2026 Reverse Mortgage Limits: $1,249,125

2026 Reverse Mortgage Limits: $1,249,125 HECM Cap Explained

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in mortgage banking, with the past 20 years devoted exclusively to reverse mortgages. A Forbes Real Estate Council member, he developed the industry's first fixed-rate jumbo reverse mortgage and has been featured in Forbes, Kiplinger, the LA Times, and Yahoo Finance. (License: NMLS# 14040) |

|

Cliff Auerswald, President of All Reverse Mortgage, Inc., and co-creator of ARLO™ — the industry's first real-time reverse mortgage pricing engine — has 27 years of experience in mortgage banking, with 20+ years focused exclusively on reverse mortgages. A recognized expert in reverse mortgage technology and consumer education, he has been featured in Kiplinger, Yahoo Finance, Realtor.com, and HousingWire. (License: NMLS# 14041) |

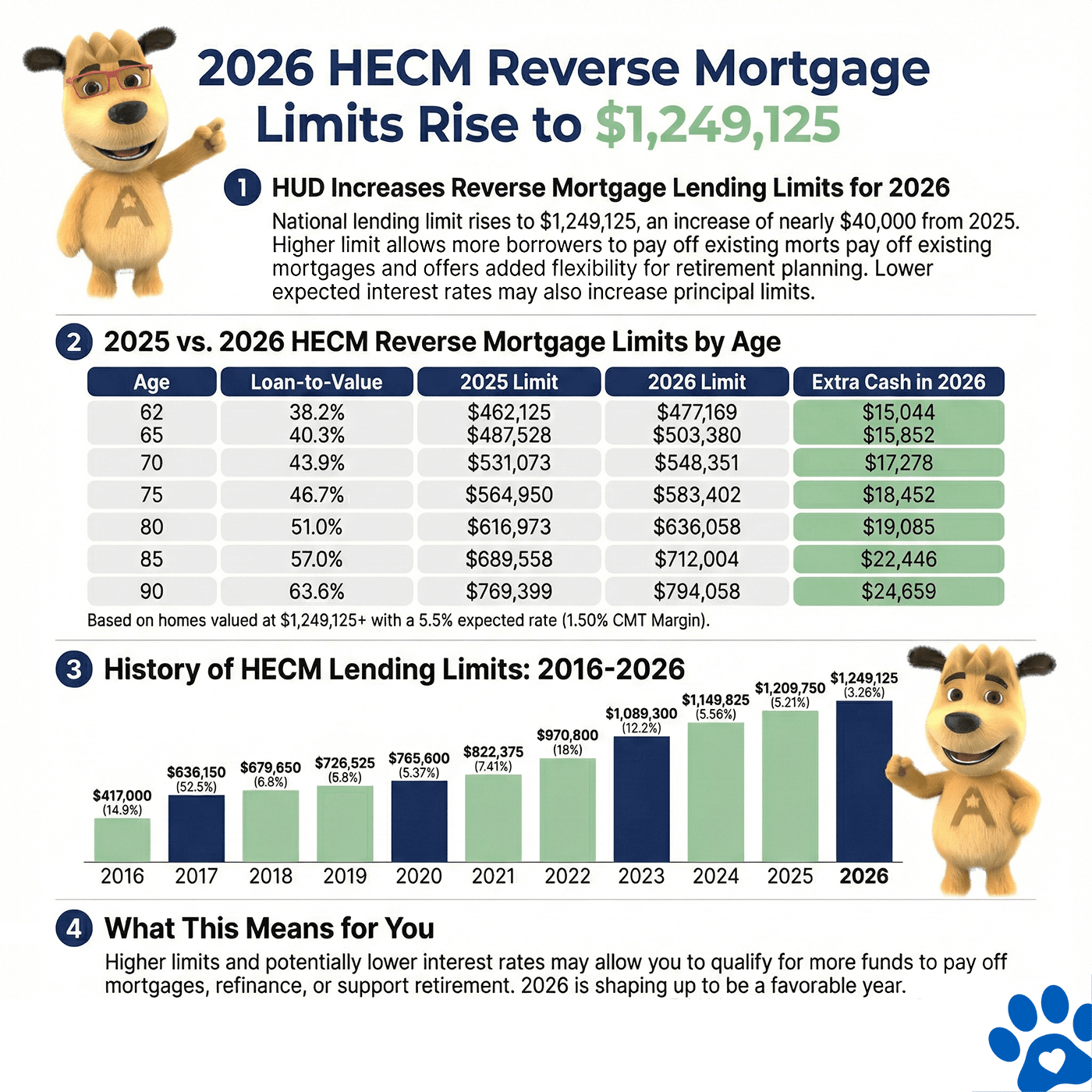

Our goal with this guide is simple. We want to explain HUD’s new lending limit in a clear and useful way, especially if you are trying to understand how the change affects the amount you can receive. You will find updated charts comparing the 2025 and 2026 limits, along with an illustration that shows how loan-to-value factors interact with the new national limit.

