mortgages

| Aspect | AARP’s Role |

|---|---|

| Education | Provides resources, glossaries, and questions to help seniors understand reverse mortgages. |

| Policy Influence | Works with policymakers via the Public Policy Institute to shape HECM protections. |

| Borrower Advocacy | Defends seniors’ rights, e.g., non-borrowing spouse protections and non-recourse clarity. |

| Loan Offering | Does not offer or endorse reverse mortgages—focuses on education and advocacy only. |

AARP works to protect reverse mortgage borrowers

As the most significant senior advocacy group, AARP ensures that the financial products available to seniors are safe and in the best interest of those who use them.

Those products include reverse mortgages. In the few cases where reverse mortgage borrowers have not been satisfied with their borrowing experience, AARP has come to the defense of those borrowers.

This has recently taken place as a defense for non-borrowing spouses involved in reverse mortgage transactions.

Those non-borrowing spouses who are not on the home title at the time of the loan closing are not entitled to inherit the home once the borrowing spouse has passed away or moved from the home under the policy set by the FHA.

Another recent example involved AARP’s urging the Federal Housing Administration to clarify its “non-recourse” policy for reverse mortgages. At AARP’s urging, FHA clarified that any non-borrowing spouse can purchase the home for fair market value if a borrowing spouse passes away or leaves the home.

This vital protection means that a reverse mortgage heir never has to repay more on the loan than the home is worth at the time of the home sale.

Want to understand how Washington helps safeguard these loans? Read our article: What is the Government’s Role in Reverse Mortgages?. It explains FHA insurance, lending limits, and the federal protections that safeguard borrowers.

Top FAQs

Does AARP offer reverse mortgages directly?

Does AARP recommend reverse mortgages?

Does AARP endorse reverse mortgage lenders?

What is AARP’s involvement with reverse mortgages?

What Lawsuit did AARP have with HUD?

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

November 25th, 2024

December 13th, 2024

July 24th, 2024

November 18th, 2023

November 22nd, 2023

September 22nd, 2024

September 29th, 2024

January 15th, 2022

January 20th, 2022

September 27th, 2020

September 27th, 2020

September 10th, 2020

September 10th, 2020

October 3rd, 2020

October 5th, 2020

September 6th, 2019

September 8th, 2019

July 21st, 2019

July 23rd, 2019

June 11th, 2019

June 11th, 2019