For many homeowners, this page serves as a reliable reference when deciding whether a reverse mortgage is the right move in the year ahead.

Exciting News: HUD Increases Reverse Mortgage Lending Limits for 2026!

Each year, HUD reviews national lending activity and sets the new HECM limit for the year ahead. For 2026, the news is especially encouraging. The national lending limit will rise to $1,249,125, an increase of nearly $40,000 from last year. Any borrower with a case number assigned on or after January 1 can take advantage of the higher cap.

This change is outlined in HUD Mortgagee Letter 2025-22, which formally establishes the 2026 national HECM lending limit.

This increase is meaningful for many homeowners. As home values have climbed, properties that once felt “high-value” now sit much closer to the middle of the market. A higher limit allows more borrowers to pay off existing mortgages and gives added flexibility when planning for retirement.

What makes this year even more favorable is the direction of interest rates. The Federal Reserve has begun lowering rates, and lower expected rates often translate into higher principal limits. When you combine a higher lending limit with improving rate conditions, many borrowers will see stronger results in 2026 than they did earlier in the year.

Take a look at the updated charts below to see how these changes could affect your own numbers. It is shaping up to be a very good year for homeowners considering a reverse mortgage.

2025 vs. 2026 HECM Reverse Mortgage Limits by Age

| Your Age | Loan-to-Value | 2025 Limit ($1,209,750) | 2026 Limit ($1,249,125) | Extra Cash in 2026 |

|---|---|---|---|---|

| 62 | 38.2% | $462,125 | $477,169 | $15,044 |

| 65 | 40.3% | $487,528 | $503,380 | $15,852 |

| 70 | 43.9% | $531,073 | $548,351 | $17,278 |

| 75 | 46.7% | $564,950 | $583,402 | $18,452 |

| 80 | 51.0% | $616,973 | $636,058 | $19,085 |

| 85 | 57.0% | $689,558 | $712,004 | $22,446 |

| 90 | 63.6% | $769,399 | $794,058 | $24,659 |

| Note: Based on homes valued at $1,249,125+ with a 5.5% expected rate (1.50% CMT Margin). | ||||

History of HECM Lending Limits

HUD Lending limits have changed over time to keep up with rising home values, giving older homeowners access to more equity. Knowing how these limits have increased can help you decide if a reverse mortgage is right for you.

In 2008, HUD established a single national lending limit of $417,000, replacing limits that previously varied by region. This made reverse mortgage limits the same for everyone, no matter where they lived. Then, in 2009, the Housing and Economic Recovery Act raised the limit to $625,500 to help homeowners during the housing crisis.

Gradual Increases Through 2017

For eight years, the limit stayed at $625,500. In 2017, it increased slightly to $636,150. While this wasn’t a big jump, it marked the beginning of steady annual increases.

- In 2018, the limit rose to $679,650, an increase of $43,500.

- In 2019, it increased by $46,875, reaching $726,525, making it easier for homeowners to refinance their reverse mortgages.

- In 2020, the limit climbed to $756,600, an increase of $39,075.

Larger Increases During the Pandemic

The COVID-19 pandemic caused home values to rise quickly, and lending limits followed.

- In 2021, the limit increased by $56,775 to $822,375.

- In 2022, there was a record-setting jump of $148,425, bringing the limit to $970,800. This reflected the sharp rise in home prices.

Recent Growth and the Move Into 2026

The upward trend continued through 2023, 2024, and 2025, pushing the limit above one million dollars for the first time. For 2026, HUD set the national lending limit at $1,249,125. While this is a new record high, it represents the smallest increase in the last ten years, which aligns with a cooling housing market.

What This Means for You

Higher limits give older homeowners more options. If you want to pay off an existing mortgage, refinance an earlier reverse mortgage, or tap into your home equity to support retirement, the increased 2026 limit may allow you to qualify for more funds, especially as interest rates begin trending lower. As the rates decline, borrowers receive more money from the program.

If the loan doesn’t give you enough money now, keep checking back with us, as it really appears that 2026 is shaping up to be a favorable year for lower rates.

HECM Reverse Mortgage Limit History: 2016-2026

| Year | HECM Limit | Increase (%) |

|---|---|---|

| 2016 | $417,000 | 14.9% |

| 2017 | $636,150 | 52.5% |

| 2018 | $679,650 | 6.8% |

| 2019 | $726,525 | 6.8% |

| 2020 | $765,600 | 5.37% |

| 2021 | $822,375 | 7.41% |

| 2022 | $970,800 | 18% |

| 2023 | $1,089,300 | 12.2% |

| 2024 | $1,149,825 | 5.56% |

| 2025 | $1,209,750 | 5.21% |

| 2026 | $1,249,125 | 3.26% |

| Note: National limit began in 2016, replacing lower regional limits. | ||

Also See: History of the Reverse Mortgage – 1969 to Present Day Facts

Comparing HECM to Jumbo Reverse Mortgage Limits

In 2026, the HUD Home Equity Conversion Mortgage (HECM) lending limit will surpass $1,000,000 for the third time, reaching $1,249,125. This increase offers an appealing option for homeowners with properties valued at more than $1,250,000, making HECM a competitive alternative to proprietary or jumbo reverse mortgage programs. It also represents one of the highest percentage increases in recent years.

When to Consider Jumbo Reverse Mortgages

If your property is valued above $1,249,125, a proprietary (jumbo) reverse mortgage may be worth exploring. However, the HUD HECM program often allows borrowers to access a larger percentage of their property’s value compared to jumbo loans. For many homeowners, this makes a HECM loan a better choice, even if the property’s value exceeds the HUD lending limit.

That said, jumbo reverse mortgages offer unique advantages. These proprietary programs can provide access to cash in ways that differ from HUD-insured loans, giving borrowers flexibility depending on their financial goals.

Choosing the Right Option

The best loan option depends on your specific needs and goals. Speak with one of our reverse mortgage specialists to compare HECM and jumbo programs. We can help you understand which loan best suits your situation and ensure you get the most value from your home equity.

2026 HECM vs. Jumbo Reverse Mortgage: Which Pays More?

| Home Value | HECM Amount (2026) | Jumbo Amount (2026) | Net Gain |

|---|---|---|---|

| $1,249,125 | $548,365 | $549,615.00 | $1,250.00 |

| $1,300,000 | $548,365 | $572,000.00 | $23,635.00 |

| $1,400,000 | $548,365 | $616,000.00 | $67,635.00 |

| $1,500,000 | $548,365 | $660,000.00 | $111,635.00 |

| $1,750,000 | $548,365 | $770,000.00 | $221,635.00 |

| $2,000,000 | $548,365 | $880,000.00 | $331,635.00 |

| $2,250,000 | $548,365 | $990,000.00 | $441,635.00 |

| $2,500,000 | $548,365 | $1,100,000.00 | $551,635.00 |

| $2,750,000 | $548,365 | $1,210,000.00 | $661,635.00 |

| $3,000,000 | $548,365 | $1,320,000.00 | $771,635.00 |

Ready to Tap Into Your Home Equity? Unlock your 2026 reverse mortgage quote from All Reverse Mortgage — America’s #1 with a 4.99/5-star rating! Call (800) 565-1722 or click here for your free quote — simple, trusted, 100% secure!

Summary

In 2026, the reverse mortgage lending limit will increase to $1,249,125, up $39,375 from last year. This adjustment is tied to home price appreciation measured earlier in the year, but it lands at a time when national home values are cooling, and the rate environment is finally easing after several years of sharp increases.

The shift in interest rates is important. As expected, rates trend lower, and many homeowners will see higher principal limits, even if the year-over-year lending limit increase is more modest than what we saw during the pandemic surge. In other words, the combination of a higher cap and improving rate conditions can open more borrowing power than the lending-limit increase alone might suggest.

The new 2026 limit is beneficial for homeowners carrying larger mortgage balances who want to refinance into a HECM. Lower rates improve proceeds, and the increased cap reduces how often borrowers are pushed into jumbo programs when a HECM may be the better fit.

For homeowners with higher-value properties, these changes create a favorable window to access more of their equity while the rate environment is slowly normalizing.

Frequently Asked Questions

What is the maximum reverse mortgage loan limit for 2026?

Would a reverse mortgage refinance in 2026 be worthwhile?

What is the maximum amount you can get on a HECM reverse mortgage?

How is the HECM limit decided, and by whom?

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

August 27th, 2024

August 31st, 2024